More on Society & Culture

Logan Rane

2 years ago

I questioned Chat-GPT for advice on the top nonfiction books. Here's What It Suggests

You have to use it.

Chat-GPT is a revolution.

All social media outlets are discussing it. How it will impact the future and different things.

True.

I've been using Chat-GPT for a few days, and it's a rare revolution. It's amazing and will only improve.

I asked Chat-GPT about the best non-fiction books. It advised this, albeit results rely on interests.

The Immortal Life of Henrietta Lacks

by Rebecca Skloot

Science, Biography

A impoverished tobacco farmer dies of cervical cancer in The Immortal Life of Henrietta Lacks. Her cell strand helped scientists treat polio and other ailments.

Rebecca Skloot discovers about Henrietta, her family, how the medical business exploited black Americans, and how her cells can live forever in a fascinating and surprising research.

You ought to read it.

if you want to discover more about the past of medicine.

if you want to discover more about American history.

Bad Blood: Secrets and Lies in a Silicon Valley Startup

by John Carreyrou

Tech, Bio

Bad Blood tells the terrifying story of how a Silicon Valley tech startup's blood-testing device placed millions of lives at risk.

John Carreyrou, a Pulitzer Prize-winning journalist, wrote this book.

Theranos and its wunderkind CEO, Elizabeth Holmes, climbed to popularity swiftly and then plummeted.

You ought to read it.

if you are a start-up employee.

specialists in medicine.

The Power of Now: A Guide to Spiritual Enlightenment

by Eckhart Tolle

Self-improvement, Spirituality

The Power of Now shows how to stop suffering and attain inner peace by focusing on the now and ignoring your mind.

The book also helps you get rid of your ego, which tries to control your ideas and actions.

If you do this, you may embrace the present, reduce discomfort, strengthen relationships, and live a better life.

You ought to read it.

if you're looking for serenity and illumination.

If you believe that you are ruining your life, stop.

if you're not happy.

The 7 Habits of Highly Effective People

by Stephen R. Covey

Profession, Success

The 7 Habits of Highly Effective People is an iconic self-help book.

This vital book offers practical guidance for personal and professional success.

This non-fiction book is one of the most popular ever.

You ought to read it.

if you want to reach your full potential.

if you want to discover how to achieve all your objectives.

if you are just beginning your journey toward personal improvement.

Sapiens: A Brief History of Humankind

by Yuval Noah Harari

Science, History

Sapiens explains how our species has evolved from our earliest ancestors to the technology age.

How did we, a species of hairless apes without tails, come to control the whole planet?

It describes the shifts that propelled Homo sapiens to the top.

You ought to read it.

if you're interested in discovering our species' past.

if you want to discover more about the origins of human society and culture.

Michelle Teheux

3 years ago

Get Real, All You Grateful Laid-Off LinkedIn Users

WTF is wrong with you people?

When I was laid off as editor of my town's daily newspaper, I went silent on social media. I knew it was coming and had been quietly removing personal items each day, but the pain was intense.

I posted a day later. I didn't bad-mouth GateHouse Media but expressed my sadness at leaving the newspaper industry, pride in my accomplishments, and hope for success in another industry.

Normal job-loss response.

What do you recognize as abnormal?

The bullshit I’ve been reading from laid-off folks on LinkedIn.

If you're there, you know. Many Twitter or Facebook/Meta employees recently lost their jobs.

Well, many of them did not “lose their job,” actually. They were “impacted by the layoffs” at their former employer. I keep seeing that phrase.

Why don’t they want to actually say it? Why the euphemism?

Many are excited about the opportunities ahead. The jobless deny being sad.

They're ecstatic! They have big plans.

Hope so. Sincerely! Being laid off stinks, especially if, like me, your skills are obsolete. It's worse if, like me, you're too old to start a new career. Ageism exists despite denials.

Nowadays, professionalism seems to demand psychotic levels of fake optimism.

Why? Life is unpredictable. That's indisputable. You shouldn't constantly complain or cry in public, but you also shouldn't pretend everything's great.

It makes you look psychotic, not positive. It's like saying at work:

“I was impacted by the death of my spouse of 20 years this week, and many of you have reached out to me, expressing your sympathy. However, I’m choosing to remember the amazing things we shared. I feel confident that there is another marriage out there for me, and after taking a quiet weekend trip to reset myself, I’ll be out there looking for the next great marital adventure! #staypositive #available #opentolove

Also:

“Now looking for our next #dreamhome after our entire neighborhood was demolished by a wildfire last night. We feel so lucky to have lived near so many amazing and inspirational neighbors, all of whom we will miss as we go on our next housing adventure. The best house for us is yet to come! If you have a great neighborhood you’d recommend, please feel free to reach out and touch base with us! #newhouse #newneighborhood #newlife

Admit it. That’s creepy.

The constant optimism makes me feel sick to my stomach.

Viscerally.

I hate fakes.

Imagine a fake wood grain desk. Wouldn't it be better if the designer accepted that it's plastic and went with that?

Real is better but not always nice. When something isn't nice, you don't have to go into detail, but you also shouldn't pretend it's great.

How to announce your job loss to the world.

Do not pretend to be happy, but don't cry and drink vodka all afternoon.

Say you loved your job, and that you're looking for new opportunities.

Yes, if you'll miss your coworkers. Otherwise, don't badmouth. No bridge-burning!

Please specify the job you want. You may want to pivot.

Alternatively, try this.

You could always flame out.

If you've pushed yourself too far into toxic positivity, you may be ready to burn it all down. If so, make it worthwhile by writing something like this:

Well, I was shitcanned by the losers at #Acme today. That bitch Linda in HR threw me under the bus just because she saw that one of my “friends” tagged me in some beach pics on social media after I called in sick with Covid. The good thing is I will no longer have to watch my ass around that #asspincher Ron in accounting, but I’m sad that I will no longer have a cushy job with high pay or access to the primo office supplies I’ve been sneaking home for the last five years. (Those gel pens were the best!) I am going to be taking some time off to enjoy my unemployment and hammer down shots of Jägermeister but in about five months I’ll be looking for anything easy with high pay and great benefits. Reach out if you can help! #officesupplies #unemploymentrocks #drinkinglikeagirlboss #acmesucks

It beats the fake positivity.

Josef Cruz

3 years ago

My friend worked in a startup scam that preys on slothful individuals.

He explained everything.

A drinking buddy confessed. Alexander. He says he works at a startup based on a scam, which appears too clever to be a lie.

Alexander (assuming he developed the story) or the startup's creator must have been a genius.

This is the story of an Internet scam that targets older individuals and generates tens of millions of dollars annually.

The business sells authentic things at 10% of their market value. This firm cannot be lucrative, but the entrepreneur has a plan: monthly subscriptions to a worthless service.

The firm can then charge the customer's credit card to settle the gap. The buyer must subscribe without knowing it. What's their strategy?

How does the con operate?

Imagine a website with a split homepage. On one page, the site offers an attractive goods at a ridiculous price (from 1 euro to 10% of the product's market worth).

Same product, but with a stupid monthly subscription. Business is unsustainable. They buy overpriced products and resell them too cheaply, hoping customers will subscribe to a useless service.

No customer will want this service. So they create another illegal homepage that hides the monthly subscription offer. After an endless scroll, a box says Yes, I want to subscribe to a service that costs x dollars per month.

Unchecking the checkbox bugs. When a customer buys a product on this page, he's enrolled in a monthly subscription. Not everyone should see it because it's illegal. So what does the startup do?

A page that varies based on the sort of website visitor, a possible consumer or someone who might be watching the startup's business

Startup technicians make sure the legal page is displayed when the site is accessed normally. Typing the web address in the browser, using Google, etc. The page crashes when buying a goods, preventing the purchase.

This avoids the startup from selling a product at a loss because the buyer won't subscribe to the worthless service and charge their credit card each month.

The illegal page only appears if a customer clicks on a Google ad, indicating interest in the offer.

Alexander says that a banker, police officer, or anyone else who visits the site (maybe for control) will only see a valid and buggy site as purchases won't be possible.

The latter will go to the site in the regular method (by typing the address in the browser, using Google, etc.) and not via an online ad.

Those who visit from ads are likely already lured by the site's price. They'll be sent to an illegal page that requires a subscription.

Laziness is humanity's secret weapon. The ordinary person ignores tiny monthly credit card charges. The subscription lasts around a year before the customer sees an unexpected deduction.

After-sales service (ASS) is useful in this situation.

After-sales assistance begins when a customer notices slight changes on his credit card, usually a year later.

The customer will search Google for the direct debit reference. How he'll complain to after-sales service.

It's crucial that ASS appears in the top 4/5 Google search results. This site must be clear, and offer chat, phone, etc., he argues.

The pigeon must be comforted after waking up. The customer learns via after-sales service that he subscribed to a service while buying the product, which justifies the debits on his card.

The customer will then clarify that he didn't intend to make the direct debits. The after-sales care professional will pretend to listen to the customer's arguments and complaints, then offer to unsubscribe him for free because his predicament has affected him.

In 99% of cases, the consumer is satisfied since the after-sales support unsubscribed him for free, and he forgets the debited amounts.

The remaining 1% is split between 0.99% who are delighted to be reimbursed and 0.01%. We'll pay until they're done. The customer should be delighted, not object or complain, and keep us beneath the radar (their situation is resolved, the rest, they don’t care).

It works, so we expand our thinking.

Startup has considered industrialization. Since this fraud is working, try another. Automate! So they used a site generator (only for product modifications), underpaid phone operators for after-sales service, and interns for fresh product ideas.

The company employed a data scientist. This has allowed the startup to recognize that specific customer profiles can be re-registered in the database and that it will take X months before they realize they're subscribing to a worthless service. Customers are re-subscribed to another service, then unsubscribed before realizing it.

Alexander took months to realize the deception and leave. Lawyers and others apparently threatened him and former colleagues who tried to talk about it.

The startup would have earned prizes and competed in contests. He adds they can provide evidence to any consumer group, media, police/gendarmerie, or relevant body. When I submitted my information to the FBI, I was told, "We know, we can't do much.", he says.

You might also like

Navdeep Yadav

3 years ago

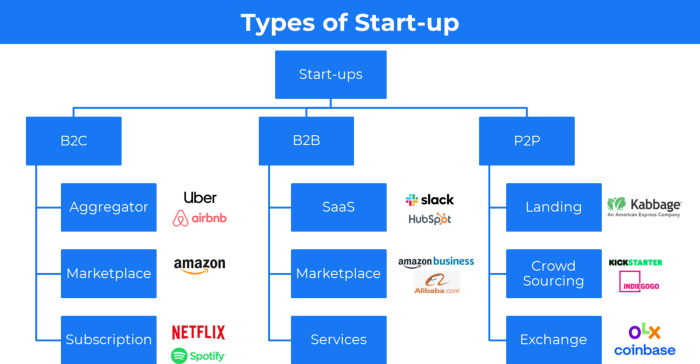

31 startup company models (with examples)

Many people find the internet's various business models bewildering.

This article summarizes 31 startup e-books.

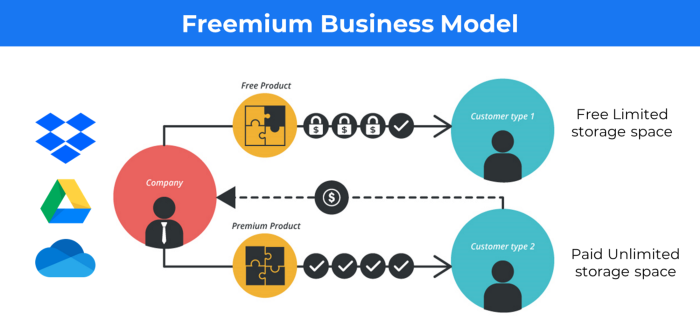

1. Using the freemium business model (free plus premium),

The freemium business model offers basic software, games, or services for free and charges for enhancements.

Examples include Slack, iCloud, and Google Drive

Provide a rudimentary, free version of your product or service to users.

Google Drive and Dropbox offer 15GB and 2GB of free space but charge for more.

Freemium business model details (Click here)

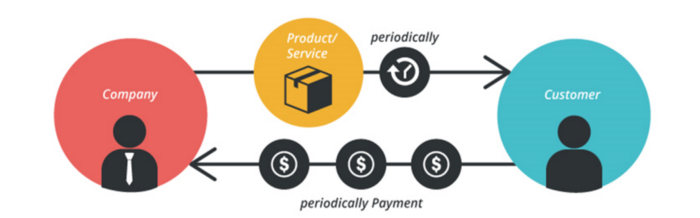

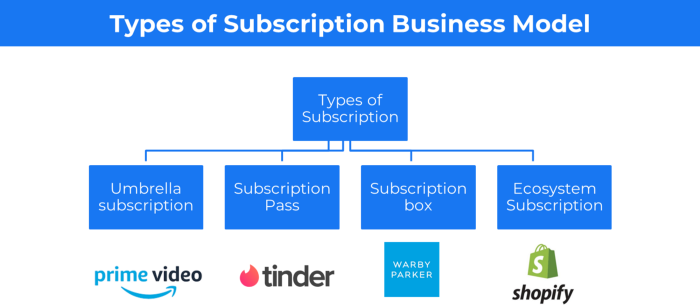

2. The Business Model of Subscription

Subscription business models sell a product or service for recurring monthly or yearly revenue.

Examples: Tinder, Netflix, Shopify, etc

It's the next step to Freemium if a customer wants to pay monthly for premium features.

Subscription Business Model (Click here)

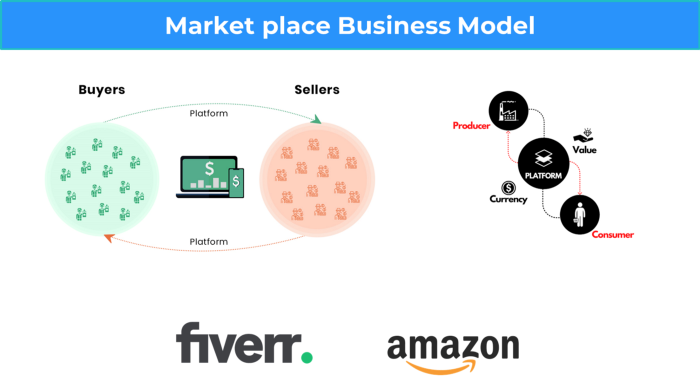

3. A market-based business strategy

It's an e-commerce site or app where third-party sellers sell products or services.

Examples are Amazon and Fiverr.

On Amazon's marketplace, a third-party vendor sells a product.

Freelancers on Fiverr offer specialized skills like graphic design.

Marketplace's business concept is explained.

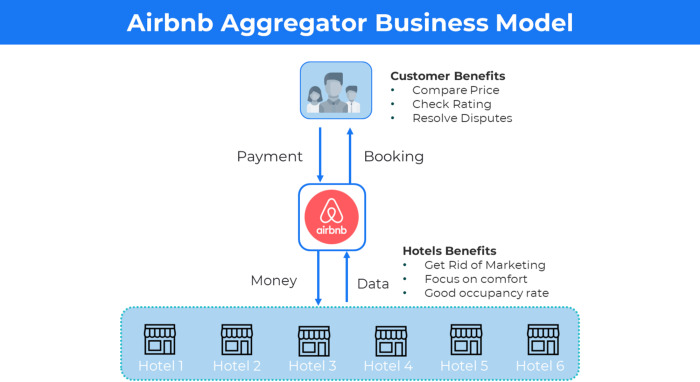

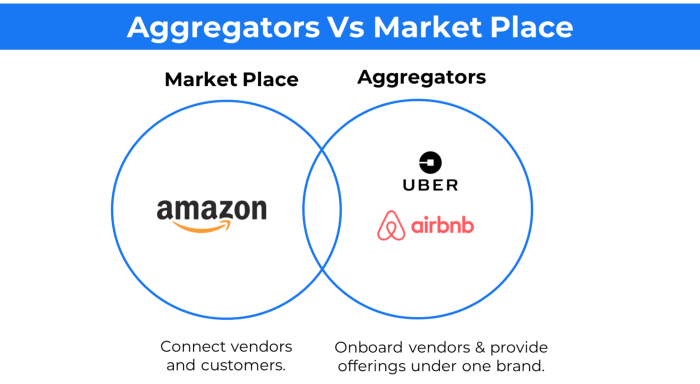

4. Business plans using aggregates

In the aggregator business model, the service is branded.

Uber, Airbnb, and other examples

Marketplace and Aggregator business models differ.

Amazon and Fiverr link merchants and customers and take a 10-20% revenue split.

Uber and Airbnb-style aggregator Join these businesses and provide their products.

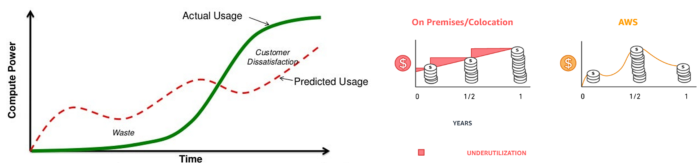

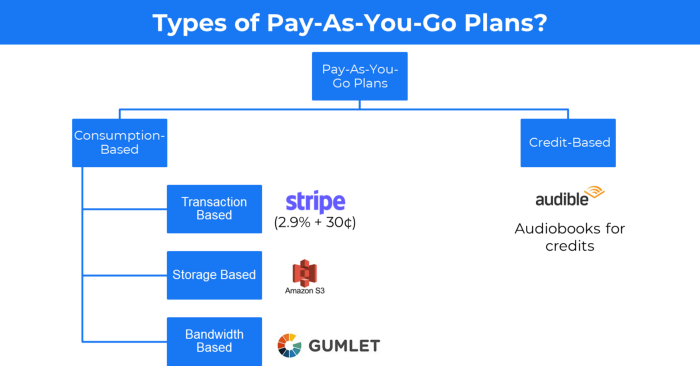

5. The pay-as-you-go concept of business

This is a consumption-based pricing system. Cloud companies use it.

Example: Amazon Web Service and Google Cloud Platform (GCP) (AWS)

AWS, an Amazon subsidiary, offers over 200 pay-as-you-go cloud services.

“In short, the more you use the more you pay”

When it's difficult to divide clients into pricing levels, pay-as-you is employed.

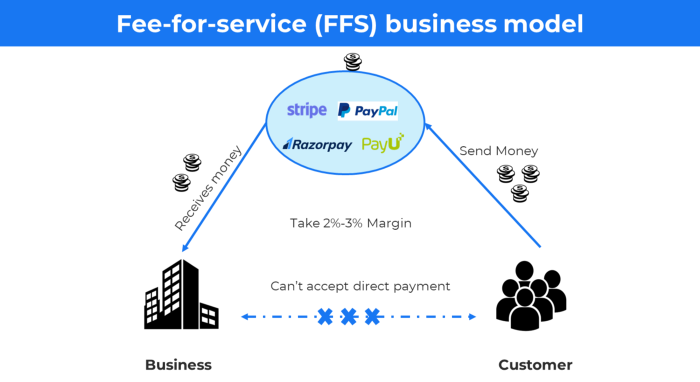

6. The business model known as fee-for-service (FFS)

FFS charges fixed and variable fees for each successful payment.

For instance, PayU, Paypal, and Stripe

Stripe charges 2.9% + 30 per payment.

These firms offer a payment gateway to take consumer payments and deposit them to a business account.

Fintech business model

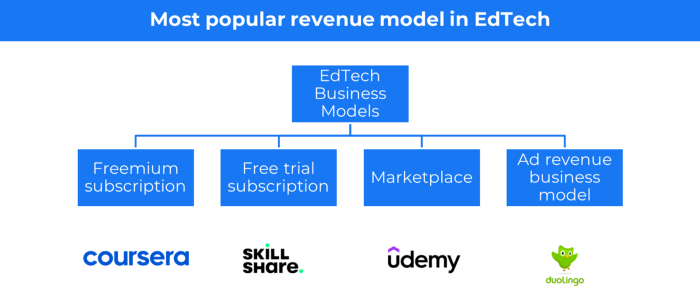

7. EdTech business strategy

In edtech, you generate money by selling material or teaching as a service.

edtech business models

Freemium When course content is free but certification isn't, e.g. Coursera

FREE TRIAL SkillShare offers free trials followed by monthly or annual subscriptions.

Self-serving marketplace approach where you pick what to learn.

Ad-revenue model The company makes money by showing adverts to its huge user base.

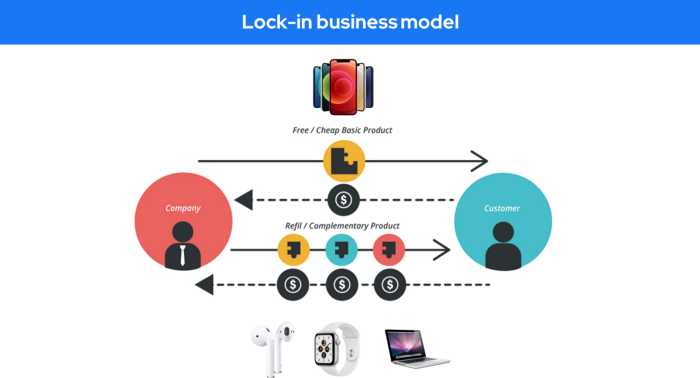

Lock-in business strategy

Lock in prevents customers from switching to a competitor's brand or offering.

It uses switching costs or effort to transmit (soft lock-in), improved brand experience, or incentives.

Apple, SAP, and other examples

Apple offers an iPhone and then locks you in with extra hardware (Watch, Airpod) and platform services (Apple Store, Apple Music, cloud, etc.).

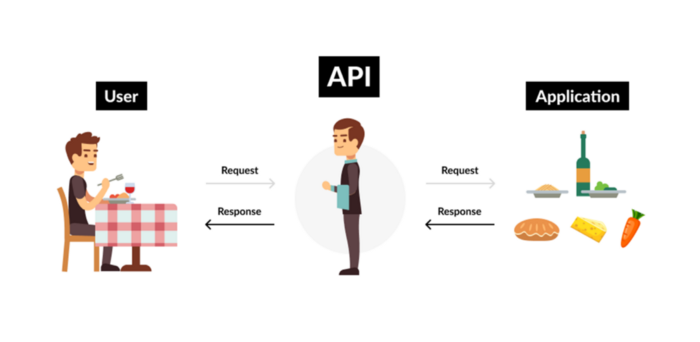

9. Business Model for API Licensing

APIs let third-party apps communicate with your service.

Uber and Airbnb use Google Maps APIs for app navigation.

Examples are Google Map APIs (Map), Sendgrid (Email), and Twilio (SMS).

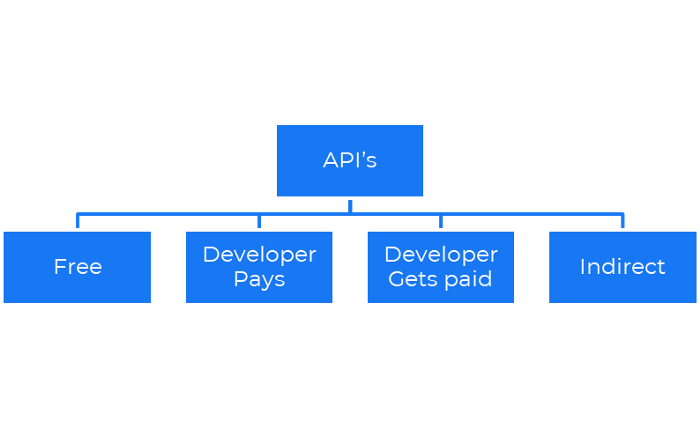

Business models for APIs

Free: The simplest API-driven business model that enables unrestricted API access for app developers. Google Translate and Facebook are two examples.

Developer Pays: Under this arrangement, service providers such as AWS, Twilio, Github, Stripe, and others must be paid by application developers.

The developer receives payment: These are the compensated content producers or developers who distribute the APIs utilizing their work. For example, Amazon affiliate programs

10. Open-source enterprise

Open-source software can be inspected, modified, and improved by anybody.

For instance, use Firefox, Java, or Android.

Google paid Mozilla $435,702 million to be their primary search engine in 2018.

Open-source software profits in six ways.

Paid assistance The Project Manager can charge for customization because he is quite knowledgeable about the codebase.

A full database solution is available as a Software as a Service (MongoDB Atlas), but there is a fee for the monitoring tool.

Open-core design R studio is a better GUI substitute for open-source applications.

sponsors of GitHub Sponsorships benefit the developers in full.

demands for paid features Earn Money By Developing Open Source Add-Ons for Current Products

Open-source business model

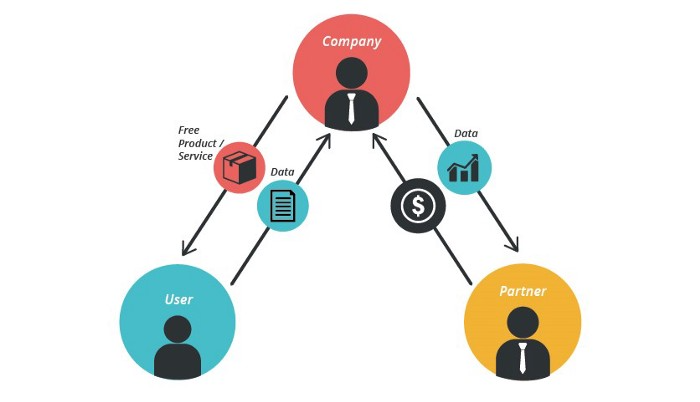

11. The business model for data

If the software or algorithm collects client data to improve or monetize the system.

Open AI GPT3 gets smarter with use.

Foursquare allows users to exchange check-in locations.

Later, they compiled large datasets to enable retailers like Starbucks launch new outlets.

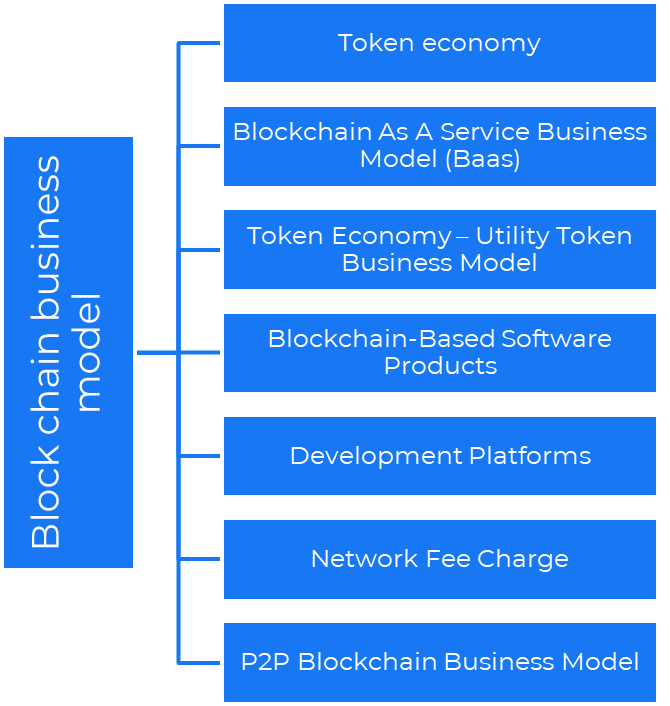

12. Business Model Using Blockchain

Blockchain is a distributed ledger technology that allows firms to deploy smart contracts without a central authority.

Examples include Alchemy, Solana, and Ethereum.

Business models using blockchain

Economy of tokens or utility When a business uses a token business model, it issues some kind of token as one of the ways to compensate token holders or miners. For instance, Solana and Ethereum

Bitcoin Cash P2P Business Model Peer-to-peer (P2P) blockchain technology permits direct communication between end users. as in IPFS

Enterprise Blockchain as a Service (Baas) BaaS focuses on offering ecosystem services similar to those offered by Amazon (AWS) and Microsoft (Azure) in the web 3 sector. Example: Ethereum Blockchain as a Service with Bitcoin (EBaaS).

Blockchain-Based Aggregators With AWS for blockchain, you can use that service by making an API call to your preferred blockchain. As an illustration, Alchemy offers nodes for many blockchains.

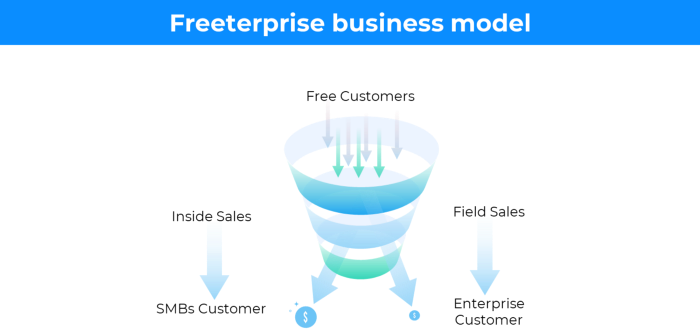

13. The free-enterprise model

In the freeterprise business model, free professional accounts are led into the funnel by the free product and later become B2B/enterprise accounts.

For instance, Slack and Zoom

Freeterprise companies flourish through collaboration.

Start with a free professional account to build an enterprise.

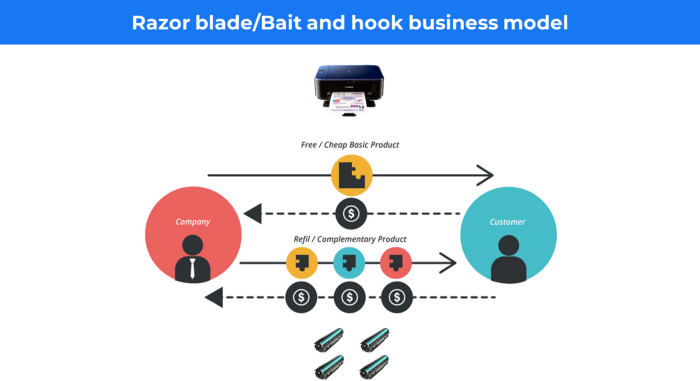

14. Business plan for razor blades

It's employed in hardware where one piece is sold at a loss and profits are made through refills or add-ons.

Gillet razor & blades, coffee machine & beans, HP printer & cartridge, etc.

Sony sells the Playstation console at a loss but makes up for it by selling games and charging for online services.

Advantages of the Razor-Razorblade Method

lowers the risk a customer will try a product. enables buyers to test the goods and services without having to pay a high initial investment.

The product's ongoing revenue stream has the potential to generate sales that much outweigh the original investments.

Razor blade business model

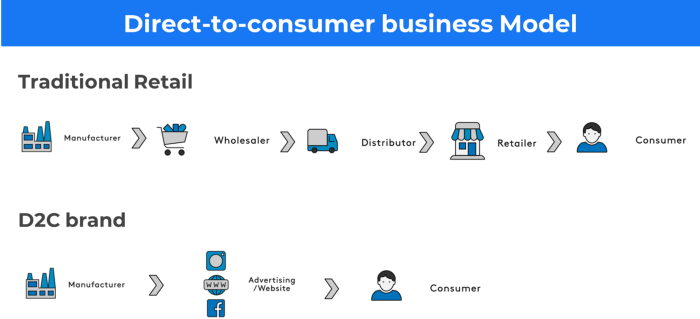

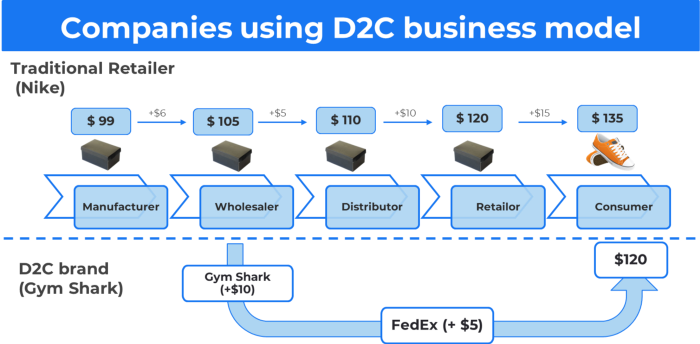

15. The business model of direct-to-consumer (D2C)

In D2C, the company sells directly to the end consumer through its website using a third-party logistic partner.

Examples include GymShark and Kylie Cosmetics.

D2C brands can only expand via websites, marketplaces (Amazon, eBay), etc.

D2C benefits

Lower reliance on middlemen = greater profitability

You now have access to more precise demographic and geographic customer data.

Additional space for product testing

Increased customisation throughout your entire product line-Inventory Less

16. Business model: White Label vs. Private Label

Private label/White label products are made by a contract or third-party manufacturer.

Most amazon electronics are made in china and white-labeled.

Amazon supplements and electronics.

Contract manufacturers handle everything after brands select product quantities on design labels.

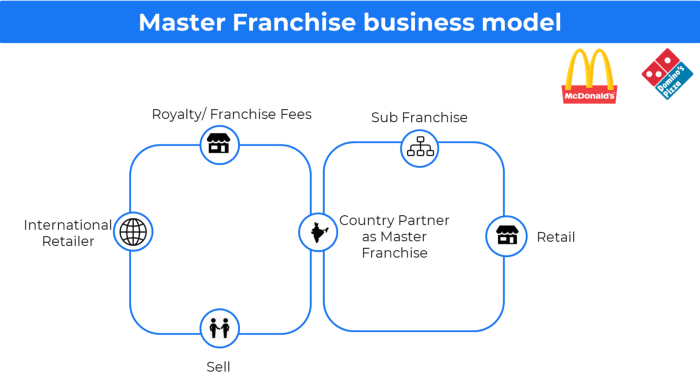

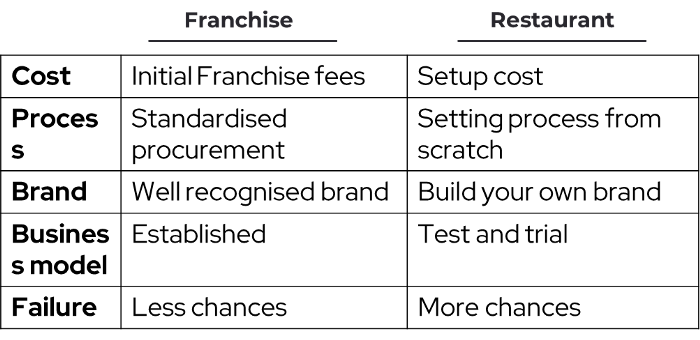

17. The franchise model

The franchisee uses the franchisor's trademark, branding, and business strategy (company).

For instance, KFC, Domino's, etc.

Subway, Domino, Burger King, etc. use this business strategy.

Many people pick a franchise because opening a restaurant is risky.

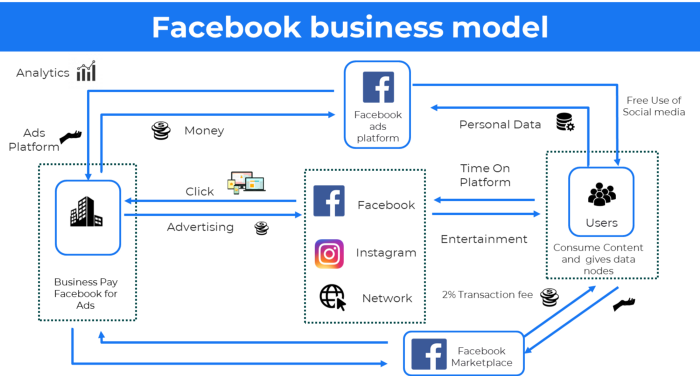

18. Ad-based business model

Social media and search engine giants exploit search and interest data to deliver adverts.

Google, Meta, TikTok, and Snapchat are some examples.

Users don't pay for the service or product given, e.g. Google users don't pay for searches.

In exchange, they collected data and hyper-personalized adverts to maximize revenue.

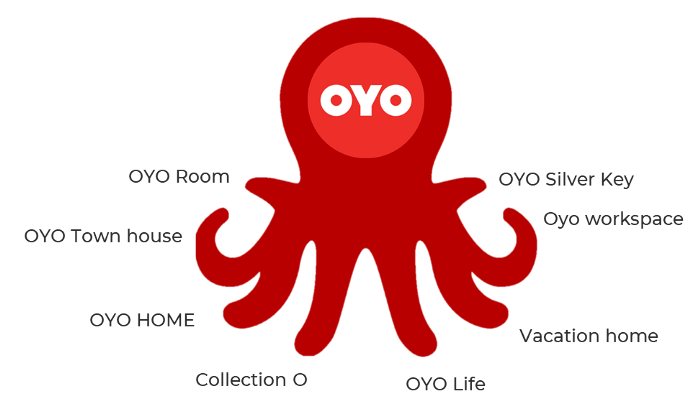

19. Business plan for octopuses

Each business unit functions separately but is connected to the main body.

Instance: Oyo

OYO is Asia's Airbnb, operating hotels, co-working, co-living, and vacation houses.

20, Transactional business model, number

Sales to customers produce revenue.

E-commerce sites and online purchases employ SSL.

Goli is an ex-GymShark.

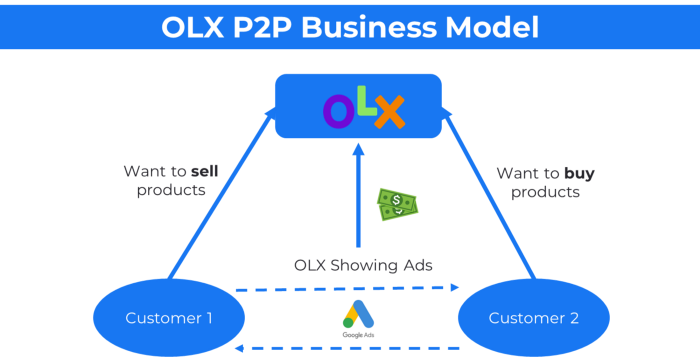

21. The peer-to-peer (P2P) business model

In P2P, two people buy and sell goods and services without a third party or platform.

Consider OLX.

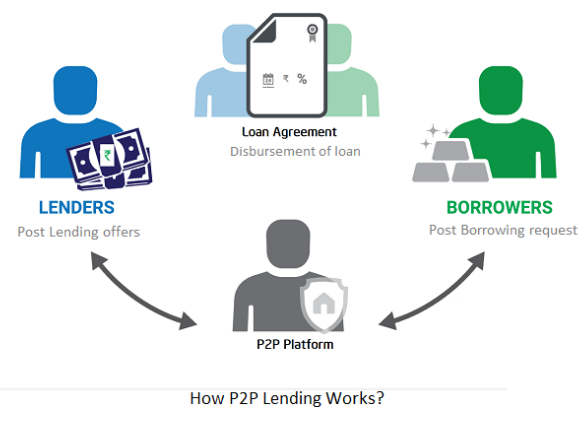

22. P2P lending as a manner of operation

In P2P lending, one private individual (P2P Lender) lends/invests or borrows money from another (P2P Borrower).

Instance: Kabbage

Social lending lets people lend and borrow money directly from each other without an intermediary financial institution.

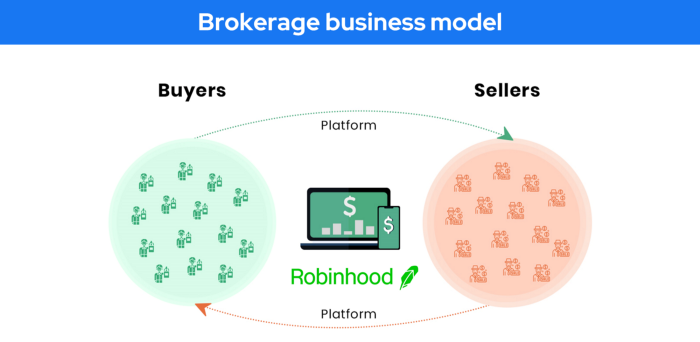

23. A business model for brokers

Brokerages charge a commission or fee for their services.

Examples include eBay, Coinbase, and Robinhood.

Brokerage businesses are common in Real estate, finance, and online and operate on this model.

Buy/sell similar models Examples include financial brokers, insurance brokers, and others who match purchase and sell transactions and charge a commission.

These brokers charge an advertiser a fee based on the date, place, size, or type of an advertisement. This is known as the classified-advertiser model. For instance, Craiglist

24. Drop shipping as an industry

Dropshipping allows stores to sell things without holding physical inventories.

When a customer orders, use a third-party supplier and logistic partners.

Retailer product portfolio and customer experience Fulfiller The consumer places the order.

Dropshipping advantages

Less money is needed (Low overhead-No Inventory or warehousing)

Simple to start (costs under $100)

flexible work environment

New product testing is simpler

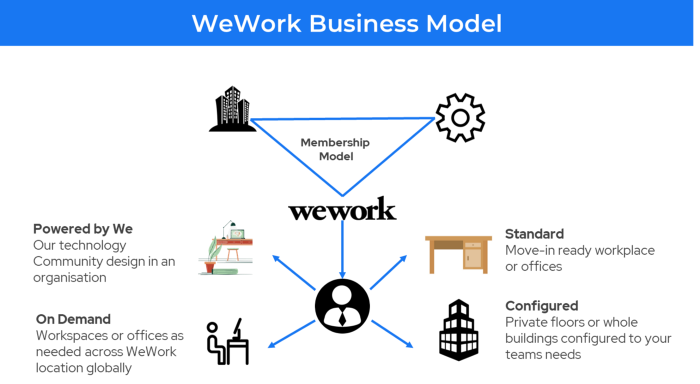

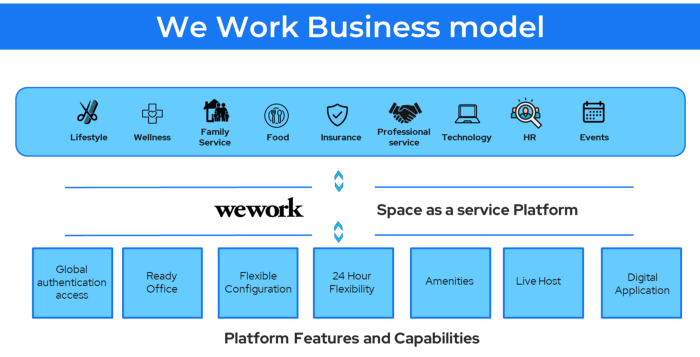

25. Business Model for Space as a Service

It's centered on a shared economy that lets millennials live or work in communal areas without ownership or lease.

Consider WeWork and Airbnb.

WeWork helps businesses with real estate, legal compliance, maintenance, and repair.

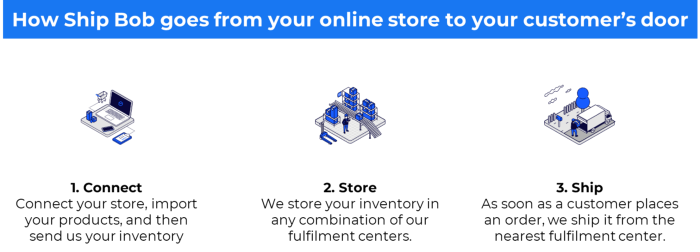

26. The business model for third-party logistics (3PL)

In 3PL, a business outsources product delivery, warehousing, and fulfillment to an external logistics company.

Examples include Ship Bob, Amazon Fulfillment, and more.

3PL partners warehouse, fulfill, and return inbound and outbound items for a charge.

Inbound logistics involves bringing products from suppliers to your warehouse.

Outbound logistics refers to a company's production line, warehouse, and customer.

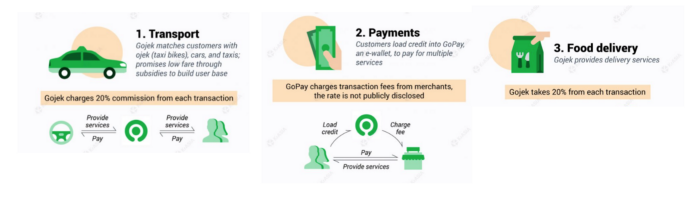

27. The last-mile delivery paradigm as a commercial strategy

Last-mile delivery is the collection of supply chain actions that reach the end client.

Examples include Rappi, Gojek, and Postmates.

Last-mile is tied to on-demand and has a nighttime peak.

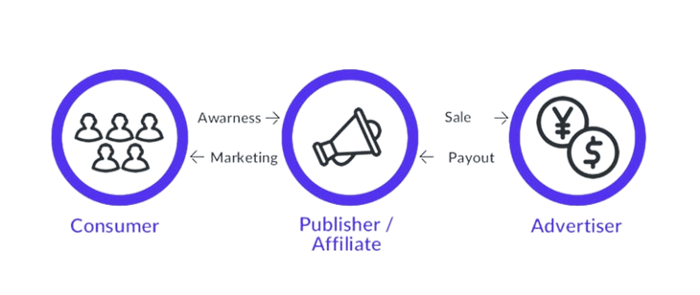

28. The use of affiliate marketing

Affiliate marketing involves promoting other companies' products and charging commissions.

Examples include Hubspot, Amazon, and Skillshare.

Your favorite youtube channel probably uses these short amazon links to get 5% of sales.

Affiliate marketing's benefits

In exchange for a success fee or commission, it enables numerous independent marketers to promote on its behalf.

Ensure system transparency by giving the influencers a specific tracking link and an online dashboard to view their profits.

Learn about the newest bargains and have access to promotional materials.

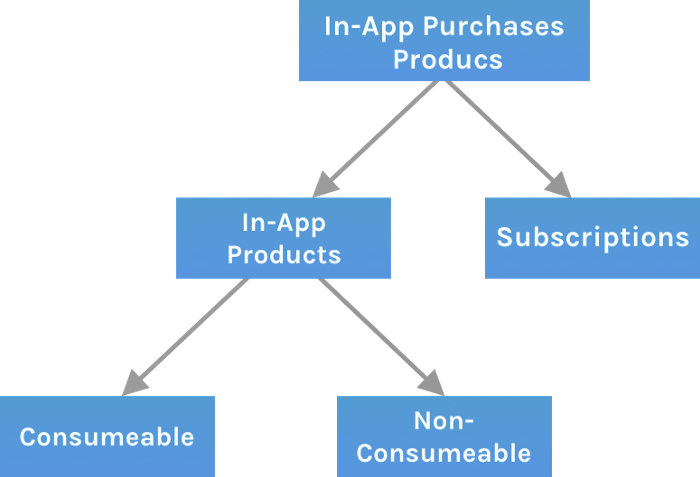

29. The business model for virtual goods

This is an in-app purchase for an intangible product.

Examples include PubG, Roblox, Candy Crush, etc.

Consumables are like gaming cash that runs out. Non-consumable products provide a permanent advantage without repeated purchases.

30. Business Models for Cloud Kitchens

Ghost, Dark, Black Box, etc.

Delivery-only restaurant.

These restaurants don't provide dine-in, only delivery.

For instance, NextBite and Faasos

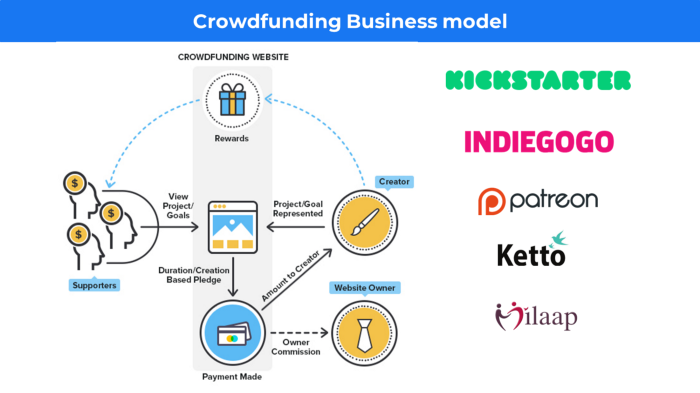

31. Crowdsourcing as a Business Model

Crowdsourcing = Using the crowd as a platform's source.

In crowdsourcing, you get support from people around the world without hiring them.

Crowdsourcing sites

Open-Source Software gives access to the software's source code so that developers can edit or enhance it. Examples include Firefox browsers and Linux operating systems.

Crowdfunding The oculus headgear would be an example of crowdfunding in essence, with no expectations.

Chritiaan Hetzner

3 years ago

Mystery of the $1 billion'meme stock' that went to $400 billion in days

Who is AMTD Digital?

An unknown Hong Kong corporation joined the global megacaps worth over $500 billion on Tuesday.

The American Depository Share (ADS) with the ticker code HKD gapped at the open, soaring 25% over the previous closing price as trading began, before hitting an intraday high of $2,555.

At its peak, its market cap was almost $450 billion, more than Facebook parent Meta or Alibaba.

Yahoo Finance reported a daily volume of 350,500 shares, the lowest since the ADS began trading and much below the average of 1.2 million.

Despite losing a fifth of its value on Wednesday, it's still worth more than Toyota, Nike, McDonald's, or Walt Disney.

The company sold 16 million shares at $7.80 each in mid-July, giving it a $1 billion market valuation.

Why the boom?

That market cap seems unjustified.

According to SEC reports, its income-generating assets barely topped $400 million in March. Fortune's emails and calls went unanswered.

Website discloses little about company model. Its one-minute business presentation film uses a Star Wars–like design to sell the company as a "one-stop digital solutions platform in Asia"

The SEC prospectus explains.

AMTD Digital sells a "SpiderNet Ecosystems Solutions" kind of club membership that connects enterprises. This is the bulk of its $25 million annual revenue in April 2021.

Pretax profits have been higher than top line over the past three years due to fair value accounting gains on Appier, DayDayCook, WeDoctor, and five Asian fintechs.

AMTD Group, the company's parent, specializes in investment banking, hotel services, luxury education, and media and entertainment. AMTD IDEA, a $14 billion subsidiary, is also traded on the NYSE.

“Significant volatility”

Why AMTD Digital listed in the U.S. is unknown, as it informed investors in its share offering prospectus that could delist under SEC guidelines.

Beijing's red tape prevents the Sarbanes-Oxley Board from inspecting its Chinese auditor.

This frustrates Chinese stock investors. If the U.S. and China can't achieve a deal, 261 Chinese companies worth $1.3 trillion might be delisted.

Calvin Choi left UBS to become AMTD Group's CEO.

His capitalist background and status as a Young Global Leader with the World Economic Forum don't stop him from praising China's Communist party or celebrating the "glory and dream of the Great Rejuvenation of the Chinese nation" a century after its creation.

Despite having an executive vice chairman with a record of battling corruption and ties to Carrie Lam, Beijing's previous proconsul in Hong Kong, Choi is apparently being targeted for a two-year industry ban by the city's securities regulator after an investor accused Choi of malfeasance.

Some CMIG-funded initiatives produced money, but he didn't give us the proceeds, a corporate official told China's Caixin in October 2020. We don't know if he misappropriated or lost some money.

A seismic anomaly

In fundamental analysis, where companies are valued based on future cash flows, AMTD Digital's mind-boggling market cap is a statistical aberration that should occur once every hundred years.

AMTD Digital doesn't know why it's so valuable. In a thank-you letter to new shareholders, it said it was confused by the stock's performance.

Since its IPO, the company has seen significant ADS price volatility and active trading volume, it said Tuesday. "To our knowledge, there have been no important circumstances, events, or other matters since the IPO date."

Permabears awoke after the jump. Jim Chanos asked if "we're all going to ignore the $400 billion meme stock in the room," while Nate Anderson called AMTD Group "sketchy."

It happened the same day SEC Chair Gary Gensler praised the 20th anniversary of the Sarbanes-Oxley Act, aimed to restore trust in America's financial markets after the Enron and WorldCom accounting fraud scandals.

The run-up revived unpleasant memories of Robinhood's decision to limit retail investors' ability to buy GameStop, regarded as a measure to protect hedge funds invested in the meme company.

Why wasn't HKD's buy button removed? Because retail wasn't behind it?" tweeted Gensler on Tuesday. "Real stock fraud. "You're worthless."

Julie Zhuo

2 years ago

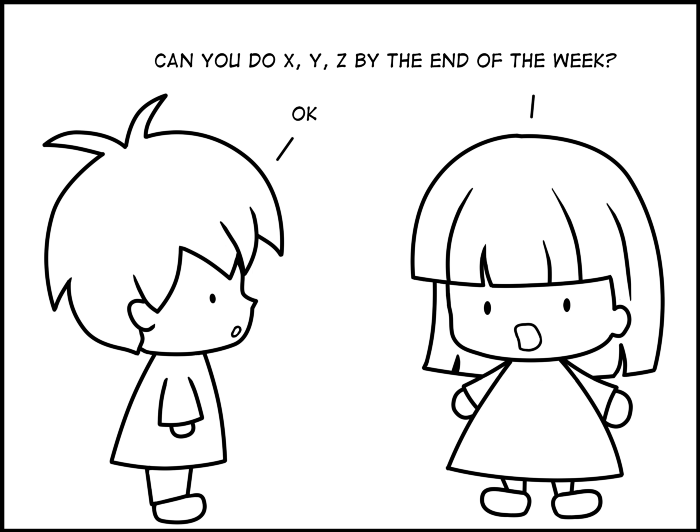

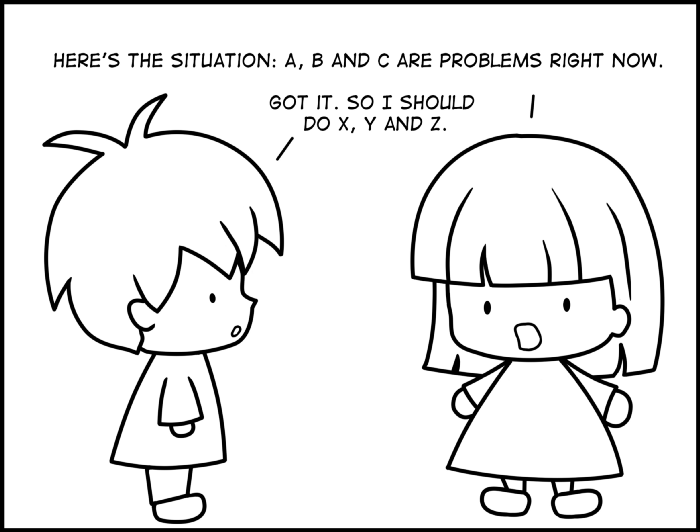

Comparing poor and excellent managers

10-sketch explanation

Choosing Tasks

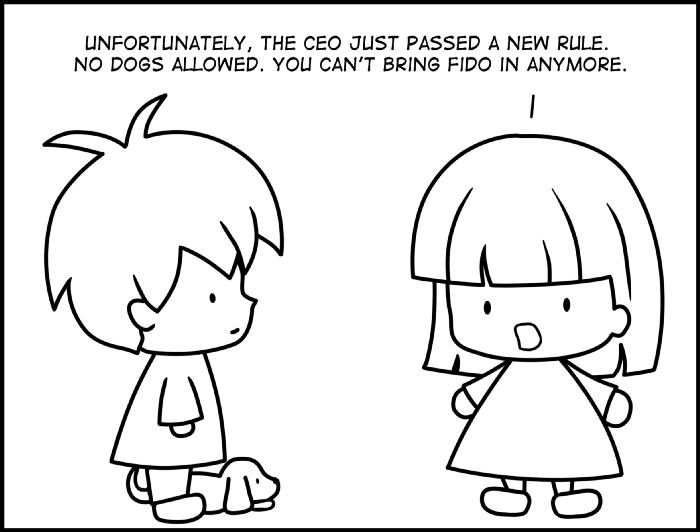

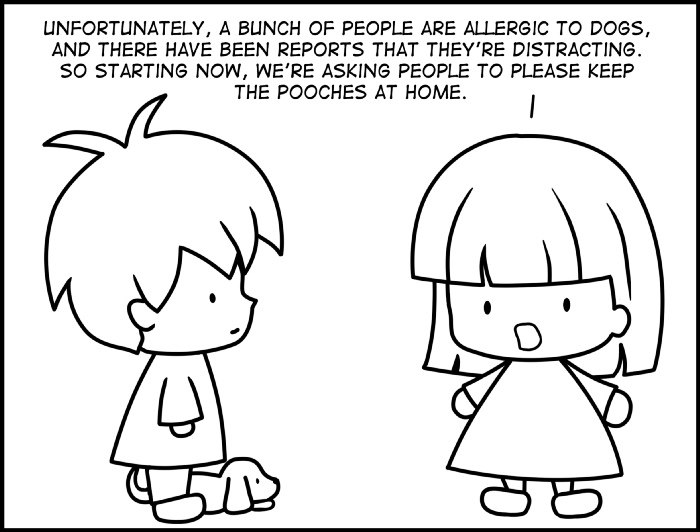

Bringing News

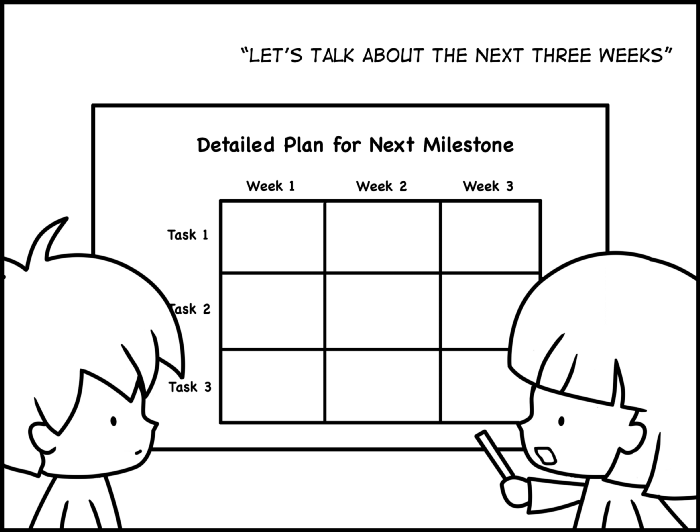

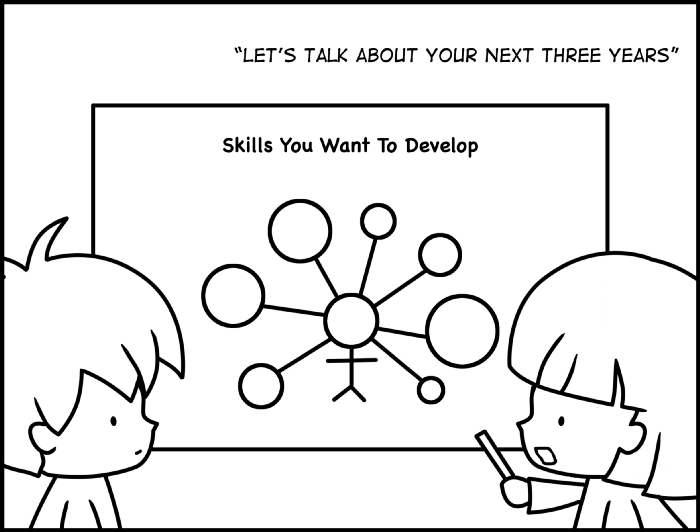

carrying out 1:1s

providing critique

Managing Turbulence