More on Entrepreneurship/Creators

Muthinja

3 years ago

Why don't you relaunch my startup projects?

Open to ideas or acquisitions

Failure is an unavoidable aspect of life, yet many recoil at the word.

I've worked on unrelated startup projects. This is a list of products I developed (often as the tech lead or co-founder) and why they failed to launch.

Chess Bet (Betting)

As a chess player who plays 5 games a day and has an ELO rating of 2100, I tried to design a chess engine to rival stockfish and Houdini.

While constructing my chess engine, my cofounder asked me about building a p2p chess betting app. Chess Bet. There couldn't be a better time.

Two people in different locations could play a staked game. The winner got 90% of the bet and we got 10%. The business strategy was clear, but our mini-launch was unusual.

People started employing the same cheat engines I mentioned, causing user churn and defaming our product.

It was the first programming problem I couldn't solve after building a cheat detection system based on player move strengths and prior games. Chess.com, the most famous online chess software, still suffers from this.

We decided to pivot because we needed an expensive betting license.

We relaunched as Chess MVP after deciding to focus on chess learning. A platform for teachers to create chess puzzles and teach content. Several chess students used our product, but the target market was too tiny.

We chose to quit rather than persevere or pivot.

BodaCare (Insure Tech)

‘BodaBoda’ in Swahili means Motorcycle. My Dad approached me in 2019 (when I was working for a health tech business) about establishing an Insurtech/fintech solution for motorbike riders to pay for insurance using SNPL.

We teamed up with an underwriter to market motorcycle insurance. Once they had enough premiums, they'd get an insurance sticker in the mail. We made it better by splitting the cover in two, making it more reasonable for motorcyclists struggling with lump-sum premiums.

Lack of capital and changing customer behavior forced us to close, with 100 motorcyclists paying 0.5 USD every day. Our unit econ didn't make sense, and CAC and retention capital only dug us deeper.

Circle (Social Networking)

Having learned from both product failures, I began to understand what worked and what didn't. While reading through Instagram, an idea struck me.

Suppose social media weren't virtual.

Imagine meeting someone on your way home. Like-minded person

People were excited about social occasions after covid restrictions were eased. Anything to escape. I just built a university student-popular experiences startup. Again, there couldn't be a better time.

I started the Android app. I launched it on Google Beta and oh my! 200 people joined in two days.

It works by signaling if people are in a given place and allowing users to IM in hopes of meeting up in near real-time. Playstore couldn't deploy the app despite its success in beta for unknown reasons. I appealed unsuccessfully.

My infrastructure quickly lost users because I lacked funding.

In conclusion

This essay contains many failures, some of which might have been avoided and others not, but they were crucial learning points in my startup path.

If you liked any idea, I have the source code on Github.

Happy reading until then!

Kaitlin Fritz

3 years ago

The Entrepreneurial Chicken and Egg

University entrepreneurship is like a Willy Wonka Factory of ideas. Classes, roommates, discussions, and the cafeteria all inspire new ideas. I've seen people establish a business without knowing its roots.

Chicken or egg? On my mind: I've asked university founders around the world whether the problem or solution came first.

The Problem

One African team I met started with the “instant noodles” problem in their academic ecosystem. Many of us have had money issues in college, which may have led to poor nutritional choices.

Many university students in a war-torn country ate quick noodles or pasta for dinner.

Noodles required heat, water, and preparation in the boarding house. Unreliable power from one hot plate per blue moon. What's healthier, easier, and tastier than sodium-filled instant pots?

BOOM. They were fixing that. East African kids need affordable, nutritious food.

This is a real difficulty the founders faced every day with hundreds of comrades.

This sparked their serendipitous entrepreneurial journey and became their business's cornerstone.

The Solution

I asked a UK team about their company idea. They said the solution fascinated them.

The crew was fiddling with social media algorithms. Why are some people more popular? They were studying platforms and social networks, which offered a way for them.

Solving a problem? Yes. Long nights of university research lead them to it. Is this like world hunger? Social media influencers confront this difficulty regularly.

It made me ponder something. Is there a correct response?

In my heart, yes, but in my head…maybe?

I believe you should lead with empathy and embrace the problem, not the solution. Big or small, businesses should solve problems. This should be your focus. This is especially true when building a social company with an audience in mind.

Philosophically, invention and innovation are occasionally accidental. Also not penalized. Think about bugs and the creation of Velcro, or the inception of Teflon. They tackle difficulties we overlook. The route to the problem may look different, but there is a path there.

There's no golden ticket to the Chicken-Egg debate, but I'll keep looking this summer.

Aure's Notes

3 years ago

I met a man who in just 18 months scaled his startup to $100 million.

A fascinating business conversation.

This week at Web Summit, I had mentor hour.

Mentor hour connects startups with experienced entrepreneurs.

The YC-selected founder who mentored me had grown his company to $100 million in 18 months.

I had 45 minutes to question him.

I've compiled this.

Context

Founder's name is Zack.

After working in private equity, Zack opted to acquire an MBA.

Surrounded by entrepreneurs at a prominent school, he decided to become one himself.

Unsure how to proceed, he bet on two horses.

On one side, he received an offer from folks who needed help running their startup owing to lack of time. On the other hand, he had an idea for a SaaS to start himself.

He just needed to validate it.

Validating

Since Zack's proposal helped companies, he contacted university entrepreneurs for comments.

He contacted university founders.

Once he knew he'd correctly identified the problem and that people were willing to pay to address it, he started developing.

He earned $100k in a university entrepreneurship competition.

His plan was evident by then.

The other startup's founders saw his potential and granted him $400k to launch his own SaaS.

Hiring

He started looking for a tech co-founder because he lacked IT skills.

He interviewed dozens and picked the finest.

As he didn't want to wait for his program to be ready, he contacted hundreds of potential clients and got 15 letters of intent promising they'd join up when it was available.

YC accepted him by then.

He had enough positive signals to raise.

Raising

He didn't say how many VCs he called, but he indicated 50 were interested.

He jammed meetings into two weeks to generate pressure and encourage them to invest.

Seed raise: $11 million.

Selling

His objective was to contact as many entrepreneurs as possible to promote his product.

He first contacted startups by scraping CrunchBase data.

Once he had more money, he started targeting companies with ZoomInfo.

His VC urged him not to hire salespeople until he closed 50 clients himself.

He closed 100 and hired a CRO through a headhunter.

Scaling

Three persons started the business.

He primarily works in sales.

Coding the product was done by his co-founder.

Another person performing operational duties.

He regretted recruiting the third co-founder, who was ineffective (could have hired an employee instead).

He wanted his company to be big, so he hired two young marketing people from a competing company.

After validating several marketing channels, he chose PR.

$100 Million and under

He developed a sales team and now employs 30 individuals.

He raised a $100 million Series A.

Additionally, he stated

He’s been rejected a lot. Like, a lot.

Two great books to read: Steve Jobs by Isaacson, and Why Startups Fail by Tom Eisenmann.

The best skill to learn for non-tech founders is “telling stories”, which means sales. A founder’s main job is to convince: co-founders, employees, investors, and customers. Learn code, or learn sales.

Conclusion

I often read about these stories but hardly take them seriously.

Zack was amazing.

Three things about him stand out:

His vision. He possessed a certain amount of fire.

His vitality. The man had a lot of enthusiasm and spoke quickly and decisively. He takes no chances and pushes the envelope in all he does.

His Rolex.

He didn't do all this in 18 months.

Not really.

He couldn't launch his company without private equity experience.

These accounts disregard entrepreneurs' original knowledge.

Hormozi will tell you how he founded Gym Launch, but he won't tell you how he had a gym first, how he worked at uni to pay for his gym, or how he went to the gym and learnt about fitness, which gave him the idea to open his own.

Nobody knows nothing. If you scale quickly, it's probable because you gained information early.

Lincoln said, "Give me six hours to chop down a tree, and I'll spend four sharpening the axe."

Sharper axes cut trees faster.

You might also like

Neeramitra Reddy

3 years ago

The best life advice I've ever heard could very well come from 50 Cent.

He built a $40M hip-hop empire from street drug dealing.

50 Cent was nearly killed by 9mm bullets.

Before 50 Cent, Curtis Jackson sold drugs.

He sold coke to worried addicts after being orphaned at 8.

Pursuing police. Murderous hustlers and gangs. Unwitting informers.

Despite his hard life, his hip-hop career was a success.

An assassination attempt ended his career at the start.

What sane producer would want to deal with a man entrenched in crime?

Most would have drowned in self-pity and drank themselves to death.

But 50 Cent isn't most people. Life on the streets had given him fearlessness.

“Having a brush with death, or being reminded in a dramatic way of the shortness of our lives, can have a positive, therapeutic effect. So it is best to make every moment count, to have a sense of urgency about life.” ― 50 Cent, The 50th Law

50 released a series of mixtapes that caught Eminem's attention and earned him a $50 million deal!

50 Cents turned death into life.

Things happen; that is life.

We want problems solved.

Every human has problems, whether it's Jeff Bezos swimming in his billions, Obama in his comfortable retirement home, or Dan Bilzerian with his hired bikini models.

All problems.

Problems churn through life. solve one, another appears.

It's harsh. Life's unfair. We can face reality or run from it.

The latter will worsen your issues.

“The firmer your grasp on reality, the more power you will have to alter it for your purposes.” — 50 Cent, The 50th Law

In a fantasy-obsessed world, 50 Cent loves reality.

Wish for better problem-solving skills rather than problem-free living.

Don't wish, work.

We All Have the True Power of Alchemy

Humans are arrogant enough to think the universe cares about them.

That things happen as if the universe notices our nanosecond existences.

Things simply happen. Period.

By changing our perspective, we can turn good things bad.

The alchemists' search for the philosopher's stone may have symbolized the ability to turn our lead-like perceptions into gold.

Negativity bias tints our perceptions.

Normal sparring broke your elbow? Rest and rethink your training. Fired? You can improve your skills and get a better job.

Consider Curtis if he had fallen into despair.

The legend we call 50 Cent wouldn’t have existed.

The Best Lesson in Life Ever?

Neither avoid nor fear your reality.

That simple sentence contains every self-help tip and life lesson on Earth.

When reality is all there is, why fear it? avoidance?

Or worse, fleeing?

To accept reality, we must eliminate the words should be, could be, wish it were, and hope it will be.

It is. Period.

Only by accepting reality's chaos can you shape your life.

“Behind me is infinite power. Before me is endless possibility, around me is boundless opportunity. My strength is mental, physical and spiritual.” — 50 Cent

Tom Connor

3 years ago

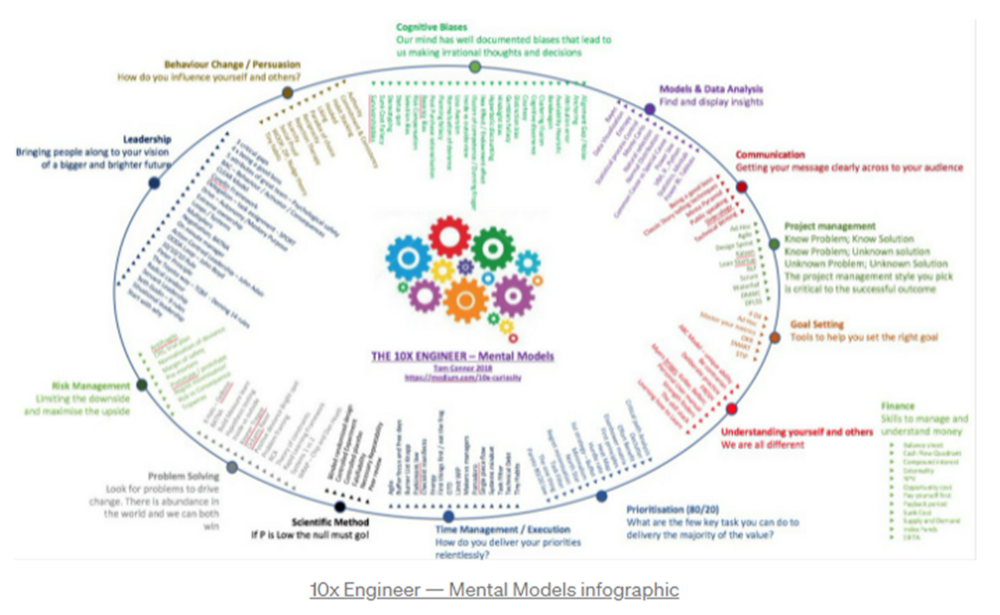

12 mental models that I use frequently

https://tomconnor.me/wp-content/uploads/2021/08/10x-Engineer-Mental-Models.pdf

I keep returning to the same mental models and tricks after writing and reading about a wide range of topics.

Top 12 mental models

12.

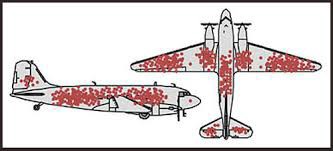

Survival bias - We perceive the surviving population as remarkable, yet they may have gotten there through sheer grit.

Survivorship bias affects us in many situations. Our retirement fund; the unicorn business; the winning team. We often study and imitate the last one standing. This can lead to genuine insights and performance improvements, but it can also lead us astray because the leader may just be lucky.

11.

The Helsinki Bus Theory - How to persevere Buss up!

Always display new work, and always be compared to others. Why? Easy. Keep riding. Stay on the fucking bus.

10.

Until it sticks… Turning up every day… — Artists teach engineers plenty. Quality work over a career comes from showing up every day and starting.

9.

WRAP decision making process (Heath Brothers)

Decision-making WRAP Model:

W — Widen your Options

R — Reality test your assumptions

A — Attain Distance

P — Prepare to be wrong or Right

8.

Systems for knowledge worker excellence - Todd Henry and Cal Newport write about techniques knowledge workers can employ to build a creative rhythm and do better work.

Todd Henry's FRESH framework:

Focus: Keep the start in mind as you wrap up.

Relationships: close a loop that's open.

Pruning is an energy.

Set aside time to be inspired by stimuli.

Hours: Spend time thinking.

7.

BBT is learning from mistakes. Science has transformed the world because it constantly updates its theories in light of failures. Complexity guarantees failure. Do we learn or self-justify?

6.

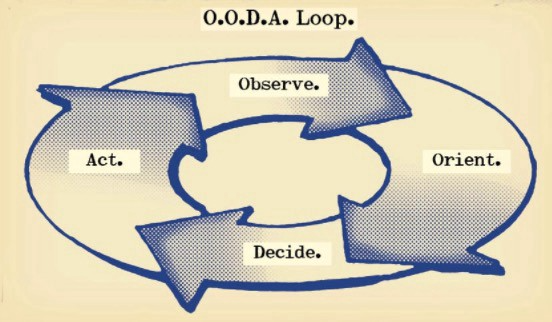

The OODA Loop - Competitive advantage

O: Observe: collect the data. Figure out exactly where you are, what’s happening.

O: Orient: analyze/synthesize the data to form an accurate picture.

D: Decide: select an action from possible options

A: Action: execute the action, and return to step (1)

Boyd's approach indicates that speed and agility are about information processing, not physical reactions. They form feedback loops. More OODA loops improve speed.

5.

Leaders who try to impose order in a complex situation fail; those who set the stage, step back, and allow patterns to develop win.

https://vimeo.com/640941172?embedded=true&source=vimeo_logo&owner=11999906

4.

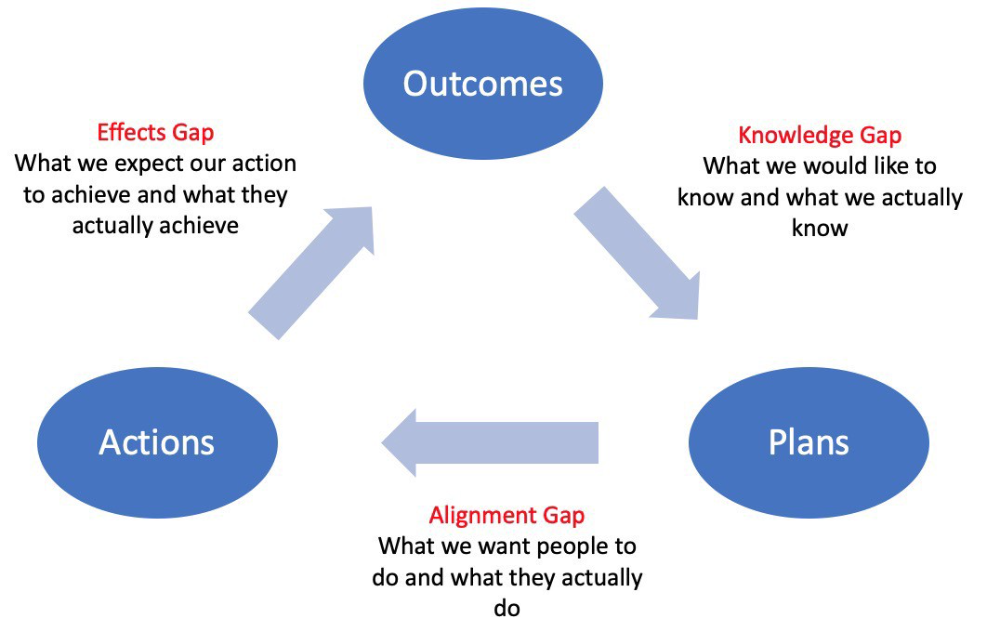

Information Gap - The discrepancy between what we know and what we would like to know

Gap in Alignment - What individuals actually do as opposed to what we wish them to do

Effects Gap - the discrepancy between our expectations and the results of our actions

3.

Theory of Constraints — The Goal - To maximize system production, maximize bottleneck throughput.

Goldratt creates a five-step procedure:

Determine the restriction

Improve the restriction.

Everything else should be based on the limitation.

Increase the restriction

Go back to step 1 Avoid letting inertia become a limitation.

Any non-constraint improvement is an illusion.

2.

Serendipity and the Adjacent Possible - Why do several amazing ideas emerge at once? How can you foster serendipity in your work?

You need specialized abilities to reach to the edge of possibilities, where you can pursue exciting tasks that will change the world. Few people do it since it takes a lot of hard work. You'll stand out if you do.

Most people simply lack the comfort with discomfort required to tackle really hard things. At some point, in other words, there’s no way getting around the necessity to clear your calendar, shut down your phone, and spend several hard days trying to make sense of the damn proof.

1.

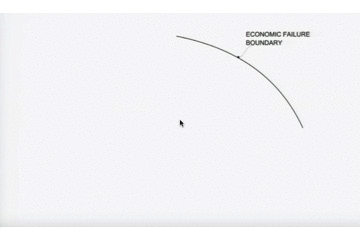

Boundaries of failure - Rasmussen's accident model.

Rasmussen modeled this. It has economic, workload, and performance boundaries.

The economic boundary is a company's profit zone. If the lights are on, you're within the economic boundaries, but there's pressure to cut costs and do more.

Performance limit reflects system capacity. Taking shortcuts is a human desire to minimize work. This is often necessary to survive because there's always more labor.

Both push operating points toward acceptable performance. Personal or process safety, or equipment performance.

If you exceed acceptable performance, you'll push back, typically forcefully.

Joe Procopio

3 years ago

Provide a product roadmap that can withstand startup velocities

This is how to build a car while driving.

Building a high-growth startup is compared to building a car while it's speeding down the highway.

How to plan without going crazy? Or, without losing team, board, and investor buy-in?

I just delivered our company's product roadmap for the rest of the year. Complete. Thorough. Page-long. I'm optimistic about its chances of surviving as everything around us changes, from internal priorities to the global economy.

It's tricky. This isn't the first time I've created a startup roadmap. I didn't invent a document. It took time to deliver a document that will be relevant for months.

Goals matter.

Although they never change, goals are rarely understood.

This is the third in a series about a startup's unique roadmapping needs. Velocity is the intensity at which a startup must produce to survive.

A high-growth startup moves at breakneck speed, which I alluded to when I said priorities and economic factors can change daily or weekly.

At that speed, a startup's roadmap must be flexible, bend but not break, and be brief and to the point. I can't tell you how many startups and large companies develop a product roadmap every quarter and then tuck it away.

Big, wealthy companies can do this. It's suicide for a startup.

The drawer thing happens because startup product roadmaps are often valid for a short time. The roadmap is a random list of features prioritized by different company factions and unrelated to company goals.

It's not because the goals changed that a roadmap is shelved or ignored. Because the company's goals were never communicated or documented in the context of its product.

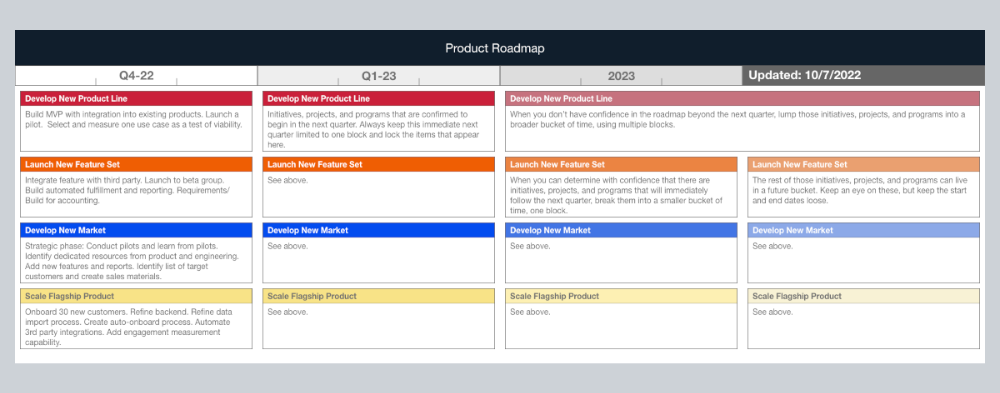

In the previous post, I discussed how to turn company goals into a product roadmap. In this post, I'll show you how to make a one-page startup roadmap.

In a future post, I'll show you how to follow this roadmap. This roadmap helps you track company goals, something a roadmap must do.

Be vague for growth, but direct for execution.

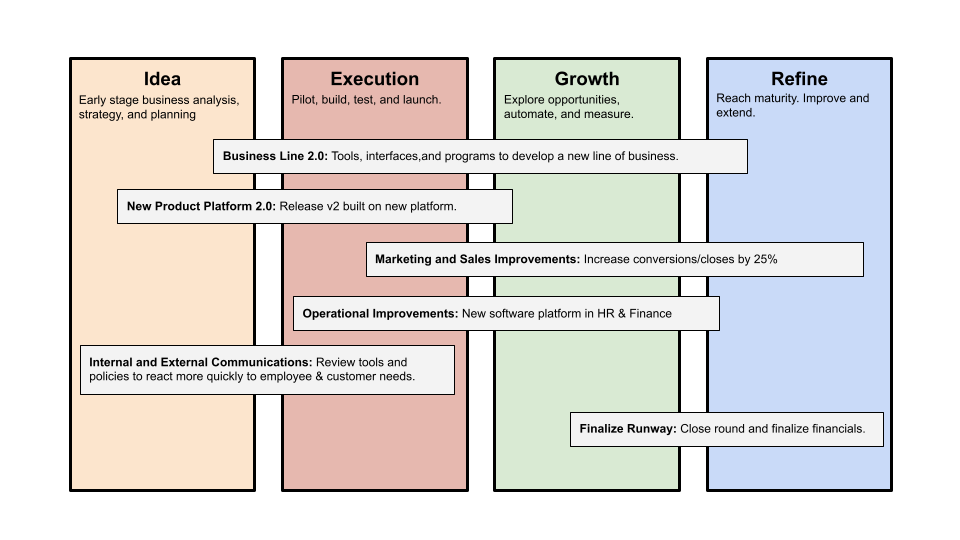

Here's my plan. The real one has more entries and more content in each.

Let's discuss smaller boxes.

Product developers and engineers know that the further out they predict, the more wrong they'll be. When developing the product roadmap, this rule is ignored. Then it bites us three, six, or nine months later when we haven't even started.

Why do we put everything in a product roadmap like a project plan?

Yes, I know. We use it when the product roadmap isn't goal-based.

A goal-based roadmap begins with a document that outlines each goal's idea, execution, growth, and refinement.

Once the goals are broken down into epics, initiatives, projects, and programs, only the idea and execution phases should be modeled. Any goal growth or refinement items should be vague and loosely mapped.

Why? First, any idea or execution-phase goal will result in growth initiatives that are unimaginable today. Second, internal priorities and external factors will change, but the goals won't. Locking items into calendar slots reduces flexibility and forces deviation from the single source of truth.

No soothsayers. Predicting the future is pointless; just prepare.

A map is useless if you don't know where you're going.

As we speed down the road, the car and the road will change. Goals define the destination.

This quarter and next quarter's roadmap should be set. After that, you should track destination milestones, not how to get there.

When you do that, even the most critical investors will understand the roadmap and buy in. When you track progress at the end of the quarter and revise your roadmap, the destination won't change.