Why I Love Azuki

Azuki Banner (www.azuki.com)

Disclaimer: This is my personal viewpoint. I'm not on the Azuki team. Please keep in mind that I am merely a fan, community member, and holder. Please do your own research and pardon my grammar. Thanks!

Azuki has changed my view of NFTs.

When I first entered the NFT world, I had no idea what to expect. I liked the idea. So I invested in some projects, fought for whitelists, and discovered some cool NFTs projects (shout-out to CATC). I lost more money than I earned at one point, but I hadn't invested excessively (only put in what you can afford to lose). Despite my losses, I kept looking. I almost waited for the “ah-ha” moment. A NFT project that changed my perspective on NFTs. What makes an NFT project more than a work of art?

Answer: Azuki.

The Art

The Azuki art drew me in as an anime fan. It looked like something out of an anime, and I'd never seen it before in NFT.

The project was still new. The first two animated teasers were released with little fanfare, but I was impressed with their quality. You can find them on Instagram or in their earlier Tweets.

The teasers hinted that this project could be big and that the team could deliver. It was amazing to see Shao cut the Azuki posters with her katana. Especially at the end when she sheaths her sword and the music cues. Then the live action video of the young boy arranging the Azuki posters seemed movie-like. I felt like I was entering the Azuki story, brand, and dope theme.

The team did not disappoint with the Azuki NFTs. The level of detail in the art is stunning. There were Azukis of all genders, skin and hair types, and more. These 10,000 Azukis have so much representation that almost anyone can find something that resonates. Rather than me rambling on, I suggest you visit the Azuki gallery

The Team

If the art is meant to draw you in and be the project's face, the team makes it more. The NFT would be a JPEG without a good team leader. Not that community isn't important, but no community would rally around a bad team.

Because I've been rugged before, I'm very focused on the team when considering a project. While many project teams are anonymous, I try to find ones that are doxxed (public) or at least appear to be established. Unlike Azuki, where most of the Azuki team is anonymous, Steamboy is public. He is (or was) Overwatch's character art director and co-creator of Azuki. I felt reassured and could trust the project after seeing someone from a major game series on the team.

Then I tried to learn as much as I could about the team. Following everyone on Twitter, reading their tweets, and listening to recorded AMAs. I was impressed by the team's professionalism and dedication to their vision for Azuki, led by ZZZAGABOND.

I believe the phrase “actions speak louder than words” applies to Azuki. I can think of a few examples of what the Azuki team has done, but my favorite is ERC721A.

With ERC721A, Azuki has created a new algorithm that allows minting multiple NFTs for essentially the same cost as minting one NFT.

I was ecstatic when the dev team announced it. This fascinates me as a self-taught developer. Azuki released a product that saves people money, improves the NFT space, and is open source. It showed their love for Azuki and the NFT community.

The Community

Community, community, community. It's almost a chant in the NFT space now. A community, like a team, can make or break a project. We are the project's consumers, shareholders, core, and lifeblood. The team builds the house, and we fill it. We stay for the community.

When I first entered the Azuki Discord, I was surprised by the calm atmosphere. There was no news about the project. No release date, no whitelisting requirements. No grinding or spamming either. People just wanted to hangout, get to know each other, and talk. It was nice. So the team could pick genuine people for their mintlist (aka whitelist).

But nothing fundamental has changed since the release. It has remained an authentic, fun, and helpful community. I'm constantly logging into Discord to chat with others or follow conversations. I see the community's openness to newcomers. Everyone respects each other (barring a few bad apples) and the variety of people passing through is fascinating. This human connection and interaction is what I enjoy about this place. Being a part of a group that supports a cause.

Finally, I want to thank the amazing Azuki mod team and the kissaten channel for their contributions.

The Brand

So, what sets Azuki apart from other projects? They are shaping a brand or identity. The Azuki website, I believe, best captures their vision. (This is me gushing over the site.)

If you go to the website, turn on the dope playlist in the bottom left. The playlist features a mix of Asian and non-Asian hip-hop and rap artists, with some lo-fi thrown in. The songs on the playlist change, but I think you get the vibe Azuki embodies just by turning on the music.

The Garden is our next stop where we are introduced to Azuki.

A brand.

We're creating a new brand together.

A metaverse brand. By the people.

A collection of 10,000 avatars that grant Garden membership. It starts with exclusive streetwear collabs, NFT drops, live events, and more. Azuki allows for a new media genre that the world has yet to discover. Let's build together an Azuki, your metaverse identity.

The Garden is a magical internet corner where art, community, and culture collide. The boundaries between the physical and digital worlds are blurring.

Try a Red Bean.

The text begins with Azuki's intention in the space. It's a community-made metaverse brand. Then it goes into more detail about Azuki's plans. Initiation of a story or journey. "Would you like to take the red bean and jump down the rabbit hole with us?" I love the Matrix red pill or blue pill play they used. (Azuki in Japanese means red bean.)

Morpheus, the rebel leader, offers Neo the choice of a red or blue pill in The Matrix. “You take the blue pill... After the story, you go back to bed and believe whatever you want. Your red pill... Let me show you how deep the rabbit hole goes.” Aware that the red pill will free him from the enslaving control of the machine-generated dream world and allow him to escape into the real world, he takes it. However, living the “truth of reality” is harsher and more difficult.

It's intriguing and draws you in. Taking the red bean causes what? Where am I going? I think they did well in piqueing a newcomer's interest.

Not convinced by the Garden? Read the Manifesto. It reinforces Azuki's role.

Here comes a new wave…

And surfing here is different.

Breaking down barriers.

Building open communities.

Creating magic internet money with our friends.

To those who don’t get it, we tell them: gm.

They’ll come around eventually.

Here’s to the ones with the courage to jump down a peculiar rabbit hole.

One that pulls you away from a world that’s created by many and owned by few…

To a world that’s created by more and owned by all.

From The Garden come the human beans that sprout into your family.

We rise together.

We build together.

We grow together.

Ready to take the red bean?

Not to mention the Mindmap, it sets Azuki apart from other projects and overused Roadmaps. I like how the team recognizes that the NFT space is not linear. So many of us are still trying to figure it out. It is Azuki's vision to adapt to changing environments while maintaining their values. I admire their commitment to long-term growth.

Conclusion

To be honest, I have no idea what the future holds. Azuki is still new and could fail. But I'm a long-term Azuki fan. I don't care about quick gains. The future looks bright for Azuki. I believe in the team's output. I love being an Azuki.

Thank you! IKUZO!

Full post here

Sam Hickmann

3 years ago

+1 💪

More on NFTs & Art

xuanling11

3 years ago

Reddit NFT Achievement

Reddit's NFT market is alive and well.

NFT owners outnumber OpenSea on Reddit.

Reddit NFTs flip in OpenSea in days:

Fast-selling.

NFT sales will make Reddit's current communities more engaged.

I don't think NFTs will affect existing groups, but they will build hype for people to acquire them.

The first season of Collectibles is unique, but many missed the first season.

Second-season NFTs are less likely to be sold for a higher price than first-season ones.

If you use Reddit, it's fun to own NFTs.

Yogita Khatri

3 years ago

Moonbirds NFT sells for $1 million in first week

On Saturday, Moonbird #2642, one of the collection's rarest NFTs, sold for a record 350 ETH (over $1 million) on OpenSea.

The Sandbox, a blockchain-based gaming company based in Hong Kong, bought the piece. The seller, "oscuranft" on OpenSea, made around $600,000 after buying the NFT for 100 ETH a week ago.

Owl avatars

Moonbirds is a 10,000 owl NFT collection. It is one of the quickest collections to achieve bluechip status. Proof, a media startup founded by renowned VC Kevin Rose, launched Moonbirds on April 16.

Rose is currently a partner at True Ventures, a technology-focused VC firm. He was a Google Ventures general partner and has 1.5 million Twitter followers.

Rose has an NFT podcast on Proof. It follows Proof Collective, a group of 1,000 NFT collectors and artists, including Beeple, who hold a Proof Collective NFT and receive special benefits.

These include early access to the Proof podcast and in-person events.

According to the Moonbirds website, they are "the official Proof PFP" (picture for proof).

Moonbirds NFTs sold nearly $360 million in just over a week, according to The Block Research and Dune Analytics. Its top ten sales range from $397,000 to $1 million.

In the current market, Moonbirds are worth 33.3 ETH. Each NFT is 2.5 ETH. Holders have gained over 12 times in just over a week.

Why was it so popular?

The Block Research's NFT analyst, Thomas Bialek, attributes Moonbirds' rapid rise to Rose's backing, the success of his previous Proof Collective project, and collectors' preference for proven NFT projects.

Proof Collective NFT holders have made huge gains. These NFTs were sold in a Dutch auction last December for 5 ETH each. According to OpenSea, the current floor price is 109 ETH.

According to The Block Research, citing Dune Analytics, Proof Collective NFTs have sold over $39 million to date.

Rose has bigger plans for Moonbirds. Moonbirds is introducing "nesting," a non-custodial way for holders to stake NFTs and earn rewards.

Holders of NFTs can earn different levels of status based on how long they keep their NFTs locked up.

"As you achieve different nest status levels, we can offer you different benefits," he said. "We'll have in-person meetups and events, as well as some crazy airdrops planned."

Rose went on to say that Proof is just the start of "a multi-decade journey to build a new media company."

Boris Müller

3 years ago

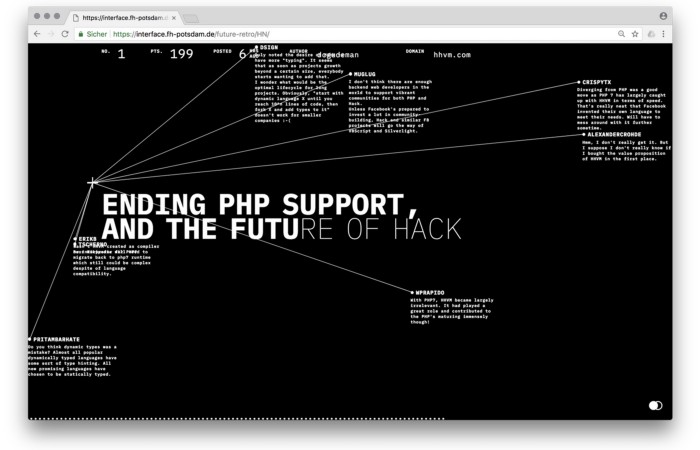

Why Do Websites Have the Same Design?

My kids redesigned the internet because it lacks inventiveness.

Internet today is bland. Everything is generic: fonts, layouts, pages, and visual language. Microtypography is messy.

Web design today seems dictated by technical and ideological constraints rather than creativity and ideas. Text and graphics are in containers on every page. All design is assumed.

Ironically, web technologies can design a lot. We can execute most designs. We make shocking, evocative websites. Experimental typography, generating graphics, and interactive experiences are possible.

Even designer websites use containers in containers. Dribbble and Behance, the two most popular creative websites, are boring. Lead image.

How did this happen?

Several reasons. WordPress and other blogging platforms use templates. These frameworks build web pages by combining graphics, headlines, body content, and videos. Not designs, templates. These rules combine related data types. These platforms don't let users customize pages beyond the template. You filled the template.

Templates are content-neutral. Thus, the issue.

Form should reflect and shape content, which is a design principle. Separating them produces content containers. Templates have no design value.

One of the fundamental principles of design is a deep and meaningful connection between form and content.

Web design lacks imagination for many reasons. Most are pragmatic and economic. Page design takes time. Large websites lack the resources to create a page from scratch due to the speed of internet news and the frequency of new items. HTML, JavaScript, and CSS continue to challenge web designers. Web design can't match desktop publishing's straightforward operations.

Designers may also be lazy. Mobile-first, generic, framework-driven development tends to ignore web page visual and contextual integrity.

How can we overcome this? How might expressive and avant-garde websites look today?

Rediscovering the past helps design the future.

'90s-era web design

At the University of the Arts Bremen's research and development group, I created my first website 23 years ago. Web design was trendy. Young web. Pages inspired me.

We struggled with HTML in the mid-1990s. Arial, Times, and Verdana were the only web-safe fonts. Anything exciting required table layouts, monospaced fonts, or GIFs. HTML was originally content-driven, thus we had to work against it to create a page.

Experimental typography was booming. Designers challenged the established quo from Jan Tschichold's Die Neue Typographie in the twenties to April Greiman's computer-driven layouts in the eighties. By the mid-1990s, an uncommon confluence of technological and cultural breakthroughs enabled radical graphic design. Irma Boom, David Carson, Paula Scher, Neville Brody, and others showed it.

Early web pages were dull compared to graphic design's aesthetic explosion. The Web Design Museum shows this.

Nobody knew how to conduct browser-based graphic design. Web page design was undefined. No standards. No CMS (nearly), CSS, JS, video, animation.

Now is as good a time as any to challenge the internet’s visual conformity.

In 2018, everything is browser-based. Massive layouts to micro-typography, animation, and video. How do we use these great possibilities? Containerized containers. JavaScript-contaminated mobile-first pages. Visually uniform templates. Web design 23 years later would disappoint my younger self.

Our imagination, not technology, restricts web design. We're too conformist to aesthetics, economics, and expectations.

Crisis generates opportunity. Challenge online visual conformity now. I'm too old and bourgeois to develop a radical, experimental, and cutting-edge website. I can ask my students.

I taught web design at the Potsdam Interface Design Programme in 2017. Each team has to redesign a website. Create expressive, inventive visual experiences on the browser. Create with contemporary web technologies. Avoid usability, readability, and flexibility concerns. Act. Ignore Erwartungskonformität.

The class outcome pleased me. This overview page shows all results. Four diverse projects address the challenge.

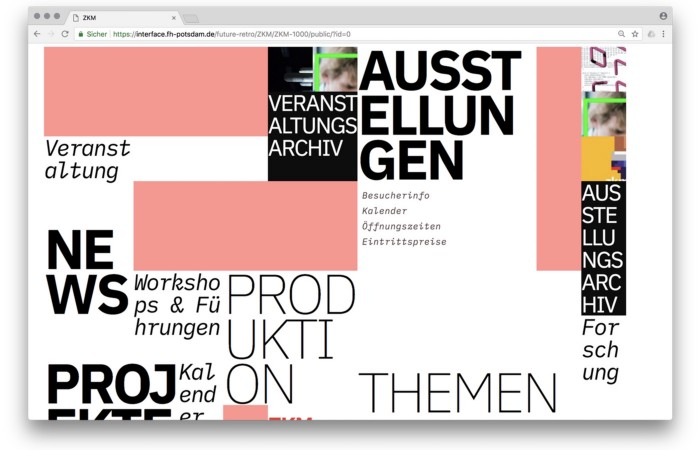

1. ZKM by Frederic Haase and Jonas Köpfer

Frederic and Jonas began their experiments on the ZKM website. The ZKM is Germany's leading media art exhibition location, but its website remains conventional. It's useful but not avant-garde like the shows' art.

Frederic and Jonas designed the ZKM site's concept, aesthetic language, and technical configuration to reflect the museum's progressive approach. A generative design engine generates new layouts for each page load.

ZKM redesign.

2. Streem by Daria Thies, Bela Kurek, and Lucas Vogel

Street art magazine Streem. It promotes new artists and societal topics. Streem includes artwork, painting, photography, design, writing, and journalism. Daria, Bela, and Lucas used these influences to develop a conceptual metropolis. They designed four neighborhoods to reflect magazine sections for their prototype. For a legible city, they use powerful illustrative styles and spatial typography.

Streem makeover.

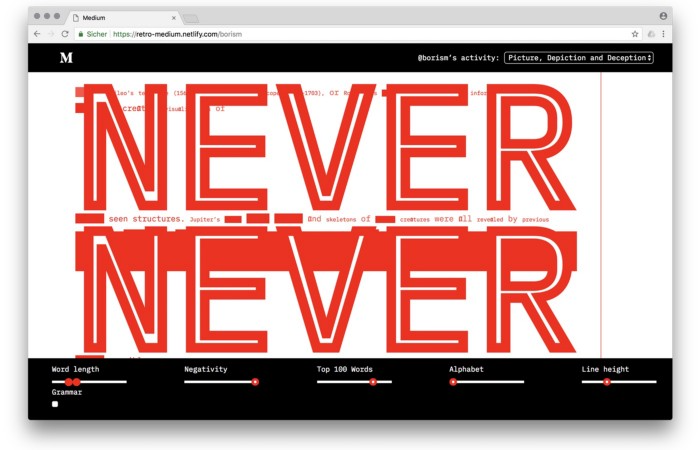

3. Medium by Amelie Kirchmeyer and Fabian Schultz

Amelie and Fabian structured. Instead of developing a form for a tale, they dissolved a web page into semantic, syntactical, and statistical aspects. HTML's flexibility was their goal. They broke Medium posts into experimental typographic space.

Medium revamp.

4. Hacker News by Fabian Dinklage and Florian Zia

Florian and Fabian made Hacker News interactive. The social networking site aggregates computer science and IT news. Its voting and debate features are extensive despite its simple style. Fabian and Florian transformed the structure into a typographic timeline and network area. News and comments sequence and connect the visuals. To read Hacker News, they connected their design to the API. Hacker News makeover.

Communication is not legibility, said Carson. Apply this to web design today. Modern websites must be legible, usable, responsive, and accessible. They shouldn't limit its visual palette. Visual and human-centered design are not stereotypes.

I want radical, generative, evocative, insightful, adequate, content-specific, and intelligent site design. I want to rediscover web design experimentation. More surprises please. I hope the web will appear different in 23 years.

Update: this essay has sparked a lively discussion! I wrote a brief response to the debate's most common points: Creativity vs. Usability

You might also like

Jano le Roux

3 years ago

My Top 11 Tools For Building A Modern Startup, With A Free Plan

The best free tools are probably unknown to you.

Modern startups are easy to build.

Start with free tools.

Let’s go.

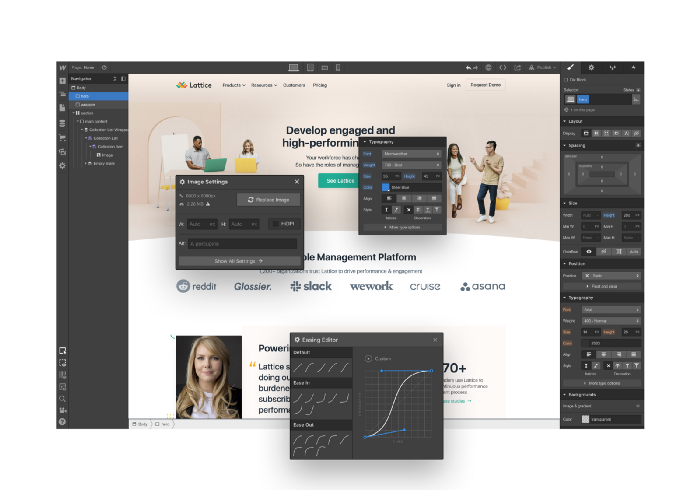

Web development — Webflow

Code-free HTML, CSS, and JS.

Webflow isn't like Squarespace, Wix, or Shopify.

It's a super-fast no-code tool for professionals to construct complex, highly-responsive websites and landing pages.

Webflow can help you add animations like those on Apple's website to your own site.

I made the jump from WordPress a few years ago and it changed my life.

No damn plugins. No damn errors. No damn updates.

The best, you can get started on Webflow for free.

Data tracking — Airtable

Spreadsheet wings.

Airtable combines spreadsheet flexibility with database power without code.

Airtable is modern.

Airtable has modularity.

Scaling Airtable is simple.

Airtable, one of the most adaptable solutions on this list, is perfect for client data management.

Clients choose customized service packages. Airtable consolidates data so you can automate procedures like invoice management and focus on your strengths.

Airtable connects with so many tools that rarely creates headaches. Airtable scales when you do.

Airtable's flexibility makes it a potential backend database.

Design — Figma

Better, faster, easier user interface design.

Figma rocks!

It’s fast.

It's free.

It's adaptable

First, design in Figma.

Iterate.

Export development assets.

Figma lets you add more team members as your company grows to work on each iteration simultaneously.

Figma is web-based, so you don't need a powerful PC or Mac to start.

Task management — Trello

Unclock jobs.

Tacky and terrifying task management products abound. Trello isn’t.

Those that follow Marie Kondo will appreciate Trello.

Everything is clean.

Nothing is complicated.

Everything has a place.

Compared to other task management solutions, Trello is limited. And that’s good. Too many buttons lead to too many decisions lead to too many hours wasted.

Trello is a must for teamwork.

Domain email — Zoho

Free domain email hosting.

Professional email is essential for startups. People relied on monthly payments for too long. Nope.

Zoho offers 5 free professional emails.

It doesn't have Google's UI, but it works.

VPN — Proton VPN

Fast Swiss VPN protects your data and privacy.

Proton VPN is secure.

Proton doesn't record any data.

Proton is based in Switzerland.

Swiss privacy regulation is among the most strict in the world, therefore user data are protected. Switzerland isn't a 14 eye country.

Journalists and activists trust Proton to secure their identities while accessing and sharing information authoritarian governments don't want them to access.

Web host — Netlify

Free fast web hosting.

Netlify is a scalable platform that combines your favorite tools and APIs to develop high-performance sites, stores, and apps through GitHub.

Serverless functions and environment variables preserve API keys.

Netlify's free tier is unmissable.

100GB of free monthly bandwidth.

Free 125k serverless operations per website each month.

Database — MongoDB

Create a fast, scalable database.

MongoDB is for small and large databases. It's a fast and inexpensive database.

Free for the first million reads.

Then, for each million reads, you must pay $0.10.

MongoDB's free plan has:

Encryption from end to end

Continual authentication

field-level client-side encryption

If you have a large database, you can easily connect MongoDB to Webflow to bypass CMS limits.

Automation — Zapier

Time-saving tip: automate repetitive chores.

Zapier simplifies life.

Zapier syncs and connects your favorite apps to do impossibly awesome things.

If your online store is connected to Zapier, a customer's purchase can trigger a number of automated actions, such as:

The customer is being added to an email chain.

Put the information in your Airtable.

Send a pre-programmed postcard to the customer.

Alexa, set the color of your smart lights to purple.

Zapier scales when you do.

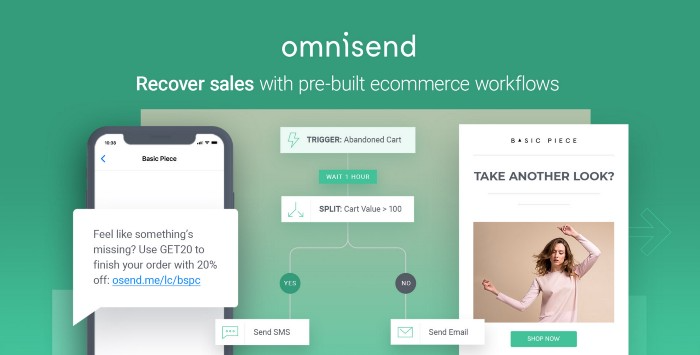

Email & SMS marketing — Omnisend

Email and SMS marketing campaigns.

This is an excellent Mailchimp option for magical emails. Omnisend's processes simplify email automation.

I love the interface's cleanliness.

Omnisend's free tier includes web push notifications.

Send up to:

500 emails per month

60 maximum SMSs

500 Web Push Maximum

Forms and surveys — Tally

Create flexible forms that people enjoy.

Typeform is clean but restricting. Sometimes you need to add many questions. Tally's needed sometimes.

Tally is flexible and cheaper than Typeform.

99% of Tally's features are free and unrestricted, including:

Unlimited forms

Countless submissions

Collect payments

File upload

Tally lets you examine what individuals contributed to forms before submitting them to see where they get stuck.

Airtable and Zapier connectors automate things further. If you pay, you can apply custom CSS to fit your brand.

See.

Free tools are the greatest.

Let's use them to launch a startup.

Alex Mathers

3 years ago

12 habits of the zenith individuals I know

Calmness is a vital life skill.

It aids communication. It boosts creativity and performance.

I've studied calm people's habits for years. Commonalities:

Have mastered the art of self-humor.

Protectors take their job seriously, draining the room's energy.

They are fixated on positive pursuits like making cool things, building a strong physique, and having fun with others rather than on depressing influences like the news and gossip.

Every day, spend at least 20 minutes moving, whether it's walking, yoga, or lifting weights.

Discover ways to take pleasure in life's challenges.

Since perspective is malleable, they change their view.

Set your own needs first.

Stressed people neglect themselves and wonder why they struggle.

Prioritize self-care.

Don't ruin your life to please others.

Make something.

Calm people create more than react.

They love creating beautiful things—paintings, children, relationships, and projects.

Don’t hold their breath.

If you're stressed or angry, you may be surprised how much time you spend holding your breath and tightening your belly.

Release, breathe, and relax to find calm.

Stopped rushing.

Rushing is disadvantageous.

Calm people handle life better.

Are aware of their own dietary requirements.

They avoid junk food and eat foods that keep them healthy, happy, and calm.

Don’t take anything personally.

Stressed people control everything.

Self-conscious.

Calm people put others and their work first.

Keep their surroundings neat.

Maintaining an uplifting and clutter-free environment daily calms the mind.

Minimise negative people.

Calm people are ruthless with their boundaries and avoid negative and drama-prone people.

Sam Warain

3 years ago

Sam Altman, CEO of Open AI, foresees the next trillion-dollar AI company

“I think if I had time to do something else, I would be so excited to go after this company right now.”

Sam Altman, CEO of Open AI, recently discussed AI's present and future.

Open AI is important. They're creating the cyberpunk and sci-fi worlds.

They use the most advanced algorithms and data sets.

GPT-3...sound familiar? Open AI built most copyrighting software. Peppertype, Jasper AI, Rytr. If you've used any, you'll be shocked by the quality.

Open AI isn't only GPT-3. They created DallE-2 and Whisper (a speech recognition software released last week).

What will they do next? What's the next great chance?

Sam Altman, CEO of Open AI, recently gave a lecture about the next trillion-dollar AI opportunity.

Who is the organization behind Open AI?

Open AI first. If you know, skip it.

Open AI is one of the earliest private AI startups. Elon Musk, Greg Brockman, and Rebekah Mercer established OpenAI in December 2015.

OpenAI has helped its citizens and AI since its birth.

They have scary-good algorithms.

Their GPT-3 natural language processing program is excellent.

The algorithm's exponential growth is astounding. GPT-2 came out in November 2019. May 2020 brought GPT-3.

Massive computation and datasets improved the technique in just a year. New York Times said GPT-3 could write like a human.

Same for Dall-E. Dall-E 2 was announced in April 2022. Dall-E 2 won a Colorado art contest.

Open AI's algorithms challenge jobs we thought required human innovation.

So what does Sam Altman think?

The Present Situation and AI's Limitations

During the interview, Sam states that we are still at the tip of the iceberg.

So I think so far, we’ve been in the realm where you can do an incredible copywriting business or you can do an education service or whatever. But I don’t think we’ve yet seen the people go after the trillion dollar take on Google.

He's right that AI can't generate net new human knowledge. It can train and synthesize vast amounts of knowledge, but it simply reproduces human work.

“It’s not going to cure cancer. It’s not going to add to the sum total of human scientific knowledge.”

But the key word is yet.

And that is what I think will turn out to be wrong that most surprises the current experts in the field.

Reinforcing his point that massive innovations are yet to come.

But where?

The Next $1 Trillion AI Company

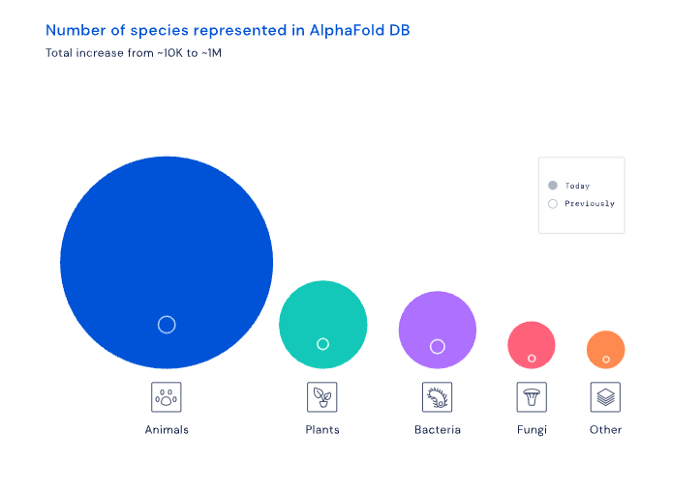

Sam predicts a bio or genomic breakthrough.

There’s been some promising work in genomics, but stuff on a bench top hasn’t really impacted it. I think that’s going to change. And I think this is one of these areas where there will be these new $100 billion to $1 trillion companies started, and those areas are rare.

Avoid human trials since they take time. Bio-materials or simulators are suitable beginning points.

AI may have a breakthrough. DeepMind, an OpenAI competitor, has developed AlphaFold to predict protein 3D structures.

It could change how we see proteins and their function. AlphaFold could provide fresh understanding into how proteins work and diseases originate by revealing their structure. This could lead to Alzheimer's and cancer treatments. AlphaFold could speed up medication development by revealing how proteins interact with medicines.

Deep Mind offered 200 million protein structures for scientists to download (including sustainability, food insecurity, and neglected diseases).

Being in AI for 4+ years, I'm amazed at the progress. We're past the hype cycle, as evidenced by the collapse of AI startups like C3 AI, and have entered a productive phase.

We'll see innovative enterprises that could replace Google and other trillion-dollar companies.

What happens after AI adoption is scary and unpredictable. How will AGI (Artificial General Intelligence) affect us? Highly autonomous systems that exceed humans at valuable work (Open AI)

My guess is that the things that we’ll have to figure out are how we think about fairly distributing wealth, access to AGI systems, which will be the commodity of the realm, and governance, how we collectively decide what they can do, what they don’t do, things like that. And I think figuring out the answer to those questions is going to just be huge. — Sam Altman CEO