More on Personal Growth

Akshad Singi

3 years ago

Four obnoxious one-minute habits that help me save more than 30 hours each week

These four, when combined, destroy procrastination.

You're not rushed. You waste it on busywork.

You'll accept this eventually.

In 2022, the daily average usage of a user on social media is 2.5 hours.

By 2020, 6 billion hours of video were watched each month by Netflix's customers, who used the service an average of 3.2 hours per day.

When we see these numbers, we think "Wow!" People squander so much time as though they don't contribute. True. These are yours. Likewise.

We don't lack time; we just waste it. Once you realize this, you can change your habits to save time. This article explains. If you adopt ALL 4 of these simple behaviors, you'll see amazing benefits.

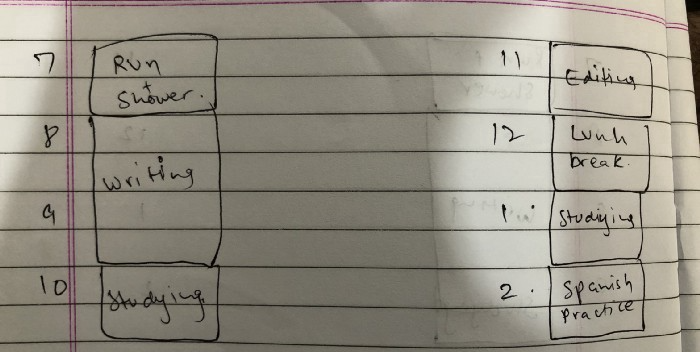

Time-blocking

Cal Newport's time-blocking trick takes a minute but improves your day's clarity.

Divide the next day into 30-minute (or 5-minute, if you're Elon Musk) segments and assign responsibilities. As seen.

Here's why:

The procrastination that results from attempting to determine when to begin working is eliminated. Procrastination is a given if you choose when to begin working in real-time. Even if you may assume you'll start working in five minutes, it won't take you long to realize that five minutes have turned into an hour. But if you've already determined to start working at 2:00 the next day, your odds of procrastinating are greatly decreased, if not eliminated altogether.

You'll also see that you have a lot of time in a day when you plan your day out on paper and assign chores to each hour. Doing this daily will permanently eliminate the lack of time mindset.

5-4-3-2-1: Have breakfast with the frog!

“If it’s your job to eat a frog, it’s best to do it first thing in the morning. And If it’s your job to eat two frogs, it’s best to eat the biggest one first.”

Eating the frog means accomplishing the day's most difficult chore. It's better to schedule it first thing in the morning when time-blocking the night before. Why?

The day's most difficult task is also the one that causes the most postponement. Because of the stress it causes, the later you schedule it, the more time you risk wasting by procrastinating.

However, if you do it right away in the morning, you'll feel good all day. This is the reason it was set for the morning.

Mel Robbins' 5-second rule can help. Start counting backward 54321 and force yourself to start at 1. If you acquire the urge to work on a goal, you must act within 5 seconds or your brain will destroy it. If you're scheduled to eat your frog at 9, eat it at 8:59. Start working.

Micro-visualisation

You've heard of visualizing to enhance the future. Visualizing a bright future won't do much if you're not prepared to focus on the now and develop the necessary habits. Alexander said:

People don’t decide their futures. They decide their habits and their habits decide their future.

I visualize the next day's schedule every morning. My day looks like this

“I’ll start writing an article at 7:30 AM. Then, I’ll get dressed up and reach the medicine outpatient department by 9:30 AM. After my duty is over, I’ll have lunch at 2 PM, followed by a nap at 3 PM. Then, I’ll go to the gym at 4…”

etc.

This reinforces the day you planned the night before. This makes following your plan easy.

Set the timer.

It's the best iPhone productivity app. A timer is incredible for increasing productivity.

Set a timer for an hour or 40 minutes before starting work. Your call. I don't believe in techniques like the Pomodoro because I can focus for varied amounts of time depending on the time of day, how fatigued I am, and how cognitively demanding the activity is.

I work with a timer. A timer keeps you focused and prevents distractions. Your mind stays concentrated because of the timer. Timers generate accountability.

To pee, I'll pause my timer. When I sit down, I'll continue. Same goes for bottle refills. To use Twitter, I must pause the timer. This creates accountability and focuses work.

Connecting everything

If you do all 4, you won't be disappointed. Here's how:

Plan out your day's schedule the night before.

Next, envision in your mind's eye the same timetable in the morning.

Speak aloud 54321 when it's time to work: Eat the frog! In the morning, devour the largest frog.

Then set a timer to ensure that you remain focused on the task at hand.

Merve Yılmaz

3 years ago

Dopamine detox

This post is for you if you can't read or study for 5 minutes.

If you clicked this post, you may be experiencing problems focusing on tasks. A few minutes of reading may tire you. Easily distracted? Using social media and video games for hours without being sidetracked may impair your dopamine system.

When we achieve a goal, the brain secretes dopamine. It might be as simple as drinking water or as crucial as college admission. Situations vary. Various events require different amounts.

Dopamine is released when we start learning but declines over time. Social media algorithms provide new material continually, making us happy. Social media use slows down the system. We can't continue without an award. We return to social media and dopamine rewards.

Mice were given a button that released dopamine into their brains to study the hormone. The mice lost their hunger, thirst, and libido and kept pressing the button. Think this is like someone who spends all day gaming or on Instagram?

When we cause our brain to release so much dopamine, the brain tries to balance it in 2 ways:

1- Decreases dopamine production

2- Dopamine cannot reach its target.

Too many quick joys aren't enough. We'll want more joys. Drugs and alcohol are similar. Initially, a beer will get you drunk. After a while, 3-4 beers will get you drunk.

Social media is continually changing. Updates to these platforms keep us interested. When social media conditions us, we can't read a book.

Same here. I used to complete a book in a day and work longer without distraction. Now I'm addicted to Instagram. Daily, I spend 2 hours on social media. This must change. My life needs improvement. So I started the 50-day challenge.

I've compiled three dopamine-related methods.

Recommendations:

Day-long dopamine detox

First, take a day off from all your favorite things. Social media, gaming, music, junk food, fast food, smoking, alcohol, friends. Take a break.

Hanging out with friends or listening to music may seem pointless. Our minds are polluted. One day away from our pleasures can refresh us.

2. One-week dopamine detox by selecting

Choose one or more things to avoid. Social media, gaming, music, junk food, fast food, smoking, alcohol, friends. Try a week without Instagram or Twitter. I use this occasionally.

One week all together

One solid detox week. It's the hardest program. First or second options are best for dopamine detox. Time will help you.

You can walk, read, or pray during a dopamine detox. Many options exist. If you want to succeed, you must avoid instant gratification. Success after hard work is priceless.

James White

3 years ago

I read three of Elon Musk's suggested books (And His Taste Is Incredible)

A reading list for successful people

Elon Musk reads and talks. So, one learns. Many brilliant individuals & amazing literature.

This article recommends 3 Elon Musk novels. All of them helped me succeed. Hope they'll help you.

Douglas Adams's The Hitchhiker's Guide to the Galaxy

Page Count: 193

Rating on Goodreads: 4.23

Arthur Dent is pulled off Earth by a buddy seconds before it's razed for a cosmic motorway. The trio hitchhikes through space and gets into problems.

I initially read Hitchhiker's as a child. To evade my mum, I'd read with a flashlight under the covers. She'd scold at me for not sleeping on school nights when she found out. Oops.

The Hitchhiker's Guide to the Galaxy is lighthearted science fiction.

My favorite book quotes are:

“Space is big. You won’t believe how vastly, hugely, mind-bogglingly big it is. I mean, you may think it’s a long way down the road to the chemist’s, but that’s just peanuts to space.”

“Far out in the uncharted backwaters of the unfashionable end of the western spiral arm of the Galaxy lies a small unregarded yellow sun. Orbiting this at a distance of roughly ninety-two million miles is an utterly insignificant little blue-green planet whose ape-descended life forms are so amazingly primitive that they still think digital watches are a pretty neat idea.”

“On planet Earth, man had always assumed that he was more intelligent than dolphins because he had achieved so much — the wheel, New York, wars, and so on — whilst all the dolphins had ever done was muck about in the water having a good time. But conversely, the dolphins had always believed that they were far more intelligent than man — for precisely the same reasons.”

the Sun Tzu book The Art Of War

Page Count: 273

Rating on Goodreads: 3.97

It's a classic. You may apply The Art of War's ideas to (nearly) every facet of life. Ex:

Pick your fights.

Keep in mind that timing is crucial.

Create a backup plan in case something goes wrong.

Obstacles provide us a chance to adapt and change.

This book was my first. Since then, I'm a more strategic entrepreneur. Excellent book. And read it ASAP!

My favorite book quotes are:

“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.”

“Engage people with what they expect; it is what they are able to discern and confirms their projections. It settles them into predictable patterns of response, occupying their minds while you wait for the extraordinary moment — that which they cannot anticipate.”

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained, you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

Peter Thiel's book Zero to One

Page Count: 195

Rating on Goodreads: 4.18

Peter argues the best money-making strategies are typically unproven. Entrepreneurship should never have a defined path to success. Whoever says differently is lying.

Zero to One explores technology and society. Peter is a philosophy major and law school graduate, which informs the work.

Peters' ideas, depth, and intellect stood out in Zero to One. It's a top business book.

My favorite book quotes are:

“The most valuable businesses of coming decades will be built by entrepreneurs who seek to empower people rather than try to make them obsolete.”

“The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them.”

“If your goal is to never make a mistake in your life, you shouldn’t look for secrets. The prospect of being lonely but right — dedicating your life to something that no one else believes in — is already hard. The prospect of being lonely and wrong can be unbearable.”

You might also like

Florian Wahl

3 years ago

An Approach to Product Strategy

I've been pondering product strategy and how to articulate it. Frameworks helped guide our thinking.

If your teams aren't working together or there's no clear path to victory, your product strategy may not be well-articulated or communicated (if you have one).

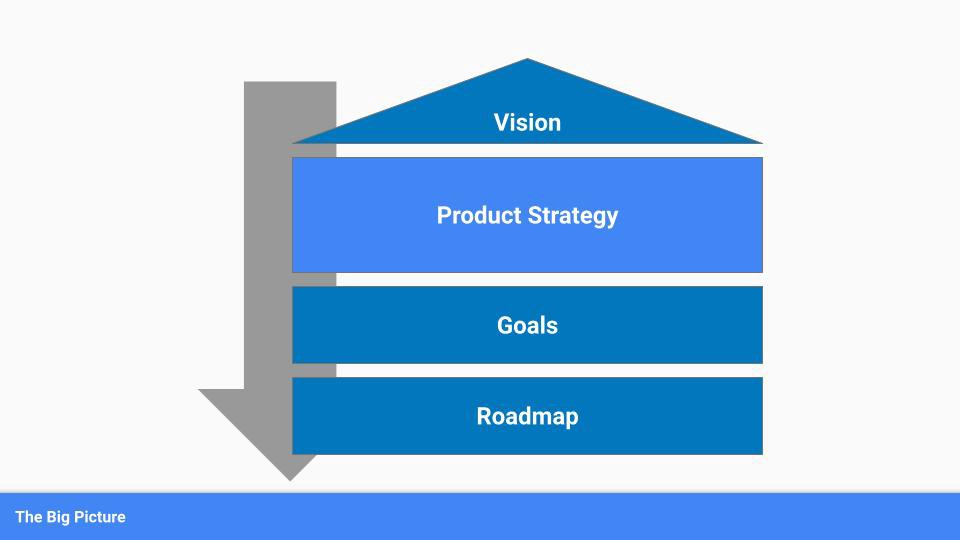

Before diving into a product strategy's details, it's important to understand its role in the bigger picture — the pieces that move your organization forward.

the overall picture

A product strategy is crucial, in my opinion. It's part of a successful product or business. It's the showpiece.

To simplify, we'll discuss four main components:

Vision

Product Management

Goals

Roadmap

Vision

Your company's mission? Your company/product in 35 years? Which headlines?

The vision defines everything your organization will do in the long term. It shows how your company impacted the world. It's your organization's rallying cry.

An ambitious but realistic vision is needed.

Without a clear vision, your product strategy may be inconsistent.

Product Management

Our main subject. Product strategy connects everything. It fulfills the vision.

In Part 2, we'll discuss product strategy.

Goals

This component can be goals, objectives, key results, targets, milestones, or whatever goal-tracking framework works best for your organization.

These product strategy metrics will help your team prioritize strategies and roadmaps.

Your company's goals should be unified. This fuels success.

Roadmap

The roadmap is your product strategy's timeline. It provides a prioritized view of your team's upcoming deliverables.

A roadmap is time-bound and includes measurable goals for your company. Your team's steps and capabilities for executing product strategy.

If your team has trouble prioritizing or defining a roadmap, your product strategy or vision is likely unclear.

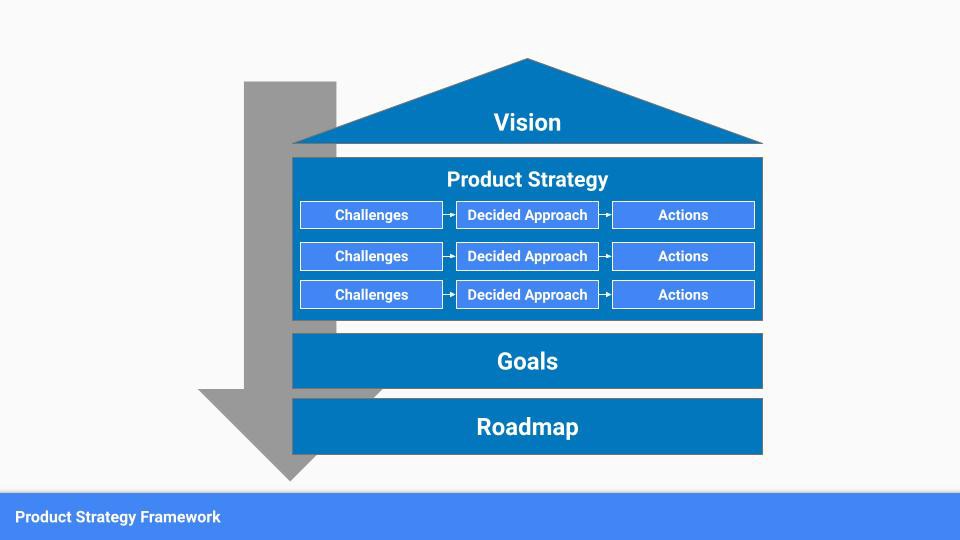

Formulation of a Product Strategy

Now that we've discussed where your product strategy fits in the big picture, let's look at a framework.

A product strategy should include challenges, an approach, and actions.

Challenges

First, analyze the problems/situations you're solving. It can be customer- or company-focused.

The analysis should explain the problems and why they're important. Try to simplify the situation and identify critical aspects.

Some questions:

What issues are we attempting to resolve?

What obstacles—internal or otherwise—are we attempting to overcome?

What is the opportunity, and why should we pursue it, in your opinion?

Decided Method

Second, describe your approach. This can be a set of company policies for handling the challenge. It's the overall approach to the first part's analysis.

The approach can be your company's bets, the solutions you've found, or how you'll solve the problems you've identified.

Again, these questions can help:

What is the value that we hope to offer to our clients?

Which market are we focusing on first?

What makes us stand out? Our benefit over rivals?

Actions

Third, identify actions that result from your approach. Second-part actions should be these.

Coordinate these actions. You may need to add products or features to your roadmap, acquire new capabilities through partnerships, or launch new marketing campaigns. Whatever fits your challenges and strategy.

Final questions:

What skills do we need to develop or obtain?

What is the chosen remedy? What are the main outputs?

What else ought to be added to our road map?

Put everything together

… and iterate!

Strategy isn't one-and-done. Changes occur. Economies change. Competitors emerge. Customer expectations change.

One unexpected event can make strategies obsolete quickly. Muscle it. Review, evaluate, and course-correct your strategies with your teams. Quarterly works. In a new or unstable industry, more often.

Nicolas Tresegnie

3 years ago

Launching 10 SaaS applications in 100 days

Apocodes helps entrepreneurs create SaaS products without writing code. This post introduces micro-SaaS and outlines its basic strategy.

Strategy

Vision and strategy differ when starting a startup.

The company's long-term future state is outlined in the vision. It establishes the overarching objectives the organization aims to achieve while also justifying its existence. The company's future is outlined in the vision.

The strategy consists of a collection of short- to mid-term objectives, the accomplishment of which will move the business closer to its vision. The company gets there through its strategy.

The vision should be stable, but the strategy must be adjusted based on customer input, market conditions, or previous experiments.

Begin modestly and aim high.

Be truthful. It's impossible to automate SaaS product creation from scratch. It's like climbing Everest without running a 5K. Physical rules don't prohibit it, but it would be suicide.

Apocodes 5K equivalent? Two options:

(A) Create a feature that includes every setting option conceivable. then query potential clients “Would you choose us to build your SaaS solution if we offered 99 additional features of the same caliber?” After that, decide which major feature to implement next.

(B) Build a few straightforward features with just one or two configuration options. Then query potential clients “Will this suffice to make your product?” What's missing if not? Finally, tweak the final result a bit before starting over.

(A) is an all-or-nothing approach. It's like training your left arm to climb Mount Everest. My right foot is next.

(B) is a better method because it's iterative and provides value to customers throughout.

Focus on a small market sector, meet its needs, and expand gradually. Micro-SaaS is Apocode's first market.

What is micro-SaaS.

Micro-SaaS enterprises have these characteristics:

A limited range: They address a specific problem with a small number of features.

A small group of one to five individuals.

Low external funding: The majority of micro-SaaS companies have Total Addressable Markets (TAM) under $100 million. Investors find them unattractive as a result. As a result, the majority of micro-SaaS companies are self-funded or bootstrapped.

Low competition: Because they solve problems that larger firms would rather not spend time on, micro-SaaS enterprises have little rivalry.

Low upkeep: Because of their simplicity, they require little care.

Huge profitability: Because providing more clients incurs such a small incremental cost, high profit margins are possible.

Micro-SaaS enterprises created with no-code are Apocode's ideal first market niche.

We'll create our own micro-SaaS solutions to better understand their needs. Although not required, we believe this will improve community discussions.

The challenge

In 100 days (September 12–December 20, 2022), we plan to build 10 micro-SaaS enterprises using Apocode.

They will be:

Self-serve: Customers will be able to use the entire product experience without our manual assistance.

Real: They'll deal with actual issues. They won't be isolated proofs of concept because we'll keep up with them after the challenge.

Both free and paid options: including a free plan and a free trial period. Although financial success would be a good result, the challenge's stated objective is not financial success.

This will let us design Apocodes features, showcase them, and talk to customers.

(Edit: The first micro-SaaS was launched!)

Follow along

If you want to follow the story of Apocode or our progress in this challenge, you can subscribe here.

If you are interested in using Apocode, sign up here.

If you want to provide feedback, discuss the idea further or get involved, email me at nicolas.tresegnie@gmail.com

CyberPunkMetalHead

3 years ago

195 countries want Terra Luna founder Do Kwon

Interpol has issued a red alert on Terraform Labs' CEO, South Korean prosecutors said.

After the May crash of Terra Luna revealed tax evasion issues, South Korean officials filed an arrest warrant for Do Kwon, but he is missing.

Do Kwon is now a fugitive in 195 countries after Seoul prosecutors placed him to Interpol's red list. Do Kwon hasn't commented since then. The red list allows any country's local authorities to apprehend Do Kwon.

Do Dwon and Terraform Labs were believed to have moved to Singapore days before the $40 billion wipeout, but Singapore authorities said he fled the country on September 17. Do Kwon tweeted that he wasn't on the run and cited privacy concerns.

Do Kwon was not on the red list at the time and said he wasn't "running," only to reply to his own tweet saying he hasn't jogged in a while and needed to trim calories.

Whether or not it makes sense to read too much into this, the reality is that Do Kwon is now on Interpol red list, despite the firmly asserts on twitter that he does absolutely nothing to hide.

UPDATE:

South Korean authorities are investigating alleged withdrawals of over $60 million U.S. and seeking to freeze these assets. Korean authorities believe a new wallet exchanged over 3000 BTC through OKX and Kucoin.

Do Kwon and the Luna Foundation Guard (of whom Do Kwon is a key member of) have declined all charges and dubbed this disinformation.

Singapore's Luna Foundation Guard (LFG) manages the Terra Ecosystem.

The Legal Situation

Multiple governments are searching for Do Kwon and five other Terraform Labs employees for financial markets legislation crimes.

South Korean authorities arrested a man suspected of tax fraud and Ponzi scheme.

The U.S. SEC is also examining Terraform Labs on how UST was advertised as a stablecoin. No legal precedent exists, so it's unclear what's illegal.

The future of Terraform Labs, Terra, and Terra 2 is unknown, and despite what Twitter shills say about LUNC, the company remains in limbo awaiting a decision that will determine its fate. This project isn't a wise investment.