More on Entrepreneurship/Creators

Stephen Moore

3 years ago

Adam Neumanns is working to create the future of living in a classic example of a guy failing upward.

The comeback tour continues…

First, he founded a $47 billion co-working company (sorry, a “tech company”).

He established WeLive to disrupt apartment life.

Then he created WeGrow, a school that tossed aside the usual curriculum to feed children's souls and release their potential.

He raised the world’s consciousness.

Then he blew it all up (without raising the world’s consciousness). (He bought a wave pool.)

Adam Neumann's WeWork business burned investors' money. The founder sailed off with unimaginable riches, leaving long-time employees with worthless stocks and the company bleeding money. His track record, which includes a failing baby clothing company, should have stopped investors cold.

Once the dust settled, folks went on. We forgot about the Neumanns! We forgot about the private jets, company retreats, many houses, and WeWork's crippling. In that moment, the prodigal son of entrepreneurship returned, choosing the blockchain as his industry. His homecoming tour began with Flowcarbon, which sold Goddess Nature Tokens to lessen companies' carbon footprints.

Did it work?

Of course not.

Despite receiving $70 million from Andreessen Horowitz's a16z, the project has been halted just two months after its announcement.

This triumph should lower his grade.

Neumann seems to have moved on and has another revolutionary idea for the future of living. Flow (not Flowcarbon) aims to help people live in flow and will launch in 2023. It's the classic Neumann pitch: lofty goals, yogababble, and charisma to attract investors.

It's a winning formula for one investment fund. a16z has backed the project with its largest single check, $350 million. It has a splash page and 3,000 rental units, but is valued at over $1 billion. The blog post praised Neumann for reimagining the office and leading a paradigm-shifting global company.

Flow's mission is to solve the nation's housing crisis. How? Idk. It involves offering community-centric services in apartment properties to the same remote workforce he once wooed with free beer and a pingpong table. Revolutionary! It seems the goal is to apply WeWork's goals of transforming physical spaces and building community to apartments to solve many of today's housing problems.

The elevator pitch probably sounded great.

At least a16z knows it's a near-impossible task, calling it a seismic shift. Marc Andreessen opposes affordable housing in his wealthy Silicon Valley town. As details of the project emerge, more investors will likely throw ethics and morals out the window to go with the flow, throwing money at a man known for burning through it while building toxic companies, hoping he can bank another fantasy valuation before it all crashes.

Insanity is repeating the same action and expecting a different result. Everyone on the Neumann hype train needs to sober up.

Like WeWork, this venture Won’tWork.

Like before, it'll cause a shitstorm.

Tim Denning

3 years ago

Bills are paid by your 9 to 5. 6 through 12 help you build money.

40 years pass. After 14 years of retirement, you die. Am I the only one who sees the problem?

I’m the Jedi master of escaping the rat race.

Not to impress. I know this works since I've tried it. Quitting a job to make money online is worse than Kim Kardashian's internet-burning advice.

Let me help you rethink the move from a career to online income to f*ck you money.

To understand why a job is a joke, do some life math.

Without a solid why, nothing makes sense.

The retirement age is 65. Our processed food consumption could shorten our 79-year average lifespan.

You spend 40 years working.

After 14 years of retirement, you die.

Am I alone in seeing the problem?

Life is too short to work a job forever, especially since most people hate theirs. After-hours skills are vital.

Money equals unrestricted power, f*ck you.

F*ck you money is the answer.

Jack Raines said it first. He says we can do anything with the money. Jack, a young rebel straight out of college, can travel and try new foods.

F*ck you money signifies not checking your bank account before buying.

F*ck you” money is pure, unadulterated freedom with no strings attached.

Jack claims you're rich when you rarely think about money.

Avoid confusion.

This doesn't imply you can buy a Lamborghini. It indicates your costs, income, lifestyle, and bank account are balanced.

Jack established an online portfolio while working for UPS in Atlanta, Georgia. So he gained boundless power.

The portion that many erroneously believe

Yes, you need internet abilities to make money, but they're not different from 9-5 talents.

Sahil Lavingia, Gumroad's creator, explains.

A job is a way to get paid to learn.

Mistreat your boss 9-5. Drain his skills. Defuse him. Love and leave him (eventually).

Find another employment if yours is hazardous. Pick an easy job. Make sure nothing sneaks into your 6-12 time slot.

The dumb game that makes you a sheep

A 9-5 job requires many job interviews throughout life.

You email your résumé to employers and apply for jobs through advertisements. This game makes you a sheep.

You're competing globally. Work-from-home makes the competition tougher. If you're not the cheapest, employers won't hire you.

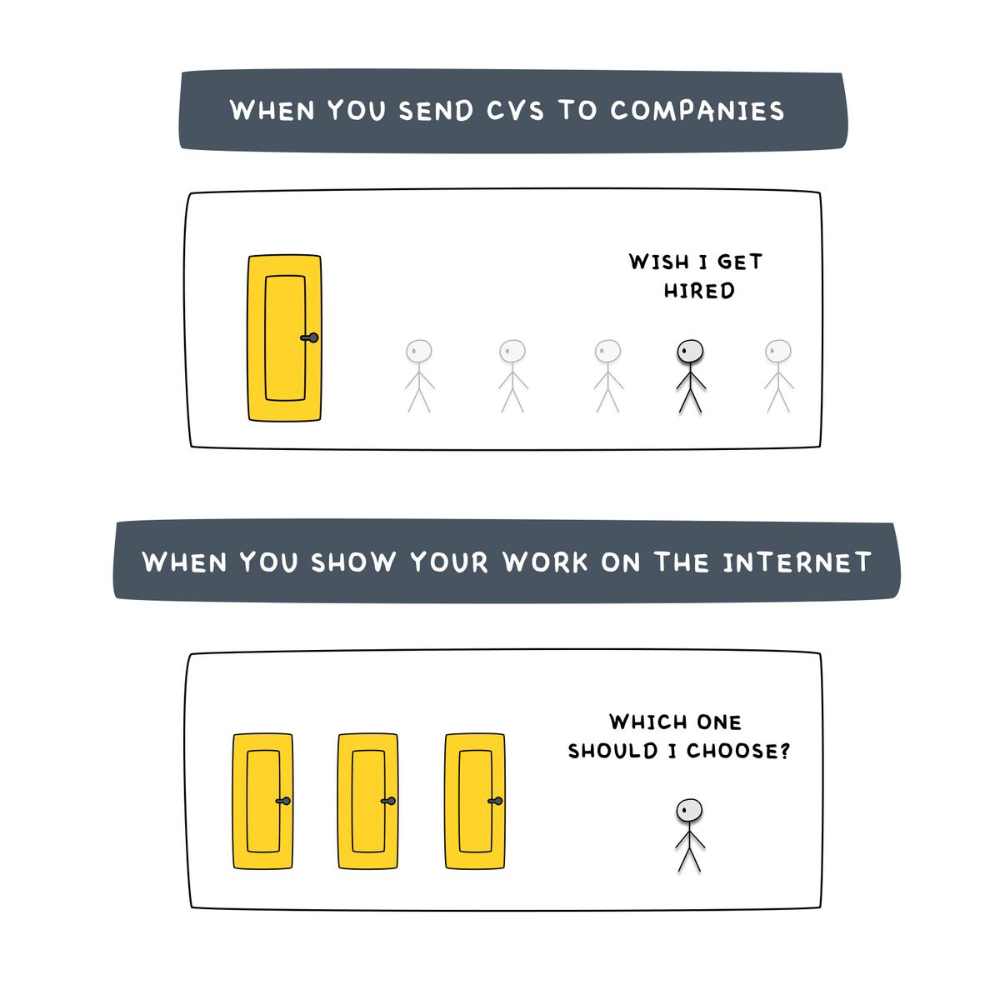

After-hours online talents (say, 6 pm-12 pm) change the game. This graphic explains it better:

Online talents boost after-hours opportunities.

You go from wanting to be picked to picking yourself. More chances equal more money. Your f*ck you fund gets the extra cash.

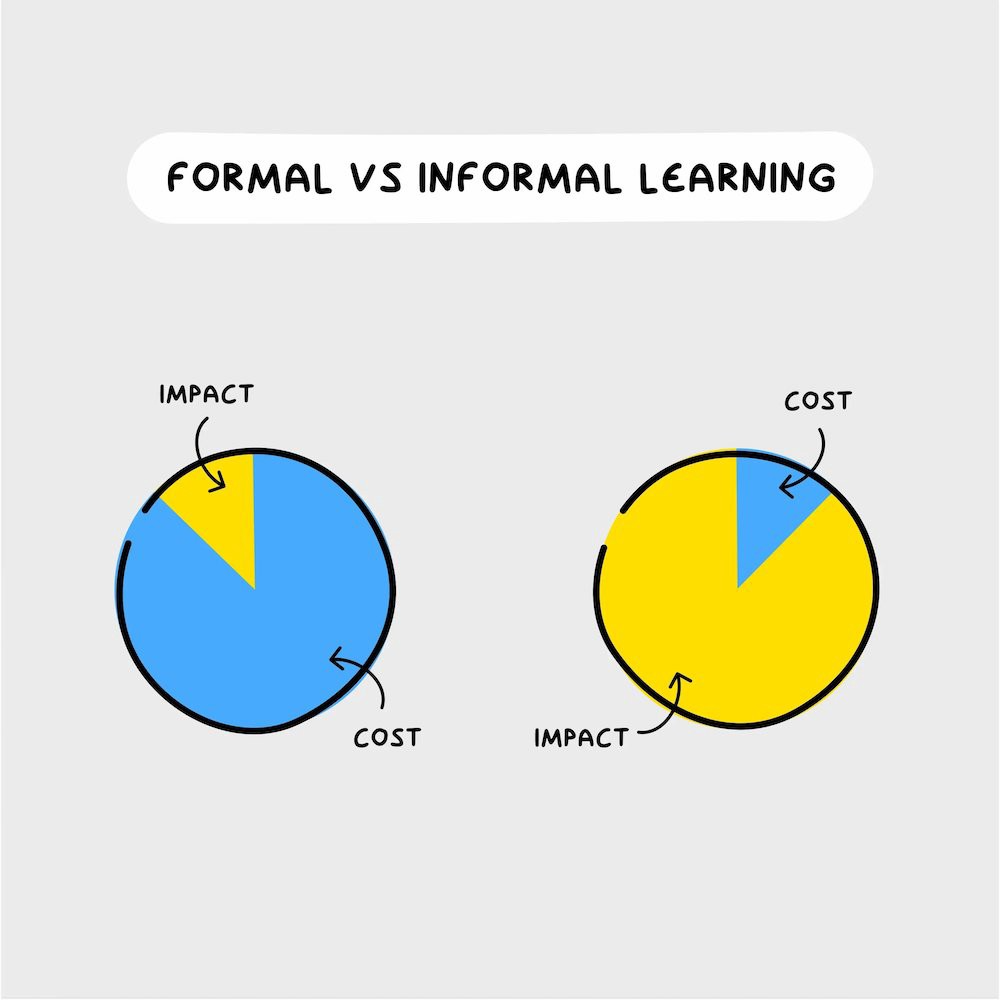

A novel method of learning is essential.

College costs six figures and takes a lifetime to repay.

Informal learning is distinct. 6-12pm:

Observe the carefully controlled Twitter newsfeed.

Make use of Teachable and Gumroad's online courses.

Watch instructional YouTube videos

Look through the top Substack newsletters.

Informal learning is more effective because it's not obvious. It's fun to follow your curiosity and hobbies.

The majority of people lack one attitude. It's simple to learn.

One big impediment stands in the way of f*ck you money and time independence. So often.

Too many people plan after 6-12 hours. Dreaming. Big-thinkers. Strategically. They fill their calendar with meetings.

This is after-hours masturb*tion.

Sahil Bloom reminded me that a bias towards action will determine if this approach works for you.

The key isn't knowing what to do from 6-12 a.m. Trust yourself and develop abilities as you go. It's for building the parachute after you jump.

Sounds risky. We've eliminated the risk by finishing this process after hours while you work 9-5.

With no risk, you can have an I-don't-care attitude and still be successful.

When you choose to move forward, this occurs.

Once you try 9-5/6-12, you'll tell someone.

It's bad.

Few of us hang out with problem-solvers.

It's how much of society operates. So they make reasons so they can feel better about not giving you money.

Matthew Kobach told me chasing f*ck you money is easier with like-minded folks.

Without f*ck you money friends, loneliness will take over and you'll think you've messed up when you just need to keep going.

Steal this easy guideline

Let's act. No more fluffing and caressing.

1. Learn

If you detest your 9-5 talents or don't think they'll work online, get new ones. If you're skilled enough, continue.

Easlo recommends these skills:

Designer for Figma

Designer Canva

bubble creators

editor in Photoshop

Automation consultant for Zapier

Designer of Webflow

video editor Adobe

Ghostwriter for Twitter

Idea consultant

Artist in Blender Studio

2. Develop the ability

Every night from 6-12, apply the skill.

Practicing ghostwriting? Write someone's tweets for free. Do someone's website copy to learn copywriting. Get a website to the top of Google for a keyword to understand SEO.

Free practice is crucial. Your 9-5 pays the money, so work for free.

3. Take off stealthily like a badass

Another mistake. Sell to few. Don't be the best. Don't claim expertise.

Sell your new expertise to others behind you.

Two ways:

Using a digital good

By providing a service,

Point 1 also includes digital service examples. Digital products include eBooks, communities, courses, ad-supported podcasts, and templates. It's easy. Your 9-5 job involves one of these.

Take ideas from work.

Why? They'll steal your time for profit.

4. Iterate while feeling awful

First-time launches always fail. You'll feel terrible. Okay. Remember your 9-5?

Find improvements. Ask free and paying consumers what worked.

Multiple relaunches, each 1% better.

5. Discover more

Never stop learning. Improve your skill. Add a relevant skill. Learn copywriting if you write online.

After-hours students earn the most.

6. Continue

Repetition is key.

7. Make this one small change.

Consistently. The 6-12 momentum won't make you rich in 30 days; that's success p*rn.

Consistency helps wage slaves become f*ck you money. Most people can't switch between the two.

Putting everything together

It's easy. You're probably already doing some.

This formula explains why, how, and what to do. It's a 5th-grade-friendly blueprint. Good.

Reduce financial risk with your 9-to-5. Replace Netflix with 6-12 money-making talents.

Life is short; do whatever you want. Today.

Atown Research

2 years ago

Meet the One-Person Businesses Earning Millions in Sales from Solo Founders

I've spent over 50 hours researching one-person firms, which interest me. I've found countless one-person enterprises that made millions on the founder's determination and perseverance.

Throughout my investigation, I found three of the most outstanding one-person enterprises. These enterprises show that people who work hard and dedicate themselves to their ideas may succeed.

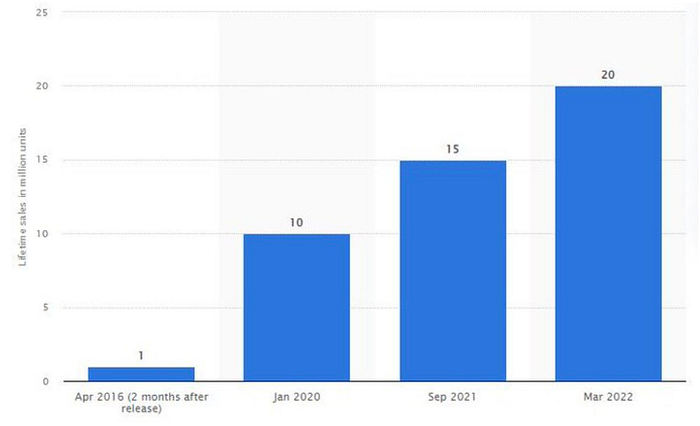

Eric Barone (@ConcernedApe) created Stardew Valley in 2011 to better his job prospects. Eric loved making the game, in which players inherit a farm, grow crops, raise livestock, make friends with the villagers, and form a family.

Eric handled complete game production, including 3D graphics, animations, and music, to maintain creative control. He stopped job hunting and worked 8-15 hours a day on the game.

Eric developed a Stardew Valley website and subreddit to engage with gamers and get feedback. Eric's devoted community helped him meet Steam's minimum vote requirement for single creators.

Stardew Valley sold 1 million copies in two months after Eric launched it for $15 in 2016. The game has sold 20 million copies and made $300 million.

The game's inexpensive price, outsourcing of PR, marketing, and publication, and loyal player base helped it succeed. Eric has turned down million-dollar proposals from Sony and Nintendo to sell the game and instead updates and improves it. Haunted Chocolatier is Eric's new game.

Is farming not profitable? Ask Stardew Valley creator Eric Barone.

Gary Brewer established BuiltWith to assist users find website technologies and services. BuiltWith boasts 3000 paying customers and $14 million in yearly revenue, making it a significant resource for businesses wishing to generate leads, do customer analytics, obtain business insight, compare websites, or search websites by keyword.

BuiltWith has one full-time employee, Gary, and one or two part-time contractors that help with the blog. Gary handles sales, customer service, and other company functions alone.

BuiltWith acquired popularity through blog promotions and a top Digg ranking. About Us, a domain directory, connected to BuiltWith on every domain page, boosting it. Gary introduced $295–$995 monthly subscriptions to search technology, keywords, and potential consumers in response to customer demand.

Gary uses numerous methods to manage a firm without staff. He spends one to two hours every day answering user queries, most of which are handled quickly by linking to BuiltWiths knowledge store. Gary creates step-by-step essays or videos for complex problems. Gary can focus on providing new features based on customer comments and requests since he makes it easy to unsubscribe.

BuiltWith is entirely automated and successful due to its unique approach and useful offerings. It works for Google, Meta, Amazon, and Twitter.

Digital Inspiration develops Google Documents, Sheets, and Slides plugins. Digital Inspiration, founded by Amit Agarwal, receives 5 million monthly visits and earns $10 million. 40 million individuals have downloaded Digital Inspirations plugins.

Amit started Digital Inspiration by advertising his blog at tech events and getting Indian filter blogs and other newspapers to promote his articles. Amit built plugins and promoted them on the blog once the blog acquired popularity, using ideas from comments, friends, and Reddit. Digital Inspiration has over 20 free and premium plugins.

Mail Merge, Notifications for Google Forms, YouTube Uploader, and Document Studio are some of Digital Inspiration's most popular plugins. Mail Merge allows users to send personalized emails in bulk and track email opens and clicks.

Since Amits manages Digital Inspiration alone, his success is astounding. Amit developed a successful company via hard work and creativity, despite platform dependence. His tale inspires entrepreneurs.

You might also like

Sammy Abdullah

3 years ago

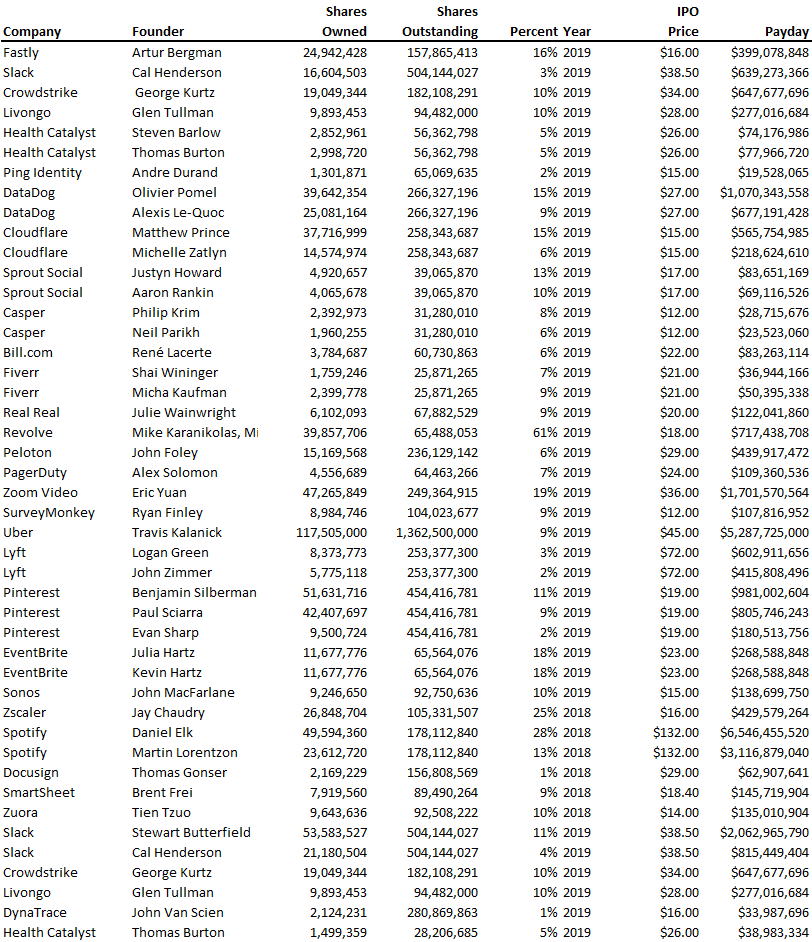

Payouts to founders at IPO

How much do startup founders make after an IPO? We looked at 2018's major tech IPOs. Paydays aren't what founders took home at the IPO (shares are normally locked up for 6 months), but what they were worth at the IPO price on the day the firm went public. It's not cash, but it's nice. Here's the data.

Several points are noteworthy.

Huge payoffs. Median and average pay were $399m and $918m. Average and median homeownership were 9% and 12%.

Coinbase, Uber, UI Path. Uber, Zoom, Spotify, UI Path, and Coinbase founders raised billions. Zoom's founder owned 19% and Spotify's 28% and 13%. Brian Armstrong controlled 20% of Coinbase at IPO and was worth $15bn. Preserving as much equity as possible by staying cash-efficient or raising at high valuations also helps.

The smallest was Ping. Ping's compensation was the smallest. Andre Duand owned 2% but was worth $20m at IPO. That's less than some billion-dollar paydays, but still good.

IPOs can be lucrative, as you can see. Preserving equity could be the difference between a $20mm and $15bln payday (Coinbase).

Isaiah McCall

3 years ago

There is a new global currency emerging, but it is not bitcoin.

America should avoid BRICS

Vladimir Putin has watched videos of Muammar Gaddafi's CIA-backed demise.

Gaddafi...

Thief.

Did you know Gaddafi wanted a gold-backed dinar for Africa? Because he considered our global financial system was a Ponzi scheme, he wanted to discontinue trading oil in US dollars.

Or, Gaddafi's Libya enjoyed Africa's highest quality of living before becoming freed. Pictured:

Vladimir Putin is a nasty guy, but he had his reasons for not mentioning NATO assisting Ukraine in resisting US imperialism. Nobody tells you. Sure.

The US dollar's corruption post-2008, debasement by quantitative easing, and lack of value are key factors. BRICS will replace the dollar.

BRICS aren't bricks.

Economy-related.

Brazil, Russia, India, China, and South Africa have cooperated for 14 years to fight U.S. hegemony with a new international currency: BRICS.

BRICS is mostly comical. Now. Saudi Arabia, the second-largest oil hegemon, wants to join.

So what?

The New World Currency is BRICS

Russia was kicked out of G8 for its aggressiveness in Crimea in 2014.

It's now G7.

No biggie, said Putin, he said, and I quote, “Bon appetite.”

He was prepared. China, India, and Brazil lead the New World Order.

Together, they constitute 40% of the world's population and, according to the IMF, 50% of the world's GDP by 2030.

Here’s what the BRICS president Marcos Prado Troyjo had to say earlier this year about no longer needing the US dollar: “We have implemented the mechanism of mutual settlements in rubles and rupees, and there is no need for our countries to use the dollar in mutual settlements. And today a similar mechanism of mutual settlements in rubles and yuan is being developed by China.”

Ick. That's D.C. and NYC warmongers licking their chops for WW3 nasty.

Here's a lovely picture of BRICS to relax you:

If Saudi Arabia joins BRICS, as President Mohammed Bin Salman has expressed interest, a majority of the Middle East will have joined forces to construct a new world order not based on the US currency.

I'm not sure of the new acronym.

SBRICSS? CIRBSS? CRIBSS?

The Reason America Is Harvesting What It Sowed

BRICS began 14 years ago.

14 years ago, what occurred? Concentrate. It involved CDOs, bad subprime mortgages, and Wall Street quants crunching numbers.

2008 recession

When two nations trade, they do so in US dollars, not Euros or gold.

What happened when 2008, an avoidable crisis caused by US banks' cupidity and ignorance, what happened?

Everyone WORLDWIDE felt the pain.

Mostly due to corporate America's avarice.

This should have been a warning that China and Russia had enough of our bs. Like when France sent a battleship to America after Nixon scrapped the gold standard. The US was warned to shape up or be dethroned (or at least try).

Nixon improved in 1971. Kinda. Invented PetroDollar.

Another BS system that unfairly favors America and possibly pushed Russia, China, and Saudi Arabia into BRICS.

The PetroDollar forces oil-exporting nations to trade in US dollars and invest in US Treasury bonds. Brilliant. Genius evil.

Our misdeeds are:

In conflicts that are not its concern, the USA uses the global reserve currency as a weapon.

Targeted nations abandon the dollar, and rightfully so, as do nations that depend on them for trade in vital resources.

The dollar's position as the world's reserve currency is in jeopardy, which could have disastrous economic effects.

Although we have actually sown our own doom, we appear astonished. According to the Bible, whomever sows to appease his sinful nature will reap destruction from that nature whereas whoever sows to appease the Spirit will reap eternal life from the Spirit.

Americans, even our leaders, lack caution and delayed pleasure. When our unsustainable systems fail, we double down. Bailouts of the banks in 2008 were myopic, puerile, and another nail in America's hegemony.

America has screwed everyone.

We're unpopular.

The BRICS's future

It's happened before.

Saddam Hussein sold oil in Euros in 2000, and the US invaded Iraq a month later. The media has devalued the word conspiracy. The Iraq conspiracy.

There were no WMDs, but NYT journalists like Judy Miller drove Americans into a warmongering frenzy because Saddam would ruin the PetroDollar. Does anyone recall that this war spawned ISIS?

I think America has done good for the world. You can make a convincing case that we're many people's villain.

Learn more in Confessions of an Economic Hitman, The Devil's Chessboard, or Tyranny of the Federal Reserve. Or ignore it. That's easier.

We, America, should extend an olive branch, ask for forgiveness, and learn from our faults, as the Tao Te Ching advises. Unlikely. Our population is apathetic and stupid, and our government is corrupt.

Argentina, Iran, Egypt, and Turkey have also indicated interest in joining BRICS. They're also considering making it gold-backed, making it a new world reserve currency.

You should pay attention.

Thanks for reading!

Jon Brosio

3 years ago

This Landing Page is a (Legal) Money-Printing Machine

and it’s easy to build.

A landing page with good copy is a money-maker.

Let's be honest, page-builder templates are garbage.

They can help you create a nice-looking landing page, but not persuasive writing.

Over the previous 90 days, I've examined 200+ landing pages.

What's crazy?

Top digital entrepreneurs use a 7-part strategy to bring in email subscribers, generate prospects, and (passively) sell their digital courses.

Steal this 7-part landing page architecture to maximize digital product sales.

The offer

Landing pages require offers.

Newsletter, cohort, or course offer.

Your reader should see this offer first. Includind:

Headline

Imagery

Call-to-action

Clear, persuasive, and simplicity are key. Example: the Linkedin OS course home page of digital entrepreneur Justin Welsh offers:

A distinctly defined problem

Everyone needs an enemy.

You need an opponent on your landing page. Problematic.

Next, employ psychology to create a struggle in your visitor's thoughts.

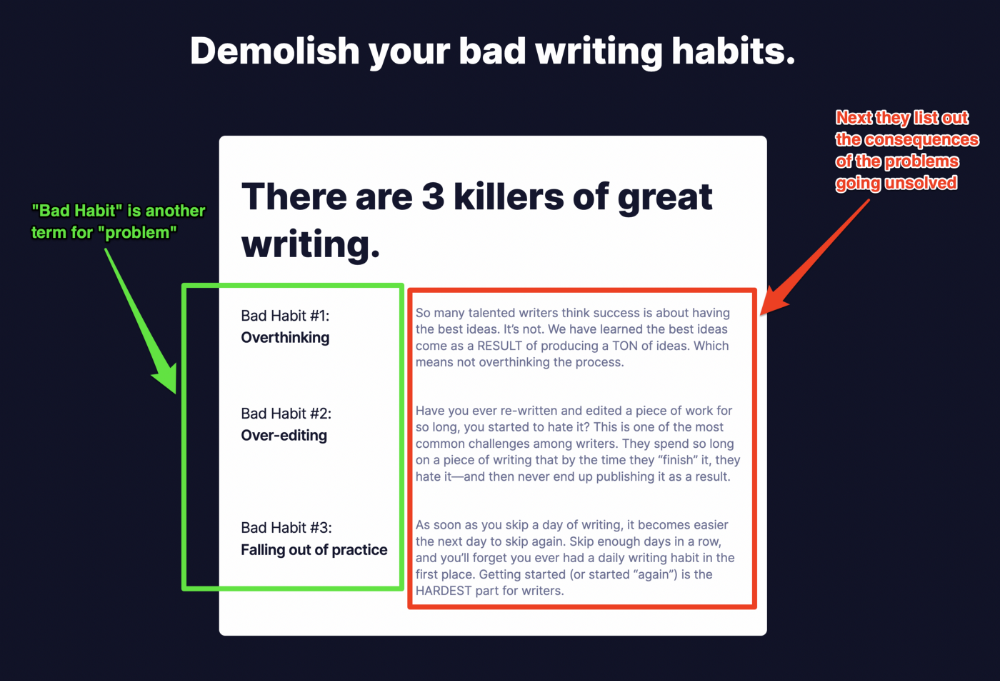

Don't be clever here; label your customer's problem. The more particular you are, the bigger the situation will seem.

When you build a clear monster, you invite defeat. I appreciate Theo Ohene's Growth Roadmaps landing page.

Exacerbation of the effects

Problem identification doesn't motivate action.

What would an unresolved problem mean?

This is landing page copy. When you describe the unsolved problem's repercussions, you accomplish several things:

You write a narrative (and stories are remembered better than stats)

You cause the reader to feel something.

You help the reader relate to the issue

Important!

My favorite script is:

"Sure, you can let [problem] go untreated. But what will happen if you do? Soon, you'll begin to notice [new problem 1] will start to arise. That might bring up [problem 2], etc."

Take the copywriting course, digital writer and entrepreneur Dickie Bush illustrates below when he labels the problem (see: "poor habit") and then illustrates the repercussions.

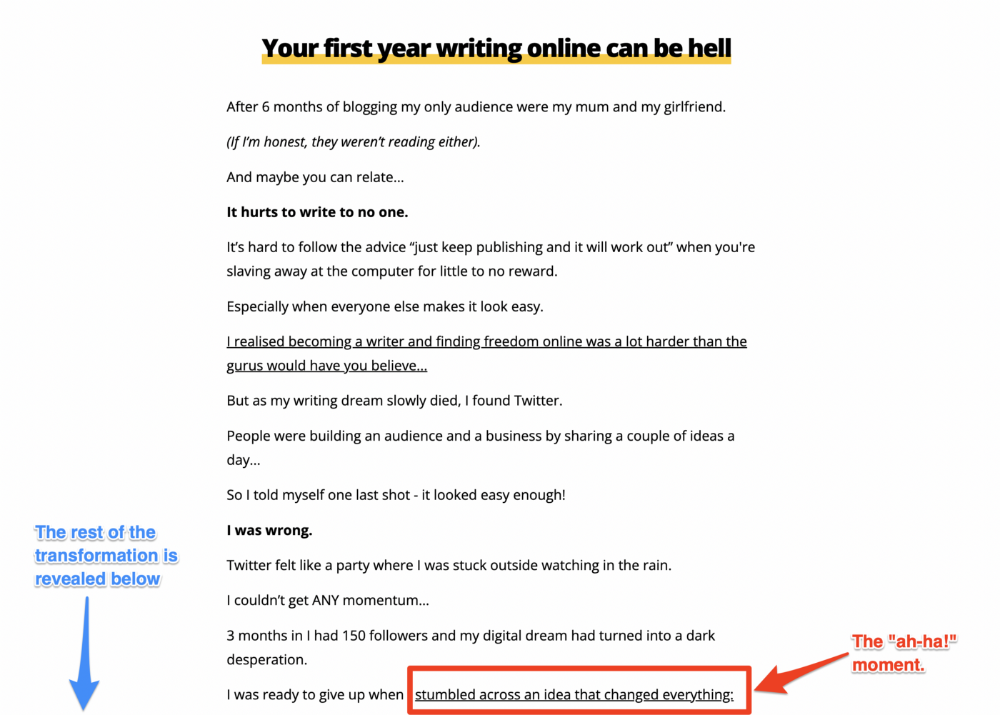

The tale of transformation

Every landing page needs that "ah-ha!" moment.

Transformation stories do this.

Did you find a solution? Someone else made the discovery? Have you tested your theory?

Next, describe your (or your subject's) metamorphosis.

Kieran Drew nails his narrative (and revelation) here. Right before the disclosure, he introduces his "ah-ha!" moment:

Testimonials

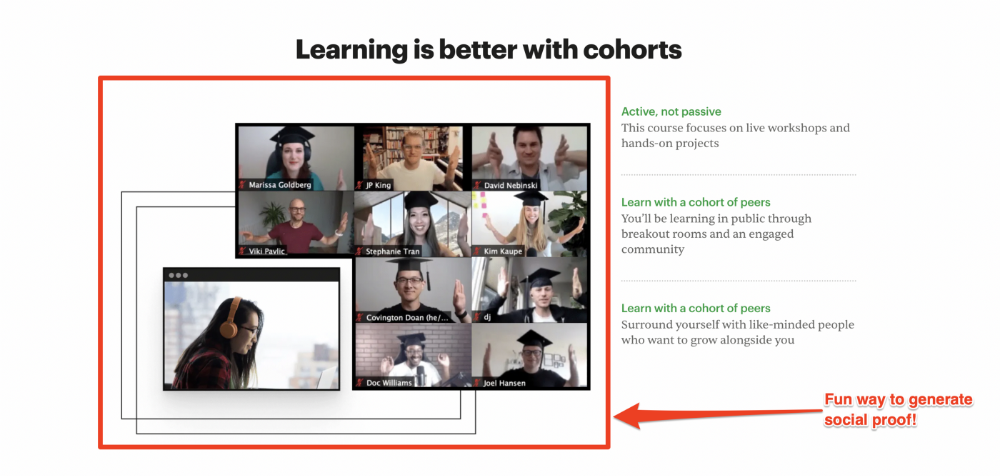

Social proof completes any landing page.

Social proof tells the reader, "If others do it, it must be worthwhile."

This is your argument.

Positive social proof helps (obviously).

Offer "free" training in exchange for a testimonial if you need social evidence. This builds social proof.

Most social proof is testimonies (recommended). Kurtis Hanni's creative take on social proof (using a screenshot of his colleague) is entertaining.

Bravo.

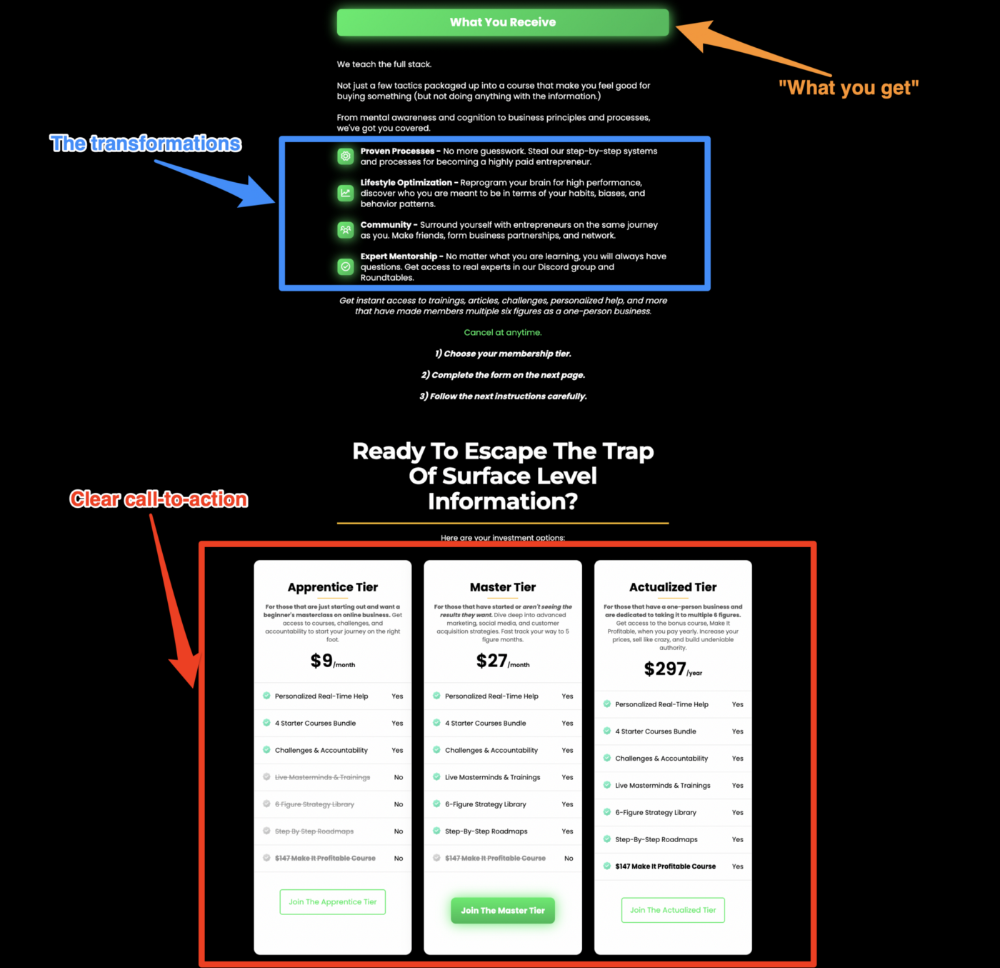

Reveal your offer

Now's the moment to act.

Describe the "bundle" that provides the transformation.

Here's:

Course

Cohort

Ebook

Whatever you're selling.

Include a product or service image, what the consumer is getting ("how it works"), the price, any "free" bonuses (preferred), and a CTA ("buy now").

Clarity is key. Don't make a cunning offer. Make sure your presentation emphasizes customer change (benefits). Dan Koe's Modern Mastery landing page makes an offer. Consider:

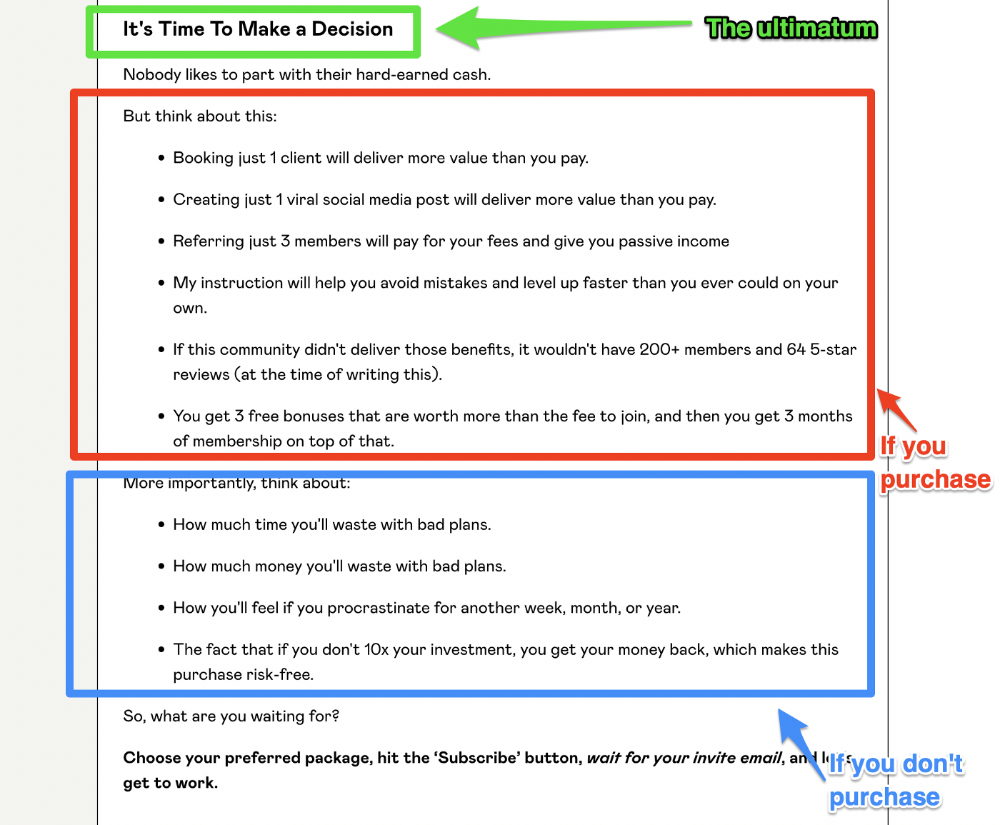

An ultimatum

Offering isn't enough.

You must give your prospect an ultimatum.

They can buy your merchandise from you.

They may exit the webpage.

That’s it.

It's crucial to show what happens if the reader does either. Stress the consequences of not buying (again, a little consequence amplification). Remind them of the benefits of buying.

I appreciate Charles Miller's product offer ending:

The top online creators use a 7-part landing page structure:

Offer the service

Describe the problem

Amplify the consequences

Tell the transformational story

Include testimonials and social proof.

Reveal the offer (with any bonuses if applicable)

Finally, give the reader a deadline to encourage them to take action.

Sequence these sections to develop a landing page that (essentially) prints money.