More on Productivity

Ethan Siegel

2 years ago

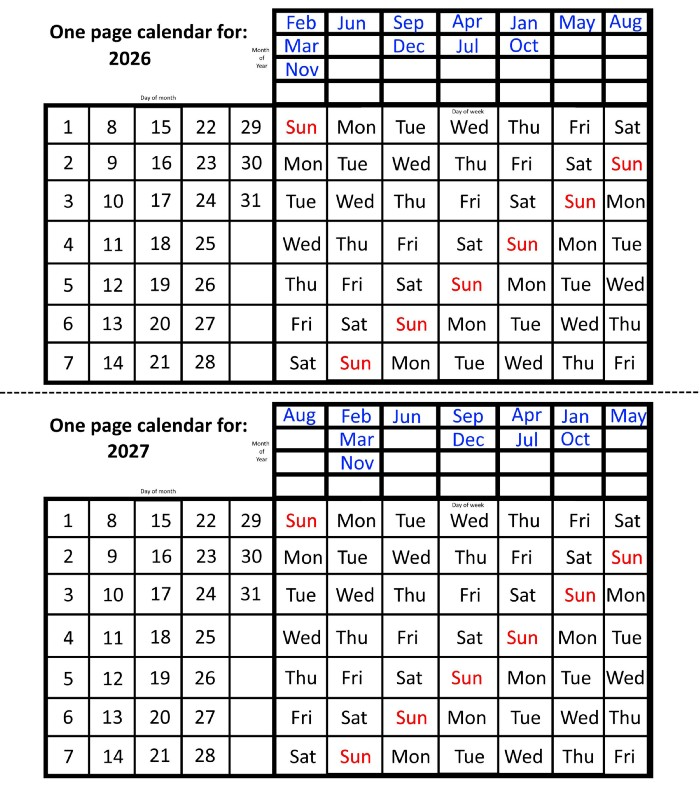

How you view the year will change after using this one-page calendar.

No other calendar is simpler, smaller, and reusable year after year. It works and is used here.

Most of us discard and replace our calendars annually. Each month, we move our calendar ahead another page, thus if we need to know which day of the week corresponds to a given day/month combination, we have to calculate it or flip forward/backward to the corresponding month. Questions like:

What day does this year's American Thanksgiving fall on?

Which months contain a Friday the thirteenth?

When is July 4th? What day of the week?

Alternatively, what day of the week is Christmas?

They're hard to figure out until you switch to the right month or look up all the months.

However, mathematically, the answers to these questions or any question that requires matching the day of the week with the day/month combination in a year are predictable, basic, and easy to work out. If you use this one-page calendar instead of a 12-month calendar, it lasts the whole year and is easy to alter for future years. Let me explain.

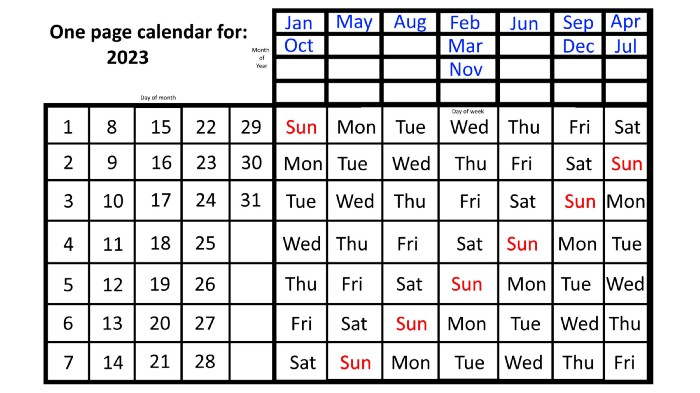

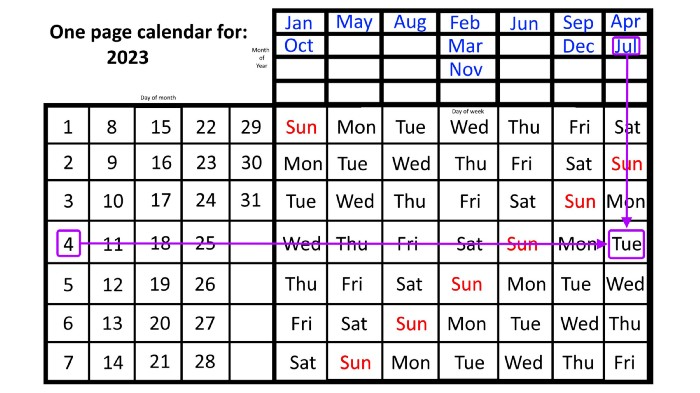

The 2023 one-page calendar is above. The days of the month are on the lower left, which works for all months if you know that:

There are 31 days in January, March, May, July, August, October, and December.

All of the months of April, June, September, and November have 30 days.

And depending on the year, February has either 28 days (in non-leap years) or 29 days (in leap years).

If you know this, this calendar makes it easy to match the day/month of the year to the weekday.

Here are some instances. American Thanksgiving is always on the fourth Thursday of November. You'll always know the month and day of the week, but the date—the day in November—changes each year.

On any other calendar, you'd have to flip to November to see when the fourth Thursday is. This one-page calendar only requires:

pick the month of November in the top-right corner to begin.

drag your finger down until Thursday appears,

then turn left and follow the monthly calendar until you reach the fourth Thursday.

It's obvious: 2023 is the 23rd American Thanksgiving. For every month and day-of-the-week combination, start at the month, drag your finger down to the desired day, and then move to the left to see which dates match.

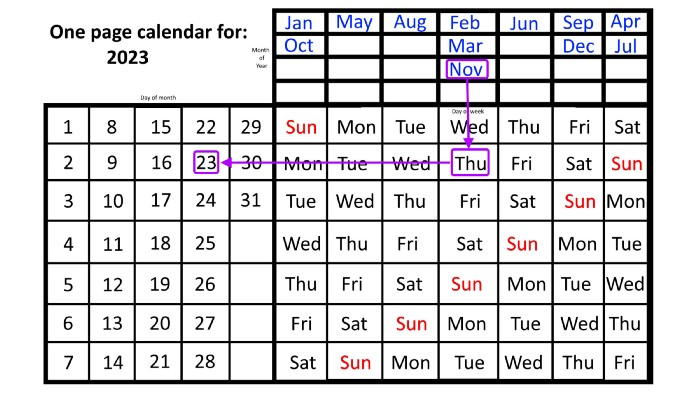

What if you knew the day of the week and the date of the month, but not the month(s)?

A different method using the same one-page calendar gives the answer. Which months have Friday the 13th this year? Just:

begin on the 13th of the month, the day you know you desire,

then swipe right with your finger till Friday appears.

and then work your way up until you can determine which months the specific Friday the 13th falls under.

One Friday the 13th occurred in January 2023, and another will occur in October.

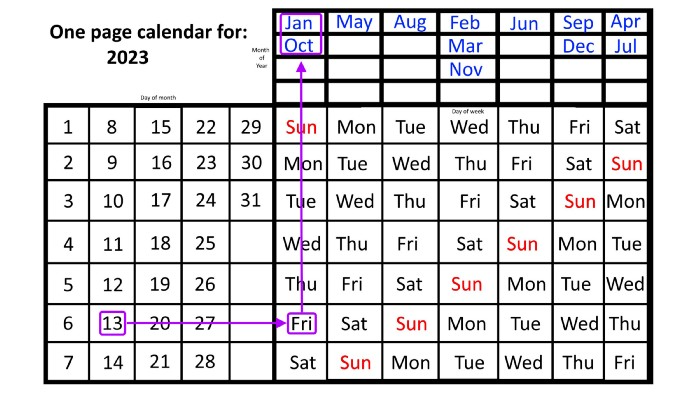

The most typical reason to consult a calendar is when you know the month/day combination but not the day of the week.

Compared to single-month calendars, the one-page calendar excels here. Take July 4th, for instance. Find the weekday here:

beginning on the left on the fourth of the month, as you are aware,

also begin with July, the month of the year you are most familiar with, at the upper right,

you should move your two fingers in the opposite directions till they meet: on a Tuesday in 2023.

That's how you find your selected day/month combination's weekday.

Another example: Christmas. Christmas Day is always December 25th, however unless your conventional calendar is open to December of your particular year, a question like "what day of the week is Christmas?" difficult to answer.

Unlike the one-page calendar!

Remember the left-hand day of the month. Top-right, you see the month. Put two fingers, one from each hand, on the date (25th) and the month (December). Slide the day hand to the right and the month hand downwards until they touch.

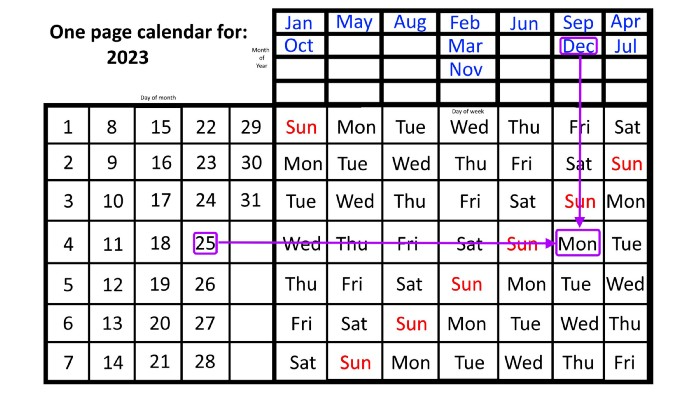

They meet on Monday—December 25, 2023.

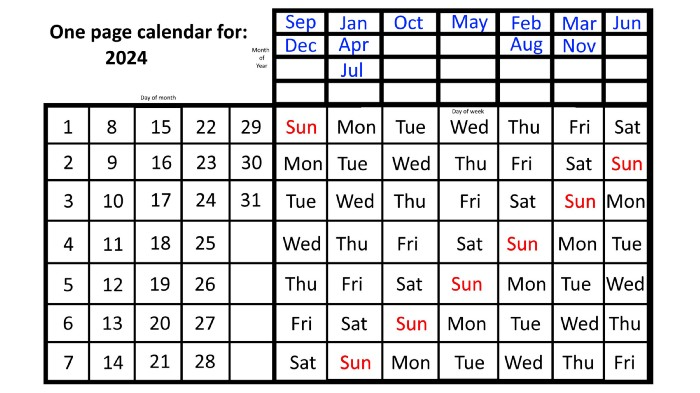

For 2023, that's fine, but what happens in 2024? Even worse, what if we want to know the day-of-the-week/day/month combo many years from now?

I think the one-page calendar shines here.

Except for the blue months in the upper-right corner of the one-page calendar, everything is the same year after year. The months also change in a consistent fashion.

Each non-leap year has 365 days—one more than a full 52 weeks (which is 364). Since January 1, 2023 began on a Sunday and 2023 has 365 days, we immediately know that December 31, 2023 will conclude on a Sunday (which you can confirm using the one-page calendar) and that January 1, 2024 will begin on a Monday. Then, reorder the months for 2024, taking in mind that February will have 29 days in a leap year.

Please note the differences between 2023 and 2024 month placement. In 2023:

October and January began on the same day of the week.

On the following Monday of the week, May began.

August started on the next day,

then the next weekday marked the start of February, March, and November, respectively.

Unlike June, which starts the following weekday,

While September and December start on the following day of the week,

Lastly, April and July start one extra day later.

Since 2024 is a leap year, February has 29 days, disrupting the rhythm. Month placements change to:

The first day of the week in January, April, and July is the same.

October will begin the following day.

Possibly starting the next weekday,

February and August start on the next weekday,

beginning on the following day of the week between March and November,

beginning the following weekday in June,

and commencing one more day of the week after that, September and December.

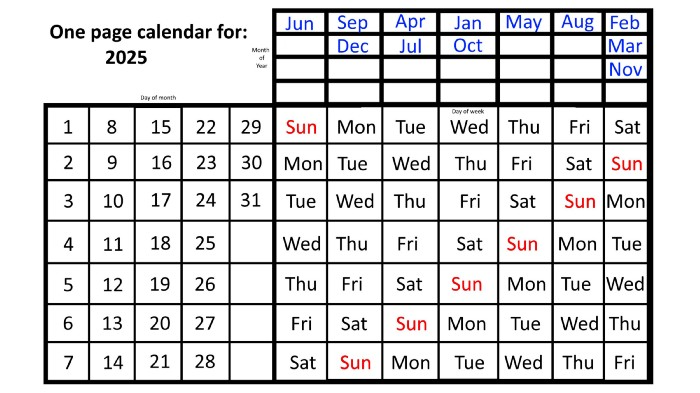

Due to the 366-day leap year, 2025 will start two days later than 2024 on January 1st.

Now, looking at the 2025 calendar, you can see that the 2023 pattern of which months start on which days is repeated! The sole variation is a shift of three days-of-the-week ahead because 2023 had one more day (365) than 52 full weeks (364), and 2024 had two more days (366). Again,

On Wednesday this time, January and October begin on the same day of the week.

Although May begins on Thursday,

August begins this Friday.

March, November, and February all begin on a Saturday.

Beginning on a Sunday in June

Beginning on Monday are September and December,

and on Tuesday, April and July begin.

In 2026 and 2027, the year will commence on a Thursday and a Friday, respectively.

We must return to our leap year monthly arrangement in 2028. Yes, January 1, 2028 begins on a Saturday, but February, which begins on a Tuesday three days before January, will have 29 days. Thus:

Start dates for January, April, and July are all Saturdays.

Given that October began on Sunday,

Although May starts on a Monday,

beginning on a Tuesday in February and August,

Beginning on a Wednesday in March and November,

Beginning on Thursday, June

and Friday marks the start of September and December.

This is great because there are only 14 calendar configurations: one for each of the seven non-leap years where January 1st begins on each of the seven days of the week, and one for each of the seven leap years where it begins on each day of the week.

The 2023 calendar will function in 2034, 2045, 2051, 2062, 2073, 2079, 2090, 2102, 2113, and 2119. Except when passing over a non-leap year that ends in 00, like 2100, the repeat time always extends to 12 years or shortens to an extra 6 years.

The pattern is repeated in 2025's calendar in 2031, 2042, 2053, 2059, 2070, 2081, 2087, 2098, 2110, and 2121.

The extra 6-year repeat at the end of the century on the calendar for 2026 will occur in the years 2037, 2043, 2054, 2065, 2071, 2082, 2093, 2099, 2105, and 2122.

The 2027s calendar repeats in 2038, 2049, 2055, 2066, 2077, 2083, 2094, 2100, 2106, and 2117, almost exactly matching the 2026s pattern.

For leap years, the recurrence pattern is every 28 years when not passing a non-leap year ending in 00, or 12 or 40 years when we do. 2024's calendar repeats in 2052, 2080, 2120, 2148, 2176, and 2216; 2028's in 2056, 2084, 2124, 2152, 2180, and 2220.

Knowing January 1st and whether it's a leap year lets you construct a one-page calendar for any year. Try it—you might find it easier than any other alternative!

Alex Mathers

3 years ago

8 guidelines to help you achieve your objectives 5x fast

If you waste time every day, even though you're ambitious, you're not alone.

Many of us could use some new time-management strategies, like these:

Focus on the following three.

You're thinking about everything at once.

You're overpowered.

It's mental. We just have what's in front of us. So savor the moment's beauty.

Prioritize 1-3 things.

To be one of the most productive people you and I know, follow these steps.

Get along with boredom.

Many of us grow bored, sweat, and turn on Netflix.

We shout, "I'm rarely bored!" Look at me! I'm happy.

Shut it, Sally.

You're not making wonderful things for the world. Boredom matters.

If you can sit with it for a second, you'll get insight. Boredom? Breathe.

Go blank.

Then watch your creativity grow.

Check your MacroVision once more.

We don't know what to do with our time, which contributes to time-wasting.

Nobody does, either. Jeff Bezos won't hand-deliver that crap to you.

Daily vision checks are required.

Also:

What are 5 things you'd love to create in the next 5 years?

You're soul-searching. It's food.

Return here regularly, and you'll adore the high you get from doing valuable work.

Improve your thinking.

What's Alex's latest nonsense?

I'm talking about overcoming our own thoughts. Worrying wastes so much time.

Too many of us are assaulted by lies, myths, and insecurity.

Stop letting your worries massage you into a worried coma like a Thai woman.

Optimizing your thoughts requires accepting what you can't control.

It means letting go of unhelpful thoughts and returning to the moment.

Keep your blood sugar level.

I gave up gluten, donuts, and sweets.

This has really boosted my energy.

Blood-sugar-spiking carbs make us irritable and tired.

These day-to-day ups and downs aren't productive. It's crucial.

Know how your diet affects insulin levels. Now I have more energy and can do more without clenching my teeth.

Reduce harmful carbs to boost energy.

Create a focused setting for yourself.

When we optimize the mind, we have more energy and use our time better because we're not tense.

Changing our environment can also help us focus. Disabling alerts is one example.

Too hot makes me procrastinate and irritable.

List five items that hinder your productivity.

You may be amazed at how much you may improve by removing distractions.

Be responsible.

Accountability is a time-saver.

Creating an emotional pull to finish things.

Writing down our goals makes us accountable.

We can engage a coach or work with an accountability partner to feel horrible if we don't show up and finish on time.

‘Hey Jake, I’m going to write 1000 words every day for 30 days — you need to make sure I do.’ ‘Sure thing, Nathan, I’ll be making sure you check in daily with me.’

Tick.

You might also blog about your ambitions to show your dedication.

Now you can't hide when you promised to appear.

Acquire a liking for bravery.

Boldness changes everything.

I sometimes feel lazy and wonder why. If my food and sleep are in order, I should assess my footing.

Most of us live backward. Doubtful. Uncertain. Feelings govern us.

Backfooting isn't living. It's lame, and you'll soon melt. Live boldly now.

Be assertive.

Get disgustingly into everything. Expand.

Even if it's hard, stop being a b*tch.

Those that make Mr. Bold Bear their spirit animal benefit. Save time to maximize your effect.

Darshak Rana

3 years ago

17 Google Secrets 99 Percent of People Don't Know

What can't Google do?

Seriously, nothing! Google rocks.

Google is a major player in online tools and services. We use it for everything, from research to entertainment.

Did I say entertain yourself?

Yes, with so many features and options, it can be difficult to fully utilize Google.

#1. Drive Google Mad

You can make Google's homepage dance if you want to be silly.

Just type “Google Gravity” into Google.com. Then select I'm lucky.

See the page unstick before your eyes!

#2 Play With Google Image

Google isn't just for work.

Then have fun with it!

You can play games right in your search results. When you need a break, google “Solitaire” or “Tic Tac Toe”.

#3. Do a Barrel Roll

Need a little more excitement in your life? Want to see Google dance?

Type “Do a barrel roll” into the Google search bar.

Then relax and watch your screen do a 360.

#4 No Internet? No issue!

This is a fun trick to use when you have no internet.

If your browser shows a “No Internet” page, simply press Space.

Boom!

We have dinosaurs! Now use arrow keys to save your pixelated T-Rex from extinction.

#5 Google Can Help

Play this Google coin flip game to see if you're lucky.

Enter “Flip a coin” into the search engine.

You'll see a coin flipping animation. If you get heads or tails, click it.

#6. Think with Google

My favorite Google find so far is the “Think with Google” website.

Think with Google is a website that offers marketing insights, research, and case studies.

I highly recommend it to entrepreneurs, small business owners, and anyone interested in online marketing.

#7. Google Can Read Images!

This is a cool Google trick that few know about.

You can search for images by keyword or upload your own by clicking the camera icon on Google Images.

Google will then show you all of its similar images.

Caution: You should be fine with your uploaded images being public.

#8. Modify the Google Logo!

Clicking on the “I'm Feeling Lucky” button on Google.com takes you to a random Google Doodle.

Each year, Google creates a Doodle to commemorate holidays, anniversaries, and other occasions.

#9. What is my IP?

Simply type “What is my IP” into Google to find out.

Your IP address will appear on the results page.

#10. Send a Self-Destructing Email With Gmail,

Create a new message in Gmail. Find an icon that resembles a lock and a clock near the SEND button. That's where the Confidential Mode is.

By clicking it, you can set an expiration date for your email. Expiring emails are automatically deleted from both your and the recipient's inbox.

#11. Blink, Google Blink!

This is a unique Google trick.

Type “blink HTML” into Google. The words “blink HTML” will appear and then disappear.

The text is displayed for a split second before being deleted.

To make this work, Google reads the HTML code and executes the “blink” command.

#12. The Answer To Everything

This is for all Douglas Adams fans.

The answer to life, the universe, and everything is 42, according to Google.

An allusion to Douglas Adams' Hitchhiker's Guide to the Galaxy, in which Ford Prefect seeks to understand life, the universe, and everything.

#13. Google in 1998

It's a blast!

Type “Google in 1998” into Google. "I'm feeling lucky"

You'll be taken to an old-school Google homepage.

It's a nostalgic trip for long-time Google users.

#14. Scholarships and Internships

Google can help you find college funding!

Type “scholarships” or “internships” into Google.

The number of results will surprise you.

#15. OK, Google. Dice!

To roll a die, simply type “Roll a die” into Google.

On the results page is a virtual dice that you can click to roll.

#16. Google has secret codes!

Hit the nine squares on the right side of your Google homepage to go to My Account. Then Personal Info.

You can add your favorite language to the “General preferences for the web” tab.

#17. Google Terminal

You can feel like a true hacker.

Just type “Google Terminal” into Google.com. "I'm feeling lucky"

Voila~!

You'll be taken to an old-school computer terminal-style page.

You can then type commands to see what happens.

Have you tried any of these activities? Tell me in the comments.

Read full article here

You might also like

DC Palter

3 years ago

Is Venture Capital a Good Fit for Your Startup?

5 VC investment criteria

I reviewed 200 startup business concepts last week. Brainache.

The enterprises sold various goods and services. The concepts were achingly similar: give us money, we'll produce a product, then get more to expand. No different from daily plans and pitches.

Most of those 200 plans sounded plausible. But 10% looked venture-worthy. 90% of startups need alternatives to venture finance.

With the success of VC-backed businesses and the growth of venture funds, a common misperception is that investors would fund any decent company idea. Finding investors that believe in the firm and founders is the key to funding.

Incorrect. Venture capital needs investing in certain enterprises. If your startup doesn't match the model, as most early-stage startups don't, you can revise your business plan or locate another source of capital.

Before spending six months pitching angels and VCs, make sure your startup fits these criteria.

Likely to generate $100 million in sales

First, I check the income predictions in a pitch deck. If it doesn't display $100M, don't bother.

The math doesn't work for venture financing in smaller businesses.

Say a fund invests $1 million in a startup valued at $5 million that is later acquired for $20 million. That's a win everyone should celebrate. Most VCs don't care.

Consider a $100M fund. The fund must reach $360M in 7 years with a 20% return. Only 20-30 investments are possible. 90% of the investments will fail, hence the 23 winners must return $100M-$200M apiece. $15M isn't worth the work.

Angel investors and tiny funds use the same ideas as venture funds, but their smaller scale affects the calculations. If a company can support its growth through exit on less than $2M in angel financing, it must have $25M in revenues before large companies will consider acquiring it.

Aiming for Hypergrowth

A startup's size isn't enough. It must expand fast.

Developing a great business takes time. Complex technology must be constructed and tested, a nationwide expansion must be built, or production procedures must go from lab to pilot to factories. These can be enormous, world-changing corporations, but venture investment is difficult.

The normal 10-year venture fund life. Investments are made during first 3–4 years.. 610 years pass between investment and fund dissolution. Funds need their investments to exit within 5 years, 7 at the most, therefore add a safety margin.

Longer exit times reduce ROI. A 2-fold return in a year is excellent. Loss at 2x in 7 years.

Lastly, VCs must prove success to raise their next capital. The 2nd fund is raised from 1st fund portfolio increases. Third fund is raised using 1st fund's cash return. Fund managers must raise new money quickly to keep their jobs.

Branding or technology that is protected

No big firm will buy a startup at a high price if they can produce a competing product for less. Their development teams, consumer base, and sales and marketing channels are large. Who needs you?

Patents, specialist knowledge, or brand name are the only answers. The acquirer buys this, not the thing.

I've heard of several promising startups. It's not a decent investment if there's no exit strategy.

A company that installs EV charging stations in apartments and shopping areas is an example. It's profitable, repeatable, and big. A terrific company. Not a startup.

This building company's operations aren't secret. No technology to protect, no special information competitors can't figure out, no go-to brand name. Despite the immense possibilities, a large construction company would be better off starting their own.

Most venture businesses build products, not services. Services can be profitable but hard to safeguard.

Probable purchase at high multiple

Once a software business proves its value, acquiring it is easy. Pharma and medtech firms have given up on their own research and instead acquire startups after regulatory permission. Many startups, especially in specialized areas, have this weakness.

That doesn't mean any lucrative $25M-plus business won't be acquired. In many businesses, the venture model requires a high exit premium.

A startup invents a new glue. 3M, BASF, Henkel, and others may buy them. Adding more adhesive to their catalogs won't boost commerce. They won't compete to buy the business. They'll only buy a startup at a profitable price. The acquisition price represents a moderate EBITDA multiple.

The company's $100M revenue presumably yields $10m in profits (assuming they’ve reached profitability at all). A $30M-$50M transaction is likely. Not terrible, but not what venture investors want after investing $25M to create a plant and develop the business.

Private equity buys profitable companies for a moderate profit multiple. It's a good exit for entrepreneurs, but not for investors seeking 10x or more what PE firms pay. If a startup offers private equity as an exit, the conversation is over.

Constructed for purchase

The startup wants a high-multiple exit. Unless the company targets $1B in revenue and does an IPO, exit means acquisition.

If they're constructing the business for acquisition or themselves, founders must decide.

If you want an indefinitely-running business, I applaud you. We need more long-term founders. Most successful organizations are founded around consumer demands, not venture capital's urge to grow fast and exit. Not venture funding.

if you don't match the venture model, what to do

VC funds moonshots. The 10% that succeed are extraordinary. Not every firm is a rocketship, and launching the wrong startup into space, even with money, will explode.

But just because your startup won't make $100M in 5 years doesn't mean it's a bad business. Most successful companies don't follow this model. It's not venture capital-friendly.

Although venture capital gets the most attention due to a few spectacular triumphs (and disasters), it's not the only or even most typical option to fund a firm.

Other ways to support your startup:

Personal and family resources, such as credit cards, second mortgages, and lines of credit

bootstrapping off of sales

government funding and honors

Private equity & project financing

collaborating with a big business

Including a business partner

Before pitching angels and VCs, be sure your startup qualifies. If so, include them in your pitch.

Joseph Mavericks

3 years ago

The world's 36th richest man uses a 5-step system to get what he wants.

Ray Dalio's super-effective roadmap

Ray Dalio's $22 billion net worth ranks him 36th globally. From 1975 to 2011, he built the world's most successful hedge fund, never losing more than 4% from 1991 to 2020. (and only doing so during 3 calendar years).

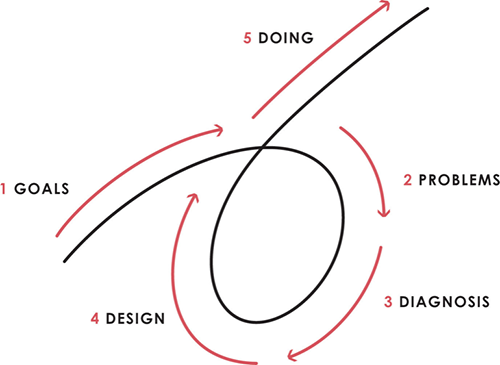

Dalio describes a 5-step process in his best-selling book Principles. It's the playbook he's used to build his hedge fund, beat the markets, and face personal challenges.

This 5-step system is so valuable and well-explained that I didn't edit or change anything; I only added my own insights in the parts I found most relevant and/or relatable as a young entrepreneur. The system's overview:

Have clear goals

Identify and don’t tolerate problems

Diagnose problems to get at their root causes

Design plans that will get you around those problems

Do what is necessary to push through the plans to get results

If you follow these 5 steps in a virtuous loop, you'll almost always see results. Repeat the process for each goal you have.

1. Have clear goals

a) Prioritize: You can have almost anything, but not everything.

I started and never launched dozens of projects for 10 years because I was scattered. I opened a t-shirt store, traded algorithms, sold art on Instagram, painted skateboards, and tinkered with electronics. I decided to try blogging for 6 months to see where it took me. Still going after 3 years.

b) Don’t confuse goals with desires.

A goal inspires you to act. Unreasonable desires prevent you from achieving your goals.

c) Reconcile your goals and desires to decide what you want.

d) Don't confuse success with its trappings.

e) Never dismiss a goal as unattainable.

Always one path is best. Your perception of what's possible depends on what you know now. I never thought I'd make money writing online so quickly, and now I see a whole new horizon of business opportunities I didn't know about before.

f) Expectations create abilities.

Don't limit your abilities. More you strive, the more you'll achieve.

g) Flexibility and self-accountability can almost guarantee success.

Flexible people accept what reality or others teach them. Self-accountability is the ability to recognize your mistakes and be more creative, flexible, and determined.

h) Handling setbacks well is as important as moving forward.

Learn when to minimize losses and when to let go and move on.

2. Don't ignore problems

a) See painful problems as improvement opportunities.

Every problem, painful situation, and challenge is an opportunity. Read The Art of Happiness for more.

b) Don't avoid problems because of harsh realities.

Recognizing your weaknesses isn't the same as giving in. It's the first step in overcoming them.

c) Specify your issues.

There is no "one-size-fits-all" solution.

d) Don’t mistake a cause of a problem with the real problem.

"I can't sleep" is a cause, not a problem. "I'm underperforming" could be a problem.

e) Separate big from small problems.

You have limited time and energy, so focus on the biggest problems.

f) Don't ignore a problem.

Identifying a problem and tolerating it is like not identifying it.

3. Identify problems' root causes

a) Decide "what to do" after assessing "what is."

"A good diagnosis takes 15 to 60 minutes, depending on its accuracy and complexity. [...] Like principles, root causes recur in different situations.

b) Separate proximate and root causes.

"You can only solve problems by removing their root causes, and to do that, you must distinguish symptoms from disease."

c) Knowing someone's (or your own) personality can help you predict their behavior.

4. Design plans that will get you around the problems

a) Retrace your steps.

Analyze your past to determine your future.

b) Consider your problem a machine's output.

Consider how to improve your machine. It's a game then.

c) There are many ways to reach your goals.

Find a solution.

d) Visualize who will do what in your plan like a movie script.

Consider your movie's actors and script's turning points, then act accordingly. The game continues.

e) Document your plan so others can judge your progress.

Accountability boosts success.

f) Know that a good plan doesn't take much time.

The execution is usually the hardest part, but most people either don't have a plan or keep changing it. Don't drive while building the car. Build it first, because it'll be bumpy.

5. Do what is necessary to push through the plans to get results

a) Great planners without execution fail.

Life is won with more than just planning. Similarly, practice without talent beats talent without practice.

b) Work ethic is undervalued.

Hyper-productivity is praised in corporate America, even if it leads nowhere. To get things done, use checklists, fewer emails, and more desk time.

c) Set clear metrics to ensure plan adherence.

I've written about the OKR strategy for organizations with multiple people here. If you're on your own, I recommend the Wheel of Life approach. Both systems start with goals and tasks to achieve them. Then start executing on a realistic timeline.

If you find solutions, weaknesses don't matter.

Everyone's weak. You, me, Gates, Dalio, even Musk. Nobody will be great at all 5 steps of the system because no one can think in all the ways required. Some are good at analyzing and diagnosing but bad at executing. Some are good planners but poor communicators. Others lack self-discipline.

Stay humble and ask for help when needed. Nobody has ever succeeded 100% on their own, without anyone else's help. That's the paradox of individual success: teamwork is the only way to get there.

Most people won't have the skills to execute even the best plan. You can get missing skills in two ways:

Self-taught (time-consuming)

Others' (requires humility) light

On knowing what to do with your life

“Some people have good mental maps and know what to do on their own. Maybe they learned them or were blessed with common sense. They have more answers than others. Others are more humble and open-minded. […] Open-mindedness and mental maps are most powerful.” — Ray Dalio

I've always known what I wanted to do, so I'm lucky. I'm almost 30 and have always had trouble executing. Good thing I never stopped experimenting, but I never committed to anything long-term. I jumped between projects. I decided 3 years ago to stick to one project for at least 6 months and haven't looked back.

Maybe you're good at staying focused and executing, but you don't know what to do. Maybe you have none of these because you haven't found your purpose. Always try new projects and talk to as many people as possible. It will give you inspiration and ideas and set you up for success.

There is almost always a way to achieve a crazy goal or idea.

Enjoy the journey, whichever path you take.

ANTHONY P.

3 years ago

Startups are difficult. Streamlining the procedure for creating the following unicorn.

New ventures are exciting. It's fun to imagine yourself rich, successful, and famous (if that's your thing). How you'll help others and make your family proud. This excitement can pull you forward for years, even when you intuitively realize that the path you're on may not lead to your desired success.

Know when to change course. Switching course can mean pivoting or changing direction.

In this not-so-short blog, I'll describe the journey of building your dream. And how the journey might look when you think you're building your dream, but fall short of that vision. Both can feel similar in the beginning, but there are subtle differences.

Let’s dive in.

How an exciting journey to a dead end looks and feels.

You want to help many people. You're business-minded, creative, and ambitious. You jump into entrepreneurship. You're excited, free, and in control.

I'll use tech as an example because that's what I know best, but this applies to any entrepreneurial endeavor.

So you start learning the basics of your field, say coding/software development. You read books, take courses, and may even join a bootcamp. You start practicing, and the journey begins. Once you reach a certain level of skill (which can take months, usually 12-24), you gain the confidence to speak with others in the field and find common ground. You might attract a co-founder this way with time. You and this person embark on a journey (Tip: the idea you start with is rarely the idea you end with).

Amateur mistake #1: You spend months building a product before speaking to customers.

Building something pulls you forward blindly. You make mistakes, avoid customers, and build with your co-founder or small team in the dark for months, usually 6-12 months.

You're excited when the product launches. We'll be billionaires! The market won't believe it. This excites you and the team. Launch.

….

Nothing happens.

Some people may sign up out of pity, only to never use the product or service again.

You and the team are confused, discouraged and in denial. They don't get what we've built yet. We need to market it better, we need to talk to more investors, someone will understand our vision.

This is a hopeless path, and your denial could last another 6 months. If you're lucky, while talking to consumers and investors (which you should have done from the start), someone who has been there before would pity you and give you an idea to pivot into that can create income.

Suppose you get this idea and pivot your business. Again, you've just pivoted into something limited by what you've already built. It may be a revenue-generating idea, but it's rarely new. Now you're playing catch-up, doing something others are doing but you can do better. (Tip #2: Don't be late.) Your chances of winning are slim, and you'll likely never catch up.

You're finally seeing revenue and feel successful. You can compete, but if you're not a first mover, you won't earn enough over time. You'll get by or work harder than ever to earn what a skilled trade could provide. You didn't go into business to stress out and make $100,000 or $200,000 a year. When you can make the same amount by becoming a great software developer, electrician, etc.

You become stuck. Either your firm continues this way for years until you realize there isn't enough growth to recruit a strong team and remove yourself from day-to-day operations due to competition. Or a catastrophic economic event forces you to admit that what you were building wasn't new and unique and wouldn't get you where you wanted to be.

This realization could take 6-10 years. No kidding.

The good news is, you’ve learned a lot along the way and this information can be used towards your next venture (if you have the energy).

Key Lesson: Don’t build something if you aren’t one of the first in the space building it just for the sake of building something.

-

Let's discuss what it's like to build something that can make your dream come true.

Case 2: Building something the market loves is difficult but rewarding.

It starts with a problem that hasn't been adequately solved for a long time but is now solvable due to technology. Or a new problem due to a change in how things are done.

Let's examine each example.

Example #1: Mass communication. The problem is now solvable due to some technological breakthrough.

Twitter — One of the first web 2 companies that became successful with the rise of smart mobile computing.

People can share their real-time activities via mobile device with friends, family, and strangers. Web 2 and smartphones made it easy and fun.

Example #2: A new problem has emerged due to some change in the way things are conducted.

Zoom- A web-conferencing company that reached massive success due to the movement towards “work from home”, remote/hybrid work forces.

Online web conferencing allows for face-to-face communication.

-

These two examples show how to build a unicorn-type company. It's a mix of solving the right problem at the right time, either through a technological breakthrough that opens up new opportunities or by fundamentally changing how people do things.

Let's find these opportunities.

Start by examining problems, such as how the world has changed and how we can help it adapt. It can also be both. Start team brainstorming. Research technologies, current world-trends, use common sense, and make a list. Then, choose the top 3 that you're most excited about and seem most workable based on your skillsets, values, and passion.

Once you have this list, create the simplest MVP you can and test it with customers. The prototype can be as simple as a picture or diagram of user flow and end-user value. No coding required. Market-test. Twitter's version 1 was simple. It was a web form that asked, "What are you doing?" Then publish it from your phone. A global status update, wherever you are. Currently, this company has a $50 billion market cap.

Here's their MVP screenshot.

Small things grow. Tiny. Simplify.

Remember Frequency and Value when brainstorming. Your product is high frequency (Twitter, Instagram, Snapchat, TikTok) or high value (Airbnb for renting travel accommodations), or both (Gmail).

Once you've identified product ideas that meet the above criteria, they're simple, have a high frequency of use, or provide deep value. You then bring it to market in the simplest, most cost-effective way. You can sell a half-working prototype with imagination and sales skills. You need just enough of a prototype to convey your vision to a user or customer.

With this, you can approach real people. This will do one of three things: give you a green light to continue on your vision as is, show you that there is no opportunity and people won't use it, or point you in a direction that is a blend of what you've come up with and what the customer / user really wants, and you update the prototype and go back to the maze. Repeat until you have enough yeses and conviction to build an MVP.