More on Entrepreneurship/Creators

The woman

3 years ago

Because he worked on his side projects during working hours, my junior was fired and sued.

Many developers do it, but I don't approve.

Aren't many programmers part-time? Many work full-time but also freelance. If the job agreement allows it, I see no problem.

Tech businesses' policies vary. I have a friend in Google, Germany. According to his contract, he couldn't do an outside job. Google owns any code he writes while employed.

I was shocked. Later, I found that different Google regions have different policies.

A corporation can normally establish any agreement before hiring you. They're negotiable. When there's no agreement, state law may apply. In court, law isn't so simple.

I won't delve into legal details. Instead, let’s talk about the incident.

How he was discovered

In one month, he missed two deadlines. His boss was frustrated because the assignment wasn't difficult to miss twice. When a team can't finish work on time, they all earn bad grades.

He annoyed the whole team. One team member (anonymous) told the project manager he worked on side projects during office hours. He may have missed deadlines because of this.

The project manager was furious. He needed evidence. The manager caught him within a week. The manager told higher-ups immediately.

The company wanted to set an example

Management could terminate him and settle the problem. But the company wanted to set an example for those developers who breached the regulation.

Because dismissal isn't enough. Every organization invests heavily in developer hiring. If developers depart or are fired after a few months, the company suffers.

The developer spent 10 months there. The employer sacked him and demanded ten months' pay. Or they'd sue him.

It was illegal and unethical. The youngster paid the fine and left the company quietly to protect his career.

Right or wrong?

Is the developer's behavior acceptable? Let's discuss developer malpractice.

During office hours, may developers work on other projects? If they're bored during office hours, they might not. Check the employment contract or state law.

If there's no employment clause, check country/state law. Because you can't justify breaking the law. Always. Most employers own their employees' work hours unless it's a contractual position.

If the company agrees, it's fine.

I also oppose companies that force developers to work overtime without pay.

Most states and countries have laws that help companies and workers. Law supports employers in this case. If any of the following are true, the company/employer owns the IP under California law.

using the business's resources

any equipment, including a laptop used for business.

company's mobile device.

offices of the company.

business time as well. This is crucial. Because this occurred in the instance of my junior.

Company resources are dangerous. Because your company may own the product's IP. If you have seen the TV show Silicon Valley, you have seen a similar situation there, right?

Conclusion

Simple rule. I avoid big side projects. I work on my laptop on weekends for side projects. I'm safe. But I also know that my company might not be happy with that.

As an employee, I suppose I can. I can make side money. I won't promote it, but I'll respect their time, resources, and task. I also sometimes work extra time to finish my company’s deadlines.

Benjamin Lin

3 years ago

I sold my side project for $20,000: 6 lessons I learned

How I monetized and sold an abandoned side project for $20,000

The Origin Story

I've always wanted to be an entrepreneur but never succeeded. I often had business ideas, made a landing page, and told my buddies. Never got customers.

In April 2021, I decided to try again with a new strategy. I noticed that I had trouble acquiring an initial set of customers, so I wanted to start by acquiring a product that had a small user base that I could grow.

I found a SaaS marketplace called MicroAcquire.com where you could buy and sell SaaS products. I liked Shareit.video, an online Loom-like screen recorder.

Shareit.video didn't generate revenue, but 50 people visited daily to record screencasts.

Purchasing a Failed Side Project

I eventually bought Shareit.video for $12,000 from its owner.

$12,000 was probably too much for a website without revenue or registered users.

I thought time was most important. I could have recreated the website, but it would take months. $12,000 would give me an organized code base and a working product with a few users to monetize.

I considered buying a screen recording website and trying to grow it versus buying a new car or investing in crypto with the $12K.

Buying the website would make me a real entrepreneur, which I wanted more than anything.

Putting down so much money would force me to commit to the project and prevent me from quitting too soon.

A Year of Development

I rebranded the website to be called RecordJoy and worked on it with my cousin for about a year. Within a year, we made $5000 and had 3000 users.

We spent $3500 on ads, hosting, and software to run the business.

AppSumo promoted our $120 Life Time Deal in exchange for 30% of the revenue.

We put RecordJoy on maintenance mode after 6 months because we couldn't find a scalable user acquisition channel.

We improved SEO and redesigned our landing page, but nothing worked.

Despite not being able to grow RecordJoy any further, I had already learned so much from working on the project so I was fine with putting it on maintenance mode. RecordJoy still made $500 a month, which was great lunch money.

Getting Taken Over

One of our customers emailed me asking for some feature requests and I replied that we weren’t going to add any more features in the near future. They asked if we'd sell.

We got on a call with the customer and I asked if he would be interested in buying RecordJoy for 15k. The customer wanted around $8k but would consider it.

Since we were negotiating with one buyer, we put RecordJoy on MicroAcquire to see if there were other offers.

We quickly received 10+ offers. We got 18.5k. There was also about $1000 in AppSumo that we could not withdraw, so we agreed to transfer that over for $600 since about 40% of our sales on AppSumo usually end up being refunded.

Lessons Learned

First, create an acquisition channel

We couldn't discover a scalable acquisition route for RecordJoy. If I had to start another project, I'd develop a robust acquisition channel first. It might be LinkedIn, Medium, or YouTube.

Purchase Power of the Buyer Affects Acquisition Price

Some of the buyers we spoke to were individuals looking to buy side projects, as well as companies looking to launch a new product category. Individual buyers had less budgets than organizations.

Customers of AppSumo vary.

AppSumo customers value lifetime deals and low prices, which may not be a good way to build a business with recurring revenue. Designed for AppSumo users, your product may not connect with other users.

Try to increase acquisition trust

Acquisition often fails. The buyer can go cold feet, cease communicating, or run away with your stuff. Trusting the buyer ensures a smooth asset exchange. First acquisition meeting was unpleasant and price negotiation was tight. In later meetings, we spent the first few minutes trying to get to know the buyer’s motivations and background before jumping into the negotiation, which helped build trust.

Operating expenses can reduce your earnings.

Monitor operating costs. We were really happy when we withdrew the $5000 we made from AppSumo and Stripe until we realized that we had spent $3500 in operating fees. Spend money on software and consultants to help you understand what to build.

Don't overspend on advertising

We invested $1500 on Google Ads but made little money. For a side project, it’s better to focus on organic traffic from SEO rather than paid ads unless you know your ads are going to have a positive ROI.

Aaron Dinin, PhD

3 years ago

There Are Two Types of Entrepreneurs in the World Make sure you are aware of your type!

Know why it's important.

The entrepreneur I was meeting with said, "I should be doing crypto, or maybe AI? Aren't those the hot spots? I should look there for a startup idea.”

I shook my head. Yes, they're exciting, but that doesn't mean they're best for you and your business.

“There are different types of entrepreneurs?” he asked.

I said "obviously." Two types, actually. Knowing what type of entrepreneur you are helps you build the right startup.

The two types of businesspeople

The best way for me to describe the two types of entrepreneurs is to start by telling you exactly the kinds of entrepreneurial opportunities I never get excited about: future opportunities.

In the early 1990s, my older brother showed me the World Wide Web and urged me to use it. Unimpressed, I returned to my Super Nintendo.

My roommate tried to get me to join Facebook as a senior in college. I remember thinking, This is dumb. Who'll use it?

In 2011, my best friend tried to convince me to buy bitcoin and I laughed.

Heck, a couple of years ago I had to buy a new car, and I never even considered buying something that didn’t require fossilized dinosaur bones.

I'm no visionary. I don't anticipate the future. I focus on the present.

This tendency makes me a problem-solving entrepreneur. I identify entrepreneurial opportunities by spotting flaws and/or inefficiencies in the world and devising solutions.

There are other ways to find business opportunities. Visionary entrepreneurs also exist. I don't mean visionary in the hyperbolic sense that implies world-changing impact. I mean visionary as an entrepreneur who identifies future technological shifts that will change how people work and live and create new markets.

Problem-solving and visionary entrepreneurs are equally good. But the two approaches to building companies are very different. Knowing the type of entrepreneur you are will help you build a startup that fits your worldview.

What is the distinction?

Let's use some simple hypotheticals to compare problem-solving and visionary entrepreneurship.

Imagine a city office building without nearby restaurants. Those office workers love to eat. Sometimes they'd rather eat out than pack a lunch. As an entrepreneur, you can solve the lack of nearby restaurants. You'd open a restaurant near that office, say a pizza parlor, and get customers because you solved the lack of nearby restaurants. Problem-solving entrepreneurship.

Imagine a new office building in a developing area with no residents or workers. In this scenario, a large office building is coming. The workers will need to eat then. As a visionary entrepreneur, you're excited about the new market and decide to open a pizzeria near the construction to meet demand.

Both possibilities involve the same product. You opened a pizzeria. How you launched that pizza restaurant and what will affect its success are different.

Why is the distinction important?

Let's say you opened a pizzeria near an office. You'll probably get customers. Because people are nearby and demand isn't being met, someone from a nearby building will stop in within the first few days of your pizzeria's grand opening. This makes solving the problem relatively risk-free. You'll get customers unless you're a fool.

The market you're targeting existed before you entered it, so you're not guaranteed success. This means people in that market solved the lack of nearby restaurants. Those office workers are used to bringing their own lunches. Why should your restaurant change their habits? Even when they eat out, they're used to traveling far. They've likely developed pizza preferences.

To be successful with your problem-solving startup, you must convince consumers to change their behavior, which is difficult.

Unlike opening a pizza restaurant near a construction site. Once the building opens, workers won't have many preferences or standardized food-getting practices. Your pizza restaurant can become the incumbent quickly. You'll be the first restaurant in the area, so you'll gain a devoted following that makes your food a routine.

Great, right? It's easier than changing people's behavior. The benefit comes with a risk. Opening a pizza restaurant near a construction site increases future risk. What if builders run out of money? No one moves in? What if the building's occupants are the National Association of Pizza Haters? Then you've opened a pizza restaurant next to pizza haters.

Which kind of businessperson are you?

This isn't to say one type of entrepreneur is better than another. Each type of entrepreneurship requires different skills.

As my simple examples show, a problem-solving entrepreneur must operate in markets with established behaviors and habits. To be successful, you must be able to teach a market a new way of doing things.

Conversely, the challenge of being a visionary entrepreneur is that you have to be good at predicting the future and getting in front of that future before other people.

Both are difficult in different ways. So, smart entrepreneurs don't just chase opportunities. Smart entrepreneurs pursue opportunities that match their skill sets.

You might also like

Joe Procopio

3 years ago

Provide a product roadmap that can withstand startup velocities

This is how to build a car while driving.

Building a high-growth startup is compared to building a car while it's speeding down the highway.

How to plan without going crazy? Or, without losing team, board, and investor buy-in?

I just delivered our company's product roadmap for the rest of the year. Complete. Thorough. Page-long. I'm optimistic about its chances of surviving as everything around us changes, from internal priorities to the global economy.

It's tricky. This isn't the first time I've created a startup roadmap. I didn't invent a document. It took time to deliver a document that will be relevant for months.

Goals matter.

Although they never change, goals are rarely understood.

This is the third in a series about a startup's unique roadmapping needs. Velocity is the intensity at which a startup must produce to survive.

A high-growth startup moves at breakneck speed, which I alluded to when I said priorities and economic factors can change daily or weekly.

At that speed, a startup's roadmap must be flexible, bend but not break, and be brief and to the point. I can't tell you how many startups and large companies develop a product roadmap every quarter and then tuck it away.

Big, wealthy companies can do this. It's suicide for a startup.

The drawer thing happens because startup product roadmaps are often valid for a short time. The roadmap is a random list of features prioritized by different company factions and unrelated to company goals.

It's not because the goals changed that a roadmap is shelved or ignored. Because the company's goals were never communicated or documented in the context of its product.

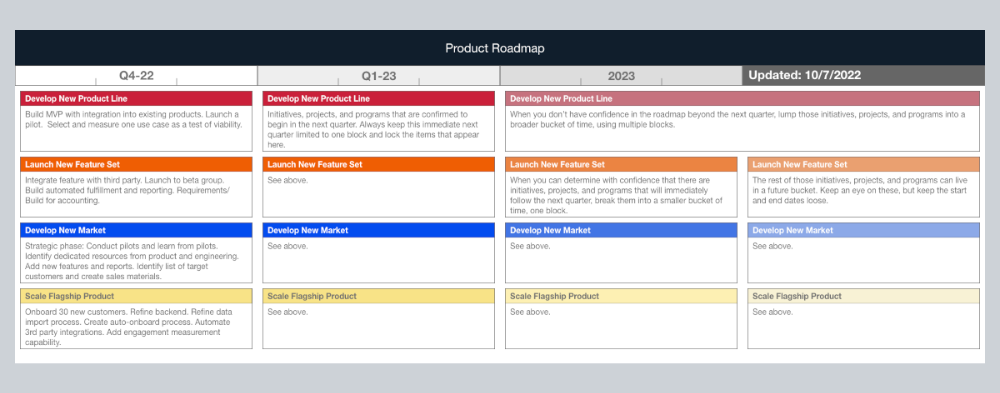

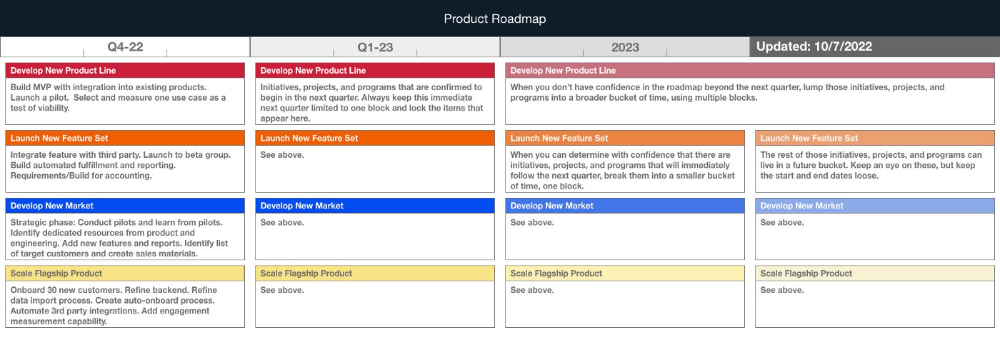

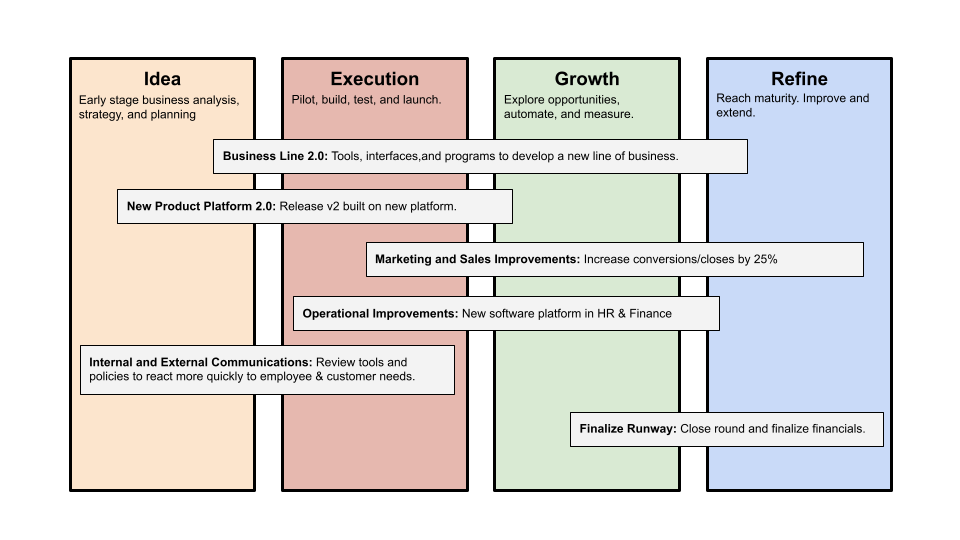

In the previous post, I discussed how to turn company goals into a product roadmap. In this post, I'll show you how to make a one-page startup roadmap.

In a future post, I'll show you how to follow this roadmap. This roadmap helps you track company goals, something a roadmap must do.

Be vague for growth, but direct for execution.

Here's my plan. The real one has more entries and more content in each.

Let's discuss smaller boxes.

Product developers and engineers know that the further out they predict, the more wrong they'll be. When developing the product roadmap, this rule is ignored. Then it bites us three, six, or nine months later when we haven't even started.

Why do we put everything in a product roadmap like a project plan?

Yes, I know. We use it when the product roadmap isn't goal-based.

A goal-based roadmap begins with a document that outlines each goal's idea, execution, growth, and refinement.

Once the goals are broken down into epics, initiatives, projects, and programs, only the idea and execution phases should be modeled. Any goal growth or refinement items should be vague and loosely mapped.

Why? First, any idea or execution-phase goal will result in growth initiatives that are unimaginable today. Second, internal priorities and external factors will change, but the goals won't. Locking items into calendar slots reduces flexibility and forces deviation from the single source of truth.

No soothsayers. Predicting the future is pointless; just prepare.

A map is useless if you don't know where you're going.

As we speed down the road, the car and the road will change. Goals define the destination.

This quarter and next quarter's roadmap should be set. After that, you should track destination milestones, not how to get there.

When you do that, even the most critical investors will understand the roadmap and buy in. When you track progress at the end of the quarter and revise your roadmap, the destination won't change.

Leonardo Castorina

3 years ago

How to Use Obsidian to Boost Research Productivity

Tools for managing your PhD projects, reading lists, notes, and inspiration.

As a researcher, you have to know everything. But knowledge is useless if it cannot be accessed quickly. An easy-to-use method of archiving information makes taking notes effortless and enjoyable.

As a PhD student in Artificial Intelligence, I use Obsidian (https://obsidian.md) to manage my knowledge.

The article has three parts:

- What is a note, how to organize notes, tags, folders, and links? This section is tool-agnostic, so you can use most of these ideas with any note-taking app.

- Instructions for using Obsidian, managing notes, reading lists, and useful plugins. This section demonstrates how I use Obsidian, my preferred knowledge management tool.

- Workflows: How to use Zotero to take notes from papers, manage multiple projects' notes, create MOCs with Dataview, and more. This section explains how to use Obsidian to solve common scientific problems and manage/maintain your knowledge effectively.

This list is not perfect or complete, but it is my current solution to problems I've encountered during my PhD. Please leave additional comments or contact me if you have any feedback. I'll try to update this article.

Throughout the article, I'll refer to your digital library as your "Obsidian Vault" or "Zettelkasten".

Other useful resources are listed at the end of the article.

1. Philosophy: Taking and organizing notes

Carl Sagan: “To make an apple pie from scratch, you must first create the universe.”

Before diving into Obsidian, let's establish a Personal Knowledge Management System and a Zettelkasten. You can skip to Section 2 if you already know these terms.

Niklas Luhmann, a prolific sociologist who wrote 400 papers and 70 books, inspired this section and much of Zettelkasten. Zettelkasten means “slip box” (or library in this article). His Zettlekasten had around 90000 physical notes, which can be found here.

There are now many tools available to help with this process. Obsidian's website has a good introduction section: https://publish.obsidian.md/hub/

Notes

We'll start with "What is a note?" Although it may seem trivial, the answer depends on the topic or your note-taking style. The idea is that a note is as “atomic” (i.e. You should read the note and get the idea right away.

The resolution of your notes depends on their detail. Deep Learning, for example, could be a general description of Neural Networks, with a few notes on the various architectures (eg. Recurrent Neural Networks, Convolutional Neural Networks etc..).

Limiting length and detail is a good rule of thumb. If you need more detail in a specific section of this note, break it up into smaller notes. Deep Learning now has three notes:

- Deep Learning

- Recurrent Neural Networks

- Convolutional Neural Networks

Repeat this step as needed until you achieve the desired granularity. You might want to put these notes in a “Neural Networks” folder because they are all about the same thing. But there's a better way:

#Tags and [[Links]] over /Folders/

The main issue with folders is that they are not flexible and assume that all notes in the folder belong to a single category. This makes it difficult to make connections between topics.

Deep Learning has been used to predict protein structure (AlphaFold) and classify images (ImageNet). Imagine a folder structure like this:

- /Proteins/

- Protein Folding

- /Deep Learning/

- /Proteins/

Your notes about Protein Folding and Convolutional Neural Networks will be separate, and you won't be able to find them in the same folder.

This can be solved in several ways. The most common one is to use tags rather than folders. A note can be grouped with multiple topics this way. Obsidian tags can also be nested (have subtags).

You can also link two notes together. You can build your “Knowledge Graph” in Obsidian and other note-taking apps like Obsidian.

My Knowledge Graph. Green: Biology, Red: Machine Learning, Yellow: Autoencoders, Blue: Graphs, Brown: Tags.

My Knowledge Graph and the note “Backrpropagation” and its links.

Backpropagation note and all its links

Why use Folders?

Folders help organize your vault as it grows. The main suggestion is to have few folders that "weakly" collect groups of notes or better yet, notes from different sources.

Among my Zettelkasten folders are:

My Zettelkasten's 5 folders

They usually gather data from various sources:

MOC: Map of Contents for the Zettelkasten.

Projects: Contains one note for each side-project of my PhD where I log my progress and ideas. Notes are linked to these.

Bio and ML: These two are the main content of my Zettelkasten and could theoretically be combined.

Papers: All my scientific paper notes go here. A bibliography links the notes. Zotero .bib file

Books: I make a note for each book I read, which I then split into multiple notes.

Keeping images separate from other files can help keep your main folders clean.

I will elaborate on these in the Workflow Section.

My general recommendation is to use tags and links instead of folders.

Maps of Content (MOC)

Making Tables of Contents is a good solution (MOCs).

These are notes that "signposts" your Zettelkasten library, directing you to the right type of notes. It can link to other notes based on common tags. This is usually done with a title, then your notes related to that title. As an example:

An example of a Machine Learning MOC generated with Dataview.

As shown above, my Machine Learning MOC begins with the basics. Then it's on to Variational Auto-Encoders. Not only does this save time, but it also saves scrolling through the tag search section.

So I keep MOCs at the top of my library so I can quickly find information and see my library. These MOCs are generated automatically using an Obsidian Plugin called Dataview (https://github.com/blacksmithgu/obsidian-dataview).

Ideally, MOCs could be expanded to include more information about the notes, their status, and what's left to do. In the absence of this, Dataview does a fantastic job at creating a good structure for your notes.

In the absence of this, Dataview does a fantastic job at creating a good structure for your notes.

2. Tools: Knowing Obsidian

Obsidian is my preferred tool because it is free, all notes are stored in Markdown format, and each panel can be dragged and dropped. You can get it here: https://obsidian.md/

Obsidian interface.

Obsidian is highly customizable, so here is my preferred interface:

The theme is customized from https://github.com/colineckert/obsidian-things

Alternatively, each panel can be collapsed, moved, or removed as desired. To open a panel later, click on the vertical "..." (bottom left of the note panel).

My interface is organized as follows:

How my Obsidian Interface is organized.

Folders/Search:

This is where I keep all relevant folders. I usually use the MOC note to navigate, but sometimes I use the search button to find a note.

Tags:

I use nested tags and look into each one to find specific notes to link.

cMenu:

Easy-to-use menu plugin cMenu (https://github.com/chetachiezikeuzor/cMenu-Plugin)

Global Graph:

The global graph shows all your notes (linked and unlinked). Linked notes will appear closer together. Zoom in to read each note's title. It's a bit overwhelming at first, but as your library grows, you get used to the positions and start thinking of new connections between notes.

Local Graph:

Your current note will be shown in relation to other linked notes in your library. When needed, you can quickly jump to another link and back to the current note.

Links:

Finally, an outline panel and the plugin Obsidian Power Search (https://github.com/aviral-batra/obsidian-power-search) allow me to search my vault by highlighting text.

Start using the tool and worry about panel positioning later. I encourage you to find the best use-case for your library.

Plugins

An additional benefit of using Obsidian is the large plugin library. I use several (Calendar, Citations, Dataview, Templater, Admonition):

Obsidian Calendar Plugin: https://github.com/liamcain

It organizes your notes on a calendar. This is ideal for meeting notes or keeping a journal.

Calendar addon from hans/obsidian-citation-plugin

Obsidian Citation Plugin: https://github.com/hans/

Allows you to cite papers from a.bib file. You can also customize your notes (eg. Title, Authors, Abstract etc..)

Plugin citation from hans/obsidian-citation-plugin

Obsidian Dataview: https://github.com/blacksmithgu/

A powerful plugin that allows you to query your library as a database and generate content automatically. See the MOC section for an example.

Allows you to create notes with specific templates like dates, tags, and headings.

Templater. Obsidian Admonition: https://github.com/valentine195/obsidian-admonition

Blocks allow you to organize your notes.

Plugin warning. Obsidian Admonition (valentine195)

There are many more, but this list should get you started.

3. Workflows: Cool stuff

Here are a few of my workflows for using obsidian for scientific research. This is a list of resources I've found useful for my use-cases. I'll outline and describe them briefly so you can skim them quickly.

3.1 Using Templates to Structure Notes

3.2 Free Note Syncing (Laptop, Phone, Tablet)

3.3 Zotero/Mendeley/JabRef -> Obsidian — Managing Reading Lists

3.4 Projects and Lab Books

3.5 Private Encrypted Diary

3.1 Using Templates to Structure Notes

Plugins: Templater and Dataview (optional).

To take effective notes, you must first make adding new notes as easy as possible. Templates can save you time and give your notes a consistent structure. As an example:

An example of a note using a template.

### [[YOUR MOC]]

# Note Title of your note

**Tags**::

**Links**::

The top line links to your knowledge base's Map of Content (MOC) (see previous sections). After the title, I add tags (and a link between the note and the tag) and links to related notes.

To quickly identify all notes that need to be expanded, I add the tag “#todo”. In the “TODO:” section, I list the tasks within the note.

The rest are notes on the topic.

Templater can help you create these templates. For new books, I use the following template:

### [[Books MOC]]

# Title

**Author**::

**Date::

**Tags::

**Links::

A book template example.

Using a simple query, I can hook Dataview to it.

dataview

table author as Author, date as “Date Finished”, tags as “Tags”, grade as “Grade”

from “4. Books”

SORT grade DESCENDING

using Dataview to query templates.

3.2 Free Note Syncing (Laptop, Phone, Tablet)

No plugins used.

One of my favorite features of Obsidian is the library's self-contained and portable format. Your folder contains everything (plugins included).

Ordinary folders and documents are available as well. There is also a “.obsidian” folder. This contains all your plugins and settings, so you can use it on other devices.

So you can use Google Drive, iCloud, or Dropbox for free as long as you sync your folder (note: your folder should be in your Cloud Folder).

For my iOS and macOS work, I prefer iCloud. You can also use the paid service Obsidian Sync.

3.3 Obsidian — Managing Reading Lists and Notes in Zotero/Mendeley/JabRef

Plugins: Quotes (required).

3.3 Zotero/Mendeley/JabRef -> Obsidian — Taking Notes and Managing Reading Lists of Scientific Papers

My preferred reference manager is Zotero, but this workflow should work with any reference manager that produces a .bib file. This file is exported to my cloud folder so I can access it from any platform.

My Zotero library is tagged as follows:

My reference manager's tags

For readings, I usually search for the tags “!!!” and “To-Read” and select a paper. Annotate the paper next (either on PDF using GoodNotes or on physical paper).

Then I make a paper page using a template in the Citations plugin settings:

An example of my citations template.

Create a new note, open the command list with CMD/CTRL + P, and find the Citations “Insert literature note content in the current pane” to see this lovely view.

Citation generated by the article https://doi.org/10.1101/2022.01.24.22269144

You can then convert your notes to digital. I found that transcribing helped me retain information better.

3.4 Projects and Lab Books

Plugins: Tweaker (required).

PhD students offering advice on thesis writing are common (read as regret). I started asking them what they would have done differently or earlier.

“Deep stuff Leo,” one person said. So my main issue is basic organization, losing track of my tasks and the reasons for them.

As a result, I'd go on other experiments that didn't make sense, and have to reverse engineer my logic for thesis writing. - PhD student now wise Postdoc

Time management requires planning. Keeping track of multiple projects and lab books is difficult during a PhD. How I deal with it:

- One folder for all my projects

- One file for each project

I use a template to create each project

### [[Projects MOC]]

# <% tp.file.title %>

**Tags**::

**Links**::

**URL**::

**Project Description**::## Notes:

### <% tp.file.last_modified_date(“dddd Do MMMM YYYY”) %>

#### Done:

#### TODO:

#### Notes

You can insert a template into a new note with CMD + P and looking for the Templater option.

I then keep adding new days with another template:

### <% tp.file.last_modified_date("dddd Do MMMM YYYY") %>

#### Done:

#### TODO:

#### Notes:

This way you can keep adding days to your project and update with reasonings and things you still have to do and have done. An example below:

Example of project note with timestamped notes.

3.5 Private Encrypted Diary

This is one of my favorite Obsidian uses.

Mini Diary's interface has long frustrated me. After the author archived the project, I looked for a replacement. I had two demands:

- It had to be private, and nobody had to be able to read the entries.

- Cloud syncing was required for editing on multiple devices.

Then I learned about encrypting the Obsidian folder. Then decrypt and open the folder with Obsidian. Sync the folder as usual.

Use CryptoMator (https://cryptomator.org/). Create an encrypted folder in Cryptomator for your Obsidian vault, set a password, and let it do the rest.

If you need a step-by-step video guide, here it is:

Conclusion

So, I hope this was helpful!

In the first section of the article, we discussed notes and note-taking techniques. We discussed when to use tags and links over folders and when to break up larger notes.

Then we learned about Obsidian, its interface, and some useful plugins like Citations for citing papers and Templater for creating note templates.

Finally, we discussed workflows and how to use Zotero to take notes from scientific papers, as well as managing Lab Books and Private Encrypted Diaries.

Thanks for reading and commenting :)

Read original post here

Taher Batterywala

3 years ago

Do You Have Focus Issues? Use These 5 Simple Habits

Many can't concentrate. The first 20% of the day isn't optimized.

Elon Musk, Tony Robbins, and Bill Gates share something:

Morning Routines.

A repeatable morning ritual saves time.

The result?

Time for hobbies.

I'll discuss 5 easy morning routines you can use.

1. Stop pressing snooze

Waking up starts the day. You disrupt your routine by hitting snooze.

One sleep becomes three. Your morning routine gets derailed.

Fix it:

Hide your phone. This disables snooze and wakes you up.

Once awake, staying awake is 10x easier. Simple trick, big results.

2. Drink water

Chronic dehydration is common. Mostly urban, air-conditioned workers/residents.

2% cerebral dehydration causes short-term memory loss.

Dehydration shrinks brain cells.

Drink 3-4 liters of water daily to avoid this.

3. Improve your focus

How to focus better?

Meditation.

Improve your mood

Enhance your memory

increase mental clarity

Reduce blood pressure and stress

Headspace helps with the habit.

Here's a meditation guide.

Sit comfortably

Shut your eyes.

Concentrate on your breathing

Breathe in through your nose

Breathe out your mouth.

5 in, 5 out.

Repeat for 1 to 20 minutes.

Here's a beginner's video:

4. Workout

Exercise raises:

Mental Health

Effort levels

focus and memory

15-60 minutes of fun:

Exercise Lifting

Running

Walking

Stretching and yoga

This helps you now and later.

5. Keep a journal

You have countless thoughts daily. Many quietly steal your focus.

Here’s how to clear these:

Write for 5-10 minutes.

You'll gain 2x more mental clarity.

Recap

5 morning practices for 5x more productivity:

Say no to snoozing

Hydrate

Improve your focus

Exercise

Journaling

Conclusion

One step starts a thousand-mile journey. Try these easy yet effective behaviors if you have trouble concentrating or have too many thoughts.

Start with one of these behaviors, then add the others. Its astonishing results are instant.