More on Entrepreneurship/Creators

Emils Uztics

3 years ago

This billionaire created a side business that brings around $90,000 per month.

Dharmesh Shah co-founded HubSpot. WordPlay reached $90,000 per month in revenue without utilizing any of his wealth.

His method:

Take Advantage Of An Established Trend

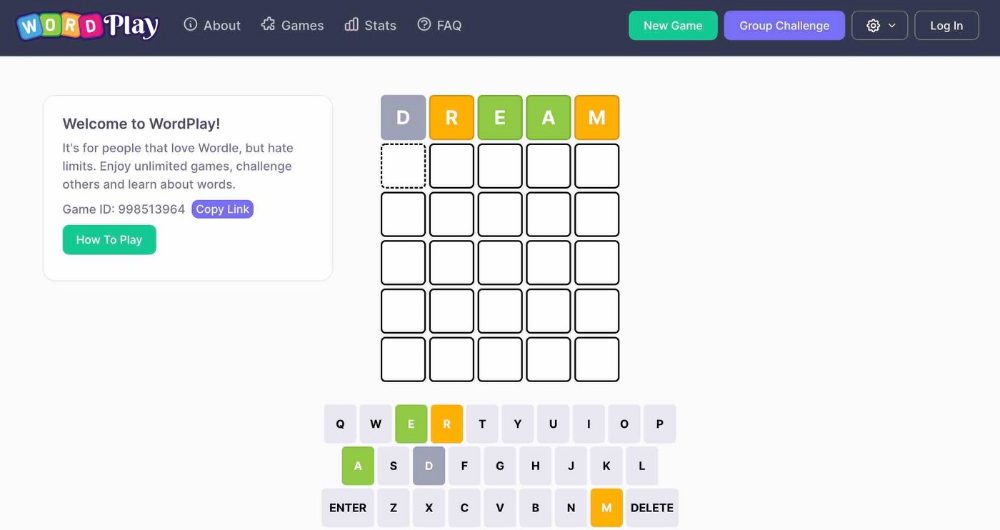

Remember Wordle? Dharmesh was instantly hooked. As was the tech world.

HubSpot's co-founder noted inefficiencies in a recent My First Million episode. He wanted to play daily. Dharmesh, a tinkerer and software engineer, decided to design a word game.

He's a billionaire. How could he?

Wordle had limitations in his opinion;

Dharmesh is fundamentally a developer. He desired to start something new and increase his programming knowledge;

This project may serve as an excellent illustration for his son, who had begun learning about software development.

Better It Up

Building a new Wordle wasn't successful.

WordPlay lets you play with friends and family. You could challenge them and compare the results. It is a built-in growth tool.

WordPlay features:

the capacity to follow sophisticated statistics after creating an account;

continuous feedback on your performance;

Outstanding domain name (wordplay.com).

Project Development

WordPlay has 9.5 million visitors and 45 million games played since February.

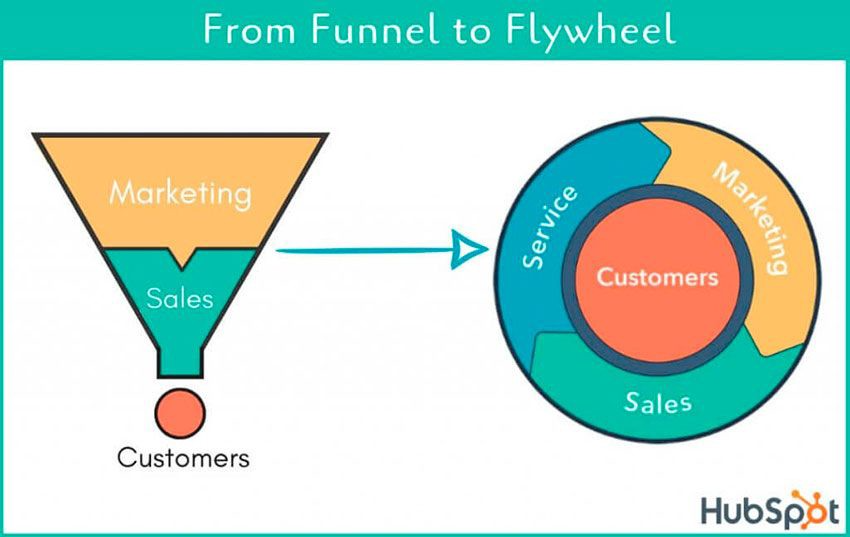

HubSpot co-founder credits tremendous growth to flywheel marketing, pushing the game through his own following.

Choosing an exploding specialty and making sharing easy also helped.

Shah enabled Google Ads on the website to test earning potential. Monthly revenue was $90,000.

That's just Google Ads. If monetization was the goal, a specialized ad network like Ezoic could double or triple the amount.

Wordle was a great buy for The New York Times at $1 million.

MAJESTY AliNICOLE WOW!

3 years ago

YouTube's faceless videos are growing in popularity, but this is nothing new.

I've always bucked social media norms. YouTube doesn't compare. Traditional video made me zig when everyone zagged. Audio, picture personality animation, thought movies, and slide show videos are most popular and profitable.

YouTube's business is shifting. While most video experts swear by the idea that YouTube success is all about making personal and professional Face-Share-Videos, those who use YouTube for business know things are different.

In this article, I will share concepts from my mini master class Figures to Followers: Prioritizing Purposeful Profits Over Popularity on YouTube to Create the Win-Win for You, Your Audience & More and my forthcoming publication The WOWTUBE-PRENEUR FACTOR EVOLUTION: The Basics of Powerfully & Profitably Positioning Yourself as a Video Communications Authority to Broadcast Your WOW Effect as a Video Entrepreneur.

I've researched the psychology, anthropology, and anatomy of significant social media platforms as an entrepreneur and social media marketing expert. While building my YouTube empire, I've paid particular attention to what works for short, mid, and long-term success, whether it's a niche-focused, lifestyle, or multi-interest channel.

Most new, semi-new, and seasoned YouTubers feel vlog-style or live-on-camera videos are popular. Faceless, animated, music-text-based, and slideshow videos do well for businesses.

Buyer-consumer vs. content-consumer thinking is totally different when absorbing content. Profitability and popularity are closely related, however most people become popular with traditional means but not profitable.

In my experience, Faceless videos are more profitable, although it depends on the channel's style. Several professionals are now teaching in their courses that non-traditional films are making the difference in their business success and popularity.

Face-Share-Personal-Touch videos make audiences feel like they know the personality, but they're not profitable.

Most spend hours creating articles, videos, and thumbnails to seem good. That's how most YouTubers gained their success in the past, but not anymore.

Looking the part and performing a typical role in videos doesn't convert well, especially for newbie channels.

Working with video marketers and YouTubers for years, I've noticed that most struggle to be consistent with content publishing since they exclusively use formats that need extensive development. Camera and green screen set ups, shooting/filming, and editing for post productions require their time, making it less appealing to post consistently, especially if they're doing all the work themselves.

Because they won't make simple format videos or audio videos with an overlay image, they overcomplicate the procedure (even with YouTube Shorts), and they leave their channels for weeks or months. Again, they believe YouTube only allows specific types of videos. Even though this procedure isn't working, they plan to keep at it.

A successful YouTube channel needs multiple video formats to suit viewer needs, I teach. Face-Share-Personal Touch and Faceless videos are both useful.

How people engage with YouTube content has changed over the years, and the average customer is no longer interested in an all-video channel.

Face-Share-Personal-Touch videos are great

Google Live

Online training

Giving listeners a different way to access your podcast that is being broadcast on sites like Anchor, BlogTalkRadio, Spreaker, Google, Apple Store, and others Many people enjoy using a video camera to record themselves while performing the internet radio, Facebook, or Instagram Live versions of their podcasts.

Video Blog Updates

even more

Faceless videos are popular for business and benefit both entrepreneurs and audiences.

For the business owner/entrepreneur…

Less production time results in time dollar savings.

enables the business owner to demonstrate the diversity of content development

For the Audience…

The channel offers a variety of appealing content options.

The same format is not monotonous or overly repetitive for the viewers.

Below are a couple videos from YouTube guru Make Money Matt's channel, which has over 347K subscribers.

Enjoy

24 Best Niches to Make Money on YouTube Without Showing Your Face

Make Money on YouTube Without Making Videos (Free Course)

In conclusion, you have everything it takes to build your own YouTube brand and empire. Learn the rules, then adapt them to succeed.

Please reread this and the other suggested articles for optimal benefit.

I hope this helped. How has this article helped you? Follow me for more articles like this and more multi-mission expressions.

Eitan Levy

3 years ago

The Top 8 Growth Hacking Techniques for Startups

The Top 8 Growth Hacking Techniques for Startups

These startups, and how they used growth-hack marketing to flourish, are some of the more ethical ones, while others are less so.

Before the 1970 World Cup began, Puma paid footballer Pele $120,000 to tie his shoes. The cameras naturally focused on Pele and his Pumas, causing people to realize that Puma was the top football brand in the world.

Early workers of Uber canceled over 5,000 taxi orders made on competing applications in an effort to financially hurt any of their rivals.

PayPal developed a bot that advertised cheap goods on eBay, purchased them, and paid for them with PayPal, fooling eBay into believing that customers preferred this payment option. Naturally, Paypal became eBay's primary method of payment.

Anyone renting a space on Craigslist had their emails collected by AirBnB, who then urged them to use their service instead. A one-click interface was also created to list immediately on AirBnB from Craigslist.

To entice potential single people looking for love, Tinder developed hundreds of bogus accounts of attractive people. Additionally, for at least a year, users were "accidentally" linked.

Reddit initially created a huge number of phony accounts and forced them all to communicate with one another. It eventually attracted actual users—the real meaning of "fake it 'til you make it"! Additionally, this gave Reddit control over the tone of voice they wanted for their site, which is still present today.

To disrupt the conferences of their main rival, Salesforce recruited fictitious protestors. The founder then took over all of the event's taxis and gave a 45-minute pitch for his startup. No place to hide!

When a wholesaler required a minimum purchase of 10, Amazon CEO Jeff Bezos wanted a way to purchase only one book from them. A wholesaler would deliver the one book he ordered along with an apology for the other eight books after he discovered a loophole and bought the one book before ordering nine books about lichens. On Amazon, he increased this across all of the users.

Original post available here

You might also like

Glorin Santhosh

3 years ago

Start organizing your ideas by using The Second Brain.

Building A Second Brain helps us remember connections, ideas, inspirations, and insights. Using contemporary technologies and networks increases our intelligence.

This approach makes and preserves concepts. It's a straightforward, practical way to construct a second brain—a remote, centralized digital store for your knowledge and its sources.

How to build ‘The Second Brain’

Have you forgotten any brilliant ideas? What insights have you ignored?

We're pressured to read, listen, and watch informative content. Where did the data go? What happened?

Our brains can store few thoughts at once. Our brains aren't idea banks.

Building a Second Brain helps us remember thoughts, connections, and insights. Using digital technologies and networks expands our minds.

Ten Rules for Creating a Second Brain

1. Creative Stealing

Instead of starting from scratch, integrate other people's ideas with your own.

This way, you won't waste hours starting from scratch and can focus on achieving your goals.

Users of Notion can utilize and customize each other's templates.

2. The Habit of Capture

We must record every idea, concept, or piece of information that catches our attention since our minds are fragile.

When reading a book, listening to a podcast, or engaging in any other topic-related activity, save and use anything that resonates with you.

3. Recycle Your Ideas

Reusing our own ideas across projects might be advantageous since it helps us tie new information to what we already know and avoids us from starting a project with no ideas.

4. Projects Outside of Category

Instead of saving an idea in a folder, group it with documents for a project or activity.

If you want to be more productive, gather suggestions.

5. Burns Slowly

Even if you could finish a job, work, or activity if you focused on it, you shouldn't.

You'll get tired and can't advance many projects. It's easier to divide your routine into daily tasks.

Few hours of daily study is more productive and healthier than entire nights.

6. Begin with a surplus

Instead of starting with a blank sheet when tackling a new subject, utilise previous articles and research.

You may have read or saved related material.

7. Intermediate Packets

A bunch of essay facts.

You can utilize it as a document's section or paragraph for different tasks.

Memorize useful information so you can use it later.

8. You only know what you make

We can see, hear, and read about anything.

What matters is what we do with the information, whether that's summarizing it or writing about it.

9. Make it simpler for yourself in the future.

Create documents or files that your future self can easily understand. Use your own words, mind maps, or explanations.

10. Keep your thoughts flowing.

If you don't employ the knowledge in your second brain, it's useless.

Few people exercise despite knowing its benefits.

Conclusion:

You may continually move your activities and goals closer to completion by organizing and applying your information in a way that is results-focused.

Profit from the information economy's explosive growth by turning your specialized knowledge into cash.

Make up original patterns and linkages between topics.

You may reduce stress and information overload by appropriately curating and managing your personal information stream.

Learn how to apply your significant experience and specific knowledge to a new job, business, or profession.

Without having to adhere to tight, time-consuming constraints, accumulate a body of relevant knowledge and concepts over time.

Take advantage of all the learning materials that are at your disposal, including podcasts, online courses, webinars, books, and articles.

Aparna Jain

3 years ago

Negative Effects of Working for a FAANG Company

Consider yourself lucky if your last FAANG interview was rejected.

FAANG—Facebook, Apple, Amazon, Netflix, Google

(I know its manga now, but watch me not care)

These big companies offer many benefits.

large salaries and benefits

Prestige

high expectations for both you and your coworkers.

However, these jobs may have major drawbacks that only become apparent when you're thrown to the wolves, so it's up to you whether you see them as drawbacks or opportunities.

I know most college graduates start working at big tech companies because of their perceived coolness.

I've worked in these companies for years and can tell you what to expect if you get a job here.

Little fish in a vast ocean

The most obvious. Most billion/trillion-dollar companies employ thousands.

You may work on a small, unnoticed product part.

Directors and higher will sometimes make you redo projects they didn't communicate well without respecting your time, talent, or will to work on trivial stuff that doesn't move company needles.

Peers will only say, "Someone has to take out the trash," even though you know company resources are being wasted.

The power imbalance is frustrating.

What you can do about it

Know your WHY. Consider long-term priorities. Though riskier, I stayed in customer-facing teams because I loved building user-facing products.

This increased my impact. However, if you enjoy helping coworkers build products, you may be better suited for an internal team.

I told the Directors and Vice Presidents that their actions could waste Engineering time, even though it was unpopular. Some were receptive, some not.

I kept having tough conversations because they were good for me and the company.

However, some of my coworkers praised my candor but said they'd rather follow the boss.

An outdated piece of technology can take years to update.

Apple introduced Swift for iOS development in 2014. Most large tech companies adopted the new language after five years.

This is frustrating if you want to learn new skills and increase your market value.

Knowing that my lack of Swift practice could hurt me if I changed jobs made writing verbose Objective C painful.

What you can do about it

Work on the new technology in side projects; one engineer rewrote the Lyft app in Swift over the course of a weekend and promoted its adoption throughout the entire organization.

To integrate new technologies and determine how to combine legacy and modern code, suggest minor changes to the existing codebase.

Most managers spend their entire day in consecutive meetings.

After their last meeting, the last thing they want is another meeting to discuss your career goals.

Sometimes a manager has 15-20 reports, making it hard to communicate your impact.

Misunderstandings and stress can result.

Especially when the manager should focus on selfish parts of the team. Success won't concern them.

What you can do about it

Tell your manager that you are a self-starter and that you will pro-actively update them on your progress, especially if they aren't present at the meetings you regularly attend.

Keep being proactive and look for mentorship elsewhere if you believe your boss doesn't have enough time to work on your career goals.

Alternately, look for a team where the manager has more authority to assist you in making career decisions.

After a certain point, company loyalty can become quite harmful.

Because big tech companies create brand loyalty, too many colleagues stayed in unhealthy environments.

When you work for a well-known company and strangers compliment you, it's fun to tell your friends.

Work defines you. This can make you stay too long even though your career isn't progressing and you're unhappy.

Google may become your surname.

Workplaces are not families.

If you're unhappy, don't stay just because they gave you the paycheck to buy your first home and make you feel like you owe your life to them.

Many employees stayed too long. Though depressed and suicidal.

What you can do about it

Your life is not worth a company.

Do you want your job title and workplace to be listed on your gravestone? If not, leave if conditions deteriorate.

Recognize that change can be challenging. It's difficult to leave a job you've held for a number of years.

Ask those who have experienced this change how they handled it.

You still have a bright future if you were rejected from FAANG interviews.

Rejections only lead to amazing opportunities. If you're young and childless, work for a startup.

Companies may pay more than FAANGs. Do your research.

Ask recruiters and hiring managers tough questions about how the company and teams prioritize respectful working hours and boundaries for workers.

I know many 15-year-olds who have a lifelong dream of working at Google, and it saddens me that they're chasing a name on their resume instead of excellence.

This article is not meant to discourage you from working at these companies, but to share my experience about what HR/managers will never mention in interviews.

Read both sides before signing the big offer letter.

Jayden Levitt

3 years ago

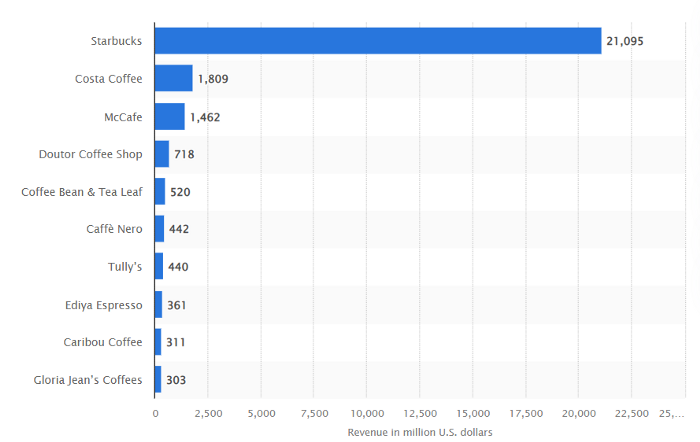

Starbucks' NFT Project recently defeated its rivals.

The same way Amazon killed bookstores. You just can’t see it yet.

Shultz globalized coffee. Before Starbucks, coffee sucked.

All accounts say 1970s coffee was awful.

Starbucks had three stores selling ground Indonesian coffee in the 1980s.

What a show!

A year after joining the company at 29, Shultz traveled to Italy for R&D.

He noticed the coffee shops' sense of theater and community and realized Starbucks was in the wrong business.

Integrating coffee and destination created a sense of community in the store.

Brilliant!

He told Starbucks' founders about his experience.

They disapproved.

For two years.

Shultz left and opened an Italian coffee shop chain like any good entrepreneur.

Starbucks ran into financial trouble, so the founders offered to sell to Shultz.

Shultz bought Starbucks in 1987 for $3.8 million, including six stores and a payment plan.

Starbucks is worth $100.79Billion, per Google Finance.

26,500 times Shultz's initial investment

Starbucks is releasing its own NFT Platform under Shultz and his early Vision.

This year, Starbucks Odyssey launches. The new digital experience combines a Loyalty Rewards program with NFT.

The side chain Polygon-based platform doesn't require a Crypto Wallet. Customers can earn and buy digital assets to unlock incentives and experiences.

They've removed all friction, making it more immersive and convenient than a coffee shop.

Brilliant!

NFTs are the access coupon to their digital community, but they don't highlight the technology.

They prioritize consumer experience by adding non-technical users to Web3. Their collectables are called journey stamps, not NFTs.

No mention of bundled gas fees.

Brady Brewer, Starbucks' CMO, said;

“It happens to be built on blockchain and web3 technologies, but the customer — to be honest — may very well not even know that what they’re doing is interacting with blockchain technology. It’s just the enabler,”

Rewards members will log into a web app using their loyalty program credentials to access Starbucks Odyssey. They won't know about blockchain transactions.

Starbucks has just dealt its rivals a devastating blow.

It generates more than ten times the revenue of its closest competitor Costa Coffee.

The coffee giant is booming.

Starbucks is ahead of its competitors. No wonder.

They have an innovative, adaptable leadership team.

Starbucks' DNA challenges the narrative, especially when others reject their ideas.

I’m off for a cappuccino.