More on Personal Growth

Neeramitra Reddy

3 years ago

The best life advice I've ever heard could very well come from 50 Cent.

He built a $40M hip-hop empire from street drug dealing.

50 Cent was nearly killed by 9mm bullets.

Before 50 Cent, Curtis Jackson sold drugs.

He sold coke to worried addicts after being orphaned at 8.

Pursuing police. Murderous hustlers and gangs. Unwitting informers.

Despite his hard life, his hip-hop career was a success.

An assassination attempt ended his career at the start.

What sane producer would want to deal with a man entrenched in crime?

Most would have drowned in self-pity and drank themselves to death.

But 50 Cent isn't most people. Life on the streets had given him fearlessness.

“Having a brush with death, or being reminded in a dramatic way of the shortness of our lives, can have a positive, therapeutic effect. So it is best to make every moment count, to have a sense of urgency about life.” ― 50 Cent, The 50th Law

50 released a series of mixtapes that caught Eminem's attention and earned him a $50 million deal!

50 Cents turned death into life.

Things happen; that is life.

We want problems solved.

Every human has problems, whether it's Jeff Bezos swimming in his billions, Obama in his comfortable retirement home, or Dan Bilzerian with his hired bikini models.

All problems.

Problems churn through life. solve one, another appears.

It's harsh. Life's unfair. We can face reality or run from it.

The latter will worsen your issues.

“The firmer your grasp on reality, the more power you will have to alter it for your purposes.” — 50 Cent, The 50th Law

In a fantasy-obsessed world, 50 Cent loves reality.

Wish for better problem-solving skills rather than problem-free living.

Don't wish, work.

We All Have the True Power of Alchemy

Humans are arrogant enough to think the universe cares about them.

That things happen as if the universe notices our nanosecond existences.

Things simply happen. Period.

By changing our perspective, we can turn good things bad.

The alchemists' search for the philosopher's stone may have symbolized the ability to turn our lead-like perceptions into gold.

Negativity bias tints our perceptions.

Normal sparring broke your elbow? Rest and rethink your training. Fired? You can improve your skills and get a better job.

Consider Curtis if he had fallen into despair.

The legend we call 50 Cent wouldn’t have existed.

The Best Lesson in Life Ever?

Neither avoid nor fear your reality.

That simple sentence contains every self-help tip and life lesson on Earth.

When reality is all there is, why fear it? avoidance?

Or worse, fleeing?

To accept reality, we must eliminate the words should be, could be, wish it were, and hope it will be.

It is. Period.

Only by accepting reality's chaos can you shape your life.

“Behind me is infinite power. Before me is endless possibility, around me is boundless opportunity. My strength is mental, physical and spiritual.” — 50 Cent

Glorin Santhosh

3 years ago

Start organizing your ideas by using The Second Brain.

Building A Second Brain helps us remember connections, ideas, inspirations, and insights. Using contemporary technologies and networks increases our intelligence.

This approach makes and preserves concepts. It's a straightforward, practical way to construct a second brain—a remote, centralized digital store for your knowledge and its sources.

How to build ‘The Second Brain’

Have you forgotten any brilliant ideas? What insights have you ignored?

We're pressured to read, listen, and watch informative content. Where did the data go? What happened?

Our brains can store few thoughts at once. Our brains aren't idea banks.

Building a Second Brain helps us remember thoughts, connections, and insights. Using digital technologies and networks expands our minds.

Ten Rules for Creating a Second Brain

1. Creative Stealing

Instead of starting from scratch, integrate other people's ideas with your own.

This way, you won't waste hours starting from scratch and can focus on achieving your goals.

Users of Notion can utilize and customize each other's templates.

2. The Habit of Capture

We must record every idea, concept, or piece of information that catches our attention since our minds are fragile.

When reading a book, listening to a podcast, or engaging in any other topic-related activity, save and use anything that resonates with you.

3. Recycle Your Ideas

Reusing our own ideas across projects might be advantageous since it helps us tie new information to what we already know and avoids us from starting a project with no ideas.

4. Projects Outside of Category

Instead of saving an idea in a folder, group it with documents for a project or activity.

If you want to be more productive, gather suggestions.

5. Burns Slowly

Even if you could finish a job, work, or activity if you focused on it, you shouldn't.

You'll get tired and can't advance many projects. It's easier to divide your routine into daily tasks.

Few hours of daily study is more productive and healthier than entire nights.

6. Begin with a surplus

Instead of starting with a blank sheet when tackling a new subject, utilise previous articles and research.

You may have read or saved related material.

7. Intermediate Packets

A bunch of essay facts.

You can utilize it as a document's section or paragraph for different tasks.

Memorize useful information so you can use it later.

8. You only know what you make

We can see, hear, and read about anything.

What matters is what we do with the information, whether that's summarizing it or writing about it.

9. Make it simpler for yourself in the future.

Create documents or files that your future self can easily understand. Use your own words, mind maps, or explanations.

10. Keep your thoughts flowing.

If you don't employ the knowledge in your second brain, it's useless.

Few people exercise despite knowing its benefits.

Conclusion:

You may continually move your activities and goals closer to completion by organizing and applying your information in a way that is results-focused.

Profit from the information economy's explosive growth by turning your specialized knowledge into cash.

Make up original patterns and linkages between topics.

You may reduce stress and information overload by appropriately curating and managing your personal information stream.

Learn how to apply your significant experience and specific knowledge to a new job, business, or profession.

Without having to adhere to tight, time-consuming constraints, accumulate a body of relevant knowledge and concepts over time.

Take advantage of all the learning materials that are at your disposal, including podcasts, online courses, webinars, books, and articles.

James White

3 years ago

Three Books That Can Change Your Life in a Day

I've summarized each.

Anne Lamott said books are important. Books help us understand ourselves and our behavior. They teach us about community, friendship, and death.

I read. One of my few life-changing habits. 100+ books a year improve my life. I'll list life-changing books you can read in a day. I hope you like them too.

Let's get started!

1) Seneca's Letters from a Stoic

One of my favorite philosophy books. Ryan Holiday, Naval Ravikant, and other prolific readers recommend it.

Seneca wrote 124 letters at the end of his life after working for Nero. Death, friendship, and virtue are discussed.

It's worth rereading. When I'm in trouble, I consult Seneca.

It's brief. The book could be read in one day. However, use it for guidance during difficult times.

My favorite book quotes:

Many men find that becoming wealthy only alters their problems rather than solving them.

You will never be poor if you live in harmony with nature; you will never be wealthy if you live according to what other people think.

We suffer more frequently in our imagination than in reality; there are more things that are likely to frighten us than to crush us.

2) Steven Pressfield's book The War of Art

I’ve read this book twice. I'll likely reread it before 2022 is over.

The War Of Art is the best productivity book. Steven offers procrastination-fighting tips.

Writers, musicians, and creative types will love The War of Art. Workplace procrastinators should also read this book.

My favorite book quotes:

The act of creation is what matters most in art. Other than sitting down and making an effort every day, nothing else matters.

Working creatively is not a selfish endeavor or an attempt by the actor to gain attention. It serves as a gift for all living things in the world. Don't steal your contribution from us. Give us everything you have.

Fear is healthy. Fear is a signal, just like self-doubt. Fear instructs us on what to do. The more terrified we are of a task or calling, the more certain we can be that we must complete it.

3) Darren Hardy's The Compound Effect

The Compound Effect offers practical tips to boost productivity by 10x.

The author believes each choice shapes your future. Pizza may seem harmless. However, daily use increases heart disease risk.

Positive outcomes too. Daily gym visits improve fitness. Reading an hour each night can help you learn. Writing 1,000 words per day would allow you to write a novel in under a year.

Your daily choices affect compound interest and your future. Thus, better habits can improve your life.

My favorite book quotes:

Until you alter a daily habit, you cannot change your life. The key to your success can be found in the actions you take each day.

The hundreds, thousands, or millions of little things are what distinguish the ordinary from the extraordinary; it is not the big things that add up in the end.

Don't worry about willpower. Time to use why-power. Only when you relate your decisions to your aspirations and dreams will they have any real meaning. The decisions that are in line with what you define as your purpose, your core self, and your highest values are the wisest and most inspiring ones. To avoid giving up too easily, you must want something and understand why you want it.

You might also like

Sammy Abdullah

3 years ago

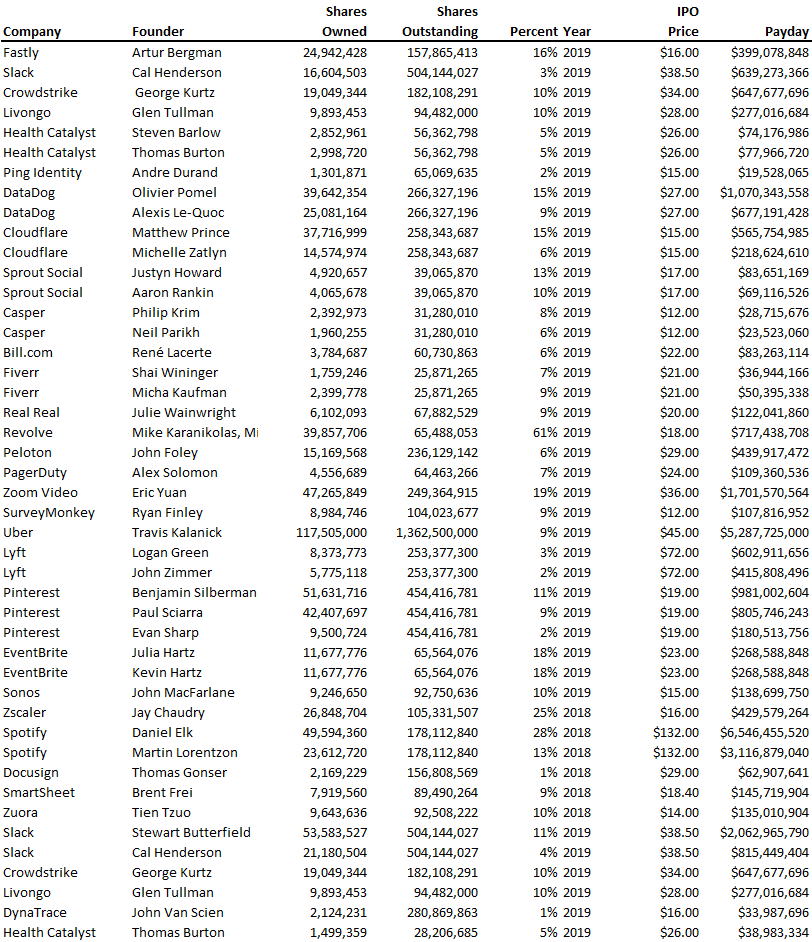

Payouts to founders at IPO

How much do startup founders make after an IPO? We looked at 2018's major tech IPOs. Paydays aren't what founders took home at the IPO (shares are normally locked up for 6 months), but what they were worth at the IPO price on the day the firm went public. It's not cash, but it's nice. Here's the data.

Several points are noteworthy.

Huge payoffs. Median and average pay were $399m and $918m. Average and median homeownership were 9% and 12%.

Coinbase, Uber, UI Path. Uber, Zoom, Spotify, UI Path, and Coinbase founders raised billions. Zoom's founder owned 19% and Spotify's 28% and 13%. Brian Armstrong controlled 20% of Coinbase at IPO and was worth $15bn. Preserving as much equity as possible by staying cash-efficient or raising at high valuations also helps.

The smallest was Ping. Ping's compensation was the smallest. Andre Duand owned 2% but was worth $20m at IPO. That's less than some billion-dollar paydays, but still good.

IPOs can be lucrative, as you can see. Preserving equity could be the difference between a $20mm and $15bln payday (Coinbase).

Sukhad Anand

3 years ago

How Do Discord's Trillions Of Messages Get Indexed?

They depend heavily on open source..

Discord users send billions of messages daily. Users wish to search these messages. How do we index these to search by message keywords?

Let’s find out.

Discord utilizes Elasticsearch. Elasticsearch is a free, open search engine for textual, numerical, geographical, structured, and unstructured data. Apache Lucene powers Elasticsearch.

How does elastic search store data? It stores it as numerous key-value pairs in JSON documents.

How does elastic search index? Elastic search's index is inverted. An inverted index lists every unique word in every page and where it appears.

4. Elasticsearch indexes documents and generates an inverted index to make data searchable in near real-time. The index API adds or updates JSON documents in a given index.

Let's examine how discord uses Elastic Search. Elasticsearch prefers bulk indexing. Discord couldn't index real-time messages. You can't search posted messages. You want outdated messages.

6. Let's check what bulk indexing requires.

1. A temporary queue for incoming communications.

2. Indexer workers that index messages into elastic search.

Discord's queue is Celery. The queue is open-source. Elastic search won't run on a single server. It's clustered. Where should a message go? Where?

8. A shard allocator decides where to put the message. Nevertheless. Shattered? A shard combines elastic search and index on. So, these two form a shard which is used as a unit by discord. The elastic search itself has some shards. But this is different, so don’t get confused.

Now, the final part is service discovery — to discover the elastic search clusters and the hosts within that cluster. This, they do with the help of etcd another open source tool.

A great thing to notice here is that discord relies heavily on open source systems and their base implementations which is very different from a lot of other products.

Jano le Roux

3 years ago

Quit worrying about Twitter: Elon moves quickly before refining

Elon's rides start rough, but then...

Elon Musk has never been so hated.

They don’t get Elon.

He began using PayPal in this manner.

He began with SpaceX in a similar manner.

He began with Tesla in this manner.

Disruptive.

Elon had rocky starts. His creativity requires it. Just like writing a first draft.

His fastest way to find the way is to avoid it.

PayPal's pricey launch

PayPal was a 1999 business flop.

They were considered insane.

Elon and his co-founders had big plans for PayPal. They adopted the popular philosophy of the time, exchanging short-term profit for growth, and pulled off a miracle just before the bubble burst.

PayPal was created as a dollar alternative. Original PayPal software allowed PalmPilot money transfers. Unfortunately, there weren't enough PalmPilot users.

Since everyone had email, the company emailed payments. Costs rose faster than sales.

The startup wanted to get a million subscribers by paying $10 to sign up and $10 for each referral. Elon thought the price was fair because PayPal made money by charging transaction fees. They needed to make money quickly.

A Wall Street Journal article valuing PayPal at $500 million attracted investors. The dot-com bubble burst soon after they rushed to get financing.

Musk and his partners sold PayPal to eBay for $1.5 billion in 2002. Musk's most successful company was PayPal.

SpaceX's start-up error

Elon and his friends bought a reconditioned ICBM in Russia in 2002.

He planned to invest much of his wealth in a stunt to promote NASA and space travel.

Many called Elon crazy.

The goal was to buy a cheap Russian rocket to launch mice or plants to Mars and return them. He thought SpaceX would revive global space interest. After a bad meeting in Moscow, Elon decided to build his own rockets to undercut launch contracts.

Then SpaceX was founded.

Elon’s plan was harder than expected.

Explosions followed explosions.

Millions lost on cargo.

Millions lost on the rockets.

Investors thought Elon was crazy, but he wasn't.

NASA's biggest competitor became SpaceX. NASA hired SpaceX to handle many of its missions.

Tesla's shaky beginning

Tesla began shakily.

Clients detested their roadster.

They continued to miss deadlines.

Lotus would handle the car while Tesla focused on the EV component, easing Tesla's entry. The business experienced elegance creep. Modifying specific parts kept the car from getting worse.

Cost overruns, delays, and other factors changed the Elise-like car's appearance. Only 7% of the Tesla Roadster's parts matched its Lotus twin.

Tesla was about to die.

Elon saved the mess as CEO.

He fired 25% of the workforce to reduce costs.

Elon Musk transformed Tesla into the world's most valuable automaker by running it like a startup.

Tesla hasn't spent a dime on advertising. They let the media do the talking by investing in innovation.

Elon sheds. Elon tries. Elon learns. Elon refines.

Twitter doesn't worry me.

The media is shocked. I’m not.

This is just Elon being Elon.

Elon makes lean.

Elon tries new things.

Elon listens to feedback.

Elon refines.

Besides Twitter will always be Twitter.