More on Entrepreneurship/Creators

Eve Arnold

3 years ago

Your Ideal Position As a Part-Time Creator

Inspired by someone I never met

Inspiration is good and bad.

Paul Jarvis inspires me. He's a web person and writer who created his own category by being himself.

Paul said no thank you when everyone else was developing, building, and assuming greater responsibilities. This isn't success. He rewrote the rules. Working for himself, expanding at his own speed, and doing what he loves were his definitions of success.

Play with a problem that you have

The biggest problem can be not recognizing a problem.

Acceptance without question is deception. When you don't push limits, you forget how. You start thinking everything must be as it is.

For example: working. Paul worked a 9-5 agency work with little autonomy. He questioned whether the 9-5 was a way to live, not the way.

Another option existed. So he chipped away at how to live in this new environment.

Don't simply jump

Internet writers tell people considering quitting 9-5 to just quit. To throw in the towel. To do what you like.

The advice is harmful, despite the good intentions. People think quitting is hard. Like courage is the issue. Like handing your boss a resignation letter.

Nope. The tough part comes after. It’s easy to jump. Landing is difficult.

The landing

Paul didn't quit. Intelligent individuals don't. Smart folks focus on landing. They imagine life after 9-5.

Paul had been a web developer for a long time, had solid clients, and was respected. Hence if he pushed the limits and discovered another route, he had the potential to execute.

Working on the side

Society loves polarization. It’s left or right. Either way. Or chaos. It's 9-5 or entrepreneurship.

But like Paul, you can stretch polarization's limits. In-between exists.

You can work a 9-5 and side jobs (as I do). A mix of your favorites. The 9-5's stability and creativity. Fire and routine.

Remember you can't have everything but anything. You can create and work part-time.

My hybrid lifestyle

Not selling books doesn't destroy my world. My globe keeps spinning if my new business fails or if people don't like my Tweets. Unhappy algorithm? Cool. I'm not bothered (okay maybe a little).

The mix gives me the best of both worlds. To create, hone my skill, and grasp big-business basics. I like routine, but I also appreciate spending 4 hours on Saturdays writing.

Some days I adore leaving work at 5 pm and disconnecting. Other days, I adore having a place to write if inspiration strikes during a run or a discussion.

I’m a part-time creator

I’m a part-time creator. No, I'm not trying to quit. I don't work 5 pm - 2 am on the side. No, I'm not at $10,000 MRR.

I work part-time but enjoy my 9-5. My 9-5 has goodies. My side job as well.

It combines both to meet my lifestyle. I'm satisfied.

Join the Part-time Creators Club for free here. I’ll send you tips to enhance your creative game.

Aaron Dinin, PhD

3 years ago

I put my faith in a billionaire, and he destroyed my business.

How did his money blind me?

Like most fledgling entrepreneurs, I wanted a mentor. I met as many nearby folks with "entrepreneur" in their LinkedIn biographies for coffee.

These meetings taught me a lot, and I'd suggest them to any new creator. Attention! Meeting with many experienced entrepreneurs means getting contradictory advice. One entrepreneur will tell you to do X, then the next one you talk to may tell you to do Y, which are sometimes opposites. You'll have to chose which suggestion to take after the chats.

I experienced this. Same afternoon, I had two coffee meetings with experienced entrepreneurs. The first meeting was with a billionaire entrepreneur who took his company public.

I met him in a swanky hotel lobby and ordered a drink I didn't pay for. As a fledgling entrepreneur, money was scarce.

During the meeting, I demoed the software I'd built, he liked it, and we spent the hour discussing what features would make it a success. By the end of the meeting, he requested I include a killer feature we both agreed would attract buyers. The feature was complex and would require some time. The billionaire I was sipping coffee with in a beautiful hotel lobby insisted people would love it, and that got me enthusiastic.

The second meeting was with a young entrepreneur who had recently raised a small amount of investment and looked as eager to pitch me as I was to pitch him. I forgot his name. I mostly recall meeting him in a filthy coffee shop in a bad section of town and buying his pricey cappuccino. Water for me.

After his pitch, I demoed my app. When I was done, he barely noticed. He questioned my customer acquisition plan. Who was my client? What did they offer? What was my plan? Etc. No decent answers.

After our meeting, he insisted I spend more time learning my market and selling. He ignored my questions about features. Don't worry about features, he said. Customers will request features. First, find them.

Putting your faith in results over relevance

Problems plagued my afternoon. I met with two entrepreneurs who gave me differing advice about how to proceed, and I had to decide which to pursue. I couldn't decide.

Ultimately, I followed the advice of the billionaire.

Obviously.

Who wouldn’t? That was the guy who clearly knew more.

A few months later, I constructed the feature the billionaire said people would line up for.

The new feature was unpopular. I couldn't even get the billionaire to answer an email showing him what I'd done. He disappeared.

Within a few months, I shut down the company, wasting all the time and effort I'd invested into constructing the killer feature the billionaire said I required.

Would follow the struggling entrepreneur's advice have saved my company? It would have saved me time in retrospect. Potential consumers would have told me they didn't want what I was producing, and I could have shut down the company sooner or built something they did want. Both outcomes would have been better.

Now I know, but not then. I favored achievement above relevance.

Success vs. relevance

The millionaire gave me advice on building a large, successful public firm. A successful public firm is different from a startup. Priorities change in the last phase of business building, which few entrepreneurs reach. He gave wonderful advice to founders trying to double their stock values in two years, but it wasn't beneficial for me.

The other failing entrepreneur had relevant, recent experience. He'd recently been in my shoes. We still had lots of problems. He may not have achieved huge success, but he had valuable advice on how to pass the closest hurdle.

The money blinded me at the moment. Not alone So much of company success is defined by money valuations, fundraising, exits, etc., so entrepreneurs easily fall into this trap. Money chatter obscures the value of knowledge.

Don't base startup advice on a person's income. Focus on what and when the person has learned. Relevance to you and your goals is more important than a person's accomplishments when considering advice.

Raad Ahmed

3 years ago

How We Just Raised $6M At An $80M Valuation From 100+ Investors Using A Link (Without Pitching)

Lawtrades nearly failed three years ago.

We couldn't raise Series A or enthusiasm from VCs.

We raised $6M (at a $80M valuation) from 100 customers and investors using a link and no pitching.

Step-by-step:

We refocused our business first.

Lawtrades raised $3.7M while Atrium raised $75M. By comparison, we seemed unimportant.

We had to close the company or try something new.

As I've written previously, a pivot saved us. Our initial focus on SMBs attracted many unprofitable customers. SMBs needed one-off legal services, meaning low fees and high turnover.

Tech startups were different. Their General Councels (GCs) needed near-daily support, resulting in higher fees and lower churn than SMBs.

We stopped unprofitable customers and focused on power users. To avoid dilution, we borrowed against receivables. We scaled our revenue 10x, from $70k/mo to $700k/mo.

Then, we reconsidered fundraising (and do it differently)

This time was different. Lawtrades was cash flow positive for most of last year, so we could dictate our own terms. VCs were still wary of legaltech after Atrium's shutdown (though they were thinking about the space).

We neither wanted to rely on VCs nor dilute more than 10% equity. So we didn't compete for in-person pitch meetings.

AngelList Roll-Up Vehicle (RUV). Up to 250 accredited investors can invest in a single RUV. First, we emailed customers the RUV. Why? Because I wanted to help the platform's users.

Imagine if Uber or Airbnb let all drivers or Superhosts invest in an RUV. Humans make the platform, theirs and ours. Giving people a chance to invest increases their loyalty.

We expanded after initial interest.

We created a Journey link, containing everything that would normally go in an investor pitch:

- Slides

- Trailer (from me)

- Testimonials

- Product demo

- Financials

We could also link to our AngelList RUV and send the pitch to an unlimited number of people. Instead of 1:1, we had 1:10,000 pitches-to-investors.

We posted Journey's link in RUV Alliance Discord. 600 accredited investors noticed it immediately. Within days, we raised $250,000 from customers-turned-investors.

Stonks, which live-streamed our pitch to thousands of viewers, was interested in our grassroots enthusiasm. We got $1.4M from people I've never met.

These updates on Pump generated more interest. Facebook, Uber, Netflix, and Robinhood executives all wanted to invest. Sahil Lavingia, who had rejected us, gave us $100k.

We closed the round with public support.

Without a single pitch meeting, we'd raised $2.3M. It was a result of natural enthusiasm: taking care of the people who made us who we are, letting them move first, and leveraging their enthusiasm with VCs, who were interested.

We used network effects to raise $3.7M from a founder-turned-VC, bringing the total to $6M at a $80M valuation (which, by the way, I set myself).

What flipping the fundraising script allowed us to do:

We started with private investors instead of 2–3 VCs to show VCs what we were worth. This gave Lawtrades the ability to:

- Without meetings, share our vision. Many people saw our Journey link. I ended up taking meetings with people who planned to contribute $50k+, but still, the ratio of views-to-meetings was outrageously good for us.

- Leverage ourselves. Instead of us selling ourselves to VCs, they did. Some people with large checks or late arrivals were turned away.

- Maintain voting power. No board seats were lost.

- Utilize viral network effects. People-powered.

- Preemptively halt churn by turning our users into owners. People are more loyal and respectful to things they own. Our users make us who we are — no matter how good our tech is, we need human beings to use it. They deserve to be owners.

I don't blame founders for being hesitant about this approach. Pump and RUVs are new and scary. But it won’t be that way for long. Our approach redistributed some of the power that normally lies entirely with VCs, putting it into our hands and our network’s hands.

This is the future — another way power is shifting from centralized to decentralized.

You might also like

Abhimanyu Bhargava

3 years ago

VeeFriends Series 2: The Biggest NFT Opportunity Ever

VeeFriends is one NFT project I'm sure will last.

I believe in blockchain technology and JPEGs, aka NFTs. NFTs aren't JPEGs. It's not as it seems.

Gary Vaynerchuk is leading the pack with his new NFT project VeeFriends, I wrote a year ago. I was spot-on. It's the most innovative project I've seen.

Since its minting in May 2021, it has given its holders enormous value, most notably the first edition of VeeCon, a multi-day superconference featuring iconic and emerging leaders in NFTs and Popular Culture. First-of-its-kind NFT-ticketed Web3 conference to build friendships, share ideas, and learn together.

VeeFriends holders got free VeeCon NFT tickets. Attendees heard iconic keynote speeches, innovative talks, panels, and Q&A sessions.

It was a unique conference that most of us, including me, are looking forward to in 2023. The lineup was epic, and it allowed many to network in new ways. Really memorable learning. Here are a couple of gratitude posts from the attendees.

VeeFriends Series 2

This article explains VeeFriends if you're still confused.

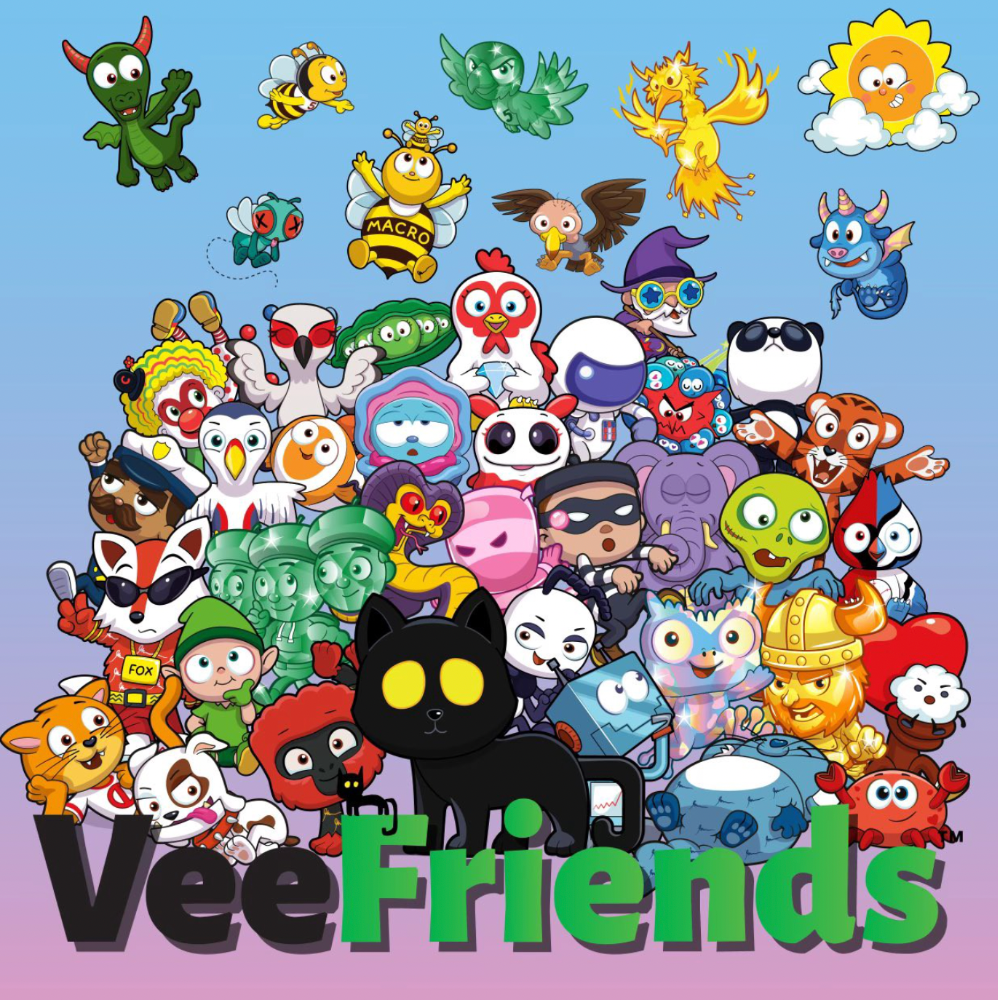

GaryVee's hand-drawn doodles have evolved into wonderful characters. The characters' poses and backgrounds bring the VeeFriends IP to life.

Yes, this is the second edition of VeeFriends, and at current prices, it's one of the best NFT opportunities in years. If you have the funds and risk appetite to invest in NFTs, VeeFriends Series 2 is worth every penny. Even if you can't invest, learn from their journey.

1. Art Is the Start

Many critics say VeeFriends artwork is below average and not by GaryVee. Art is often the key to future success.

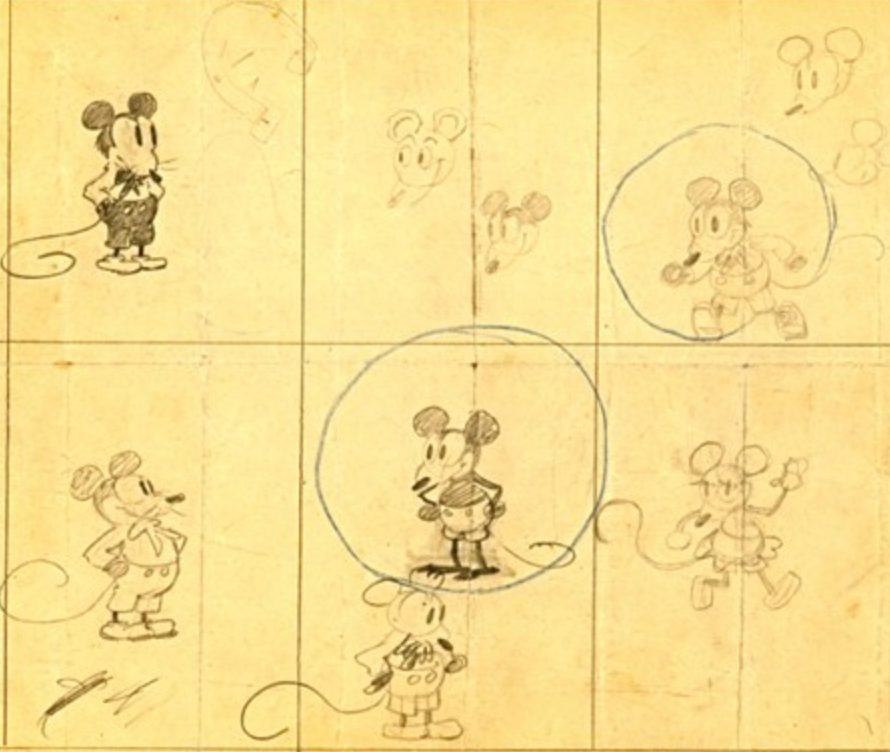

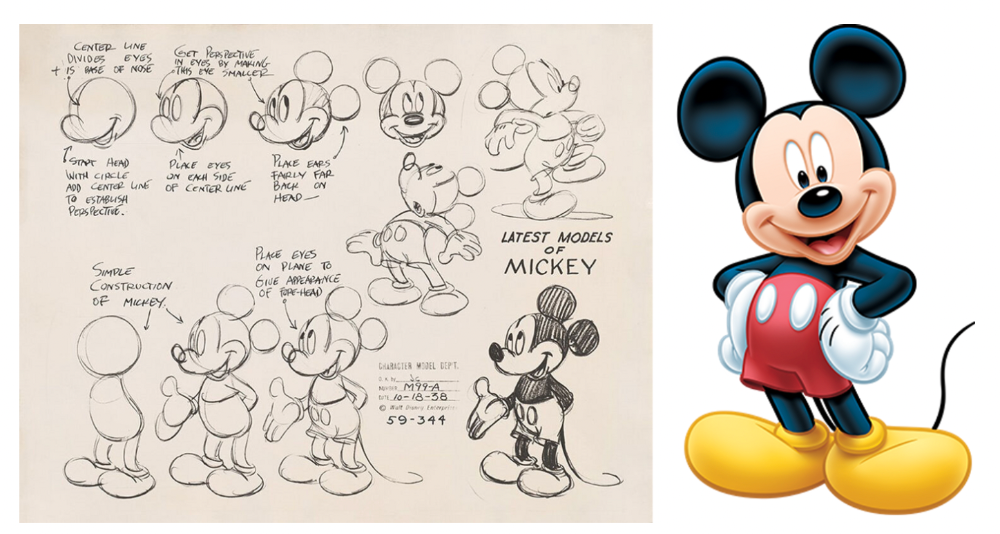

Let's look at one of the first Mickey Mouse drawings. No one would have guessed that this would become one of the most beloved animated short film characters. In Walt Before Mickey, Walt Disney's original mouse Mortimer was less refined.

First came a mouse...

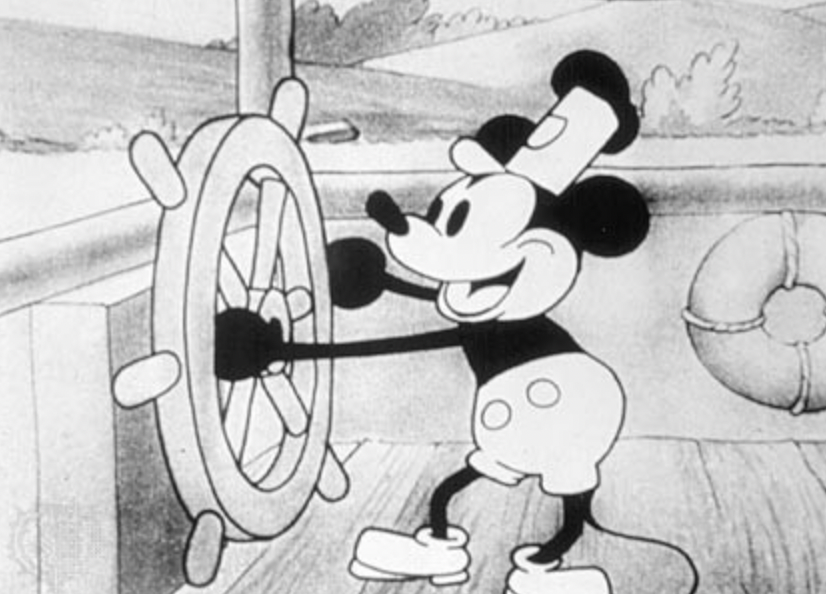

These sketches evolved into Steamboat Willie, Disney's first animated short film.

Fred Moore redesigned the character artwork into what we saw in cartoons as kids. Mickey Mouse's history is here.

Looking at how different cartoon characters have evolved and gained popularity over decades, I believe Series 2 characters like Self-Aware Hare, Kind Kudu, and Patient Pig can do the same.

GaryVee captures this journey on the blockchain and lets early supporters become part of history. Time will tell if it rivals Disney, Pokemon, or Star Wars. Gary has been vocal about this vision.

2. VeeFriends is Intellectual Property for the Coming Generations

Most of us grew up watching cartoons, playing with toys, cards, and video games. Our interactions with fictional characters and the stories we hear shape us.

GaryVee is slowly curating an experience for the next generation with animated videos, card games, merchandise, toys, and more.

VeeFriends UNO, a collaboration with Mattel Creations, features 17 VeeFriends characters.

VeeFriends and Zerocool recently released Trading Cards featuring all 268 Series 1 characters and 15 new ones. Another way to build VeeFriends' collectibles brand.

At Veecon, all the characters were collectible toys. Something will soon emerge.

Kids and adults alike enjoy the YouTube channel's animated shorts and VeeFriends Tunes. Here's a song by the holder's Optimistic Otter-loving daughter.

This VeeFriends story is only the beginning. I'm looking forward to animated short film series, coloring books, streetwear, candy, toys, physical collectibles, and other forms of VeeFriends IP.

3. Veefriends will always provide utilities

Smart contracts can be updated at any time and authenticated on a ledger.

VeeFriends Series 2 gives no promise of any utility whatsoever. GaryVee released no project roadmap. In the first few months after launch, many owners of specific characters or scenes received utilities.

Every benefit or perk you receive helps promote the VeeFriends brand.

Recent partnerships are listed below.

MaryRuth's Multivitamin Gummies

Productive Puffin holders from VeeFriends x Primitive

Pickleball Scene & Clown Holders Only

Pickleball & Competitive Clown Exclusive experience, anteater multivitamin gummies, and Puffin x Primitive merch

Considering the price of NFTs, it may not seem like much. It's just the beginning; you never know what the future holds. No other NFT project offers such diverse, ongoing benefits.

4. Garyvee's team is ready

Gary Vaynerchuk's team and record are undisputed. He's a serial entrepreneur and the Chairman & CEO of VaynerX, which includes VaynerMedia, VaynerCommerce, One37pm, and The Sasha Group.

Gary founded VaynerSports, Resy, and Empathy Wines. He's a Candy Digital Board Member, VCR Group Co-Founder, ArtOfficial Co-Founder, and VeeFriends Creator & CEO. Gary was recently named one of Fortune's Top 50 NFT Influencers.

Gary Vayenerchuk aka GaryVee

Gary documents his daily life as a CEO on social media, which has 34 million followers and 272 million monthly views. GaryVee Audio Experience is a top podcast. He's a five-time New York Times best-seller and sought-after speaker.

Gary can observe consumer behavior to predict trends. He understood these trends early and pioneered them.

1997 — Realized e-potential commerce's and started winelibrary.com. In five years, he grew his father's wine business from $3M to $60M.

2006 — Realized content marketing's potential and started Wine Library on YouTube. TV

2009 — Estimated social media's potential (Web2) and invested in Facebook, Twitter, and Tumblr.

2014: Ethereum and Bitcoin investments

2021 — Believed in NFTs and Web3 enough to launch VeeFriends

GaryVee isn't all of VeeFriends. Andy Krainak, Dave DeRosa, Adam Ripps, Tyler Dowdle, and others work tirelessly to make VeeFriends a success.

GaryVee has said he'll let other businesses fail but not VeeFriends. We're just beginning his 40-year vision.

I have more confidence than ever in a company with a strong foundation and team.

5. Humans die, but characters live forever

What if GaryVee dies or can't work?

A writer's books can immortalize them. As long as their books exist, their words are immortal. Socrates, Hemingway, Aristotle, Twain, Fitzgerald, and others have become immortal.

Everyone knows Vincent Van Gogh's The Starry Night.

We all love reading and watching Peter Parker, Thor, or Jessica Jones. Their behavior inspires us. Stan Lee's message and stories live on despite his death.

GaryVee represents VeeFriends. Creating characters to communicate ensures that the message reaches even those who don't listen.

Gary wants his values and messages to be omnipresent in 268 characters. Messengers die, but their messages live on.

Gary envisions VeeFriends creating timeless stories and experiences. Ten years from now, maybe every kid will sing Patient Pig.

6. I love the intent.

Gary planned to create Workplace Warriors three years ago when he began designing Patient Panda, Accountable Ant, and Empathy elephant. The project stalled. When NFTs came along, he knew.

Gary wanted to create characters with traits he values, such as accountability, empathy, patience, kindness, and self-awareness. He wants future generations to find these traits cool. He hopes one or more of his characters will become pop culture icons.

These emotional skills aren't taught in schools or colleges, but they're crucial for business and life success. I love that someone is teaching this at scale.

In the end, intent matters.

Humans Are Collectors

Buy and collect things to communicate. Since the 1700s. Medieval people formed communities around hidden metals and stones. Many people still collect stamps and coins, and luxury and fashion are multi-trillion dollar industries. We're collectors.

The early 2020s NFTs will be remembered in the future. VeeFriends will define a cultural and technological shift in this era. VeeFriends Series 1 is the original hand-drawn art, but it's expensive. VeeFriends Series 2 is a once-in-a-lifetime opportunity at $1,000.

If you are new to NFTs, check out How to Buy a Non Fungible Token (NFT) For Beginners

This is a non-commercial article. Not financial or legal advice. Information isn't always accurate. Before making important financial decisions, consult a pro or do your own research.

This post is a summary. Read the full article here

Scott Galloway

3 years ago

First Health

ZERO GRACE/ZERO MALICE

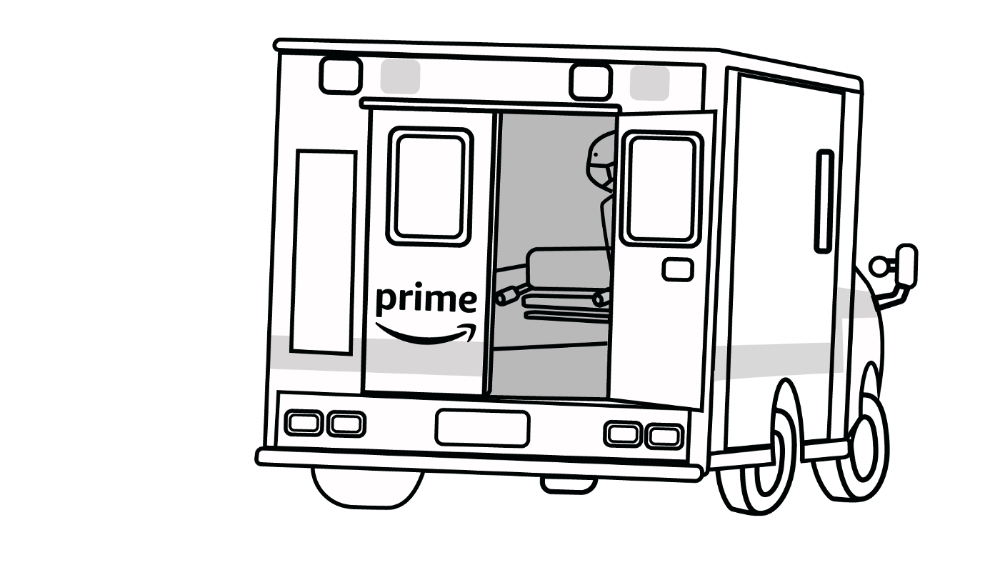

Amazon's purchase of One Medical could speed up American healthcare

The U.S. healthcare industry is a 7-ton seal bleeding at sea. Predators are circling. Unearned margin: price increases relative to inflation without quality improvements. Amazon is the 11-foot megalodon with 7-inch teeth. Amazon is no longer circling... but attacking.

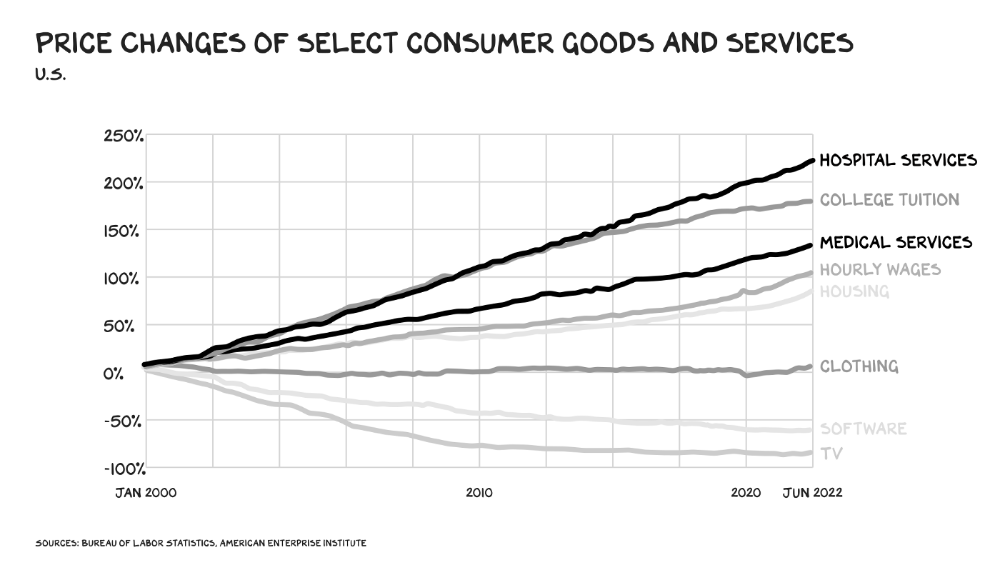

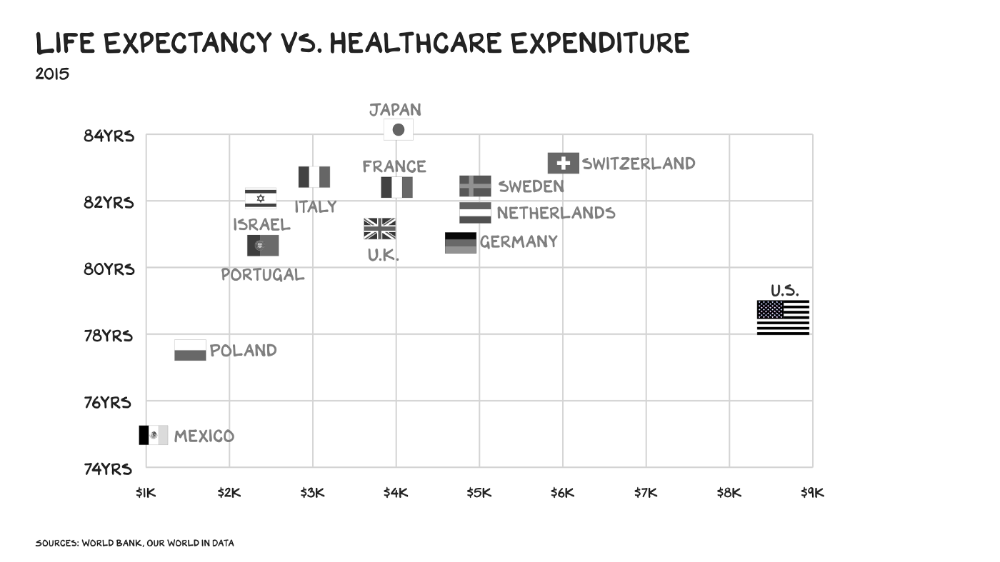

In 2020 dollars, per capita U.S. healthcare spending increased from $2,968 in 1980 to $12,531. The result is a massive industry with 13% of the nation's workers and a fifth of GDP.

Doctor No

In 40 years, healthcare has made progress. From 73.7 in 1980 to 78.8 in 2019, life expectancy rose (before Covid knocked it back down a bit). Pharmacological therapies have revolutionized, and genetic research is paying off. The financial return, improvement split by cost increases, is terrible. No country has expense rises like the U.S., and no one spends as much per capita as we do. Developed countries have longer life expectancies, healthier populations, and less economic hardship.

Two-thirds of U.S. personal bankruptcies are due to medical expenses and/or missed work. Mom or Dad getting cancer could bankrupt many middle-class American families. 40% of American adults delayed or skipped needed care due to cost. Every healthcare improvement seems to have a downside. Same pharmacological revolution that helped millions caused opioid epidemic. Our results are poor in many areas: The U.S. has a high infant mortality rate.

Healthcare is the second-worst retail industry in the country. Gas stations are #1. Imagine walking into a Best Buy to buy a TV and a Blue Shirt associate requests you fill out the same 14 pages of paperwork you filled out yesterday. Then you wait in a crowded room until they call you, 20 minutes after the scheduled appointment you were asked to arrive early for, to see the one person in the store who can talk to you about TVs, who has 10 minutes for you. The average emergency room wait time in New York is 6 hours and 10 minutes.

If it's bad for the customer, it's worse for the business. Physicians spend 27% of their time helping patients; 49% on EHRs. Documentation, order entry, billing, and inbox management. Spend a decade getting an M.D., then become a bureaucrat.

No industry better illustrates scale diseconomies. If we got the same return on healthcare spending as other countries, we'd all live to 100. We could spend less, live longer and healthier, and pay off the national debt in 15 years. U.S. healthcare is the worst ever.

What now? Competition is at the heart of capitalism, the worst system of its kind.

Priority Time

Amazon is buying One Medical for $3.9 billion. I think this deal will liberate society. Two years in, I think One Medical is great. When I got Covid, I pressed the One Medical symbol on my phone; a nurse practitioner prescribed Paxlovid and told me which pharmacies had it in stock.

Amazon enables the company's vision. One Medical's stock is down to $10 from $40 at the start of 2021. Last year, it lost $250 million and needs cash (Amazon has $60 billion). ONEM must grow. The service has 736,000 members. Half of U.S. households have Amazon Prime. Finally, delivery. One Medical is a digital health/physical office hybrid, but you must pick up medication at the pharmacy. Upgrade your Paxlovid delivery time after a remote consultation. Amazon's core competency means it'll happen. Healthcare speed and convenience will feel alien.

It's been a long, winding road to disruption. Amazon, JPMorgan, and Berkshire Hathaway formed Haven four years ago to provide better healthcare for their 1.5 million employees. It rocked healthcare stocks the morning of the press release, but folded in 2021.

Amazon Care is an employee-focused service. Home-delivered virtual health services and nurses. It's doing well, expanding nationwide, and providing healthcare for other companies. Hilton is Amazon Care's biggest customer. The acquisition of One Medical will bring 66 million Prime households capital, domain expertise, and billing infrastructure. Imagine:

"Alexa, I'm hot and my back hurts."

"Connecting you to a Prime doctor now."

Want to vs. Have to

I predicted Amazon entering healthcare years ago. Why? For the same reason Apple is getting into auto. Amazon's P/E is 56, double Walmart's. The corporation must add $250 billion in revenue over the next five years to retain its share price. White-label clothes or smart home products won't generate as much revenue. It must enter a huge market without scale, operational competence, and data skills.

Current Situation

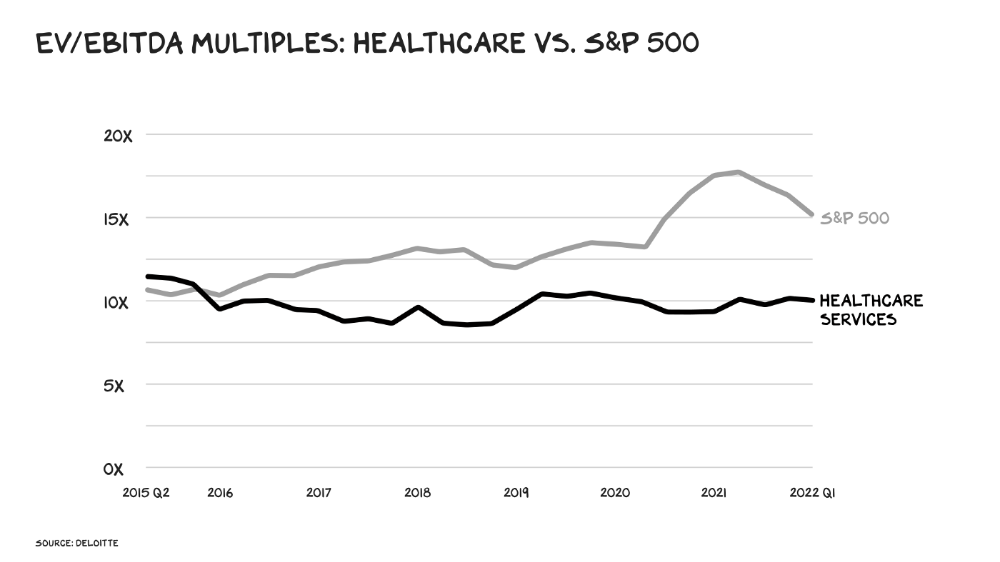

Healthcare reform benefits both consumers and investors. In 2015, healthcare services had S&P 500-average multiples. The market is losing faith in public healthcare businesses' growth. Healthcare services have lower EV/EBITDA multiples than the S&P 500.

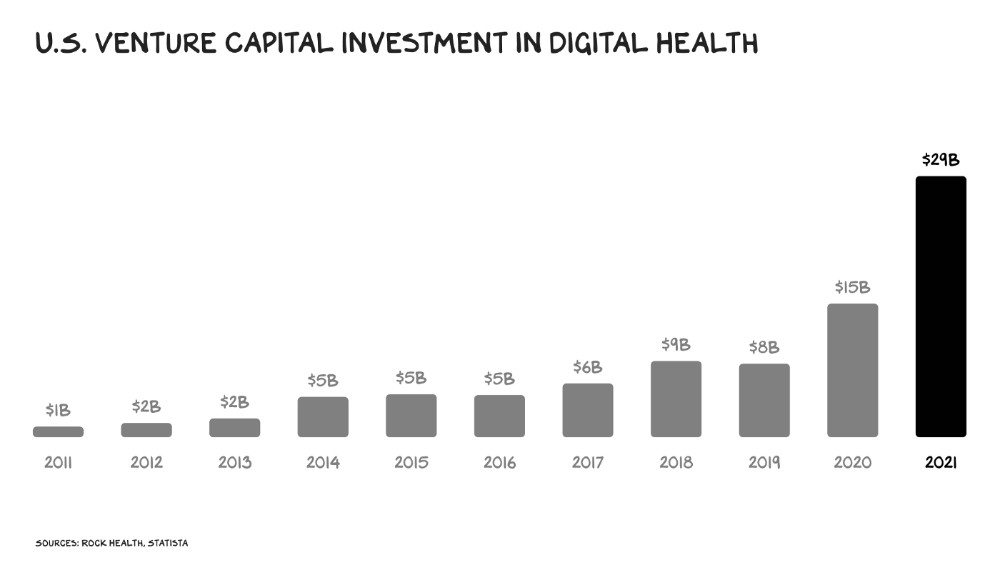

Amazon isn't the only prey-hunter. Walmart and Alibaba are starting pharmacies. Uber is developing medical transportation. Private markets invested $29 billion in telehealth last year, up 95% from 2020.

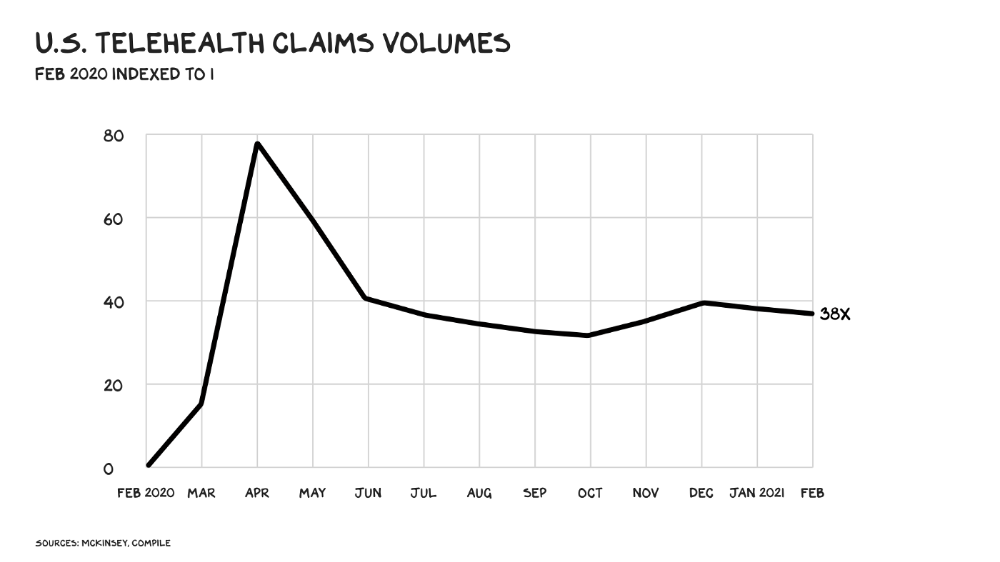

The pandemic accelerated telehealth, the immediate unlock. After the first positive Covid case in the U.S., services that had to be delivered in person shifted to Zoom... We lived. We grew. Video house calls continued after in-person visits were allowed. McKinsey estimates telehealth visits are 38 times pre-pandemic levels. Doctors adopted the technology, regulators loosened restrictions, and patients saved time. We're far from remote surgery, but many patient visits are unnecessary. A study of 40 million patients during lockdown found that for chronic disease patients, online visits didn't affect outcomes. This method of care will only improve.

Amazon's disruption will be significant and will inspire a flood of capital, startups, and consumer brands. Mark Cuban launched a pharmacy that eliminates middlemen in January. Outcome? A 90-day supply of acid-reflux medication costs $17. Medicare could have saved $3.6 billion by buying generic drugs from Cuban's pharmacy. Other apex predators will look at different limbs of the carcass for food. Nike could enter healthcare via orthopedics, acupuncture, and chiropractic. LVMH, L'Oréal, and Estée Lauder may launch global plastic surgery brands. Hilton and Four Seasons may open hospitals. Lennar and Pulte could build "Active Living" communities that Nana would leave feet first, avoiding the expense and tragedy of dying among strangers.

Risks

Privacy matters: HIV status is different from credit card and billing address. Most customers (60%) feel fine sharing personal health data via virtual technologies, though. Unavoidable. 85% of doctors believe data-sharing and interoperability will become the norm. Amazon is the most trusted tech company for handling personal data. Not Meta: Amazon.

What about antitrust, then?

Amazon should be required to spin off AWS and/or Amazon Fulfillment and banned from promoting its own products. It should be allowed to acquire hospitals. One Medical's $3.9 billion acquisition is a drop in the bucket compared to UnitedHealth's $498 billion market valuation.

Antitrust enforcement shouldn't assume some people/firms are good/bad. It should recognize that competition is good and focus on making markets more competitive in each deal. The FTC should force asset divestitures in e-commerce, digital marketing, and social media. These companies can also promote competition in a social ill.

U.S. healthcare makes us fat, depressed, and broke. Competition has produced massive value and prosperity across most of our economy.

Dear Amazon … bring it.

Jon Brosio

3 years ago

You can learn more about marketing from these 8 copywriting frameworks than from a college education.

Email, landing pages, and digital content

Today's most significant skill:

Copywriting.

Unfortunately, most people don't know how to write successful copy because they weren't taught in school.

I've been obsessed with copywriting for two years. I've read 15 books, completed 3 courses, and studied internet's best digital entrepreneurs.

Here are 8 copywriting frameworks that educate more than a four-year degree.

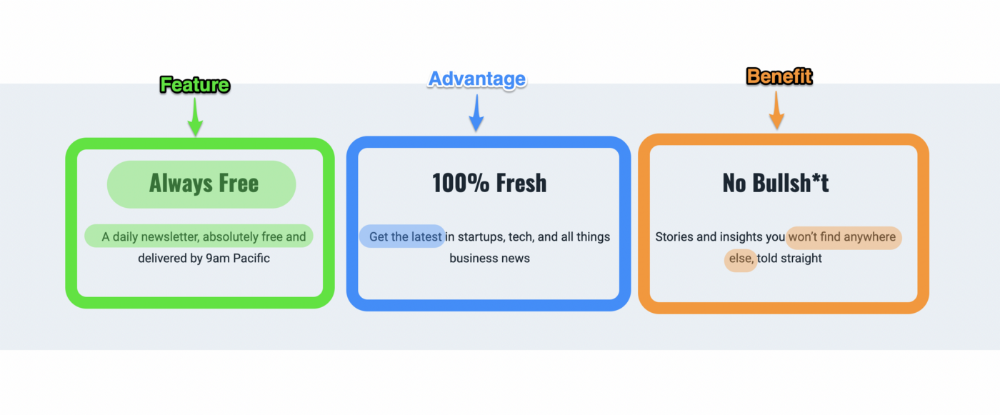

1. Feature — Advantage — Benefit (F.A.B)

This is the most basic copywriting foundation. Email marketing, landing page copy, and digital video ads can use it.

F.A.B says:

How it works (feature)

which is helpful (advantage)

What's at stake (benefit)

The Hustle uses this framework on their landing page to convince people to sign up:

2. P. A. S. T. O. R.

This framework is for longer-form copywriting. PASTOR uses stories to engage with prospects. It explains why people should buy this offer.

PASTOR means:

Problem

Amplify

Story

Testimonial

Offer

Response

Dan Koe's landing page is a great example. It shows PASTOR frame-by-frame.

3. Before — After — Bridge

Before-after-bridge is a copywriting framework that draws attention and shows value quickly.

This framework highlights:

where you are

where you want to be

how to get there

Works great for: Email threads/landing pages

Zain Kahn utilizes this framework to write viral threads.

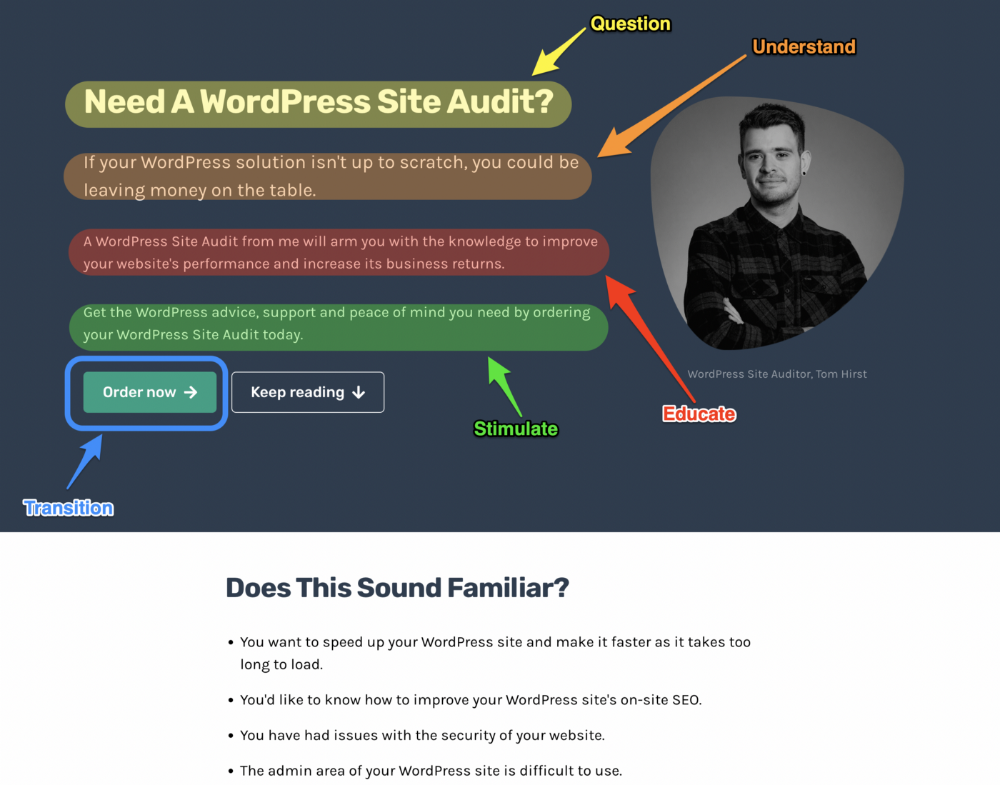

4. Q.U.E.S.T

QUEST is about empathetic writing. You know their issues, obstacles, and headaches. This allows coverups.

QUEST:

Qualifies

Understands

Educates

Stimulates

Transitions

Tom Hirst's landing page uses the QUEST framework.

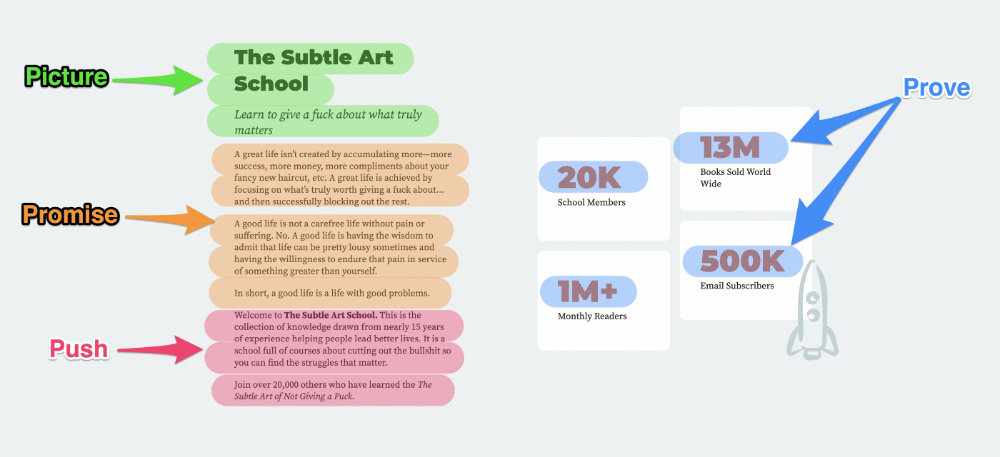

5. The 4P’s model

The 4P’s approach pushes your prospect to action. It educates and persuades quickly.

4Ps:

The problem the visitor is dealing with

The promise that will help them

The proof the promise works

A push towards action

Mark Manson is a bestselling author, digital creator, and pop-philosopher. He's also a great copywriter, and his membership offer uses the 4P’s framework.

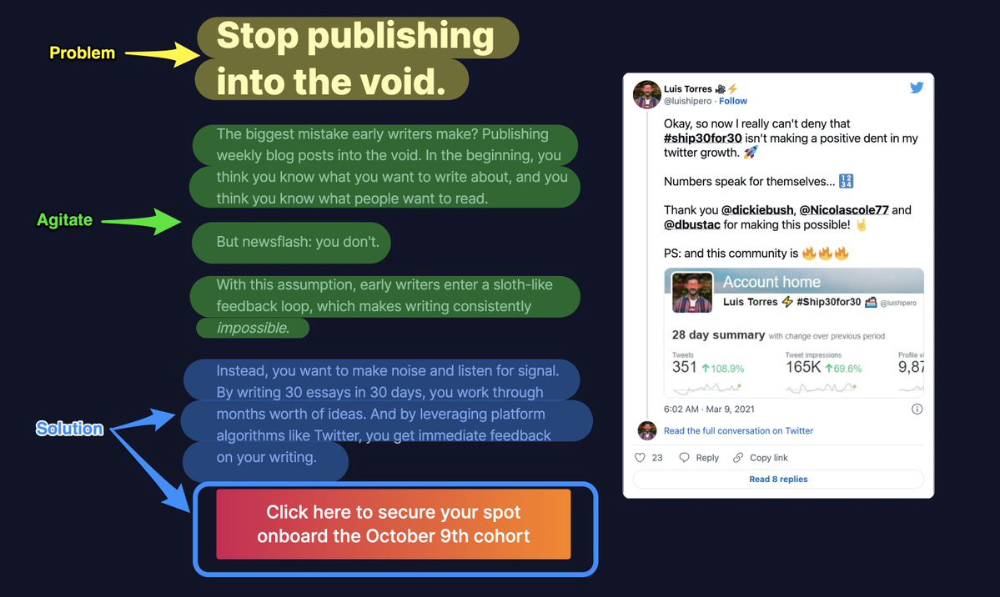

6. Problem — Agitate — Solution (P.A.S)

Up-and-coming marketers should understand problem-agitate-solution copywriting. Once you understand one structure, others are easier. It drives passion and presents a clear solution.

PAS outlines:

The issue the visitor is having

It then intensifies this issue through emotion.

finally offers an answer to that issue (the offer)

The customer's story loops. Nicolas Cole and Dickie Bush use PAS to promote Ship 30 for 30.

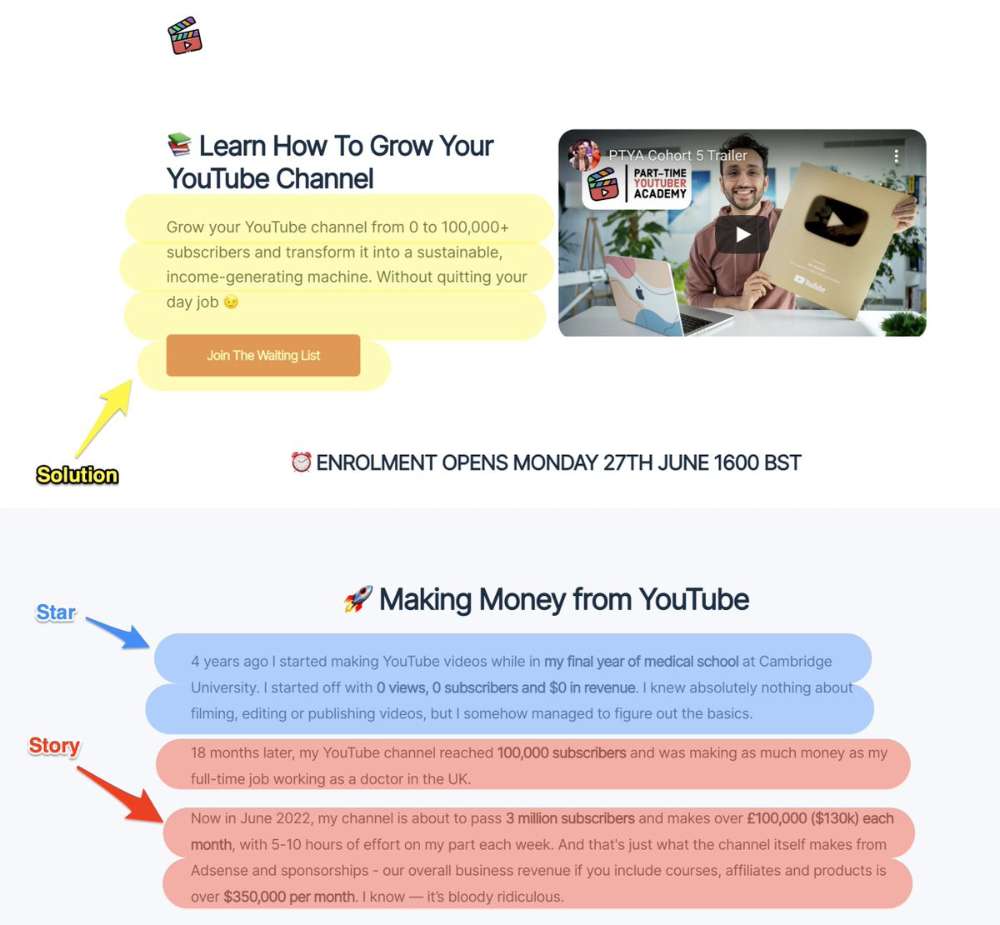

7. Star — Story — Solution (S.S.S)

PASTOR + PAS = star-solution-story. Like PAS, it employs stories to persuade.

S.S.S. is effective storytelling:

Star: (Person had a problem)

Story: (until they had a breakthrough)

Solution: (That created a transformation)

Ali Abdaal is a YouTuber with a great S.S.S copy.

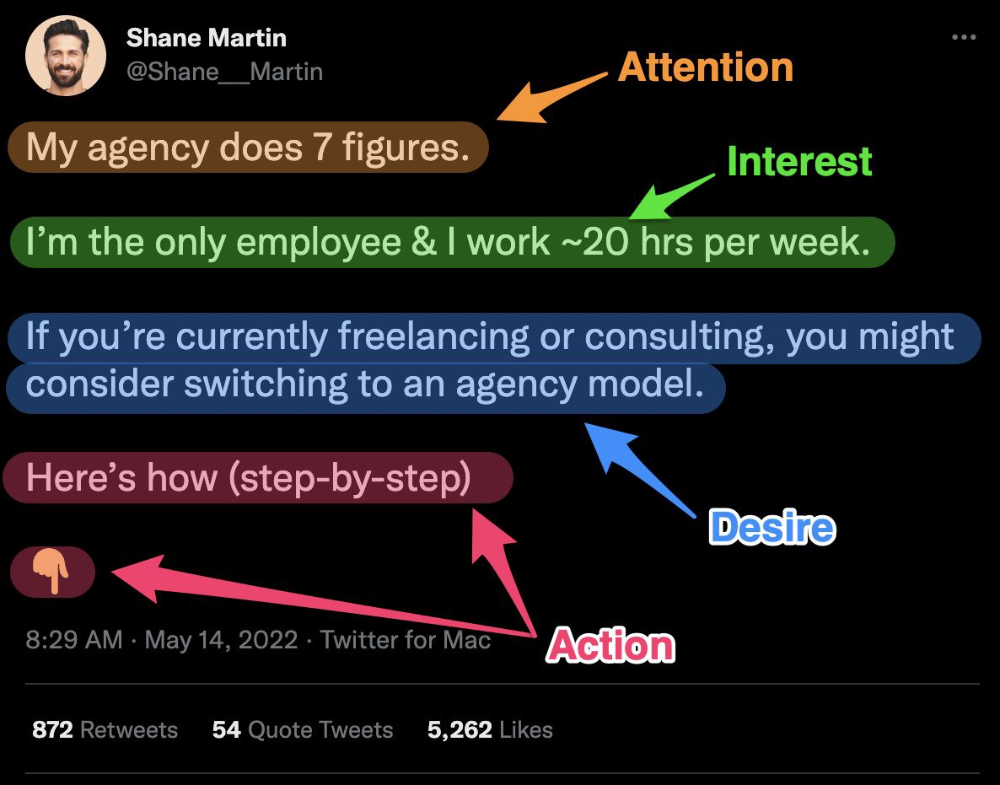

8. Attention — Interest — Desire — Action

AIDA is another classic. This copywriting framework is great for fast-paced environments (think all digital content on Linkedin, Twitter, Medium, etc.).

It works with:

Page landings

writing on thread

Email

It's a good structure since it's concise, attention-grabbing, and action-oriented.

Shane Martin, Twitter's creator, uses this approach to create viral content.

TL;DR

8 copywriting frameworks that teach marketing better than a four-year degree

Feature-advantage-benefit

Before-after-bridge

Star-story-solution

P.A.S.T.O.R

Q.U.E.S.T

A.I.D.A

P.A.S

4P’s