More on Entrepreneurship/Creators

The woman

3 years ago

Because he worked on his side projects during working hours, my junior was fired and sued.

Many developers do it, but I don't approve.

Aren't many programmers part-time? Many work full-time but also freelance. If the job agreement allows it, I see no problem.

Tech businesses' policies vary. I have a friend in Google, Germany. According to his contract, he couldn't do an outside job. Google owns any code he writes while employed.

I was shocked. Later, I found that different Google regions have different policies.

A corporation can normally establish any agreement before hiring you. They're negotiable. When there's no agreement, state law may apply. In court, law isn't so simple.

I won't delve into legal details. Instead, let’s talk about the incident.

How he was discovered

In one month, he missed two deadlines. His boss was frustrated because the assignment wasn't difficult to miss twice. When a team can't finish work on time, they all earn bad grades.

He annoyed the whole team. One team member (anonymous) told the project manager he worked on side projects during office hours. He may have missed deadlines because of this.

The project manager was furious. He needed evidence. The manager caught him within a week. The manager told higher-ups immediately.

The company wanted to set an example

Management could terminate him and settle the problem. But the company wanted to set an example for those developers who breached the regulation.

Because dismissal isn't enough. Every organization invests heavily in developer hiring. If developers depart or are fired after a few months, the company suffers.

The developer spent 10 months there. The employer sacked him and demanded ten months' pay. Or they'd sue him.

It was illegal and unethical. The youngster paid the fine and left the company quietly to protect his career.

Right or wrong?

Is the developer's behavior acceptable? Let's discuss developer malpractice.

During office hours, may developers work on other projects? If they're bored during office hours, they might not. Check the employment contract or state law.

If there's no employment clause, check country/state law. Because you can't justify breaking the law. Always. Most employers own their employees' work hours unless it's a contractual position.

If the company agrees, it's fine.

I also oppose companies that force developers to work overtime without pay.

Most states and countries have laws that help companies and workers. Law supports employers in this case. If any of the following are true, the company/employer owns the IP under California law.

using the business's resources

any equipment, including a laptop used for business.

company's mobile device.

offices of the company.

business time as well. This is crucial. Because this occurred in the instance of my junior.

Company resources are dangerous. Because your company may own the product's IP. If you have seen the TV show Silicon Valley, you have seen a similar situation there, right?

Conclusion

Simple rule. I avoid big side projects. I work on my laptop on weekends for side projects. I'm safe. But I also know that my company might not be happy with that.

As an employee, I suppose I can. I can make side money. I won't promote it, but I'll respect their time, resources, and task. I also sometimes work extra time to finish my company’s deadlines.

Startup Journal

3 years ago

The Top 14 Software Business Ideas That Are Sure To Succeed in 2023

Software can change any company.

Software is becoming essential. Everyone should consider how software affects their lives and others'.

Software on your phone, tablet, or computer offers many new options. We're experts in enough ways now.

Software Business Ideas will be popular by 2023.

ERP Programs

ERP software meets rising demand.

ERP solutions automate and monitor tasks that large organizations, businesses, and even schools would struggle to do manually.

ERP software could reach $49 billion by 2024.

CRM Program

CRM software is a must-have for any customer-focused business.

Having an open mind about your business services and products allows you to change platforms.

Another company may only want your CRM service.

Medical software

Healthcare facilities need reliable, easy-to-use software.

EHRs, MDDBs, E-Prescribing, and more are software options.

The global medical software market could reach $11 billion by 2025, and mobile medical apps may follow.

Presentation Software in the Cloud

SaaS presentation tools are great.

They're easy to use, comprehensive, and full of traditional Software features.

In today's cloud-based world, these solutions make life easier for people. We don't know about you, but we like it.

Software for Project Management

People began working remotely without signs or warnings before the 2020 COVID-19 pandemic.

Many organizations found it difficult to track projects and set deadlines.

With PMP software tools, teams can manage remote units and collaborate effectively.

App for Blockchain-Based Invoicing

This advanced billing and invoicing solution is for businesses and freelancers.

These blockchain-based apps can calculate taxes, manage debts, and manage transactions.

Intelligent contracts help blockchain track transactions more efficiently. It speeds up and improves invoice generation.

Software for Business Communications

Internal business messaging is tricky.

Top business software tools for communication can share files, collaborate on documents, host video conferences, and more.

Payroll Automation System

Software development also includes developing an automated payroll system.

These software systems reduce manual tasks for timely employee payments.

These tools help enterprise clients calculate total wages quickly, simplify tax calculations, improve record-keeping, and support better financial planning.

System for Detecting Data Leaks

Both businesses and individuals value data highly. Yahoo's data breach is dangerous because of this.

This area of software development can help people protect their data.

You can design an advanced data loss prevention system.

AI-based Retail System

AI-powered shopping systems are popular. The systems analyze customers' search and purchase patterns and store history and are equipped with a keyword database.

These systems offer many customers pre-loaded products.

AI-based shopping algorithms also help users make purchases.

Software for Detecting Plagiarism

Software can help ensure your projects are original and not plagiarized.

These tools detect plagiarized content that Google, media, and educational institutions don't like.

Software for Converting Audio to Text

Machine Learning converts speech to text automatically.

These programs can quickly transcribe cloud-based files.

Software for daily horoscopes

Daily and monthly horoscopes will continue to be popular.

Software platforms that can predict forecasts, calculate birth charts, and other astrology resources are good business ideas.

E-learning Programs

Traditional study methods are losing popularity as virtual schools proliferate and physical space shrinks.

Khan Academy online courses are the best way to keep learning.

Online education portals can boost your learning. If you want to start a tech startup, consider creating an e-learning program.

Conclusion

Software is booming. There's never been a better time to start a software development business, with so many people using computers and smartphones. This article lists eight business ideas for 2023. Consider these ideas if you're just starting out or looking to expand.

Victoria Kurichenko

3 years ago

Updates From Google For Content Producers What You Should Know Is This

People-first update.

Every Google upgrade causes website owners to panic.

Some have just recovered from previous algorithm tweaks and resumed content development.

If you follow Google's Webmaster rules, you shouldn't fear its adjustments.

Everyone has a view of them. Miscommunication and confusion result.

Now, for some (hopefully) exciting news.

Google tweeted on August 18, 2022 about a fresh content update.

This change is another Google effort to remove low-quality, repetitive, and AI-generated content.

The algorithm generates and analyzes search results, not humans.

Google spends a lot to teach its algorithm what searchers want. Intent isn't always clear.

Google's content update aims to:

“… ensure people see more original, helpful content written by people, for people, in search results.”

Isn't it a noble goal?

However, what does it mean for content creators and website owners?

How can you ensure you’re creating content that will be successful after the updates roll out?

Let's first define people-first content.

What does "people-first-content" mean?

If asked, I'd say information written to answer queries and solve problems.

Like others, I read it from the term.

Content creators and marketers disagree. They need more information to follow recommendations.

Google gives explicit instructions for creating people-first content.

According to Google, if you answer yes to the following questions, you have a people-first attitude.

Do you have customers who might find your content useful if they contacted you directly?

Does your content show the breadth of your knowledge?

Do you have a niche or a focus for your website?

After reading your content, will readers learn something new to aid them in achieving their goals?

Are readers happy after reading your content?

Have you been adhering to Google's fundamental updates and product reviews?

As an SEO writer, I'm not scared.

I’ve been following these rules consciously while creating content for my website. That’s why it’s been steadily growing despite me publishing just one or two stories a month.

If you avoid AI-generated text and redundant, shallow material, your website won't suffer.

If you use unscrupulous methods to boost your website's traffic, including link buying or keyword stuffing, stop. Google is getting smarter and will find and punish your site eventually.

For those who say, “SEO is no longer working,” I dedicated the whole paragraph below.

This does not imply that SEO is obsolete.

Google:

“People-first content creators focus on creating satisfying content, while also utilizing SEO best practices to bring searchers additional value.”

The official helpful content update page lists two people-first content components:

meeting user needs

best practices for SEO

Always read official guidelines, not unsolicited suggestions.

SEO will work till search engines die.

How to use the update

Google said the changes will arrive in August 2022.

They pledged to post updates on Google's search ranking updates page.

Google also tweets this info. If you haven't followed it already, I recommend it.

Ranking adjustments could take two weeks and will affect English searches internationally initially.

Google affirmed plans to extend to other languages.

If you own a website, monitor your rankings and traffic to see if it's affected.

You might also like

Onchain Wizard

3 years ago

Three Arrows Capital & Celsius Updates

I read 1k+ page 3AC liquidation documentation so you don't have to. Also sharing revised Celsius recovery plans.

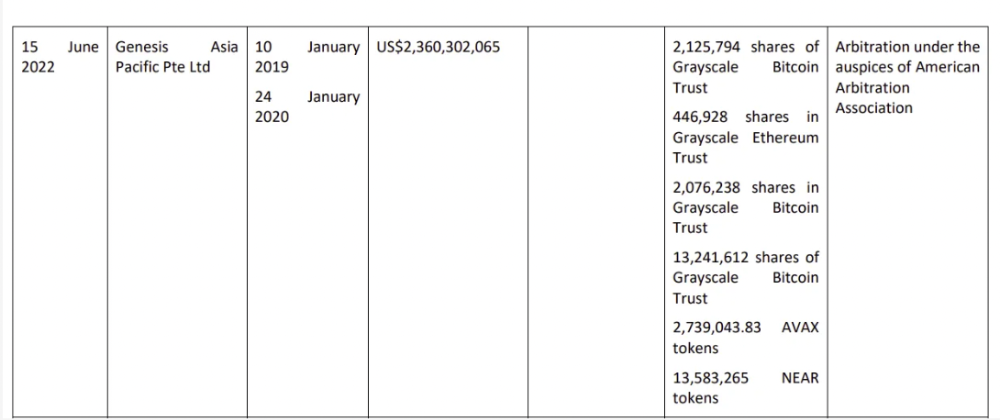

3AC's liquidation documents:

Someone disclosed 3AC liquidation records in the BVI courts recently. I'll discuss the leak's timeline and other highlights.

Three Arrows Capital began trading traditional currencies in emerging markets in 2012. They switched to equities and crypto, then purely crypto in 2018.

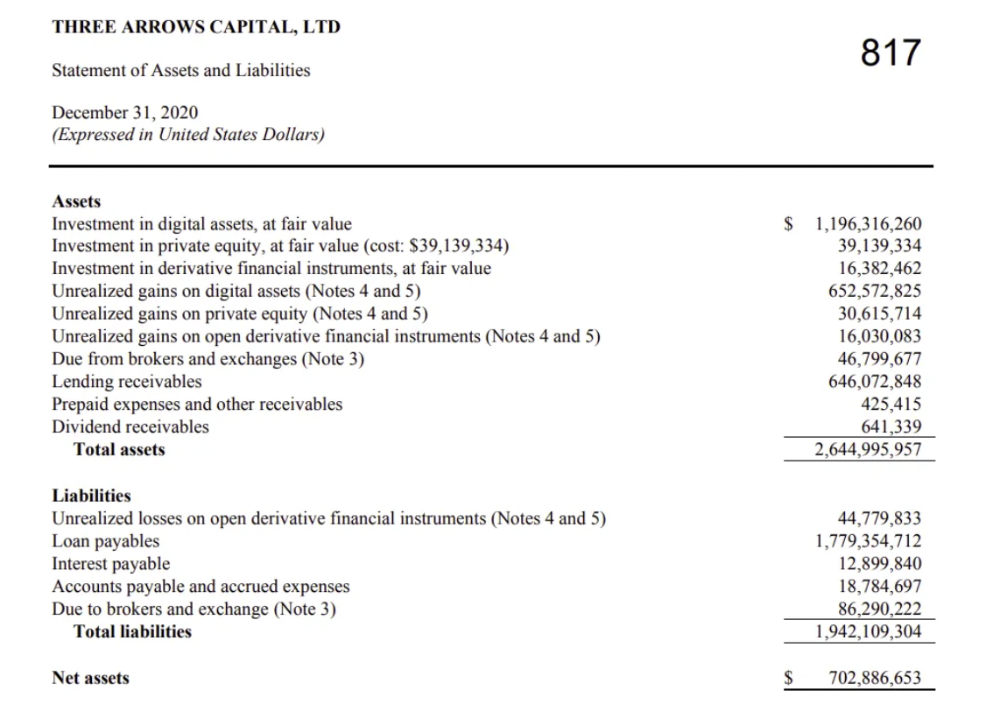

By 2020, the firm had $703mm in net assets and $1.8bn in loans (these guys really like debt).

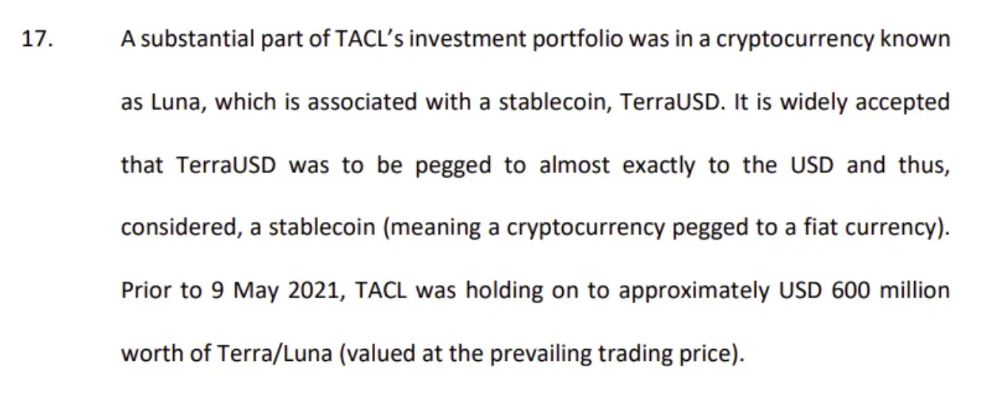

The firm's net assets under control reached $3bn in April 2022, according to the filings. 3AC had $600mm of LUNA/UST exposure before May 9th 2022, which put them over.

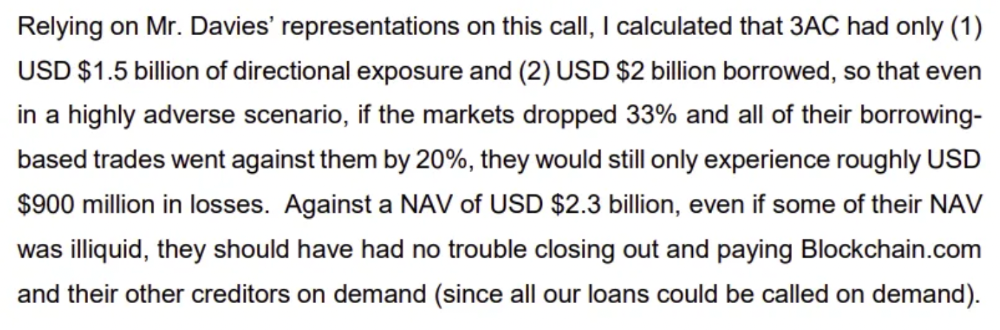

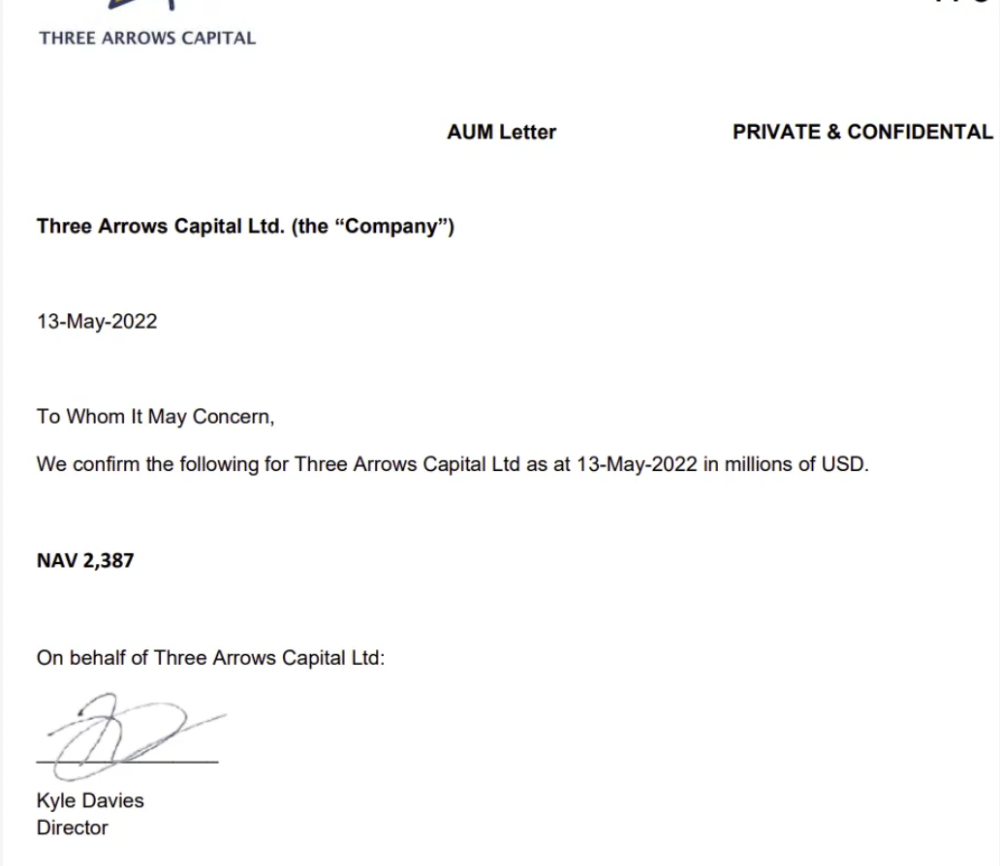

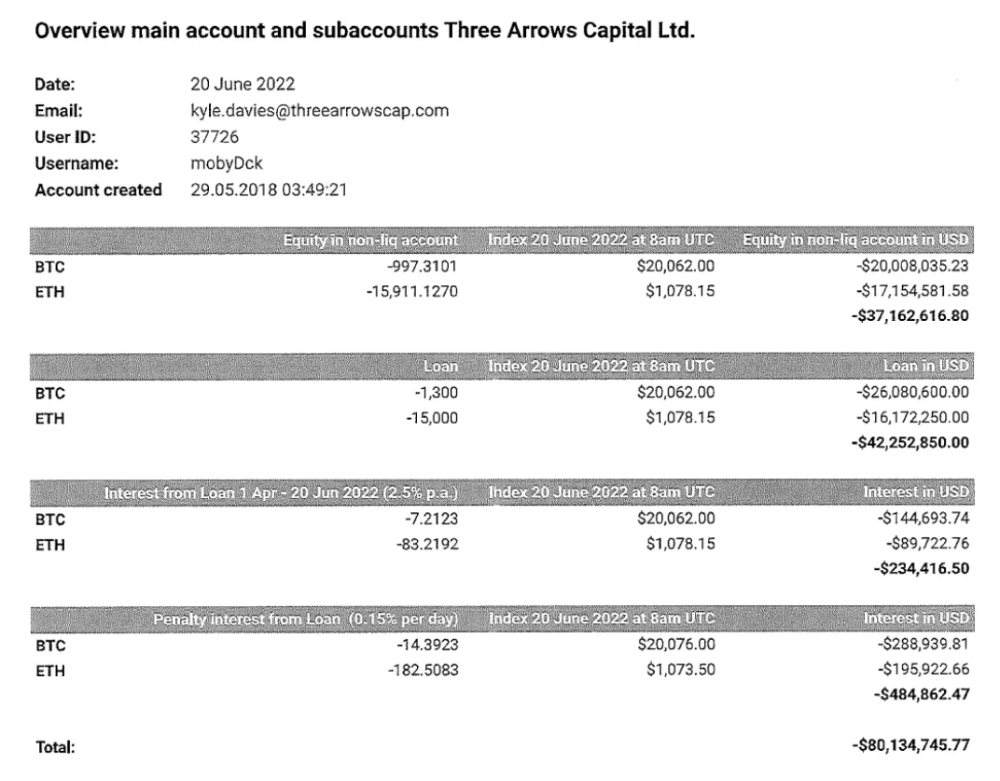

LUNA and UST go to zero quickly (I wrote about the mechanics of the blowup here). Kyle Davies, 3AC co-founder, told Blockchain.com on May 13 that they have $2.4bn in assets and $2.3bn NAV vs. $2bn in borrowings. As BTC and ETH plunged 33% and 50%, the company became insolvent by mid-2022.

3AC sent $32mm to Tai Ping Shen, a Cayman Islands business owned by Su Zhu and Davies' partner, Kelly Kaili Chen (who knows what is going on here).

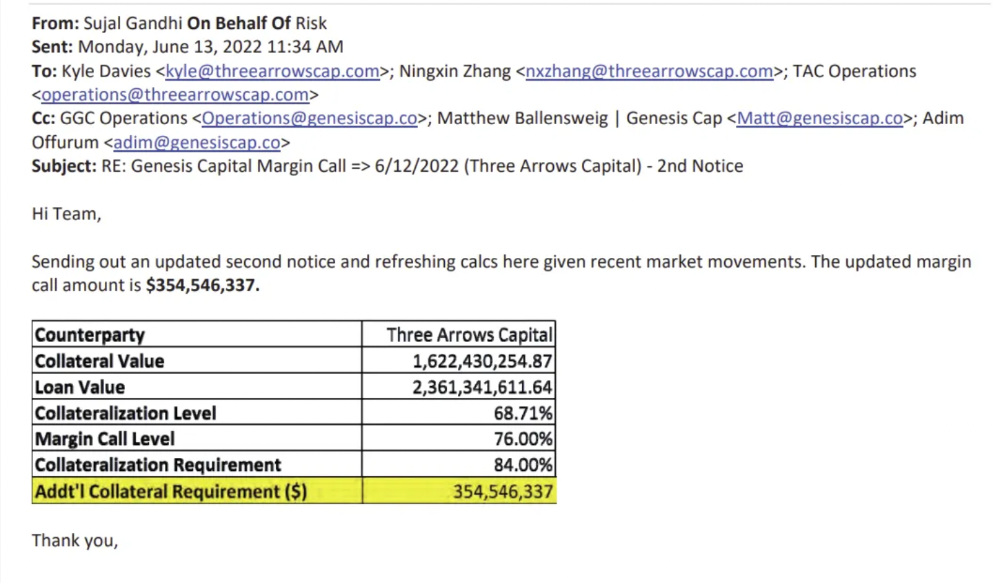

3AC had borrowed over $3.5bn in notional principle, with Genesis ($2.4bn) and Voyager ($650mm) having the most exposure.

Genesis demanded $355mm in further collateral in June.

Deribit (another 3AC investment) called for $80 million in mid-June.

Even in mid-June, the corporation was trying to borrow more money to stay afloat. They approached Genesis for another $125mm loan (to pay another lender) and HODLnauts for BTC & ETH loans.

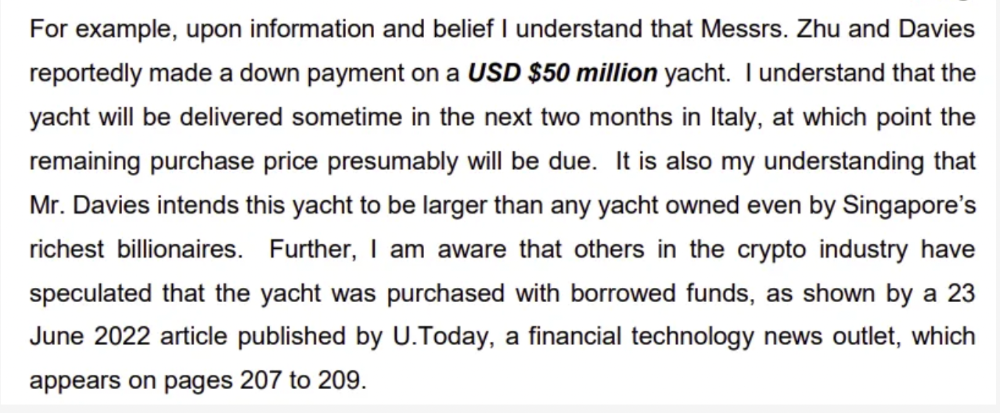

Pretty crazy. 3AC founders used borrowed money to buy a $50 million boat, according to the leak.

Su requesting for $5m + Chen Kaili Kelly asserting they loaned $65m unsecured to 3AC are identified as creditors.

Celsius:

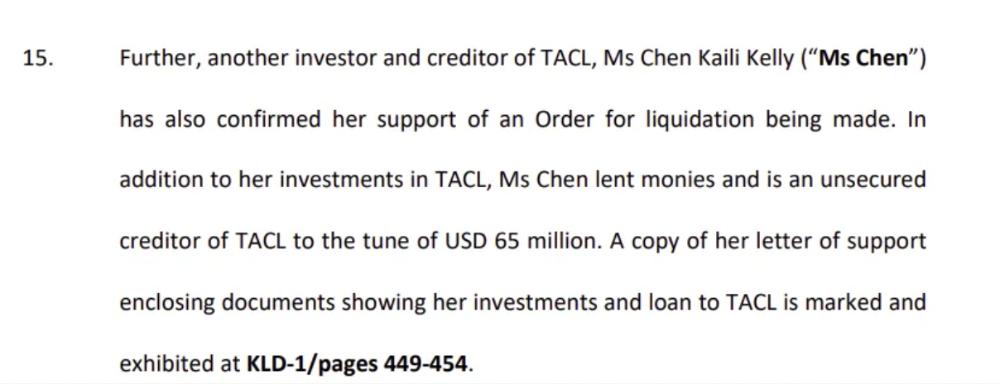

This bankruptcy presentation shows the Celsius breakdown from March to July 14, 2022. From $22bn to $4bn, crypto assets plummeted from $14.6bn to $1.8bn (ouch). $16.5bn in user liabilities dropped to $4.72bn.

In my recent post, I examined if "forced selling" is over, with Celsius' crypto assets being a major overhang. In this presentation, it looks that Chapter 11 will provide clients the opportunity to accept cash at a discount or remain long crypto. Provided that a fresh source of money is unlikely to enter the Celsius situation, cash at a discount or crypto given to customers will likely remain a near-term market risk - cash at a discount will likely come from selling crypto assets, while customers who receive crypto could sell at any time. I'll share any Celsius updates I find.

Conclusion

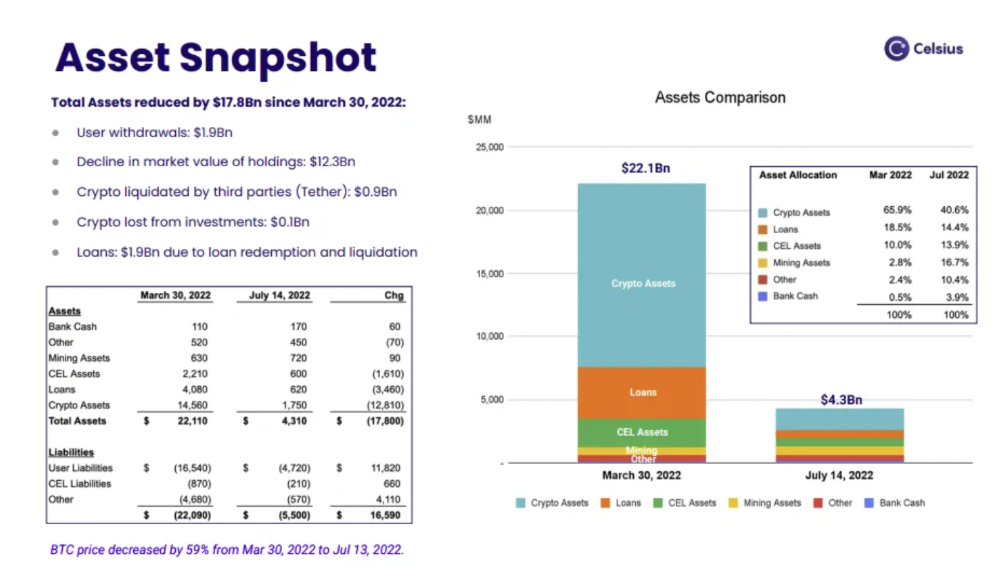

Only Celsius and the Mt Gox BTC unlock remain as forced selling catalysts. While everything went through a "relief" pump, with ETH up 75% from the bottom and numerous alts multiples higher, there are still macro dangers to equities + risk assets. There's a lot of wealth waiting to be deployed in crypto ($153bn in stables), but fund managers are risk apprehensive (lower than 2008 levels).

We're hopefully over crypto's "bottom," with peak anxiety and forced selling behind us, but we may chop around.

To see the full article, click here.

The woman

3 years ago

Why Google's Hiring Process is Brilliant for Top Tech Talent

Without a degree and experience, you can get a high-paying tech job.

Most organizations follow this hiring rule: you chat with HR, interview with your future boss and other senior managers, and they make the final hiring choice.

If you've ever applied for a job, you know how arduous it can be. A newly snapped photo and a glossy resume template can wear you out. Applying to Google can change this experience.

According to an Universum report, Google is one of the world's most coveted employers. It's not simply the search giant's name and reputation that attract candidates, but its role requirements or lack thereof.

Candidates no longer need a beautiful resume, cover letter, Ivy League laurels, or years of direct experience. The company requires no degree or experience.

Elon Musk started it. He employed the two-hands test to uncover talented non-graduates. The billionaire eliminated the requirement for experience.

Google is deconstructing traditional employment with programs like the Google Project Management Degree, a free online and self-paced professional credential course.

Google's hiring is interesting. After its certification course, applicants can work in project management. Instead of academic degrees and experience, the company analyzes coursework.

Google finds the best project managers and technical staff in exchange. Google uses three strategies to find top talent.

Chase down the innovators

Google eliminates restrictions like education, experience, and others to find the polar bear amid the snowfall. Google's free project management education makes project manager responsibilities accessible to everyone.

Many jobs don't require a degree. Overlooking individuals without a degree can make it difficult to locate a candidate who can provide value to a firm.

Firsthand knowledge follows the same rule. A lack of past information might be an employer's benefit. This is true for creative teams or businesses that prefer to innovate.

Or when corporations conduct differently from the competition. No-experience candidates can offer fresh perspectives. Fast Company reports that people with no sales experience beat those with 10 to 15 years of experience.

Give the aptitude test first priority.

Google wants the best candidates. Google wouldn't be able to receive more applications if it couldn't screen them for fit. Its well-organized online training program can be utilized as a portfolio.

Google learns a lot about an applicant through completed assignments. It reveals their ability, leadership style, communication capability, etc. The course mimics the job to assess candidates' suitability.

Basic screening questions might provide information to compare candidates. Any size small business can use screening questions and test projects to evaluate prospective employees.

Effective training for employees

Businesses must train employees regardless of their hiring purpose. Formal education and prior experience don't guarantee success. Maintaining your employees' professional knowledge gaps is key to their productivity and happiness. Top-notch training can do that. Learning and development are key to employee engagement, says Bob Nelson, author of 1,001 Ways to Engage Employees.

Google's online certification program isn't available everywhere. Improving the recruiting process means emphasizing aptitude over experience and a degree. Instead of employing new personnel and having them work the way their former firm trained them, train them how you want them to function.

If you want to know more about Google’s recruiting process, we recommend you watch the movie “Internship.”

Akshad Singi

3 years ago

Four obnoxious one-minute habits that help me save more than 30 hours each week

These four, when combined, destroy procrastination.

You're not rushed. You waste it on busywork.

You'll accept this eventually.

In 2022, the daily average usage of a user on social media is 2.5 hours.

By 2020, 6 billion hours of video were watched each month by Netflix's customers, who used the service an average of 3.2 hours per day.

When we see these numbers, we think "Wow!" People squander so much time as though they don't contribute. True. These are yours. Likewise.

We don't lack time; we just waste it. Once you realize this, you can change your habits to save time. This article explains. If you adopt ALL 4 of these simple behaviors, you'll see amazing benefits.

Time-blocking

Cal Newport's time-blocking trick takes a minute but improves your day's clarity.

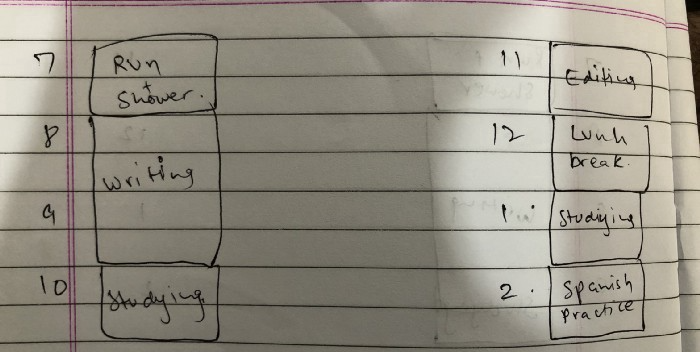

Divide the next day into 30-minute (or 5-minute, if you're Elon Musk) segments and assign responsibilities. As seen.

Here's why:

The procrastination that results from attempting to determine when to begin working is eliminated. Procrastination is a given if you choose when to begin working in real-time. Even if you may assume you'll start working in five minutes, it won't take you long to realize that five minutes have turned into an hour. But if you've already determined to start working at 2:00 the next day, your odds of procrastinating are greatly decreased, if not eliminated altogether.

You'll also see that you have a lot of time in a day when you plan your day out on paper and assign chores to each hour. Doing this daily will permanently eliminate the lack of time mindset.

5-4-3-2-1: Have breakfast with the frog!

“If it’s your job to eat a frog, it’s best to do it first thing in the morning. And If it’s your job to eat two frogs, it’s best to eat the biggest one first.”

Eating the frog means accomplishing the day's most difficult chore. It's better to schedule it first thing in the morning when time-blocking the night before. Why?

The day's most difficult task is also the one that causes the most postponement. Because of the stress it causes, the later you schedule it, the more time you risk wasting by procrastinating.

However, if you do it right away in the morning, you'll feel good all day. This is the reason it was set for the morning.

Mel Robbins' 5-second rule can help. Start counting backward 54321 and force yourself to start at 1. If you acquire the urge to work on a goal, you must act within 5 seconds or your brain will destroy it. If you're scheduled to eat your frog at 9, eat it at 8:59. Start working.

Micro-visualisation

You've heard of visualizing to enhance the future. Visualizing a bright future won't do much if you're not prepared to focus on the now and develop the necessary habits. Alexander said:

People don’t decide their futures. They decide their habits and their habits decide their future.

I visualize the next day's schedule every morning. My day looks like this

“I’ll start writing an article at 7:30 AM. Then, I’ll get dressed up and reach the medicine outpatient department by 9:30 AM. After my duty is over, I’ll have lunch at 2 PM, followed by a nap at 3 PM. Then, I’ll go to the gym at 4…”

etc.

This reinforces the day you planned the night before. This makes following your plan easy.

Set the timer.

It's the best iPhone productivity app. A timer is incredible for increasing productivity.

Set a timer for an hour or 40 minutes before starting work. Your call. I don't believe in techniques like the Pomodoro because I can focus for varied amounts of time depending on the time of day, how fatigued I am, and how cognitively demanding the activity is.

I work with a timer. A timer keeps you focused and prevents distractions. Your mind stays concentrated because of the timer. Timers generate accountability.

To pee, I'll pause my timer. When I sit down, I'll continue. Same goes for bottle refills. To use Twitter, I must pause the timer. This creates accountability and focuses work.

Connecting everything

If you do all 4, you won't be disappointed. Here's how:

Plan out your day's schedule the night before.

Next, envision in your mind's eye the same timetable in the morning.

Speak aloud 54321 when it's time to work: Eat the frog! In the morning, devour the largest frog.

Then set a timer to ensure that you remain focused on the task at hand.