More on Entrepreneurship/Creators

Stephen Moore

3 years ago

Adam Neumanns is working to create the future of living in a classic example of a guy failing upward.

The comeback tour continues…

First, he founded a $47 billion co-working company (sorry, a “tech company”).

He established WeLive to disrupt apartment life.

Then he created WeGrow, a school that tossed aside the usual curriculum to feed children's souls and release their potential.

He raised the world’s consciousness.

Then he blew it all up (without raising the world’s consciousness). (He bought a wave pool.)

Adam Neumann's WeWork business burned investors' money. The founder sailed off with unimaginable riches, leaving long-time employees with worthless stocks and the company bleeding money. His track record, which includes a failing baby clothing company, should have stopped investors cold.

Once the dust settled, folks went on. We forgot about the Neumanns! We forgot about the private jets, company retreats, many houses, and WeWork's crippling. In that moment, the prodigal son of entrepreneurship returned, choosing the blockchain as his industry. His homecoming tour began with Flowcarbon, which sold Goddess Nature Tokens to lessen companies' carbon footprints.

Did it work?

Of course not.

Despite receiving $70 million from Andreessen Horowitz's a16z, the project has been halted just two months after its announcement.

This triumph should lower his grade.

Neumann seems to have moved on and has another revolutionary idea for the future of living. Flow (not Flowcarbon) aims to help people live in flow and will launch in 2023. It's the classic Neumann pitch: lofty goals, yogababble, and charisma to attract investors.

It's a winning formula for one investment fund. a16z has backed the project with its largest single check, $350 million. It has a splash page and 3,000 rental units, but is valued at over $1 billion. The blog post praised Neumann for reimagining the office and leading a paradigm-shifting global company.

Flow's mission is to solve the nation's housing crisis. How? Idk. It involves offering community-centric services in apartment properties to the same remote workforce he once wooed with free beer and a pingpong table. Revolutionary! It seems the goal is to apply WeWork's goals of transforming physical spaces and building community to apartments to solve many of today's housing problems.

The elevator pitch probably sounded great.

At least a16z knows it's a near-impossible task, calling it a seismic shift. Marc Andreessen opposes affordable housing in his wealthy Silicon Valley town. As details of the project emerge, more investors will likely throw ethics and morals out the window to go with the flow, throwing money at a man known for burning through it while building toxic companies, hoping he can bank another fantasy valuation before it all crashes.

Insanity is repeating the same action and expecting a different result. Everyone on the Neumann hype train needs to sober up.

Like WeWork, this venture Won’tWork.

Like before, it'll cause a shitstorm.

Owolabi Judah

3 years ago

How much did YouTube pay for 10 million views?

Ali's $1,054,053.74 YouTube Adsense haul.

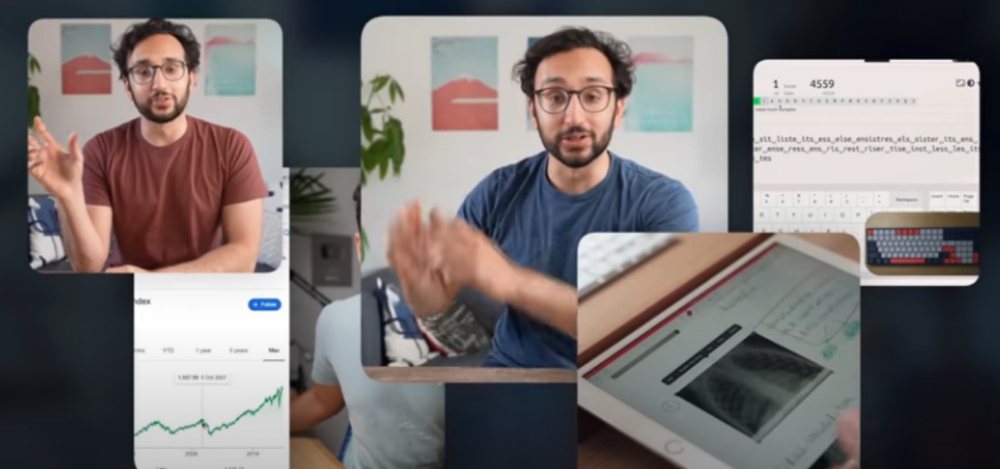

YouTuber, entrepreneur, and former doctor Ali Abdaal. He began filming productivity and financial videos in 2017. Ali Abdaal has 3 million YouTube subscribers and has crossed $1 million in AdSense revenue. Crazy, no?

Ali will share the revenue of his top 5 youtube videos, things he's learned that you can apply to your side hustle, and how many views it takes to make a livelihood off youtube.

First, "The Long Game."

All good things take time to bear fruit. Compounding improves everything. Long-term work yields better returns. Ali made his first dollar after nine months and 85 videos.

Second, "One piece of content can transform your life, but you never know which one."

Had he abandoned YouTube at 84 videos without making any money, he wouldn't have filmed the 85th video that altered everything.

Third Lesson: Your Industry Choice Can Multiply.

The industry or niche you target as a business owner or side hustler can have a major impact on how much money you make.

Here are the top 5 videos.

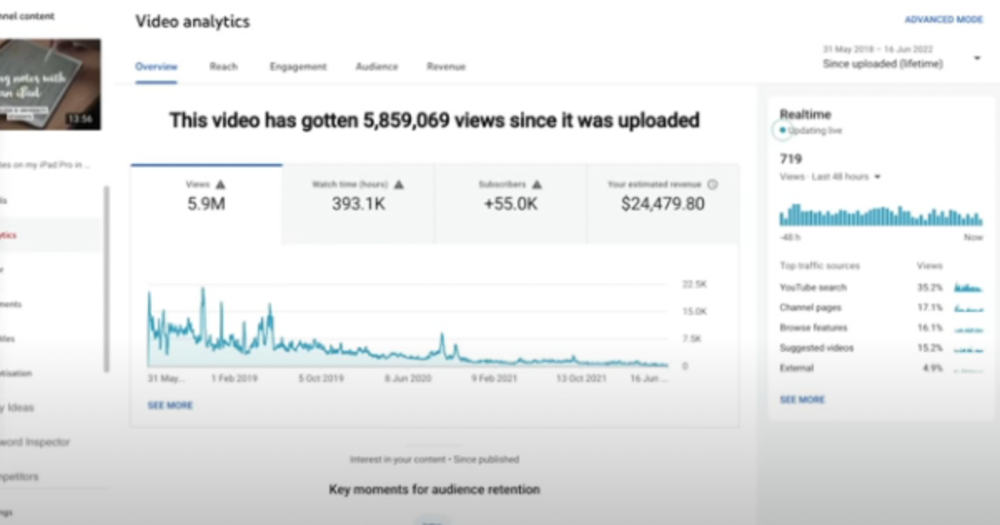

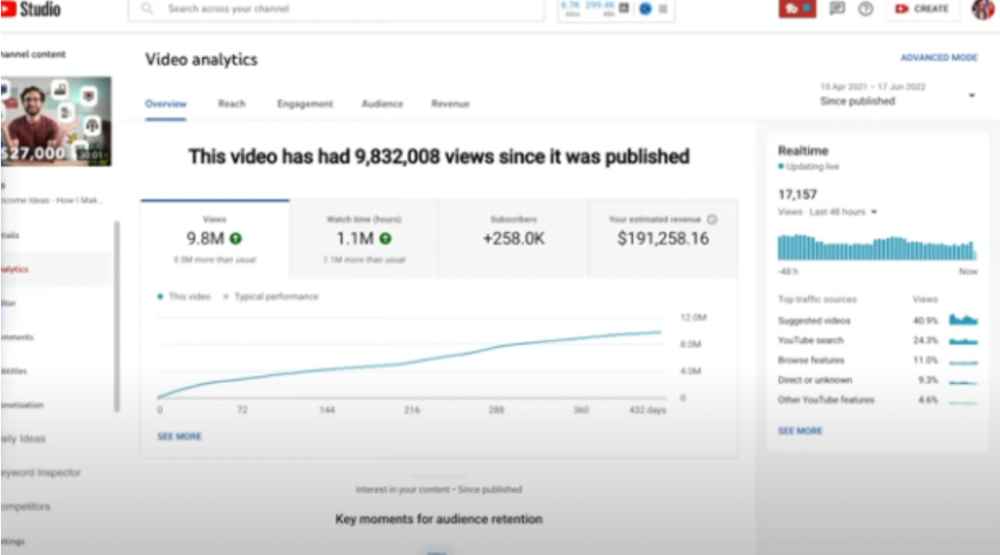

1) 9.8m views: $191,258.16 for 9 passive income ideas

Ali made 2 points.

We should consider YouTube videos digital assets. They're investments, which make us money. His investments are yielding passive income.

Investing extra time and effort in your films can pay off.

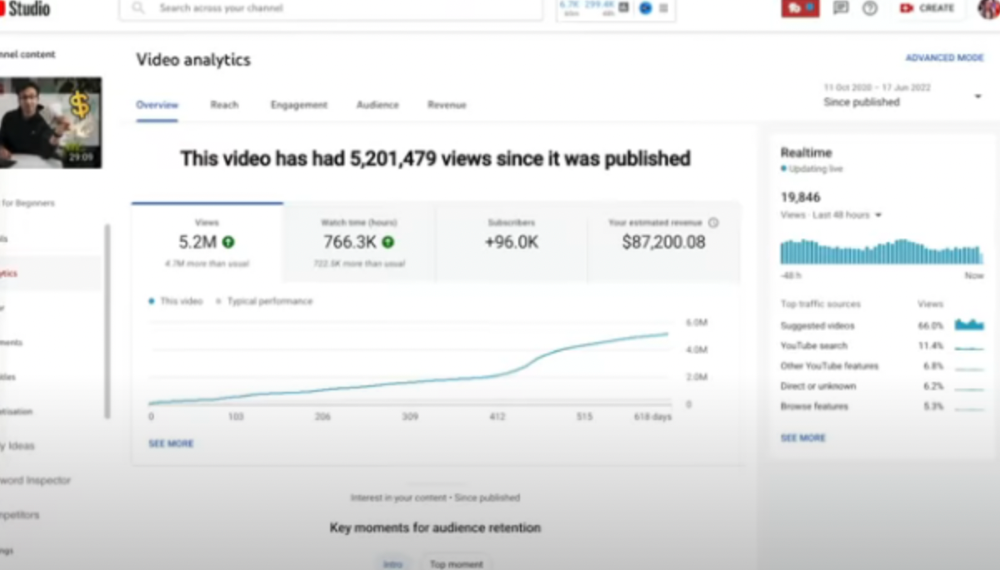

2) How to Invest for Beginners — 5.2m Views: $87,200.08.

This video did poorly in the first several weeks after it was published; it was his tenth poorest performer. Don't worry about things you can't control. This applies to life, not just YouTube videos.

He stated we constantly have anxieties, fears, and concerns about things outside our control, but if we can find that line, life is easier and more pleasurable.

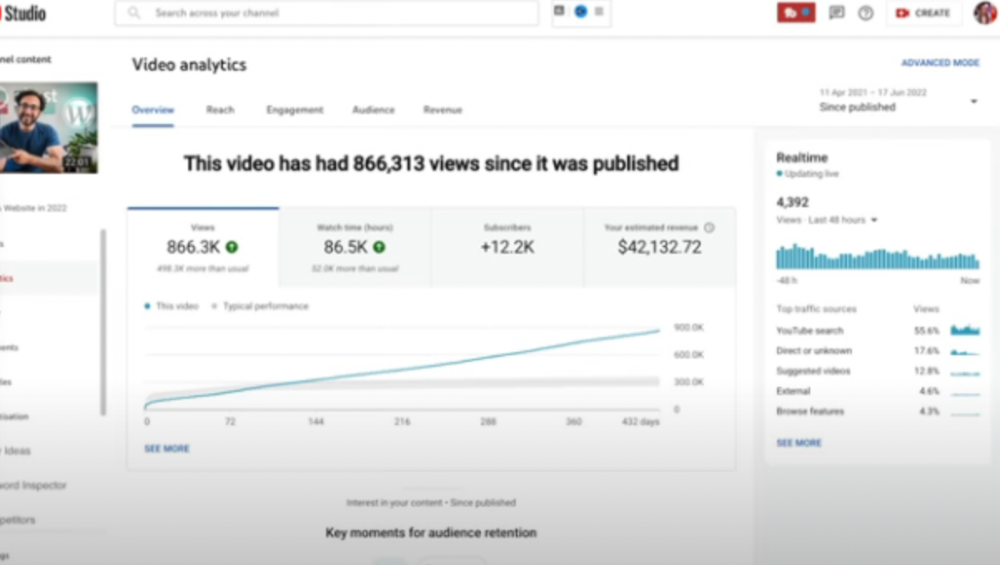

3) How to Build a Website in 2022— 866.3k views: $42,132.72.

The RPM was $48.86 per thousand views, making it his highest-earning video. Squarespace, Wix, and other website builders are trying to put ads on it and competing against one other, so ad rates go up.

Because it was beyond his niche, Ali almost didn't make the video. He made the video because he wanted to help at least one person.

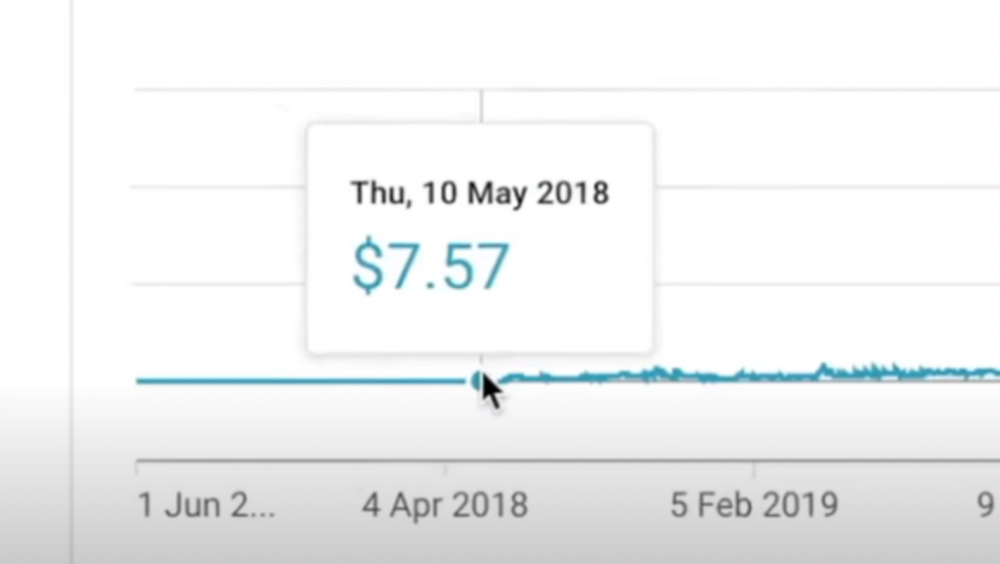

4) How I take notes on my iPad in medical school — 5.9m views: $24,479.80

85th video. It's the video that affected Ali's YouTube channel and his life the most. The video's success wasn't certain.

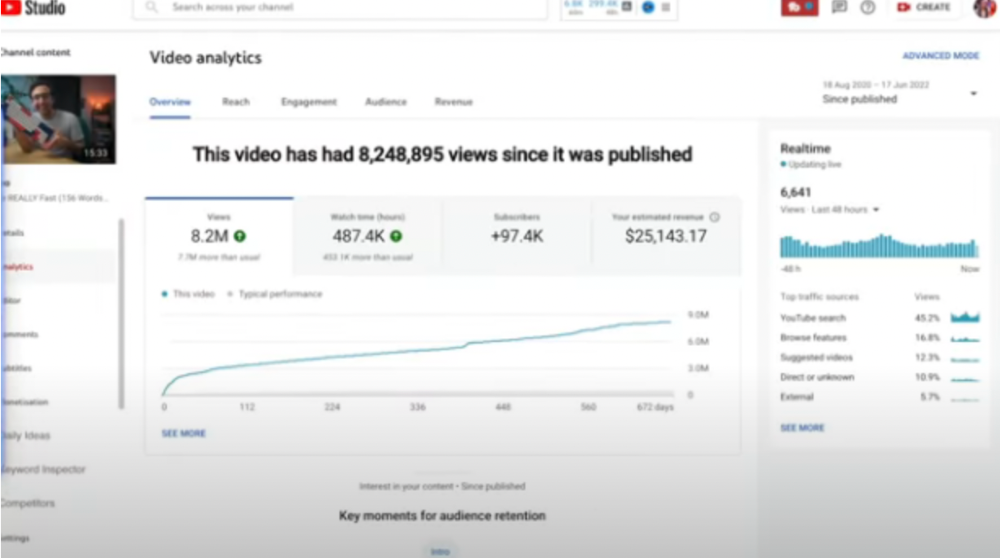

5) How I Type Fast 156 Words Per Minute — 8.2M views: $25,143.17

Ali didn't know this video would perform well; he made it because he can type fast and has been practicing for 10 years. So he made a video with his best advice.

How many views to different wealth levels?

It depends on geography, niche, and other monetization sources. To keep things simple, he would solely utilize AdSense.

How many views to generate money?

To generate money on Youtube, you need 1,000 subscribers and 4,000 hours of view time. How much work do you need to make pocket money?

Ali's first 1,000 subscribers took 52 videos and 6 months. The typical channel with 1,000 subscribers contains 152 videos, according to Tubebuddy. It's time-consuming.

After monetizing, you'll need 15,000 views/month to make $5-$10/day.

How many views to go part-time?

Say you make $35,000/year at your day job. If you work 5 days/week, you make $7,000/year each day. If you want to drop down from 5 days to 4 days/week, you need to make an extra $7,000/year from YouTube, or $600/month.

What's the quit-your-job budget?

Silicon Valley Girl is in a highly successful niche targeting tech-focused folks in the west. When her channel had 500k views/month, she made roughly $3,000/month or $47,000/year, enough to quit your work.

Marina has another 1.5m subscriber channel in Russia, which has a lower rpm because fewer corporations advertise there than in the west. 2.3 million views/month is $4,000/month or $50,000/year, enough to quit your employment.

Marina is an intriguing example because she has three YouTube channels with the same skills, but one is 16x more profitable due to the niche she chose.

In Ali's case, he made 100+ videos when his channel was producing enough money to quit his job, roughly $4,000/month.

How many views make you rich?

Depending on how you define rich. Ali felt prosperous with over $100,000/year and 3–5m views/month.

Conclusion

YouTubers and artists don't treat their work like a company, which is a mistake. Businesses have been attempting to figure this out for decades, if not centuries.

We can learn from the business world how to monetize YouTube, Instagram, and Tiktok and make them into sustainable enterprises where we can hire people and delegate tasks.

Bonus

Watch Ali's video explaining all this:

This post is a summary. Read the full article here

Jenn Leach

3 years ago

How Much I Got Paid by YouTube for a 68 Million Views Video

My nameless, faceless channel case study

The Numbers

I anonymize this YouTube channel.

It's in a trendy, crowded niche. Sharing it publicly will likely enhance competition.

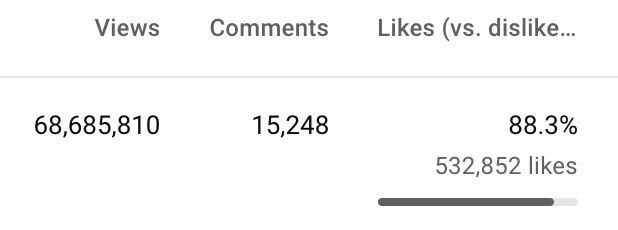

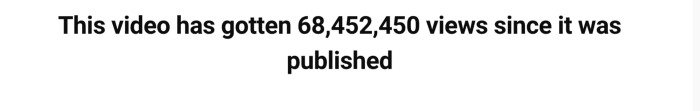

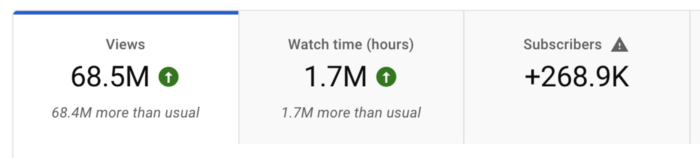

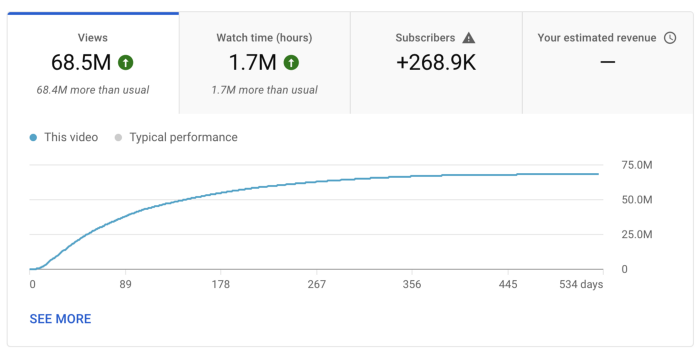

I'll still share my dashboard numbers:

A year ago, the video was released.

What I earned

I'll stop stalling. Here's a screenshot of my YouTube statistics page displaying Adsense profits.

YouTube Adsense made me ZERO dollars.

OMG!

How is this possible?

YouTube Adsense can't monetize my niche. This is typical in faceless niches like TikTok's rain videos. If they were started a while ago, I'm sure certain rain accounts are monetized, but not today.

I actually started a soothing sounds faceless YouTube channel. This was another account of mine.

I looped Pexels films for hours. No background music, just wind, rain, etc.

People could watch these videos to relax or get ready for bed. They're ideal for background noise and relaxation.

They're long-lasting, too. It's easy to make a lot from YouTube Adsense if you insert ads.

Anyway, I tried to monetize it and couldn’t. This was about a year ago. That’s why I doubt new accounts in this genre would be able to get approved for ads.

Back to my faceless channel with 68 million views.

I received nothing from YouTube Adsense, but I made money elsewhere.

Getting paid by the gods of affiliate marketing

Place links in the video and other videos on the channel to get money. Visitors that buy through your affiliate link earn you a commission.

This video earned many clicks on my affiliate links.

I linked to a couple of Amazon products, a YouTube creator tool, my kofi link, and my subscribe link.

Sponsorships

Brands pay you to include ads in your videos.

This video led to many sponsorships.

I've done dozens of sponsorship campaigns that paid $40 to $50 for an end screen to $450 for a preroll ad.

Last word

Overall, I made less than $3,000.

If I had time, I'd be more proactive with sponsorships. You can pitch brand sponsorships. This actually works.

I'd do that if I could rewind time.

I still can, but I think the reaction rate would be higher closer to the viral video's premiere date.

You might also like

Asha Barbaschow

3 years ago

Apple WWDC 2022 Announcements

WWDC 2022 began early Tuesday morning. WWDC brought a ton of new features (which went for just shy of two hours).

With so many announcements, we thought we'd compile them. And now...

WWDC?

WWDC is Apple's developer conference. This includes iOS, macOS, watchOS, and iPadOS (all of its iPads). It's where Apple announces new features for developers to use. It's also where Apple previews new software.

Virtual WWDC runs June 6-10. You can rewatch the stream on Apple's website.

WWDC 2022 news:

Completely everything. Really. iOS 16 first.

iOS 16.

iOS 16 is a major iPhone update. iOS 16 adds the ability to customize the Lock Screen's color/theme. And widgets. It also organizes notifications and pairs Lock Screen with Focus themes. Edit or recall recently sent messages, recover recently deleted messages, and mark conversations as unread. Apple gives us yet another reason to stay in its walled garden with iMessage.

New iOS includes family sharing. Parents can set up a child's account with parental controls to restrict apps, movies, books, and music. iOS 16 lets large families and friend pods share iCloud photos. Up to six people can contribute photos to a separate iCloud library.

Live Text is getting creepier. Users can interact with text in any video frame. Touch and hold an image's subject to remove it from its background and place it in apps like messages. Dictation offers a new on-device voice-and-touch experience. Siri can run app shortcuts without setup in iOS 16. Apple also unveiled a new iOS 16 feature to help people break up with abusive partners who track their locations or read their messages. Safety Check.

Apple Pay Later allows iPhone users to buy products and pay for them later. iOS 16 pushes Mail. Users can schedule emails and cancel delivery before it reaches a recipient's inbox (be quick!). Mail now detects if you forgot an attachment, as Gmail has for years. iOS 16's Maps app gets "Multi-Stop Routing," .

Apple News also gets an iOS 16 update. Apple News adds My Sports. With iOS 16, the Apple Watch's Fitness app is also coming to iOS and the iPhone, using motion-sensing tech to track metrics and performance (as long as an athlete is wearing or carrying the device on their person).

iOS 16 includes accessibility updates like Door Detection.

watchOS9

Many of Apple's software updates are designed to take advantage of the larger screens in recent models, but they also improve health and fitness tracking.

The most obvious reason to upgrade watchOS every year is to get new watch faces from Apple. WatchOS 9 will add four new faces.

Runners' workout metrics improve.

Apple quickly realized that fitness tracking would be the Apple Watch's main feature, even though it's been the killer app for wearables since their debut. For watchOS 9, the Apple Watch will use its accelerometer and gyroscope to track a runner's form, stride length, and ground contact time. It also introduces the ability to specify heart rate zones, distance, and time intervals, with vibrating haptic feedback and voice alerts.

The Apple Watch's Fitness app is coming to iOS and the iPhone, using the smartphone's motion-sensing tech to track metrics and performance (as long as an athlete is wearing or carrying the device on their person).

We'll get sleep tracking, medication reminders, and drug interaction alerts. Your watch can create calendar events. A new Week view shows what meetings or responsibilities stand between you and the weekend.

iPadOS16

WWDC 2022 introduced iPad updates. iPadOS 16 is similar to iOS for the iPhone, but has features for larger screens and tablet accessories. The software update gives it many iPhone-like features.

iPadOS 16's Home app, like iOS 16, will have a new design language. iPad users who want to blame it on the rain finally have a Weather app. iPadOS 16 will have iCloud's Shared Photo Library, Live Text and Visual Look Up upgrades, and FaceTime Handoff, so you can switch between devices during a call.

Apple highlighted iPadOS 16's multitasking at WWDC 2022. iPad's Stage Manager sounds like a community theater app. It's a powerful multitasking tool for tablets and brings them closer to emulating laptops. Apple's iPadOS 16 supports multi-user collaboration. You can share content from Files, Keynote, Numbers, Pages, Notes, Reminders, Safari, and other third-party apps in Apple Messages.

M2-chip

WWDC 2022 revealed Apple's M2 chip. Apple has started the next generation of Apple Silicon for the Mac with M2. Apple says this device improves M1's performance.

M2's second-generation 5nm chip has 25% more transistors than M1's. 100GB/s memory bandwidth (50 per cent more than M1). M2 has 24GB of unified memory, up from 16GB but less than some ultraportable PCs' 32GB. The M2 chip has 10% better multi-core CPU performance than the M2, and it's nearly twice as fast as the latest 10-core PC laptop chip at the same power level (CPU performance is 18 per cent greater than M1).

New MacBooks

Apple introduced the M2-powered MacBook Air. Apple's entry-level laptop has a larger display, a new processor, new colors, and a notch.

M2 also powers the 13-inch MacBook Pro. The 13-inch MacBook Pro has 24GB of unified memory and 50% more memory bandwidth. New MacBook Pro batteries last 20 hours. As I type on the 2021 MacBook Pro, I can only imagine how much power the M2 will add.

macOS 13.0 (or, macOS Ventura)

macOS Ventura will take full advantage of M2 with new features like Stage Manager and Continuity Camera and Handoff for FaceTime. Safari, Mail, Messages, Spotlight, and more get updates in macOS Ventura.

Apple hasn't run out of California landmarks to name its OS after yet. macOS 13 will be called Ventura when it's released in a few months, but it's more than a name change and new wallpapers.

Stage Manager organizes windows

Stage Manager is a new macOS tool that organizes open windows and applications so they're still visible while focusing on a specific task. The main app sits in the middle of the desktop, while other apps and documents are organized and piled up to the side.

Improved Searching

Spotlight is one of macOS's least appreciated features, but with Ventura, it's becoming even more useful. Live Text lets you extract text from Spotlight results without leaving the window, including images from the photo library and the web.

Mail lets you schedule or unsend emails.

We've all sent an email we regret, whether it contained regrettable words or was sent at the wrong time. In macOS Ventura, Mail users can cancel or reschedule a message after sending it. Mail will now intelligently determine if a person was forgotten from a CC list or if a promised attachment wasn't included. Procrastinators can set a reminder to read a message later.

Safari adds tab sharing and password passkeys

Apple is updating Safari to make it more user-friendly... mostly. Users can share a group of tabs with friends or family, a useful feature when researching a topic with too many tabs. Passkeys will replace passwords in Safari's next version. Instead of entering random gibberish when creating a new account, macOS users can use TouchID to create an on-device passkey. Using an iPhone's camera and a QR system, Passkey syncs and works across all Apple devices and Windows computers.

Continuity adds Facetime device switching and iPhone webcam.

With macOS Ventura, iPhone users can transfer a FaceTime call from their phone to their desktop or laptop using Handoff, or vice versa if they started a call at their desk and need to continue it elsewhere. Apple finally admits its laptop and monitor webcams aren't the best. Continuity makes the iPhone a webcam. Apple demonstrated a feature where the wide-angle lens could provide a live stream of the desk below, while the standard zoom lens could focus on the speaker's face. New iPhone laptop mounts are coming.

System Preferences

System Preferences is Now System Settings and Looks Like iOS

Ventura's System Preferences has been renamed System Settings and is much more similar in appearance to iOS and iPadOS. As the iPhone and iPad are gateway devices into Apple's hardware ecosystem, new Mac users should find it easier to adjust.

This post is a summary. Read full article here

Scott Duke Kominers

3 years ago

NFT Creators Go Creative Commons Zero (cc0)

On January 1, "Public Domain Day," thousands of creative works immediately join the public domain. The original creator or copyright holder loses exclusive rights to reproduce, adapt, or publish the work, and anybody can use it. It happens with movies, poems, music, artworks, books (where creative rights endure 70 years beyond the author's death), and sometimes source code.

Public domain creative works open the door to new uses. 400,000 sound recordings from before 1923, including Winnie-the-Pooh, were released this year. With most of A.A. Milne's 1926 Winnie-the-Pooh characters now available, we're seeing innovative interpretations Milne likely never planned. The ancient hyphenated version of the honey-loving bear is being adapted for a horror movie: "Winnie-the-Pooh: Blood and Honey"... with Pooh and Piglet as the baddies.

Counterintuitively, experimenting and recombination can occasionally increase IP value. Open source movements allow the public to build on (or fork and duplicate) existing technologies. Permissionless innovation helps Android, Linux, and other open source software projects compete. Crypto's success at attracting public development is also due to its support of open source and "remix culture," notably in NFT forums.

Production memes

NFT projects use several IP strategies to establish brands, communities, and content. Some preserve regular IP protections; others offer NFT owners the opportunity to innovate on connected IP; yet others have removed copyright and other IP safeguards.

By using the "Creative Commons Zero" (cc0) license, artists can intentionally select for "no rights reserved." This option permits anyone to benefit from derivative works without legal repercussions. There's still a lot of confusion between copyrights and NFTs, so nothing here should be considered legal, financial, tax, or investment advice. Check out this post for an overview of copyright vulnerabilities with NFTs and how authors can protect owners' rights. This article focuses on cc0.

Nouns, a 2021 project, popularized cc0 for NFTs. Others followed, including: A Common Place, Anonymice, Blitmap, Chain Runners, Cryptoadz, CryptoTeddies, Goblintown, Gradis, Loot, mfers, Mirakai, Shields, and Terrarium Club are cc0 projects.

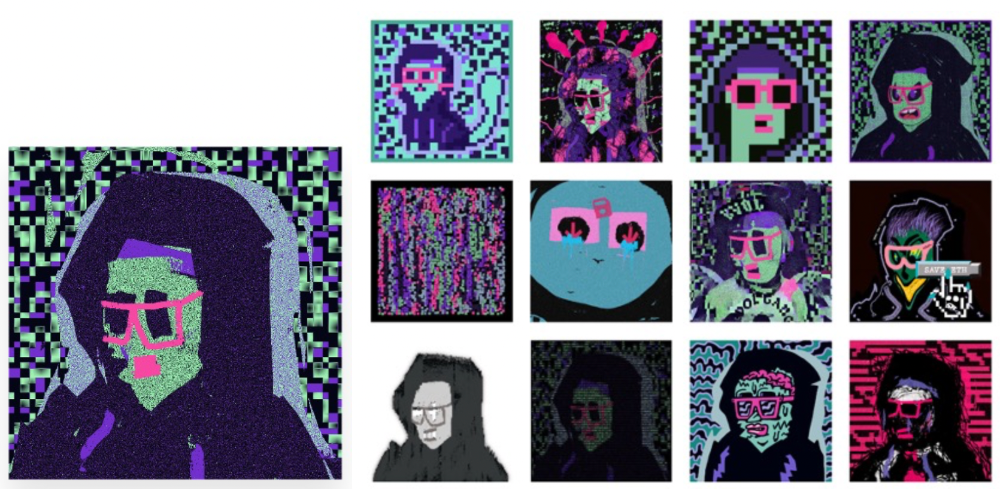

Popular crypto artist XCOPY licensed their 1-of-1 NFT artwork "Right-click and Save As Guy" under cc0 in January, exactly one month after selling it. cc0 has spawned many derivatives.

"Right-click Save As Guy" by XCOPY (1)/derivative works (2)

XCOPY said Monday he would apply cc0 to "all his existing art." "We haven't seen a cc0 summer yet, but I think it's approaching," said the artist. - predicting a "DeFi summer" in 2020, when decentralized finance gained popularity.

Why do so many NFT authors choose "no rights"?

Promoting expansions of the original project to create a more lively and active community is one rationale. This makes sense in crypto, where many value open sharing and establishing community.

Creativity depends on cultural significance. NFTs may allow verifiable ownership of any digital asset, regardless of license, but cc0 jumpstarts "meme-ability" by actively, not passively, inviting derivative works. As new derivatives are made and shared, attention might flow back to the original, boosting its reputation. This may inspire new interpretations, leading in a flywheel effect where each derivative adds to the original's worth - similar to platform network effects, where platforms become more valuable as more users join them.

cc0 licence allows creators "seize production memes."

Physical items are also using cc0 NFT assets, thus it's not just a digital phenomenon. The Nouns Vision initiative turned the square-framed spectacles shown on each new NounsDAO NFT ("one per day, forever") into luxury sunglasses. Blitmap's pixel-art has been used on shoes, apparel, and caps. In traditional IP regimes, a single owner controls creation, licensing, and production.

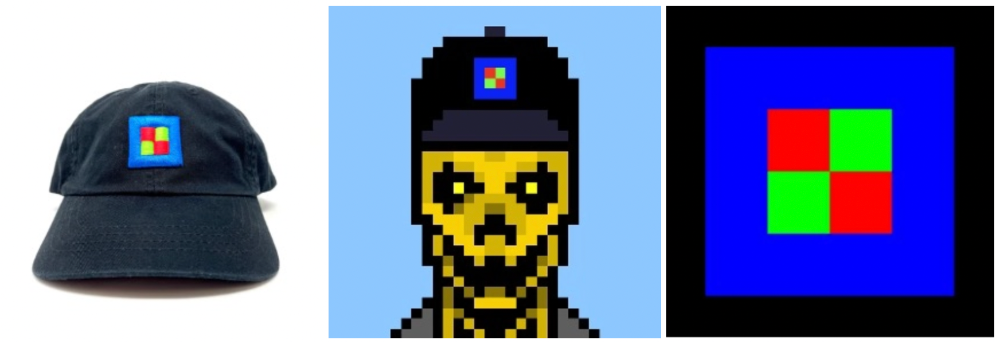

The physical "blitcap" (3rd level) is a descendant of the trait in the cc0 Chain Runners collection (2nd), which uses the "logo" from cc0 Blitmap (1st)! The Logo is Blitmap token #84 and has been used as a trait in various collections. The "Dom Rose" is another popular token. These homages reference Blitmap's influence as a cc0 leader, as one of the earliest NFT projects to proclaim public domain intents. A new collection, Citizens of Tajigen, emerged last week with a Blitcap characteristic.

These derivatives can be a win-win for everyone, not just the original inventors, especially when using NFT assets to establish unique brands. As people learn about the derivative, they may become interested in the original. If you see someone wearing Nouns glasses on the street (or in a Super Bowl ad), you may desire a pair, but you may also be interested in buying an original NounsDAO NFT or related derivative.

Blitmap Logo Hat (1), Chain Runners #780 ft. Hat (2), and Blitmap Original "Logo #87" (3)

Co-creating open source

NFTs' power comes from smart contract technology's intrinsic composability. Many smart contracts can be integrated or stacked to generate richer applications.

"Money Legos" describes how decentralized finance ("DeFi") smart contracts interconnect to generate new financial use cases. Yearn communicates with MakerDAO's stablecoin $DAI and exchange liquidity provider Curve by calling public smart contract methods. NFTs and their underlying smart contracts can operate as the base-layer framework for recombining and interconnecting culture and creativity.

cc0 gives an NFT's enthusiast community authority to develop new value layers whenever, wherever, and however they wish.

Multiple cc0 projects are playable characters in HyperLoot, a Loot Project knockoff.

Open source and Linux's rise are parallels. When the internet was young, Microsoft dominated the OS market with Windows. Linux (and its developer Linus Torvalds) championed a community-first mentality, freely available the source code without restrictions. This led to developers worldwide producing new software for Linux, from web servers to databases. As people (and organizations) created world-class open source software, Linux's value proposition grew, leading to explosive development and industry innovation. According to Truelist, Linux powers 96.3% of the top 1 million web servers and 85% of smartphones.

With cc0 licensing empowering NFT community builders, one might hope for long-term innovation. Combining cc0 with NFTs "turns an antagonistic game into a co-operative one," says NounsDAO cofounder punk4156. It's important on several levels. First, decentralized systems from open source to crypto are about trust and coordination, therefore facilitating cooperation is crucial. Second, the dynamics of this cooperation work well in the context of NFTs because giving people ownership over their digital assets allows them to internalize the results of co-creation through the value that accrues to their assets and contributions, which incentivizes them to participate in co-creation in the first place.

Licensed to create

If cc0 projects are open source "applications" or "platforms," then NFT artwork, metadata, and smart contracts provide the "user interface" and the underlying blockchain (e.g., Ethereum) is the "operating system." For these apps to attain Linux-like potential, more infrastructure services must be established and made available so people may take advantage of cc0's remixing capabilities.

These services are developing. Zora protocol and OpenSea's open source Seaport protocol enable open, permissionless NFT marketplaces. A pixel-art-rendering engine was just published on-chain to the Ethereum blockchain and integrated into OKPC and ICE64. Each application improves blockchain's "out-of-the-box" capabilities, leading to new apps created from the improved building blocks.

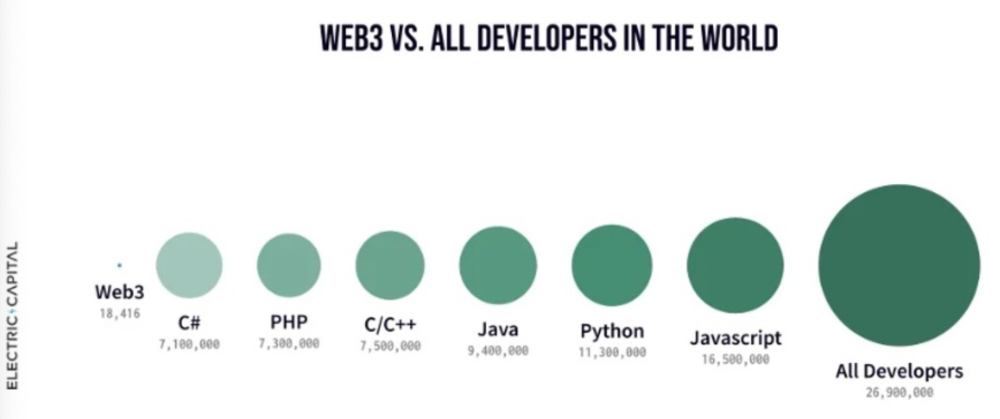

Web3 developer growth is at an all-time high, yet it's still a small fraction of active software developers globally. As additional developers enter the field, prospective NFT projects may find more creative and infrastructure Legos for cc0 and beyond.

Electric Capital Developer Report (2021), p. 122

Growth requires composability. Users can easily integrate digital assets developed on public standards and compatible infrastructure into other platforms. The Loot Project is one of the first to illustrate decentralized co-creation, worldbuilding, and more in NFTs. This example was low-fi or "incomplete" aesthetically, providing room for imagination and community co-creation.

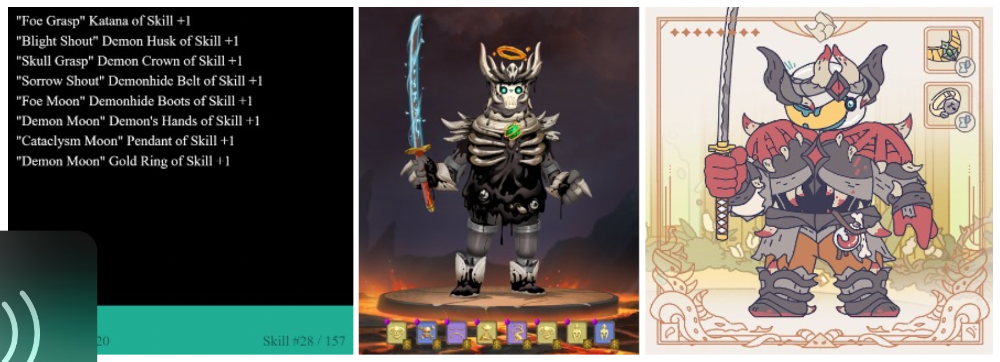

Loot began with a series of Loot bag NFTs, each listing eight "adventure things" in white writing on a black backdrop (such as Loot Bag #5726's "Katana, Divine Robe, Great Helm, Wool Sash, Divine Slippers, Chain Gloves, Amulet, Gold Ring"). Dom Hofmann's free Loot bags served as a foundation for the community.

Several projects have begun metaphorical (lore) and practical (game development) world-building in a short time, with artists contributing many variations to the collective "Lootverse." They've produced games (Realms & The Crypt), characters (Genesis Project, Hyperloot, Loot Explorers), storytelling initiatives (Banners, OpenQuill), and even infrastructure (The Rift).

Why cc0 and composability? Because consumers own and control Loot bags, they may use them wherever they choose by connecting their crypto wallets. This allows users to participate in multiple derivative projects, such as Genesis Adventurers, whose characters appear in many others — creating a decentralized franchise not owned by any one corporation.

Genesis Project's Genesis Adventurer (1) with HyperLoot (2) and Loot Explorer (3) versions

When to go cc0

There are several IP development strategies NFT projects can use. When it comes to cc0, it’s important to be realistic. The public domain won't make a project a runaway success just by implementing the license. cc0 works well for NFT initiatives that can develop a rich, enlarged ecosystem.

Many of the most successful cc0 projects have introduced flexible intellectual property. The Nouns brand is as obvious for a beer ad as for real glasses; Loot bags are simple primitives that make sense in all adventure settings; and the Goblintown visual style looks good on dwarfs, zombies, and cranky owls as it does on Val Kilmer.

The ideal cc0 NFT project gives builders the opportunity to add value:

vertically, by stacking new content and features directly on top of the original cc0 assets (for instance, as with games built on the Loot ecosystem, among others), and

horizontally, by introducing distinct but related intellectual property that helps propagate the original cc0 project’s brand (as with various Goblintown derivatives, among others).

These actions can assist cc0 NFT business models. Because cc0 NFT projects receive royalties from secondary sales, third-party extensions and derivatives can boost demand for the original assets.

Using cc0 license lowers friction that could hinder brand-reinforcing extensions or lead to them bypassing the original. Robbie Broome recently argued (in the context of his cc0 project A Common Place) that giving away his IP to cc0 avoids bad rehashes down the line. If UrbanOutfitters wanted to put my design on a tee, they could use the actual work instead of hiring a designer. CC0 can turn competition into cooperation.

Community agreement about core assets' value and contribution can help cc0 projects. Cohesion and engagement are key. Using the above examples: Developers can design adventure games around whatever themes and item concepts they desire, but many choose Loot bags because of the Lootverse's community togetherness. Flipmap shared half of its money with the original Blitmap artists in acknowledgment of that project's core role in the community. This can build a healthy culture within a cc0 project ecosystem. Commentator NiftyPins said it was smart to acknowledge the people that constructed their universe. Many OG Blitmap artists have popped into the Flipmap discord to share information.

cc0 isn't a one-size-fits-all answer; NFTs formed around well-established brands may prefer more restrictive licenses to preserve their intellectual property and reinforce exclusivity. cc0 has some superficial similarities to permitting NFT owners to market the IP connected with their NFTs (à la Bored Ape Yacht Club), but there is a significant difference: cc0 holders can't exclude others from utilizing the same IP. This can make it tougher for holders to develop commercial brands on cc0 assets or offer specific rights to partners. Holders can still introduce enlarged intellectual property (such as backstories or derivatives) that they control.

Blockchain technologies and the crypto ethos are decentralized and open-source. This makes it logical for crypto initiatives to build around cc0 content models, which build on the work of the Creative Commons foundation and numerous open source pioneers.

NFT creators that choose cc0 must select how involved they want to be in building the ecosystem. Some cc0 project leaders, like Chain Runners' developers, have kept building on top of the initial cc0 assets, creating an environment derivative projects can plug into. Dom Hofmann stood back from Loot, letting the community lead. (Dom is also working on additional cc0 NFT projects for the company he formed to build Blitmap.) Other authors have chosen out totally, like sartoshi, who announced his exit from the cc0 project he founded, mfers, and from the NFT area by publishing a final edition suitably named "end of sartoshi" and then deactivating his Twitter account. A multi-signature wallet of seven mfers controls the project's smart contract.

cc0 licensing allows a robust community to co-create in ways that benefit all members, regardless of original creators' continuous commitment. We foresee more organized infrastructure and design patterns as NFT matures. Like open source software, value capture frameworks may see innovation. (We could imagine a variant of the "Sleepycat license," which requires commercial software to pay licensing fees when embedding open source components.) As creators progress the space, we expect them to build unique rights and licensing strategies. cc0 allows NFT producers to bootstrap ideas that may take off.

Michelle Teheux

3 years ago

Get Real, All You Grateful Laid-Off LinkedIn Users

WTF is wrong with you people?

When I was laid off as editor of my town's daily newspaper, I went silent on social media. I knew it was coming and had been quietly removing personal items each day, but the pain was intense.

I posted a day later. I didn't bad-mouth GateHouse Media but expressed my sadness at leaving the newspaper industry, pride in my accomplishments, and hope for success in another industry.

Normal job-loss response.

What do you recognize as abnormal?

The bullshit I’ve been reading from laid-off folks on LinkedIn.

If you're there, you know. Many Twitter or Facebook/Meta employees recently lost their jobs.

Well, many of them did not “lose their job,” actually. They were “impacted by the layoffs” at their former employer. I keep seeing that phrase.

Why don’t they want to actually say it? Why the euphemism?

Many are excited about the opportunities ahead. The jobless deny being sad.

They're ecstatic! They have big plans.

Hope so. Sincerely! Being laid off stinks, especially if, like me, your skills are obsolete. It's worse if, like me, you're too old to start a new career. Ageism exists despite denials.

Nowadays, professionalism seems to demand psychotic levels of fake optimism.

Why? Life is unpredictable. That's indisputable. You shouldn't constantly complain or cry in public, but you also shouldn't pretend everything's great.

It makes you look psychotic, not positive. It's like saying at work:

“I was impacted by the death of my spouse of 20 years this week, and many of you have reached out to me, expressing your sympathy. However, I’m choosing to remember the amazing things we shared. I feel confident that there is another marriage out there for me, and after taking a quiet weekend trip to reset myself, I’ll be out there looking for the next great marital adventure! #staypositive #available #opentolove

Also:

“Now looking for our next #dreamhome after our entire neighborhood was demolished by a wildfire last night. We feel so lucky to have lived near so many amazing and inspirational neighbors, all of whom we will miss as we go on our next housing adventure. The best house for us is yet to come! If you have a great neighborhood you’d recommend, please feel free to reach out and touch base with us! #newhouse #newneighborhood #newlife

Admit it. That’s creepy.

The constant optimism makes me feel sick to my stomach.

Viscerally.

I hate fakes.

Imagine a fake wood grain desk. Wouldn't it be better if the designer accepted that it's plastic and went with that?

Real is better but not always nice. When something isn't nice, you don't have to go into detail, but you also shouldn't pretend it's great.

How to announce your job loss to the world.

Do not pretend to be happy, but don't cry and drink vodka all afternoon.

Say you loved your job, and that you're looking for new opportunities.

Yes, if you'll miss your coworkers. Otherwise, don't badmouth. No bridge-burning!

Please specify the job you want. You may want to pivot.

Alternatively, try this.

You could always flame out.

If you've pushed yourself too far into toxic positivity, you may be ready to burn it all down. If so, make it worthwhile by writing something like this:

Well, I was shitcanned by the losers at #Acme today. That bitch Linda in HR threw me under the bus just because she saw that one of my “friends” tagged me in some beach pics on social media after I called in sick with Covid. The good thing is I will no longer have to watch my ass around that #asspincher Ron in accounting, but I’m sad that I will no longer have a cushy job with high pay or access to the primo office supplies I’ve been sneaking home for the last five years. (Those gel pens were the best!) I am going to be taking some time off to enjoy my unemployment and hammer down shots of Jägermeister but in about five months I’ll be looking for anything easy with high pay and great benefits. Reach out if you can help! #officesupplies #unemploymentrocks #drinkinglikeagirlboss #acmesucks

It beats the fake positivity.