More on Entrepreneurship/Creators

Kaitlin Fritz

3 years ago

The Entrepreneurial Chicken and Egg

University entrepreneurship is like a Willy Wonka Factory of ideas. Classes, roommates, discussions, and the cafeteria all inspire new ideas. I've seen people establish a business without knowing its roots.

Chicken or egg? On my mind: I've asked university founders around the world whether the problem or solution came first.

The Problem

One African team I met started with the “instant noodles” problem in their academic ecosystem. Many of us have had money issues in college, which may have led to poor nutritional choices.

Many university students in a war-torn country ate quick noodles or pasta for dinner.

Noodles required heat, water, and preparation in the boarding house. Unreliable power from one hot plate per blue moon. What's healthier, easier, and tastier than sodium-filled instant pots?

BOOM. They were fixing that. East African kids need affordable, nutritious food.

This is a real difficulty the founders faced every day with hundreds of comrades.

This sparked their serendipitous entrepreneurial journey and became their business's cornerstone.

The Solution

I asked a UK team about their company idea. They said the solution fascinated them.

The crew was fiddling with social media algorithms. Why are some people more popular? They were studying platforms and social networks, which offered a way for them.

Solving a problem? Yes. Long nights of university research lead them to it. Is this like world hunger? Social media influencers confront this difficulty regularly.

It made me ponder something. Is there a correct response?

In my heart, yes, but in my head…maybe?

I believe you should lead with empathy and embrace the problem, not the solution. Big or small, businesses should solve problems. This should be your focus. This is especially true when building a social company with an audience in mind.

Philosophically, invention and innovation are occasionally accidental. Also not penalized. Think about bugs and the creation of Velcro, or the inception of Teflon. They tackle difficulties we overlook. The route to the problem may look different, but there is a path there.

There's no golden ticket to the Chicken-Egg debate, but I'll keep looking this summer.

Alex Mathers

3 years ago

400 articles later, nobody bothered to read them.

Writing for readers:

14 years of daily writing.

I post practically everything on social media. I authored hundreds of articles, thousands of tweets, and numerous volumes to almost no one.

Tens of thousands of readers regularly praise me.

I despised writing. I'm stuck now.

I've learned what readers like and what doesn't.

Here are some essential guidelines for writing with impact:

Readers won't understand your work if you can't.

Though obvious, this slipped me up. Share your truths.

Stories engage human brains.

Showing the journey of a person from worm to butterfly inspires the human spirit.

Overthinking hinders powerful writing.

The best ideas come from inner understanding in between thoughts.

Avoid writing to find it. Write.

Writing a masterpiece isn't motivating.

Write for five minutes to simplify. Step-by-step, entertaining, easy steps.

Good writing requires a willingness to make mistakes.

So write loads of garbage that you can edit into a good piece.

Courageous writing.

A courageous story will move readers. Personal experience is best.

Go where few dare.

Templates, outlines, and boundaries help.

Limitations enhance writing.

Excellent writing is straightforward and readable, removing all the unnecessary fat.

Use five words instead of nine.

Use ordinary words instead of uncommon ones.

Readers desire relatability.

Too much perfection will turn it off.

Write to solve an issue if you can't think of anything to write.

Instead, read to inspire. Best authors read.

Every tweet, thread, and novel must have a central idea.

What's its point?

This can make writing confusing.

️ Don't direct your reader.

Readers quit reading. Demonstrate, describe, and relate.

Even if no one responds, have fun. If you hate writing it, the reader will too.

Desiree Peralta

3 years ago

Why Now Is Your Chance To Create A Millionaire Career

People don’t believe in influencers anymore; they need people like you.

Social media influencers have dominated for years. We've seen videos, images, and articles of *famous* individuals unwrapping, reviewing, and endorsing things.

This industry generates billions. This year, marketers spent $2.23 billion on Instagram, $1 million on Youtube, and $775 million on Tiktok. This marketing has helped start certain companies.

Influencers are dying, so ordinary people like us may take over this billion-dollar sector. Why?

Why influencers are perishing

Most influencers lie to their fans, especially on Instagram. Influencers' first purpose was to make their lives so flawless that others would want to buy their stuff.

In 2015, an Australian influencer with 600,000 followers went viral for revealing all her photos and everything she did to seem great before deleting her account.

“I dramatically edited the pictures, I manipulated the environements, and made my life look perfect in social media… I remember I obsessively checked the like count for a full week since uploading it, a selfie that now has close to 2,500 likes. It got 5 likes. This was when I was so hungry for social media validation … This was the reason why I quit social media: for me, personally, it consumed me. I wasn’t living in a 3D world.”

Influencers then lost credibility.

Influencers seem to live in a bubble, separate from us. Thanks to self-popularity love's and constant awareness campaigns, people find these people ridiculous.

Influencers are praised more for showing themselves as natural and common than for showing luxuries and lies.

Little by little, they are dying, making room for a new group to take advantage of this multi-million dollar business, which gives us (ordinary people) a big opportunity to grow on any content creation platform we want.

Why this is your chance to develop on any platform for creating content

In 2021, I wrote “Not everyone who talks about money is a Financial Advisor, be careful of who you take advice from,”. In it, I warned that not everyone with a large following is a reputable source of financial advice.

Other writers hated this post and said I was wrong.

People don't want Jeff Bezos or Elon Musk's counsel, they said. They prefer to hear about their neighbor's restroom problems or his closest friend's terrible business.

Real advice from regular folks.

And I found this was true when I returned to my independent YouTube channel and had more than 1000 followers after having abandoned it with fewer than 30 videos in 2021 since there were already many personal finance and travel channels and I thought mine wasn't special.

People appreciated my videos because I was a 20-something girl trying to make money online, and they believed my advice more than that of influencers with thousands of followers.

I think today is the greatest time to grow on any platform as an ordinary person. Normal individuals give honest recommendations about what works for them and look easier to make because they have the same options as us.

Nobody cares how a millionaire acquired a Lamborghini unless it's entertaining. Education works now. Real counsel from average people is replicable.

Many individuals don't appreciate how false influencers seem (unreal bodies and excessive surgery and retouching) since it makes them feel uneasy.

That's why body-positive advertisements have been so effective, but they've lost ground in places like Tiktok, where the audience wants more content from everyday people than influencers living amazing lives. More people will relate to your content if you appear genuine.

Last thoughts

Influencers are dwindling. People want more real people to give real advice and demonstrate an ordinary life.

People will enjoy anything you tell about your daily life as long as you provide value, and you can build a following rapidly if you're honest.

This is a millionaire industry that is getting more expensive and will go with what works, so stand out immediately.

You might also like

Darius Foroux

2 years ago

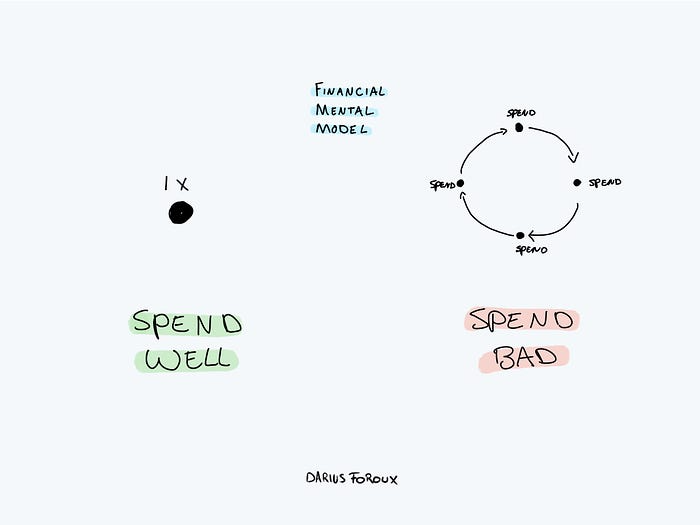

My financial life was changed by a single, straightforward mental model.

Prioritize big-ticket purchases

I've made several spending blunders. I get sick thinking about how much money I spent.

My financial mental model was poor back then.

Stoicism and mindfulness keep me from attaching to those feelings. It still hurts.

Until four or five years ago, I bought a new winter jacket every year.

Ten years ago, I spent twice as much. Now that I have a fantastic, warm winter parka, I don't even consider acquiring another one. No more spending. I'm not looking for jackets either.

Saving time and money by spending well is my thinking paradigm.

The philosophy is expressed in most languages. Cheap is expensive in the Netherlands. This applies beyond shopping.

In this essay, I will offer three examples of how this mental paradigm transformed my financial life.

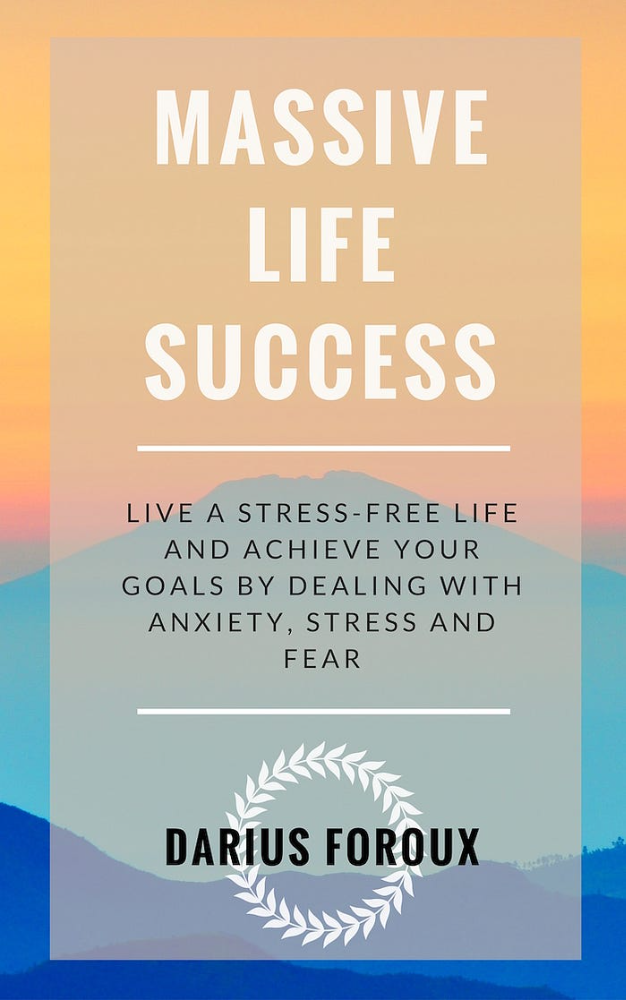

Publishing books

In 2015, I presented and positioned my first book poorly.

I called the book Huge Life Success and made a funny Canva cover in 30 minutes. This:

That looks nothing like my present books. No logo or style. The book felt amateurish.

The book started bothering me a few weeks after publication. The advice was good, but it didn't appear professional. I studied the book business extensively.

I created a style for all my designs. Branding. Win Your Inner Wars was reissued a year later.

Title, cover, and description changed. Rearranging the chapters improved readability.

Seven years later, the book sells hundreds of copies a month. That taught me a lot.

Rushing to finish a project is enticing. Send it and move forward.

Avoid rushing everything. Relax. Develop your projects. Perform well. Perform the job well.

My first novel was underfunded and underworked. A bad book arrived. I then invested time and money in writing the greatest book I could.

That book still sells.

Traveling

I hate travel. Airports, flights, trains, and lines irritate me.

But, I enjoy traveling to beautiful areas.

I do it strangely. I make up travel rules. I never go to airports in summer. I hate being near airports on holidays. Unworthy.

No vacation packages for me. Those airline packages with a flight, shuttle, and hotel. I've had enough.

I try to avoid crowds and popular spots. July Paris? Nuts and bolts, please. Christmas in NYC? No, please keep me sane.

I fly business class behind. I accept upgrades upon check-in. I prefer driving. I drove from the Netherlands to southern Spain.

Thankfully, no lines. What if travel costs more? Thus? I enjoy it from the start. I start traveling then.

I rarely travel since I'm so difficult. One great excursion beats several average ones.

Personal effectiveness

New apps, tools, and strategies intrigue most productivity professionals.

No.

I researched years ago. I spent years investigating productivity in university.

I bought books, courses, applications, and tools. It was expensive and time-consuming.

Im finished. Productivity no longer costs me time or money. OK. I worked on it once and now follow my strategy.

I avoid new programs and systems. My stuff works. Why change winners?

Spending wisely saves time and money.

Spending wisely means spending once. Many people ignore productivity. It's understudied. No classes.

Some assume reading a few articles or a book is enough. Productivity is personal. You need a personal system.

Time invested is one-time. You can trust your system for life once you find it.

Concentrate on the expensive choices.

Life's short. Saving money quickly is enticing.

Spend less on groceries today. True. That won't fix your finances.

Adopt a lifestyle that makes you affluent over time. Consider major choices.

Are they causing long-term poverty? Are you richer?

Leasing cars comes to mind. The automobile costs a fortune today. The premium could accomplish a million nice things.

Focusing on important decisions makes life easier. Consider your future. You want to improve next year.

Claire Berehova

3 years ago

There’s no manual for that

| Kyiv oblast in springtime. Photo by author. |

We’ve been receiving since the war began text messages from the State Emergency Service of Ukraine every few days. They’ve contained information on how to comfort a child and what to do in case of a water outage.

But a question that I struggle to suppress irks within me: How would we know if there really was a threat coming our away? So how can I happily disregard an air raid siren and continue singing to my three-month-old son when I feel like a World War II film became reality? There’s no manual for that.

Along with the anxiety, there’s the guilt that always seems to appear alongside dinner we’re fortunate to still have each evening while brave Ukrainian soldiers are facing serious food insecurity. There’s no manual for how to deal with this guilt.

When it comes to the enemy, there is no manual for how to react to the news of Russian casualties. Every dead Russian soldier weakens Putin, but I also know that many of these men had wives and girlfriends who are now living a nightmare.

So, I felt like I had to start writing my own manual.

The anxiety around the air raid siren? Only with time does it get easier to ignore it, but never completely.

The guilt? All we can do is pray.

That inner conflict? As Russia continues to stun the world with its war crimes, my emotions get less gray — I have to get used to accommodating absurd levels of hatred.

Sadness? It feels a bit more manageable when we laugh, and a little alcohol helps (as it usually does).

Cabin fever? Step outside in the yard when possible. At least the sunshine is becoming more fervent with spring approaching.

Slava Ukraini. Heroyam slava. (Glory to Ukraine. Glory to the heroes.)

Joseph Mavericks

3 years ago

You Don't Have to Spend $250 on TikTok Ads Because I Did

900K impressions, 8K clicks, and $$$ orders…

I recently started dropshipping. Now that I own my business and can charge it as a business expense, it feels less like money wasted if it doesn't work. I also made t-shirts to sell. I intended to open a t-shirt store and had many designs on a hard drive. I read that Tiktok advertising had a high conversion rate and low cost because they were new. According to many, the advertising' cost/efficiency ratio would plummet and become as bad as Google or Facebook Ads. Now felt like the moment to try Tiktok marketing and dropshipping. I work in marketing for a SaaS firm and have seen how poorly ads perform. I wanted to try it alone.

I set up $250 and ran advertising for a week. Before that, I made my own products, store, and marketing. In this post, I'll show you my process and results.

Setting up the store

Dropshipping is a sort of retail business in which the manufacturer ships the product directly to the client through an online platform maintained by a seller. The seller takes orders but has no stock. The manufacturer handles all orders. This no-stock concept increases profitability and flexibility.

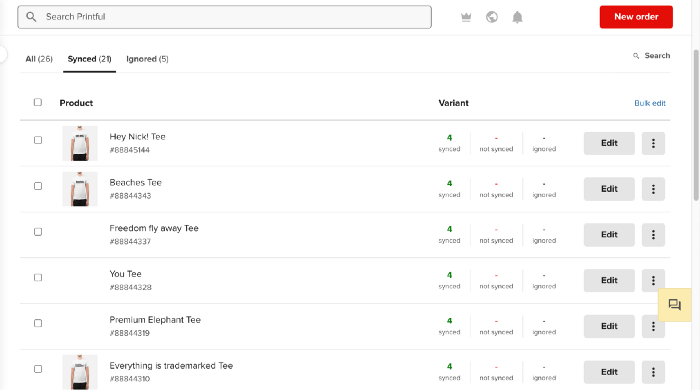

In my situation, I used previous t-shirt designs to make my own product. I didn't want to handle order fulfillment logistics, so I looked for a way to print my designs on demand, ship them, and handle order tracking/returns automatically. So I found Printful.

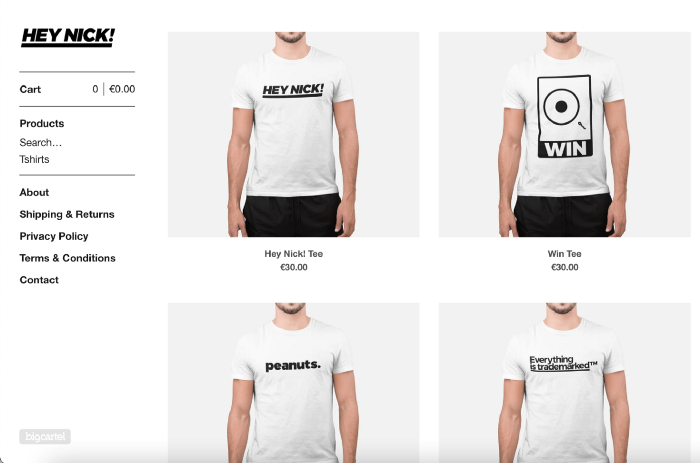

I needed to connect my backend and supplier to a storefront so visitors could buy. 99% of dropshippers use Shopify, but I didn't want to master the difficult application. I wanted a one-day project. I'd previously worked with Big Cartel, so I chose them.

Big Cartel doesn't collect commissions on sales, simply a monthly flat price ($9.99 to $19.99 depending on your plan).

After opening a Big Cartel account, I uploaded 21 designs and product shots, then synced each product with Printful.

Developing the ads

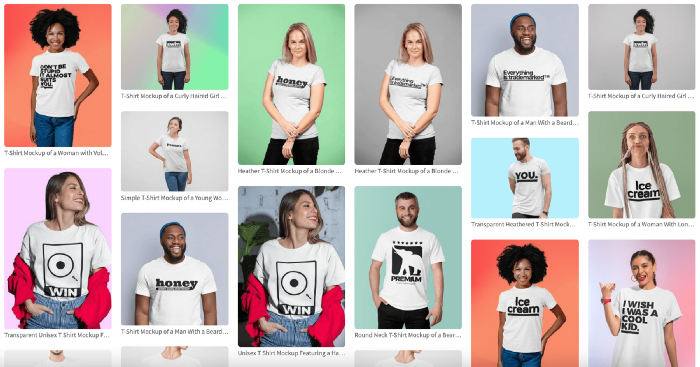

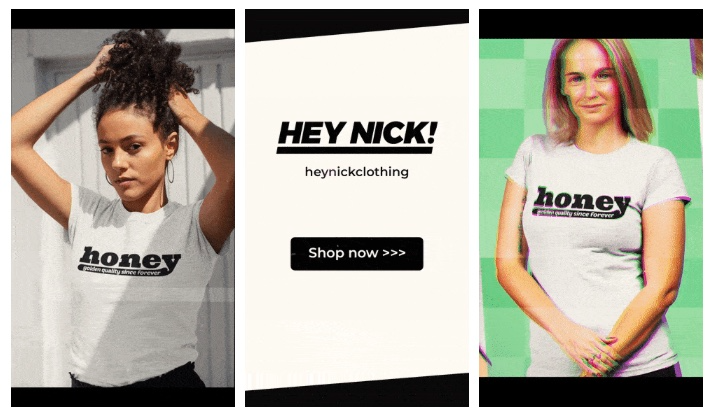

I mocked up my designs on cool people photographs from placeit.net, a great tool for creating product visuals when you don't have a studio, camera gear, or models to wear your t-shirts.

I opened an account on the website and had advertising visuals within 2 hours.

Because my designs are simple (black design on white t-shirt), I chose happy, stylish people on plain-colored backdrops. After that, I had to develop an animated slideshow.

Because I'm a graphic designer, I chose to use Adobe Premiere to create animated Tiktok advertising.

Premiere is a fancy video editing application used for more than advertisements. Premiere is used to edit movies, not social media marketing. I wanted this experiment to be quick, so I got 3 social media ad templates from motionarray.com and threw my visuals in. All the transitions and animations were pre-made in the files, so it only took a few hours to compile. The result:

I downloaded 3 different soundtracks for the videos to determine which would convert best.

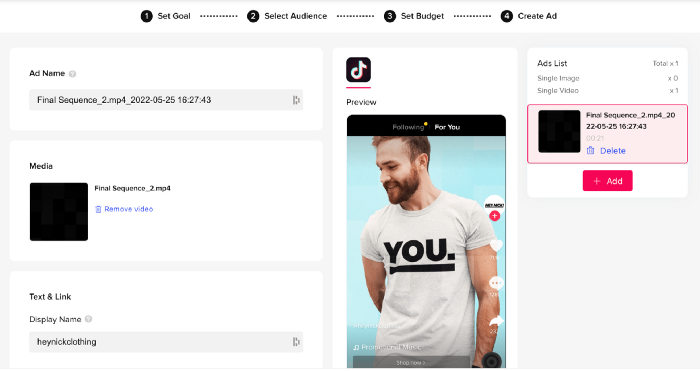

After that, I opened a Tiktok business account, uploaded my films, and inserted ad info. They went live within one hour.

The (poor) outcomes

As a European company, I couldn't deliver ads in the US. All of my advertisements' material (title, description, and call to action) was in English, hence they continued getting rejected in Europe for countries that didn't speak English. There are a lot of them:

I lost a lot of quality traffic, but I felt that if the images were engaging, people would check out the store and buy my t-shirts. I was wrong.

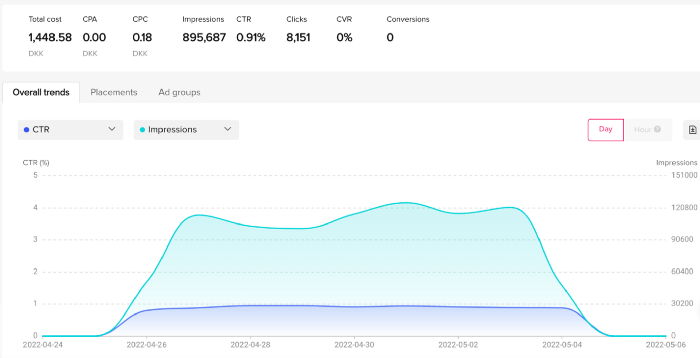

51,071 impressions on Day 1. 0 orders after 411 clicks

114,053 impressions on Day 2. 1.004 clicks and no orders

Day 3: 987 clicks, 103,685 impressions, and 0 orders

101,437 impressions on Day 4. 0 orders after 963 clicks

115,053 impressions on Day 5. 1,050 clicks and no purchases

125,799 impressions on day 6. 1,184 clicks, no purchases

115,547 impressions on Day 7. 1,050 clicks and no purchases

121,456 impressions on day 8. 1,083 clicks, no purchases

47,586 impressions on Day 9. 419 Clicks. No orders

My overall conversion rate for video advertisements was 0.9%. TikTok's paid ad formats all result in strong engagement rates (ads average 3% to 12% CTR to site), therefore a 1 to 2% CTR should have been doable.

My one-week experiment yielded 8,151 ad clicks but no sales. Even if 0.1% of those clicks converted, I should have made 8 sales. Even companies with horrible web marketing would get one download or trial sign-up for every 8,151 clicks. I knew that because my advertising were in English, I had no impressions in the main EU markets (France, Spain, Italy, Germany), and that this impacted my conversion potential. I still couldn't believe my numbers.

I dug into the statistics and found that Tiktok's stats didn't match my store traffic data.

Looking more closely at the numbers

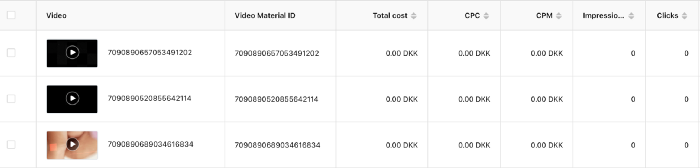

My ads were approved on April 26 but didn't appear until April 27. My store dashboard showed 440 visitors but 1,004 clicks on Tiktok. This happens often while tracking campaign results since different platforms handle comparable user activities (click, view) differently. In online marketing, residual data won't always match across tools.

My data gap was too large. Even if half of the 1,004 persons who clicked closed their browser or left before the store site loaded, I would have gained 502 visitors. The significant difference between Tiktok clicks and Big Cartel store visits made me suspicious. It happened all week:

Day 1: 440 store visits and 1004 ad clicks

Day 2: 482 store visits, 987 ad clicks

3rd day: 963 hits on ads, 452 store visits

443 store visits and 1,050 ad clicks on day 4.

Day 5: 459 store visits and 1,184 ad clicks

Day 6: 430 store visits and 1,050 ad clicks

Day 7: 409 store visits and 1,031 ad clicks

Day 8: 166 store visits and 418 ad clicks

The disparity wasn't related to residual data or data processing. The disparity between visits and clicks looked regular, but I couldn't explain it.

After the campaign concluded, I discovered all my creative assets (the videos) had a 0% CTR and a $0 expenditure in a separate dashboard. Whether it's a dashboard reporting issue or a budget allocation bug, online marketers shouldn't see this.

Tiktok can present any stats they want on their dashboard, just like any other platform that runs advertisements to promote content to its users. I can't verify that 895,687 individuals saw and clicked on my ad. I invested $200 for what appears to be around 900K impressions, which is an excellent ROI. No one bought a t-shirt, even an unattractive one, out of 900K people?

Would I do it again?

Nope. Whether I didn't make sales because Tiktok inflated the dashboard numbers or because I'm horrible at producing advertising and items that sell, I’ll stick to writing content and making videos. If setting up a business and ads in a few days was all it took to make money online, everyone would do it.

Video advertisements and dropshipping aren't dead. As long as the internet exists, people will click ads and buy stuff. Converting ads and selling stuff takes a lot of work, and I want to focus on other things.

I had always wanted to try dropshipping and I’m happy I did, I just won’t stick to it because that’s not something I’m interested in getting better at.

If I want to sell t-shirts again, I'll avoid Tiktok advertisements and find another route.