More on Marketing

Jon Brosio

3 years ago

This Landing Page is a (Legal) Money-Printing Machine

and it’s easy to build.

A landing page with good copy is a money-maker.

Let's be honest, page-builder templates are garbage.

They can help you create a nice-looking landing page, but not persuasive writing.

Over the previous 90 days, I've examined 200+ landing pages.

What's crazy?

Top digital entrepreneurs use a 7-part strategy to bring in email subscribers, generate prospects, and (passively) sell their digital courses.

Steal this 7-part landing page architecture to maximize digital product sales.

The offer

Landing pages require offers.

Newsletter, cohort, or course offer.

Your reader should see this offer first. Includind:

Headline

Imagery

Call-to-action

Clear, persuasive, and simplicity are key. Example: the Linkedin OS course home page of digital entrepreneur Justin Welsh offers:

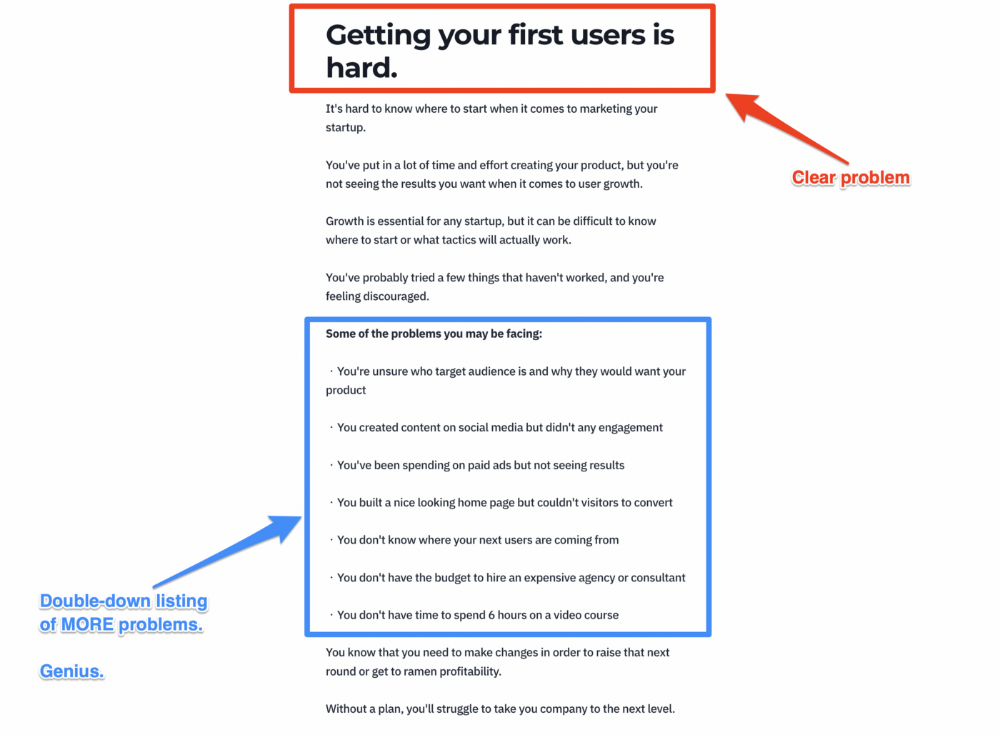

A distinctly defined problem

Everyone needs an enemy.

You need an opponent on your landing page. Problematic.

Next, employ psychology to create a struggle in your visitor's thoughts.

Don't be clever here; label your customer's problem. The more particular you are, the bigger the situation will seem.

When you build a clear monster, you invite defeat. I appreciate Theo Ohene's Growth Roadmaps landing page.

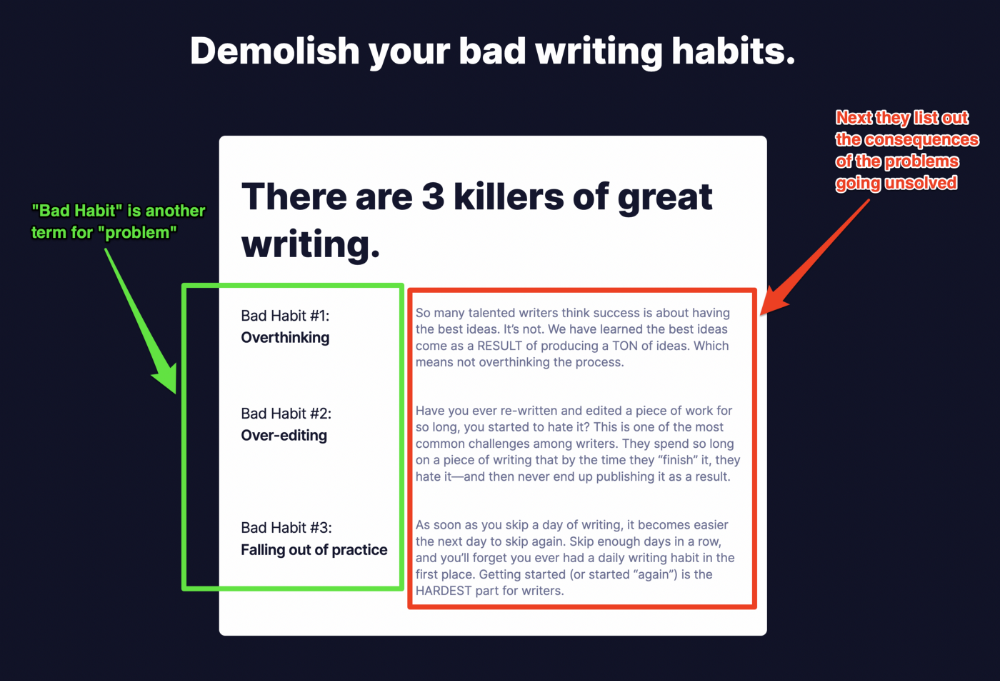

Exacerbation of the effects

Problem identification doesn't motivate action.

What would an unresolved problem mean?

This is landing page copy. When you describe the unsolved problem's repercussions, you accomplish several things:

You write a narrative (and stories are remembered better than stats)

You cause the reader to feel something.

You help the reader relate to the issue

Important!

My favorite script is:

"Sure, you can let [problem] go untreated. But what will happen if you do? Soon, you'll begin to notice [new problem 1] will start to arise. That might bring up [problem 2], etc."

Take the copywriting course, digital writer and entrepreneur Dickie Bush illustrates below when he labels the problem (see: "poor habit") and then illustrates the repercussions.

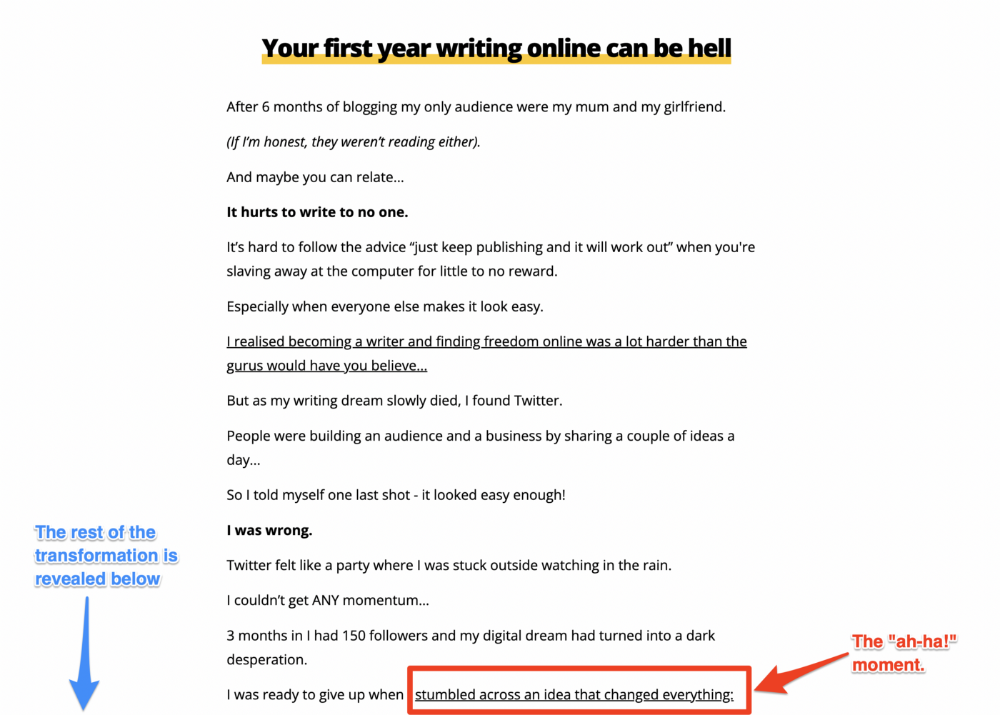

The tale of transformation

Every landing page needs that "ah-ha!" moment.

Transformation stories do this.

Did you find a solution? Someone else made the discovery? Have you tested your theory?

Next, describe your (or your subject's) metamorphosis.

Kieran Drew nails his narrative (and revelation) here. Right before the disclosure, he introduces his "ah-ha!" moment:

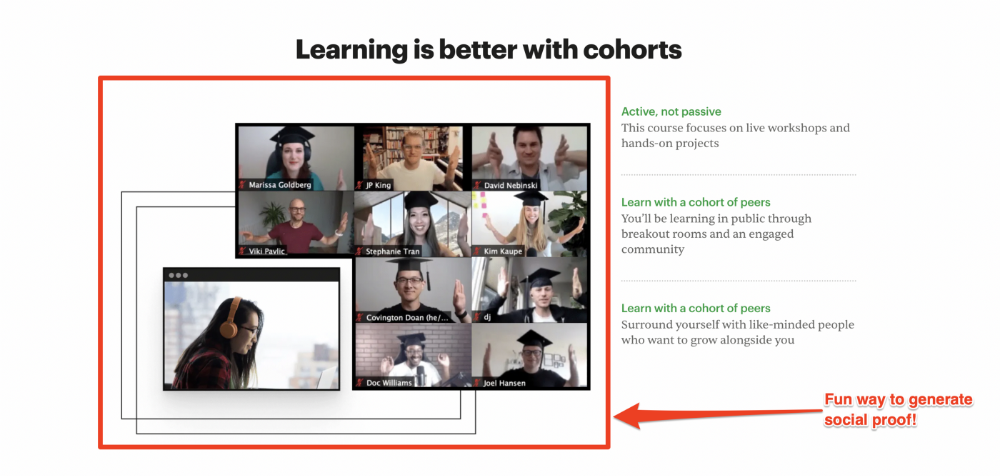

Testimonials

Social proof completes any landing page.

Social proof tells the reader, "If others do it, it must be worthwhile."

This is your argument.

Positive social proof helps (obviously).

Offer "free" training in exchange for a testimonial if you need social evidence. This builds social proof.

Most social proof is testimonies (recommended). Kurtis Hanni's creative take on social proof (using a screenshot of his colleague) is entertaining.

Bravo.

Reveal your offer

Now's the moment to act.

Describe the "bundle" that provides the transformation.

Here's:

Course

Cohort

Ebook

Whatever you're selling.

Include a product or service image, what the consumer is getting ("how it works"), the price, any "free" bonuses (preferred), and a CTA ("buy now").

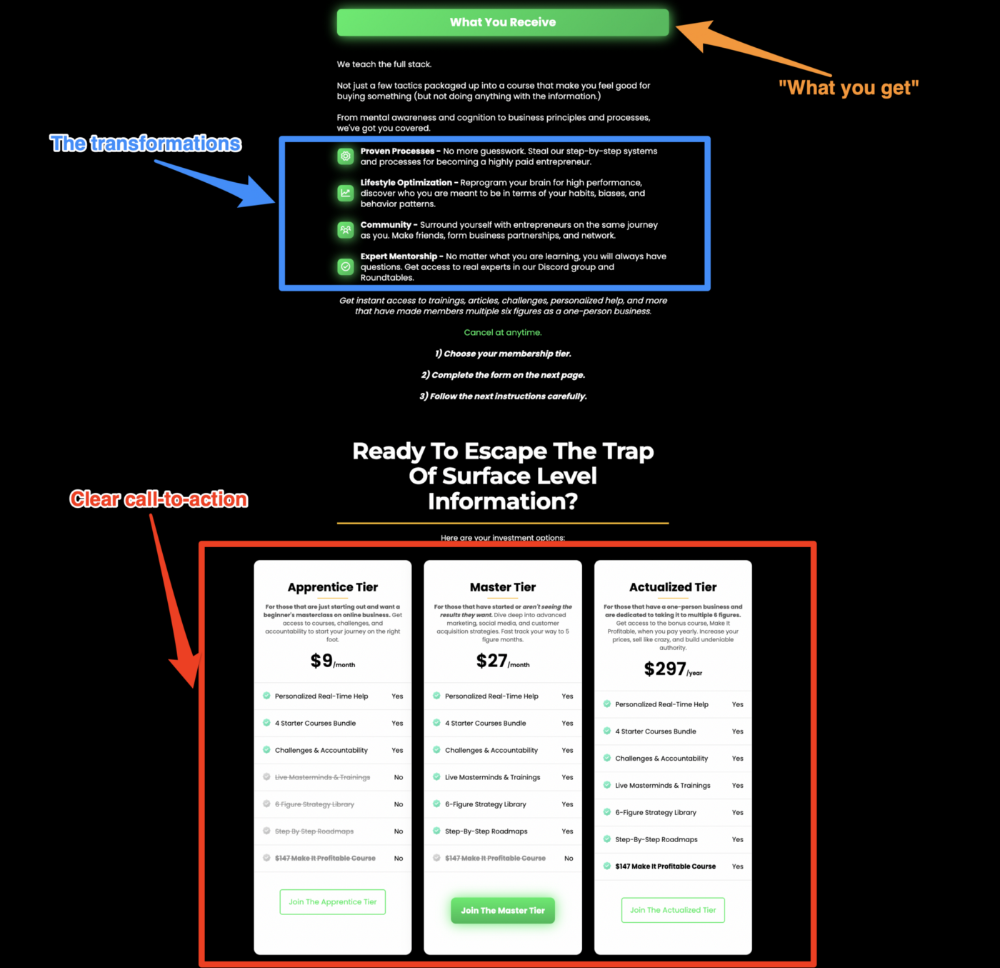

Clarity is key. Don't make a cunning offer. Make sure your presentation emphasizes customer change (benefits). Dan Koe's Modern Mastery landing page makes an offer. Consider:

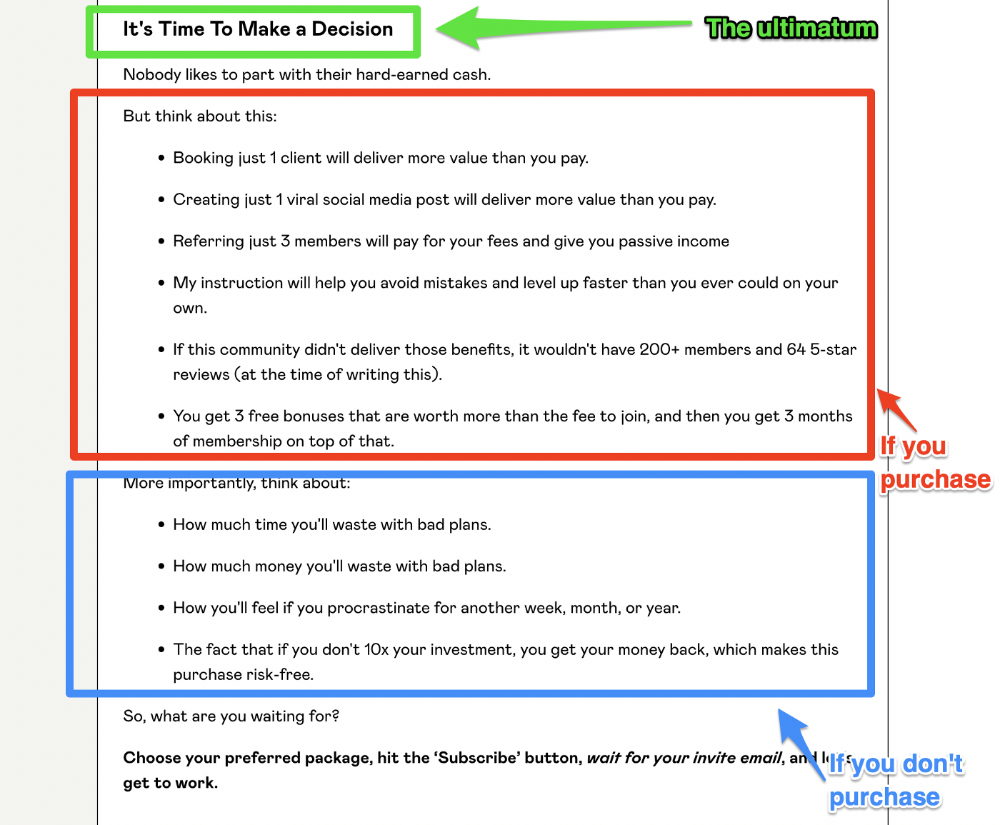

An ultimatum

Offering isn't enough.

You must give your prospect an ultimatum.

They can buy your merchandise from you.

They may exit the webpage.

That’s it.

It's crucial to show what happens if the reader does either. Stress the consequences of not buying (again, a little consequence amplification). Remind them of the benefits of buying.

I appreciate Charles Miller's product offer ending:

The top online creators use a 7-part landing page structure:

Offer the service

Describe the problem

Amplify the consequences

Tell the transformational story

Include testimonials and social proof.

Reveal the offer (with any bonuses if applicable)

Finally, give the reader a deadline to encourage them to take action.

Sequence these sections to develop a landing page that (essentially) prints money.

Victoria Kurichenko

3 years ago

My Blog Is in Google's Top 10—Here's How to Compete

"Competition" is beautiful and hateful.

Some people bury their dreams because they are afraid of competition. Others challenge themselves, shaping our world.

Competition is normal.

It spurs innovation and progress.

I wish more people agreed.

As a marketer, content writer, and solopreneur, my readers often ask:

"I want to create a niche website, but I have no ideas. Everything's done"

"Is a website worthwhile?"

I can't count how many times I said, "Yes, it makes sense, and you can succeed in a competitive market."

I encourage and share examples, but it's not enough to overcome competition anxiety.

I launched an SEO writing website for content creators a year ago, knowing it wouldn't beat Ahrefs, Semrush, Backlinko, etc.

Not needed.

Many of my website's pages rank highly on Google.

Everyone can eat the pie.

In a competitive niche, I took a different approach.

Look farther

When chatting with bloggers that want a website, I discovered something fascinating.

They want to launch a website but have no ideas. As a next step, they start listing the interests they believe they should work on, like wellness, lifestyle, investments, etc. I could keep going.

Too many generalists who claim to know everything confuse many.

Generalists aren't trusted.

We want someone to fix our problems immediately.

I don't think broad-spectrum experts are undervalued. People have many demands that go beyond generalists' work. Narrow-niche experts can help.

I've done SEO for three years. I learned from experts and courses. I couldn't find a comprehensive SEO writing resource.

I read tons of articles before realizing that wasn't it. I took courses that covered SEO basics eventually.

I had a demand for learning SEO writing, but there was no solution on the market. My website fills this micro-niche.

Have you ever had trouble online?

Professional courses too general, boring, etc.?

You've bought off-topic books, right?

You're not alone.

Niche ideas!

Big players often disregard new opportunities. Too small. Individual content creators can succeed here.

In a competitive market:

Never choose wide subjects

Think about issues you can relate to and have direct experience with.

Be a consumer to discover both the positive and negative aspects of a good or service.

Merchandise your annoyances.

Consider ways to transform your frustrations into opportunities.

The right niche is half-success. Here is what else I did to hit the Google front page with my website.

An innovative method for choosing subjects

Why publish on social media and websites?

Want likes, shares, followers, or fame?

Some people do it for fun. No judgment.

I bet you want more.

You want to make decent money from blogging.

Writing about random topics, even if they are related to your niche, won’t help you attract an audience from organic search. I'm a marketer and writer.

I worked at companies with dead blogs because they posted for themselves, not readers. They did not follow SEO writing rules; that’s why most of their content flopped.

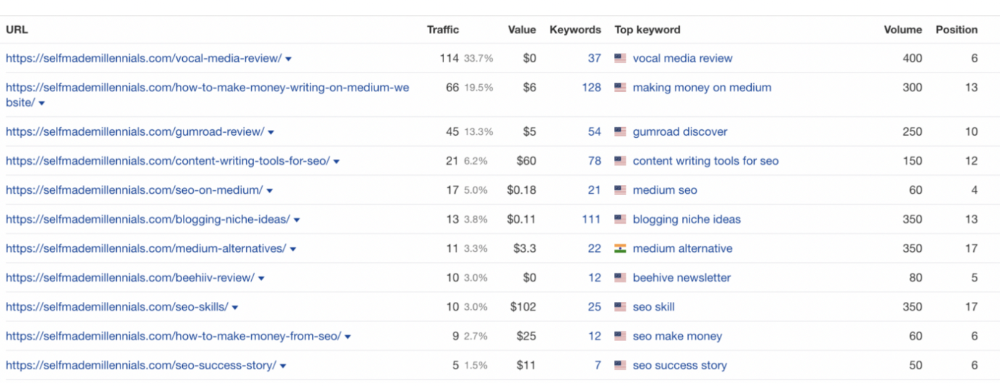

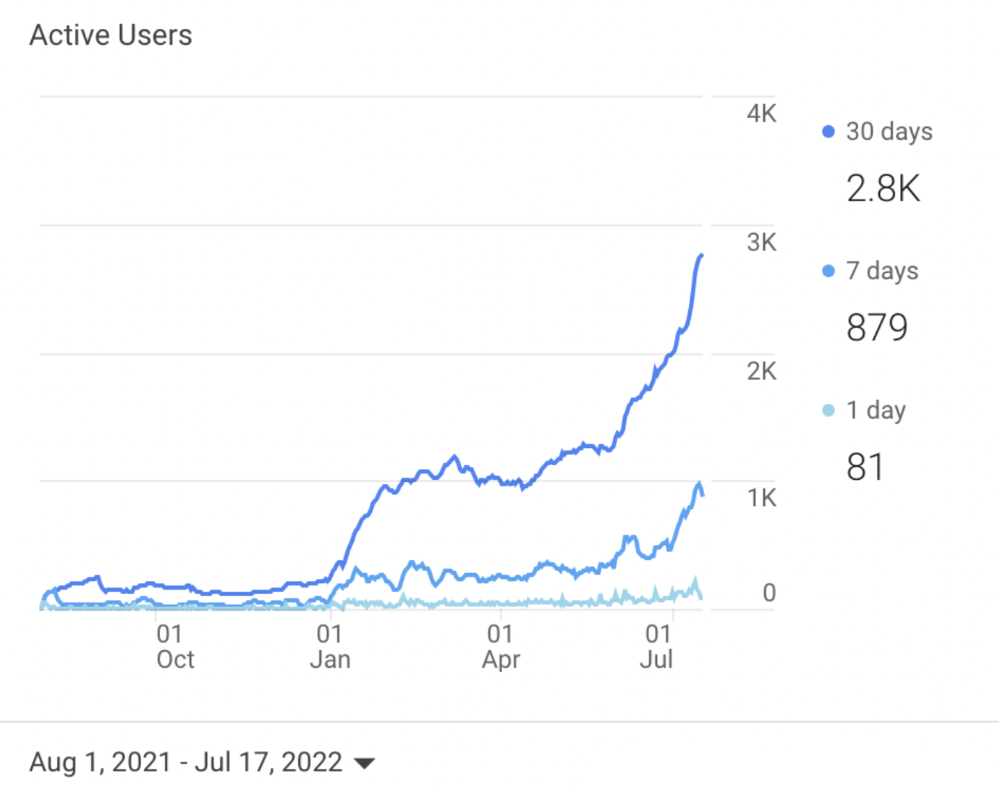

I learned these hard lessons and grew my website from 0 to 3,000+ visitors per month while working on it a few hours a week only. Evidence:

I choose website topics using these criteria:

- Business potential. The information should benefit my audience and generate revenue. There would be no use in having it otherwise.

My topics should help me:

Attract organic search traffic with my "fluff-free" content -> Subscribers > SEO ebook sales.

Simple and effective.

- traffic on search engines. The number of monthly searches reveals how popular my topic is all across the world. If I find that no one is interested in my suggested topic, I don't write a blog article.

- Competition. Every search term is up against rivals. Some are more popular (thus competitive) since more websites target them in organic search. A new website won't score highly for keywords that are too competitive. On the other side, keywords with moderate to light competition can help you rank higher on Google more quickly.

- Search purpose. The "why" underlying users' search requests is revealed. I analyze search intent to understand what users need when they plug various queries in the search bar and what content can perfectly meet their needs.

My specialty website produces money, ranks well, and attracts the target audience because I handpick high-traffic themes.

Following these guidelines, even a new website can stand out.

I wrote a 50-page SEO writing guide where I detailed topic selection and share my front-page Google strategy.

My guide can help you run a successful niche website.

In summary

You're not late to the niche-website party.

The Internet offers many untapped opportunities.

We need new solutions and are willing to listen.

There are unexplored niches in any topic.

Don't fight giants. They have their piece of the pie. They might overlook new opportunities while trying to keep that piece of the pie. You should act now.

Jenn Leach

3 years ago

This clever Instagram marketing technique increased my sales to $30,000 per month.

No Paid Ads Required

I had an online store. After a year of running the company alongside my 9-to-5, I made enough to resign.

That day was amazing.

This Instagram marketing plan helped the store succeed.

How did I increase my sales to five figures a month without using any paid advertising?

I used customer event marketing.

I'm not sure this term exists. I invented it to describe what I was doing.

Instagram word-of-mouth, fan engagement, and interaction drove sales.

If a customer liked or disliked a product, the buzz would drive attention to the store.

I used customer-based events to increase engagement and store sales.

Success!

Here are the weekly Instagram customer events I coordinated while running my business:

Be the Buyer Days

Flash sales

Mystery boxes

Be the Buyer Days: How do they work?

Be the Buyer Days are exactly that.

You choose a day to share stock selections with social media followers.

This is an easy approach to engaging customers and getting fans enthusiastic about new releases.

First, pick a handful of items you’re considering ordering. I’d usually pick around 3 for Be the Buyer Day.

Then I'd poll the crowd on Instagram to vote on their favorites.

This was before Instagram stories, polls, and all the other cool features Instagram offers today. I think using these tools now would make this event even better.

I'd ask customers their favorite back then.

The growing comments excited customers.

Then I'd declare the winner, acquire the products, and start selling it.

How do flash sales work?

I mostly ran flash sales.

You choose a limited number of itemsdd for a few-hour sale.

We wanted most sales to result in sold-out items.

When an item sells out, it contributes to the sensation of scarcity and can inspire customers to visit your store to buy a comparable product, join your email list, become a fan, etc.

We hoped they'd act quickly.

I'd hold flash deals twice a week, which generated scarcity and boosted sales.

The store had a few thousand Instagram followers when I started flash deals.

Each flash sale item would make $400 to $600.

$400 x 3= $1,200

That's $1,200 on social media!

Twice a week, you'll make roughly $10K a month from Instagram.

$1,200/day x 8 events/month=$9,600

Flash sales did great.

We held weekly flash deals and sent social media and email reminders. That’s about it!

How are mystery boxes put together?

All you do is package a box of store products and sell it as a mystery box on TikTok or retail websites.

A $100 mystery box would cost $30.

You're discounting high-value boxes.

This is a clever approach to get rid of excess inventory and makes customers happy.

It worked!

Be the Buyer Days, flash deals, and mystery boxes helped build my company without paid advertisements.

All companies can use customer event marketing. Involving customers and providing an engaging environment can boost sales.

Try it!

You might also like

Leah

3 years ago

The Burnout Recovery Secrets Nobody Is Talking About

What works and what’s just more toxic positivity

Just keep at it; you’ll get it.

I closed the Zoom call and immediately dropped my head. Open tabs included material on inspiration, burnout, and recovery.

I searched everywhere for ways to avoid burnout.

It wasn't that I needed to keep going, change my routine, employ 8D audio playlists, or come up with fresh ideas. I had several ideas and a schedule. I knew what to do.

I wasn't interested. I kept reading, changing my self-care and mental health routines, and writing even though it was tiring.

Since burnout became a psychiatric illness in 2019, thousands have shared their experiences. It's spreading rapidly among writers.

What is the actual key to recovering from burnout?

Every A-list burnout story emphasizes prevention. Other lists provide repackaged self-care tips. More discuss mental health.

It's like the mid-2000s, when pink quotes about bubble baths saturated social media.

The self-care mania cost us all. Self-care is crucial, but utilizing it to address everything didn't work then or now.

How can you recover from burnout?

Time

Are extended breaks actually good for you? Most people need a break every 62 days or so to avoid burnout.

Real-life burnout victims all took breaks. Perhaps not a long hiatus, but breaks nonetheless.

Burnout is slow and gradual. It takes little bits of your motivation and passion at a time. Sometimes it’s so slow that you barely notice or blame it on other things like stress and poor sleep.

Burnout doesn't come overnight; neither will recovery.

I don’t care what anyone else says the cure for burnout is. It has to be time because time is what gave us all burnout in the first place.

Sofien Kaabar, CFA

2 years ago

Innovative Trading Methods: The Catapult Indicator

Python Volatility-Based Catapult Indicator

As a catapult, this technical indicator uses three systems: Volatility (the fulcrum), Momentum (the propeller), and a Directional Filter (Acting as the support). The goal is to get a signal that predicts volatility acceleration and direction based on historical patterns. We want to know when the market will move. and where. This indicator outperforms standard indicators.

Knowledge must be accessible to everyone. This is why my new publications Contrarian Trading Strategies in Python and Trend Following Strategies in Python now include free PDF copies of my first three books (Therefore, purchasing one of the new books gets you 4 books in total). GitHub-hosted advanced indications and techniques are in the two new books above.

The Foundation: Volatility

The Catapult predicts significant changes with the 21-period Relative Volatility Index.

The Average True Range, Mean Absolute Deviation, and Standard Deviation all assess volatility. Standard Deviation will construct the Relative Volatility Index.

Standard Deviation is the most basic volatility. It underpins descriptive statistics and technical indicators like Bollinger Bands. Before calculating Standard Deviation, let's define Variance.

Variance is the squared deviations from the mean (a dispersion measure). We take the square deviations to compel the distance from the mean to be non-negative, then we take the square root to make the measure have the same units as the mean, comparing apples to apples (mean to standard deviation standard deviation). Variance formula:

As stated, standard deviation is:

# The function to add a number of columns inside an array

def adder(Data, times):

for i in range(1, times + 1):

new_col = np.zeros((len(Data), 1), dtype = float)

Data = np.append(Data, new_col, axis = 1)

return Data

# The function to delete a number of columns starting from an index

def deleter(Data, index, times):

for i in range(1, times + 1):

Data = np.delete(Data, index, axis = 1)

return Data

# The function to delete a number of rows from the beginning

def jump(Data, jump):

Data = Data[jump:, ]

return Data

# Example of adding 3 empty columns to an array

my_ohlc_array = adder(my_ohlc_array, 3)

# Example of deleting the 2 columns after the column indexed at 3

my_ohlc_array = deleter(my_ohlc_array, 3, 2)

# Example of deleting the first 20 rows

my_ohlc_array = jump(my_ohlc_array, 20)

# Remember, OHLC is an abbreviation of Open, High, Low, and Close and it refers to the standard historical data file

def volatility(Data, lookback, what, where):

for i in range(len(Data)):

try:

Data[i, where] = (Data[i - lookback + 1:i + 1, what].std())

except IndexError:

pass

return Data

The RSI is the most popular momentum indicator, and for good reason—it excels in range markets. Its 0–100 range simplifies interpretation. Fame boosts its potential.

The more traders and portfolio managers look at the RSI, the more people will react to its signals, pushing market prices. Technical Analysis is self-fulfilling, therefore this theory is obvious yet unproven.

RSI is determined simply. Start with one-period pricing discrepancies. We must remove each closing price from the previous one. We then divide the smoothed average of positive differences by the smoothed average of negative differences. The RSI algorithm converts the Relative Strength from the last calculation into a value between 0 and 100.

def ma(Data, lookback, close, where):

Data = adder(Data, 1)

for i in range(len(Data)):

try:

Data[i, where] = (Data[i - lookback + 1:i + 1, close].mean())

except IndexError:

pass

# Cleaning

Data = jump(Data, lookback)

return Data

def ema(Data, alpha, lookback, what, where):

alpha = alpha / (lookback + 1.0)

beta = 1 - alpha

# First value is a simple SMA

Data = ma(Data, lookback, what, where)

# Calculating first EMA

Data[lookback + 1, where] = (Data[lookback + 1, what] * alpha) + (Data[lookback, where] * beta)

# Calculating the rest of EMA

for i in range(lookback + 2, len(Data)):

try:

Data[i, where] = (Data[i, what] * alpha) + (Data[i - 1, where] * beta)

except IndexError:

pass

return Datadef rsi(Data, lookback, close, where, width = 1, genre = 'Smoothed'):

# Adding a few columns

Data = adder(Data, 7)

# Calculating Differences

for i in range(len(Data)):

Data[i, where] = Data[i, close] - Data[i - width, close]

# Calculating the Up and Down absolute values

for i in range(len(Data)):

if Data[i, where] > 0:

Data[i, where + 1] = Data[i, where]

elif Data[i, where] < 0:

Data[i, where + 2] = abs(Data[i, where])

# Calculating the Smoothed Moving Average on Up and Down

absolute values

lookback = (lookback * 2) - 1 # From exponential to smoothed

Data = ema(Data, 2, lookback, where + 1, where + 3)

Data = ema(Data, 2, lookback, where + 2, where + 4)

# Calculating the Relative Strength

Data[:, where + 5] = Data[:, where + 3] / Data[:, where + 4]

# Calculate the Relative Strength Index

Data[:, where + 6] = (100 - (100 / (1 + Data[:, where + 5])))

# Cleaning

Data = deleter(Data, where, 6)

Data = jump(Data, lookback)

return Data

def relative_volatility_index(Data, lookback, close, where):

# Calculating Volatility

Data = volatility(Data, lookback, close, where)

# Calculating the RSI on Volatility

Data = rsi(Data, lookback, where, where + 1)

# Cleaning

Data = deleter(Data, where, 1)

return DataThe Arm Section: Speed

The Catapult predicts momentum direction using the 14-period Relative Strength Index.

As a reminder, the RSI ranges from 0 to 100. Two levels give contrarian signals:

A positive response is anticipated when the market is deemed to have gone too far down at the oversold level 30, which is 30.

When the market is deemed to have gone up too much, at overbought level 70, a bearish reaction is to be expected.

Comparing the RSI to 50 is another intriguing use. RSI above 50 indicates bullish momentum, while below 50 indicates negative momentum.

The direction-finding filter in the frame

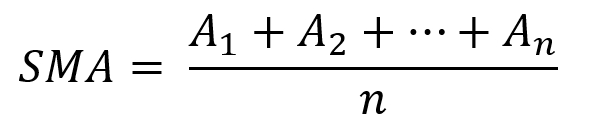

The Catapult's directional filter uses the 200-period simple moving average to keep us trending. This keeps us sane and increases our odds.

Moving averages confirm and ride trends. Its simplicity and track record of delivering value to analysis make them the most popular technical indicator. They help us locate support and resistance, stops and targets, and the trend. Its versatility makes them essential trading tools.

This is the plain mean, employed in statistics and everywhere else in life. Simply divide the number of observations by their total values. Mathematically, it's:

We defined the moving average function above. Create the Catapult indication now.

Indicator of the Catapult

The indicator is a healthy mix of the three indicators:

The first trigger will be provided by the 21-period Relative Volatility Index, which indicates that there will now be above average volatility and, as a result, it is possible for a directional shift.

If the reading is above 50, the move is likely bullish, and if it is below 50, the move is likely bearish, according to the 14-period Relative Strength Index, which indicates the likelihood of the direction of the move.

The likelihood of the move's direction will be strengthened by the 200-period simple moving average. When the market is above the 200-period moving average, we can infer that bullish pressure is there and that the upward trend will likely continue. Similar to this, if the market falls below the 200-period moving average, we recognize that there is negative pressure and that the downside is quite likely to continue.

lookback_rvi = 21

lookback_rsi = 14

lookback_ma = 200

my_data = ma(my_data, lookback_ma, 3, 4)

my_data = rsi(my_data, lookback_rsi, 3, 5)

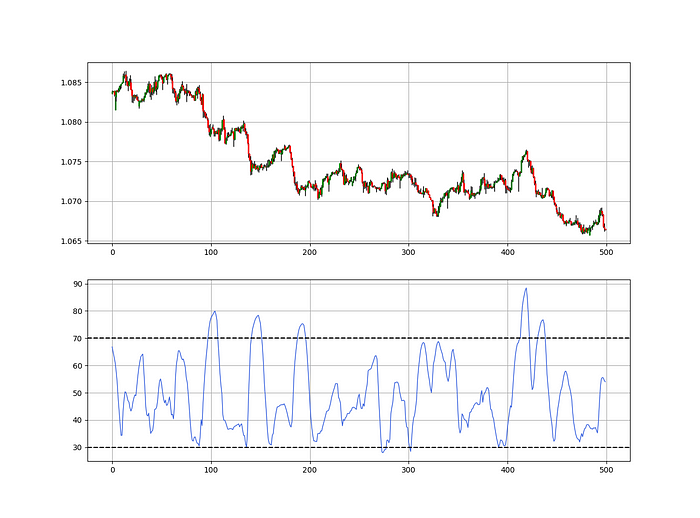

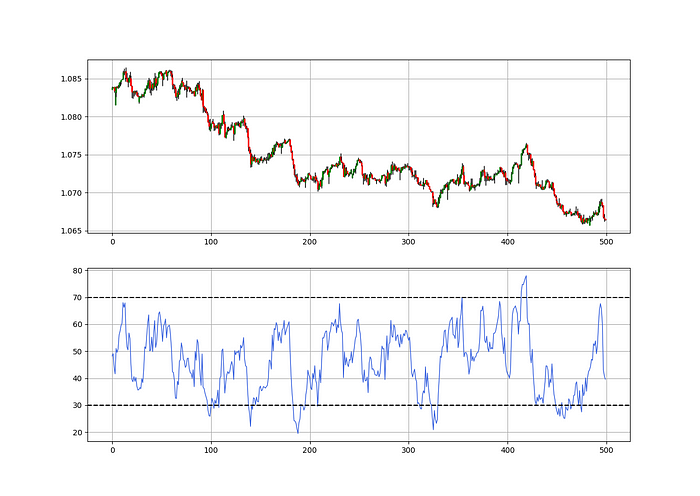

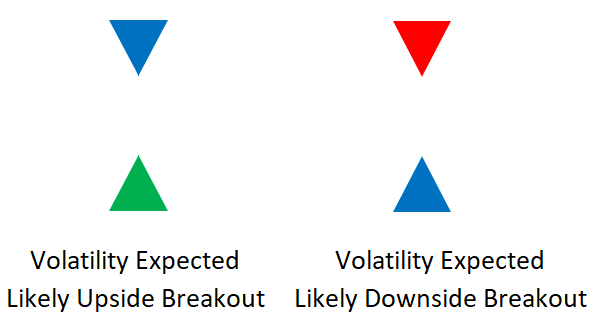

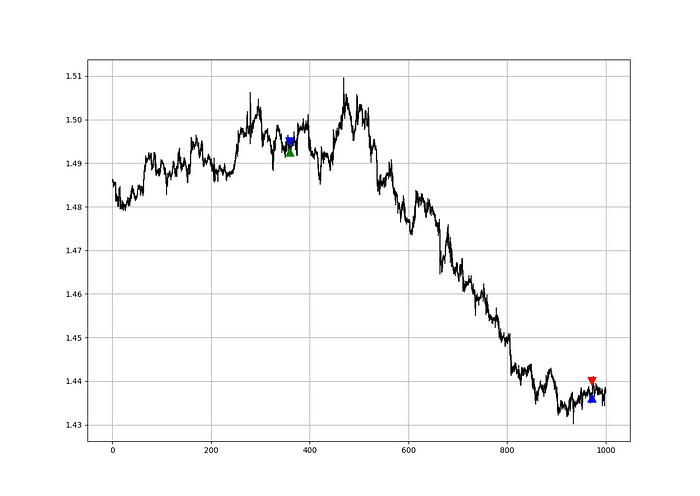

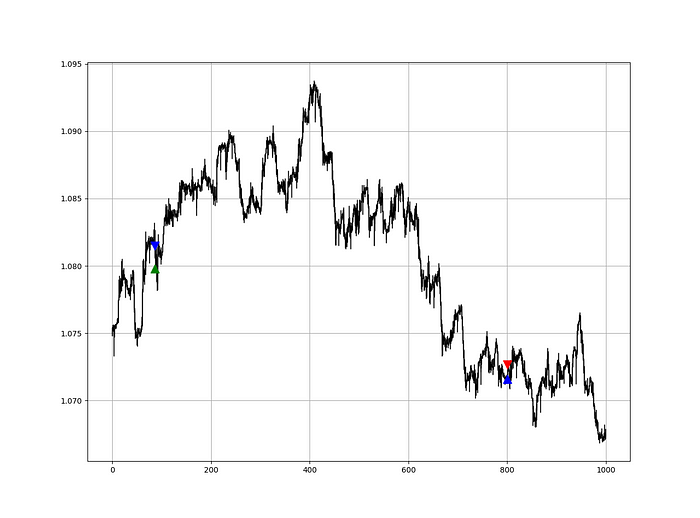

my_data = relative_volatility_index(my_data, lookback_rvi, 3, 6)Two-handled overlay indicator Catapult. The first exhibits blue and green arrows for a buy signal, and the second shows blue and red for a sell signal.

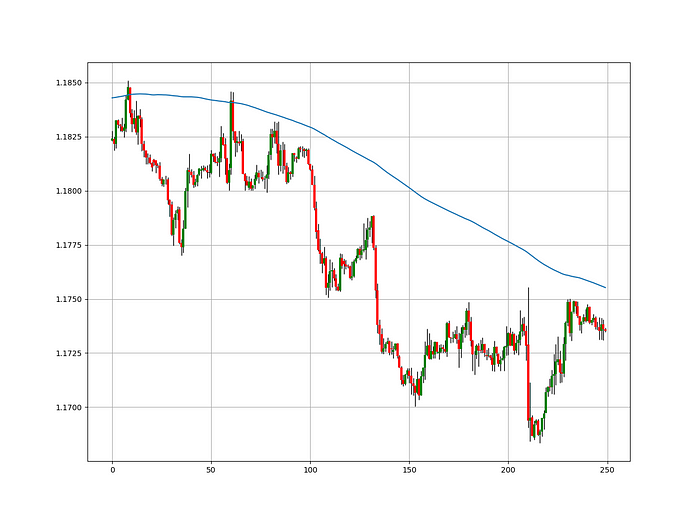

The chart below shows recent EURUSD hourly values.

def signal(Data, rvi_col, signal):

Data = adder(Data, 10)

for i in range(len(Data)):

if Data[i, rvi_col] < 30 and \

Data[i - 1, rvi_col] > 30 and \

Data[i - 2, rvi_col] > 30 and \

Data[i - 3, rvi_col] > 30 and \

Data[i - 4, rvi_col] > 30 and \

Data[i - 5, rvi_col] > 30:

Data[i, signal] = 1

return Data

Signals are straightforward. The indicator can be utilized with other methods.

my_data = signal(my_data, 6, 7)

Lumiwealth shows how to develop all kinds of algorithms. I recommend their hands-on courses in algorithmic trading, blockchain, and machine learning.

Summary

To conclude, my goal is to contribute to objective technical analysis, which promotes more transparent methods and strategies that must be back-tested before implementation. Technical analysis will lose its reputation as subjective and unscientific.

After you find a trading method or approach, follow these steps:

Put emotions aside and adopt an analytical perspective.

Test it in the past in conditions and simulations taken from real life.

Try improving it and performing a forward test if you notice any possibility.

Transaction charges and any slippage simulation should always be included in your tests.

Risk management and position sizing should always be included in your tests.

After checking the aforementioned, monitor the plan because market dynamics may change and render it unprofitable.

Pat Vieljeux

3 years ago

Your entrepreneurial experience can either be a beautiful adventure or a living hell with just one decision.

Choose.

DNA makes us distinct.

We act alike. Most people follow the same road, ignoring differences. We remain quiet about our uniqueness for fear of exclusion (family, social background, religion). We live a more or less imposed life.

Off the beaten path, we stand out from the others. We obey without realizing we're sewing a shroud. We're told to do as everyone else and spend 40 years dreaming of a golden retirement and regretting not living.

“One of the greatest regrets in life is being what others would want you to be, rather than being yourself.” - Shannon L. Alder

Others dare. Again, few are creative; most follow the example of those who establish a business for the sake of entrepreneurship. To live.

They pick a potential market and model their MVP on an existing solution. Most mimic others, alter a few things, appear to be original, and end up with bland products, adding to an already crowded market.

SaaS, PaaS, etc. followed suit. It's reduced pricing, profitability, and product lifespan.

As competitors become more aggressive, their profitability diminishes, making life horrible for them and their employees. They fail to innovate, cut costs, and close their company.

Few of them look happy and fulfilled.

How did they do it?

The answer is unsettlingly simple.

They are themselves.

They start their company, propelled at first by a passion or maybe a calling.

Then, at their own pace, they create it with the intention of resolving a dilemma.

They assess what others are doing and consider how they might improve it.

In contrast to them, they respond to it in their own way by adding a unique personal touch. Therefore, it is obvious.

Originals, like their DNA, can't be copied. Or if they are, they're poorly printed. Originals are unmatched. Artist-like. True collectors only buy Picasso paintings by the master, not forgeries, no matter how good.

Imaginative people are constantly ahead. Copycats fall behind unless they innovate. They watch their competition continuously. Their solution or product isn't sexy. They hope to cash in on their copied product by flooding the market.

They're mostly pirates. They're short-sighted, unlike creators.

Creators see further ahead and have no rivals. They use copiers to confirm a necessity. To maintain their individuality, creators avoid copying others. They find copying boring. It's boring. They oppose plagiarism.

It's thrilling and inspiring.

It will also make them more able to withstand their opponents' tension. Not to mention roadblocks. For creators, impediments are games.

Others fear it. They race against the clock and fear threats that could interrupt their momentum since they lack inventiveness and their product has a short life cycle.

Creators have time on their side. They're dedicated. Clearly. Passionate booksellers will have their own bookstore. Their passion shows in their book choices. Only the ones they love.

The copier wants to display as many as possible, including mediocre authors, and will cut costs. All this to dominate the market. They're digging their own grave.

The bookseller is just one example. I could give you tons of them.

Closing remarks

Entrepreneurs might follow others or be themselves. They risk exhaustion trying to predict what their followers will do.

It's true.

Life offers choices.

Being oneself or doing as others do, with the possibility of regretting not expressing our uniqueness and not having lived.

“Be yourself; everyone else is already taken”. Oscar Wilde

The choice is yours.